|

市场调查报告书

商品编码

1536841

汽车涂料:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

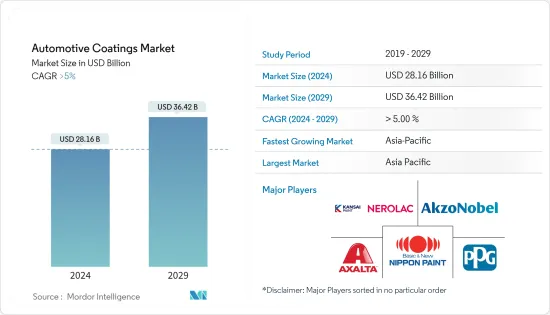

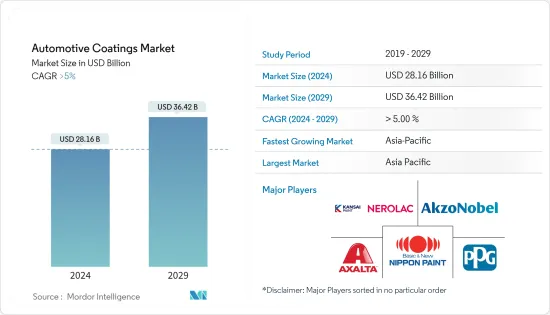

预计2024年全球汽车涂料市场规模将达到281.6亿美元,并在2024-2029年预测期内以超过5%的复合年增长率成长,到2029年将达到364.2亿美元。

主要亮点

- 汽车生产的扩张、投资的增加以及有利于汽车OEM的政府政策预计将推动汽车涂料市场的发展。

- 然而,严格的挥发性有机化合物法规预计将阻碍市场成长。

- 电动车市场的成长预计将在预测期内为市场创造机会。

- 亚太地区在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。这是由于该地区汽车OEM和精炼行业对汽车涂料的需求不断增加。

汽车涂料市场趋势

OEM领域预计将显着成长。

- 乘用车、轻型商用车等车辆暴露在温度变化、酸雨、灰尘、水等各种恶劣环境下,导致其外观和性能劣化。涂料可以透过减轻车辆重量和增加轮胎滚动阻力来帮助提高车辆整体效率。

- 基于聚氨酯的涂料可为汽车表面提供持久、改善的外观和高光泽度。儘管聚氨酯树脂系统的初始成本比环氧树脂系统更高,但从长远来看,它们具有成本效益,因为其使用寿命比环氧树脂系统长约1.5至2倍。

- 丙烯酸基涂料和聚酯基涂料是汽车OEM应用中发现的其他类型的树脂涂料。环氧树脂是比丙烯酸树脂更坚固的塑胶。因此,在汽车OEM应用中,可以更有效地完成精细细节,并且还具有优异的抛光性能。

- 溶剂在汽车OEM涂料中发挥重要作用。随着消费者偏好转向涂料和被覆剂中较低VOC含量,预计在预测期内水性涂料将更受青睐。然而,与水性涂料相比,溶剂表现出更好的性能。

- 全球汽车产量的增加可能会增加对汽车OEM涂料市场的需求。例如,根据欧洲汽车工业协会(ACEA)的预测,2022年全球汽车产量将达到8,540万辆,较2021年成长5.7%。

- 由于这些因素,所研究市场的OEM应用领域可能会在预测期内呈现成长。

预计亚太地区成长率最高

- 亚太地区是最大的汽车涂料市场,其次是北美和欧洲。印度和东南亚国协的汽车生产预计将推动该地区汽车涂料的需求。

- 根据中国工业协会预测,2023年中国汽车产量将达3,016万辆,与前一年同期比较增加11.6%。根据国际工业协会(OICA)预计,2022年中国汽车产量将达2,702万辆,较2021年同期成长3%。

- 根据国际贸易管理局预测,到2025年,中国国内汽车产量预计将达到3,500万辆。该国汽车产量的增加可能会导致汽车涂料消费量的增加。

- 印度汽车工业是印度经济的重要指标,该产业在技术进步和宏观经济扩张中发挥关键作用。从产业趋势来看,印度汽车产业近年来成长迅速。

- 由于汽车产量的增加,预计未来几年对汽车涂料的需求将会增加。多家国内外製造商正在该国投资,以增加汽车产量并满足该国的需求。例如,2023年5月,印度最大的汽车生产商马鲁蒂铃木印度公司透露,计画投资超过55亿美元,到2030年将产能翻倍。

- 日本汽车工业是世界第三大汽车製造业,全国拥有78家工厂,僱用超过550万名工人。汽车製造业占日本第一大製造业(交通运输设备工业)的89%,汽车零件製造商是日本经济的重要组成部分。

- 日本工业协会(JAMA)公布的新车登记资料显示,2023年9月日本新车市场达437,493辆,较上月的395,163辆增长近11%。继 8 月市场开拓后,9 月出现强劲成长。连续三个月放缓的日本市场在八月加速成长。

- 由于这些因素,预计该地区的汽车涂料市场在预测期内将稳定成长。

汽车涂装业概况

汽车涂料市场分散。该市场的主要企业包括(排名不分先后)Akzo Nobel NV、Axalta Coating Systems Ltd、Kansai Nerolac Paints Limited、Nippon Paint Holdings 和 PPG Industries Inc。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车产量的成长

- 汽车OEM加大投资和政府政策

- 其他司机

- 市场限制因素

- 严格的VOC法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:以金额为准)

- 按类型

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 其他树脂类型

- 依技术

- 溶剂型

- 水性的

- 粉末

- 分层

- 电着底漆

- 底漆

- 底涂层

- 透明涂层

- 按用途

- OEM

- 修补漆

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲/纽西兰

- 印尼

- 马来西亚

- 泰国

- 其他东协国家

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems Ltd

- BASF SE

- Beckers Group

- Cabot Corporation

- Eastman Chemical Company

- HMG Paints Limited

- Jotun

- Kansai Nerolac Paints Limited

- KCC Corporation

- Nippon Paint Holdings Co. Ltd

- Parker Hannifin Corp.

