|

市场调查报告书

商品编码

1536837

工业需量反应管理系统 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Demand Response Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

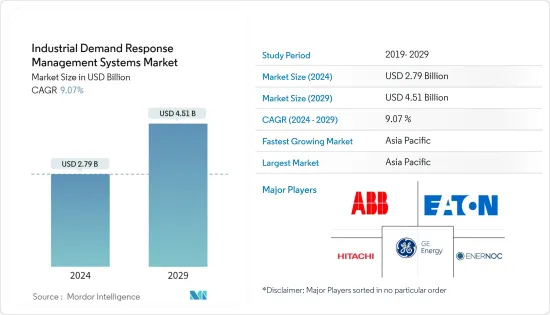

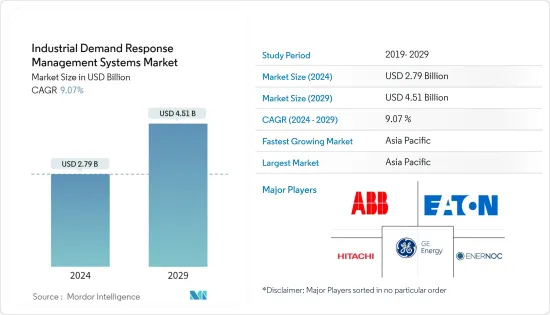

工业需量反应管理系统市场规模预计到 2024 年为 27.9 亿美元,预计到 2029 年将达到 45.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 9.07%。

主要亮点

- 对高效能能源管理系统的需求和再生能源来源渗透率的不断提高预计将在中期内推动市场发展。

- 另一方面,有关工业需量反应管理系统的隐私问题预计将阻碍市场成长。

- 话虽如此,预计智慧电网技术的日益采用将成为预测期内市场的重大机会。

- 由于再生能源来源的采用不断增加,预计亚太地区将占据市场主要份额。

工业需量反应管理系统市场趋势

再生能源来源渗透率的提高推动市场发展

- 工业需量反应管理系统需求增加的主要驱动力之一是再生能源来源在电网中的渗透率不断提高。在过去的十年中,全球电力产业积极转向清洁能源发电,重点是风能、太阳能和水力发电。

- 根据国际可再生能源机构(IRENA)预测,2022年全球可再生能源装置容量将达到3,371GW以上,较2021年的3,077GW以上成长近10%。增加可再生能源的部署预计将推动对工业需量反应管理系统的需求。

- 预计几个最大的经济体将在大规模措施的支持下促进可再生能源的使用。这些倡议预计将在促进可再生能源以及智慧电网方面取得重大进展。

- 为因应能源危机,欧盟加速部署太阳能和风电,2022年新增装置容量超过50GW,较2021年成长近45%。此外,REPowerEU和绿色新政工业计划提案的新政策和目标预计将继续大幅促进各国可再生能源投资,并为工业需量反应管理系统创造巨大市场。

- 美国能源资讯署(EIA)预测,2022年至2023年,风力发电在美国发电结构中的份额将从约11%上升至12%。此外,从 2022 年到 2023 年,太阳能预计将从 4% 成长到 5%。这些雄心勃勃的目标预计将在预测期内为工业需量反应管理系统市场提供重大机会。

- 随着可再生能源和分散式技术迅速融入电网,企业正在升级现有系统,以应对维持电能品质、即时平衡供需以及确保足够的配电基础设施容量等挑战。这些进步预计将加速工业需量反应管理系统的成长和部署。

亚太地区实现显着成长

- 亚太地区工业需量反应管理系统市场预计在预测期内将显着成长。

- 中国越来越注重实施需求面管理(DSM)计划,以此作为减少高峰电力需求并使可再生能源与需求相符的手段。据国际能源总署(IEA)称,2023年初中国新增精製能约为300万桶/日(bpd)。 IEA 预测,如果精製新增产能持续超过加工产能,到 2028 年中国新增产能将增加至 320 万桶/日。

- 此外,IEA预测,2022年至2028年间,中国将新增150万桶/日的精製产能,将其名义加工能力提高至1,970万桶/日。儘管如此,在预测期内,吞吐量预计将增加至 1,650 万桶/日。此外,中国的几家炼油厂正在进行扩建升级工作。随着新精製能的增加和扩大,未来几年对 DRMS 的需求预计将增加。

- 需量反应(DR)系统能够根据电网要求调整负载,这在印度监管生态系统中并不是一个全新的概念。灾难復原方法可以实现需求调整,因此客户可以参与响应不断变化的电网状况。 DR是一种经过验证的需求管理工具,其实施将帮助印度配电公司管理未来几年不断增长的电力消耗,并以更可靠的方式运作更绿色的电网。

- 2023年2月,虚拟发电厂和分散式能源管理系统(DERMS)供应商Autogrid宣布与印度最大的综合电力公司塔塔电力合作。除了支持印度的清洁能源转型外,这项开创性计画还将有助于解决住宅、商业和工业领域的高峰需求。

- 到 2025 年夏季,塔塔电力计画为印度最大城市孟买的客户推出新的需量反应管理计画。该计画涉及6,000家大型工商业客户,前六个月将实现尖峰容量削减75MW,此后继续增加至200MW。

- 考虑到该地区工业部门的发展和需量反应计划的采用,预计该地区未来将出现对 DRMS 的巨大需求。

工业需量反应管理系统产业概述

工业需量反应系统市场已减少一半。市场上的主要企业(排名不分先后)包括Schneider Electric公司、伊顿公司、日立公司、EnerNOC公司、通用电气公司和ABB。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 市场动态

- 促进因素

- 需要高效率的能源管理系统

- 扩大再生能源来源

- 抑制因素

- 工业需量反应管理系统的隐私问题

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 传统需量反应

- 自动需量反应

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 埃及

- 奈及利亚

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schneider Electric SE

- Siemens AG

- Hitachi Ltd

- Mitsubishi Electric Corporation

- ABB Ltd.

- Alstom SA

- General Electric Company

- Eaton Corporation PLC

- Silver Spring Networks Inc.

- EnerNOC Inc.

- REGEN Energy Inc.

- Autogrid Systems Inc.

- 市场排名分析

第七章 市场机会及未来趋势

- 扩大智慧电网技术的采用

简介目录

Product Code: 51306

The Industrial Demand Response Management Systems Market size is estimated at USD 2.79 billion in 2024, and is expected to reach USD 4.51 billion by 2029, growing at a CAGR of 9.07% during the forecast period (2024-2029).

Key Highlights

- The need for efficient energy management systems and the growing penetration of renewable energy sources are expected to drive the market over the medium term.

- On the other hand, privacy concerns about industrial demand response management systems are expected to hamper the market's growth.

- Nevertheless, the rising adoption of smart grid technologies is expected to be a significant opportunity for the market in the forecast period.

- Asia-Pacific is expected to have a significant share of the market due to the increasing adoption of renewable energy sources.

Industrial Demand Response Management Systems Market Trends

Growing Penetration of Renewable Energy Sources to Drive the Market

- One of the key drivers behind the rising demand for the industrial demand response management system is the increasing penetration of renewable energy sources into the power grid. Over the past decade, the global power sector has been actively transitioning towards cleaner energy generation, focusing significantly on wind, solar, and hydroelectric power.

- According to the International Renewable Energy Agency (IRENA), the global renewable energy installed capacity reached more than 3,371 GW in 2022, a nearly 10% rise from over 3,077 GW in 2021. The increasing adoption of renewable energy is anticipated to drive the demand for industrial demand response management systems.

- Several of the biggest economies are expected to boost renewable energy use supported by massive initiatives. These initiatives are expected to make notable progress in advancing renewables, which in turn will drive smart grids.

- The European Union (EU) accelerated the deployment of solar and wind power in response to the energy crisis, with over 50 GW added in 2022, an almost 45% surge compared to 2021. Additionally, the new policies and targets proposed in the REPowerEU and the Green Deal Industrial Plan are expected to continue significantly boosting renewable energy investments in the countries, creating a significant market for industrial demand response management systems.