- PPG Industries Inc.

- RPM International Inc.

- Shanghai Kinlita Chemical Co. Ltd

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- 电动车市场不断成长的机会

- 其他机会

简介目录

Product Code: 51942

The Automotive Coatings Market size is estimated at USD 28.16 billion in 2024, and is expected to reach USD 36.42 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

Key Highlights

- The growing automotive production, increasing investments, and favorable government policies for automotive OEMs are expected to drive the market for automotive coatings.

- However, stringent VOC regulations are expected to hinder the market's growth.

- Growth in the electric vehicle market is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market, registering the highest CAGR during the forecast period. This is due to the rising demand for automotive coatings from automotive OEM and refinish industries in the region.

Automotive Coatings Market Trends

OEM Segment is Likely to Show Significant Growth

- Automotive vehicles such as passenger cars and light commercial vehicles are subjected to various harsh environments, such as changing temperatures, acid rains, dust, and water, which deteriorate the aesthetics and performance of the vehicle. Coatings help in increasing the vehicle's overall efficiency by making it lighter or enhancing the tires' rolling resistance.

- Polyurethane-based coatings deliver an improved appearance and high gloss for a longer period to automotive surfaces. While a polyurethane resin system will initially cost more compared to an epoxy resin system, it is more cost-effective in the long term as its lifespan is roughly one and a half to double that of the epoxy resin system.

- Acrylic-based coatings and polyester-based coatings are other types of resin coatings found in automotive OEM applications. Epoxy resin is a tougher plastic than acrylic resin. Hence, it provides minor details more effectively and also offers good polishing properties for automotive OEM applications.

- In automotive OEM coatings, solvents play a significant role. Consumer preferences are shifting toward lesser VOC in paints and coatings, and hence, water-borne coatings are expected to be more preferred during the forecast period. However, solvents offer greater properties when compared to water-borne coatings.

- Rising automotive production globally is likely to increase the demand for the automotive OEM coating market. For instance, according to the European Automotive Manufacturers Association (ACEA), global vehicle production reached 85.4 million in 2022, which increased by 5.7% compared to 2021.

- Owing to these factors, the OEM application segment of the market studied is likely to witness growth during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is the largest market for automotive coatings, followed by North America and Europe. Automotive production in India and ASEAN countries is expected to boost the demand for automotive coatings in the region.

- According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, witnessing a growth of 11.6% compared to the previous year. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

- Domestic production in China is expected to reach 35 million units by 2025, according to the International Trade Administration. The growing production of automobiles in the country is likely to create a hike in the consumption of automotive coatings.

- The automotive industry in India is an essential indicator of the Indian economy, as this sector plays a vital role in both technological advancements and macroeconomic expansion. As per industry trends, the automotive industry in India has been growing on a huge scale in recent times.

- The rising vehicle production is projected to increase the demand for automobile coatings in the coming years. Several domestic and international manufacturers are investing in the country to increase vehicle production and meet the country's demand. For instance, in May 2023, Maruti Suzuki India, the largest vehicle producer in India, revealed its plans to invest over USD 5.5 billion to double capacity by 2030.

- Japan's automotive industry is the world's third-largest automotive manufacturing industry, with 78 factories spread across the country employing more than 5.5 million workers. Automotive manufacturing accounts for 89% of the largest manufacturing sector (transportation machinery industry) in the country, while auto parts suppliers have become a significant part of the Japanese economy.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by the Japan Automotive Manufacturers Association (JAMA). The strong September growth followed a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Due to all these factors, the market for automotive coatings in the region is expected to show steady growth during the forecast period.

Automotive Coatings Industry Overview

The automotive coatings market is fragmented in nature. Some of the major players in the market include (not in any particular order) Akzo Nobel NV, Axalta Coating Systems Ltd, Kansai Nerolac Paints Limited, Nippon Paint Holdings Co. Ltd, and PPG Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Increasing Investments and Government Policies for Automotive OEM

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Stringent VOC Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types

- 5.2 By Technology

- 5.2.1 Solvent-Borne

- 5.2.2 Water-Borne

- 5.2.3 Powder

- 5.3 By Layers

- 5.3.1 E-Coat

- 5.3.2 Primer

- 5.3.3 Base Coat

- 5.3.4 Clear Coat

- 5.4 By Application

- 5.4.1 OEM

- 5.4.2 Refinish

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia and New Zealand

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Rest of ASEAN

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems Ltd

- 6.4.3 BASF SE

- 6.4.4 Beckers Group

- 6.4.5 Cabot Corporation

- 6.4.6 Eastman Chemical Company

- 6.4.7 HMG Paints Limited

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 KCC Corporation

- 6.4.11 Nippon Paint Holdings Co. Ltd

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 PPG Industries Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Shanghai Kinlita Chemical Co. Ltd

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Opportunity in the Electric Vehicle Market

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219