- The United States Energy Information Administration (EIA) projected that wind energy's share of the United States electricity generation mix would rise from around 11% to 12% from 2022 to 2023. Further, solar energy was expected to grow from 4% to 5% from 2022 to 2023. Such ambitious targets are anticipated to provide significant opportunities for the industrial demand response management system market during the forecast period.

- With the rapid integration of renewables and distributed technologies onto the grid, companies are increasingly upgrading their existing systems to address the challenges of maintaining power quality, balancing supply and demand in real-time, and ensuring adequate distribution infrastructure capacity. These advancements are expected to accelerate the growth and deployment of industrial demand response management systems.

Asia-Pacific to Witness a Significant Growth

- The market for industrial demand response management systems in the Asia-Pacific region is expected to witness significant growth during the forecast period.

- China is making increasing efforts to implement demand-side management (DSM) programs as a means of reducing peak electricity demand and matching renewable energy with demand. According to the International Energy Agency (IEA), China had about three million barrels per day (bpd) of new refining capacity at the start of 2023. It expects that China's new capacity will increase to 3.2 million bpd by 2028 as further refining units are added at a more rapid rate than throughput volumes.

- Besides, as per IEA, during the 2022-28 period, China will likely add 1.5 million bpd of new refining capacity, taking nameplate capacity to 19.7 million bpd. Still, processing volumes are expected to rise to 16.5 million bpd over the forecast period. Additionally, expansion and upgradation operations are ongoing at multiple Chinese refineries. The addition or expansion of new refining capacity is expected to increase the demand for DRMS in the coming years.

- A demand response (DR) system whose ability to adjust load owing to the grid requirements is not an entirely new concept in the Indian regulatory ecosystem. The DR method enables the adjustment of demand, which in turn allows customers to participate in the response to changing grid conditions. The implementation of DR, a proven demand management tool, will assist electricity distribution companies in India in managing their increasing electricity consumption over the coming years and operating more reliably in a greener grid.

- In February 2023, AutoGrid, a provider of virtual power plants and distributed energy management systems (DERMS), announced a collaborative initiative with Tata Power, one of India's largest integrated power companies. In addition to supporting India's clean energy transition, this pioneering program will help address peak demand in residential, commercial, and industrial areas.

- By the summer of 2025, Tata Power plans to roll out a new Demand Response Management Program to serve its customers in Mumbai, India's largest city. The program will involve 6,000 large commercial and industrial customers to attain 75 MW of peak capacity decrease within the first six months and then continue to rise to 200 MW.

- Considering the development of the industrial sector in the region and the adoption of demand response programs, the region is expected to witness a massive demand for DRMS in the future.

Industrial Demand Response Management Systems Industry Overview

The industrial demand response system market is semi-fragmented. Some of the major players in the market (in no particular order) include Schneider Electric SE, Eaton Corporation PLC, Hitachi Ltd, EnerNOC Inc., General Electric Company, ABB Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 Need for Efficient Energy Management Systems

- 4.4.1.2 Growing Penetration of Renewable Energy Sources

- 4.4.2 Restraints

- 4.4.2.1 Privacy Concerns on the Industrial Demand Response Management Systems

- 4.4.1 Drivers

- 4.5 Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional Demand Response

- 5.1.2 Automated Demand Response

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Australia

- 5.2.2.5 Malaysia

- 5.2.2.6 Thailand

- 5.2.2.7 Indonesia

- 5.2.2.8 Vietnam

- 5.2.2.9 Rest of Asia-pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric SE

- 6.3.2 Siemens AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 ABB Ltd.

- 6.3.6 Alstom SA

- 6.3.7 General Electric Company

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Silver Spring Networks Inc.

- 6.3.10 EnerNOC Inc.

- 6.3.11 REGEN Energy Inc.

- 6.3.12 Autogrid Systems Inc.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Smart Grid Technologies

02-2729-4219

+886-2-2729-4219