|

市场调查报告书

商品编码

1640377

CO 气体感测器 -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)CO Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

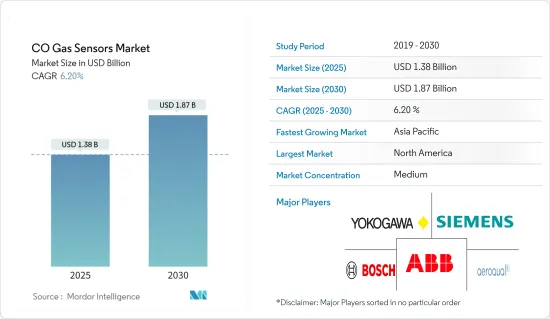

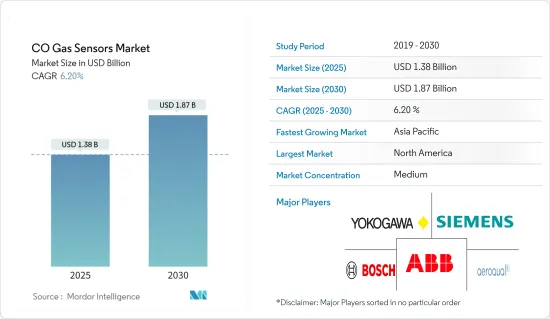

CO气体感测器市场规模预计到2025年为13.8亿美元,预计到2030年将达到18.7亿美元,在估计和预测期间市场复合年增长率为6.2%。

各行业有多种应用,一些行业使用二氧化碳气体进行与製程相关的操作,而其他行业则将其作为特定产品排放。业界遵循严格的法规,以确保安全的工作环境并避免危及工人生命的接触。此类法规对于一氧化碳气体警报器和侦测器的快速推出极为重要。这直接影响了工业界对CO气体感测器日益增长的需求。

这些感测器在二氧化碳气体浓度升至危险浓度时提供早期预警,在拯救生命方面发挥关键作用。这些感测器提醒人们潜在的危险,并实现快速疏散和干预,防止二氧化碳气体中毒和死亡。

确保职场安全的政府法规主要推动了一氧化碳气体感测器市场的成长。例如,英国、德国和法国实施了各种法规,以避免向大气中释放危险气体。化学工业气体具有低闪点、较低的爆炸极限 (LEL) 和频谱的可燃性/可燃性。另一方面,透过持续使用此类气体感测器和监视器,可以将这些气体造成的危险降至最低。

此外,工业物联网正在各个地区取得进展。客户对物联网一氧化碳气体探测器的兴趣日益浓厚,企业参与企业正在努力推出针对物联网解决方案量身定制的产品系列。持续即时监控和排放气体检测的需求需要无线感测器,预计未来几年将推动对二氧化碳气体探测器的需求。

此外,产品小型化促进了可携式气体感测器设备的发展,提供了便携灵活性。这些行业专注于采用自动化和收集所有资料。这些要求推动了对具有双向通讯功能的无线感测器的需求。

然而,缺乏监管要求降低了采用这些感测器的紧迫性并限制了市场成长。虽然CO气体感测器已经有了很大的改进,但它们也存在技术限制。例如,某些感测器难以检测低含量的 CO 气体,使用寿命有限,并且需要频繁校准。这些技术限制预计将阻碍一氧化碳气体感测器市场的发展。

此外,俄罗斯和乌克兰之间的战争影响了半导体和电子元件供应链,该供应链是生产半导体和电子元件(包括感测器)的原材料的重要供应商。衝突可能会扰乱供应链并导致这些材料的短缺和价格上涨,从而影响一氧化碳 (CO) 气体感测器製造商并导致最终用户的成本更高。

CO气体感测器市场趋势

石化产业推动成长

- CO 气体感测器正在迅速引入液化石油气和液化天然气领域。这是因为这些产业需要在气体储存、生产和运输的每个阶段进行检查。此外,随着全球天然气产量的增加,对加工设施安全保障的需求也增加。根据MOSPI统计,石化产品占印度同年能源消费量总量的37%。

- 目前的TWA仅5,000 ppm,二氧化碳的重量是空气的两倍以上。目前使用的浓度为 40,000 ppm,即 IDLH 体积的 4%。接触有毒物质的症状包括头痛、呼吸困难、心率加速和抽搐。

- 在石化产业,石油回收和尿素/甲醇生产需要使用感测器来监测二氧化碳气体,这些感测器会连续检测二氧化碳浓度,并在气体达到有毒水平时发出持续的警报命令。

- 它也用于气体洩漏检测和空气品质监测。 CO气体感测器可与红外线成像器和红外线摄影机等其他设备配合使用,以协助识别气体洩漏源。

预计北美将占据较大市场占有率

- 该地区正在大力投资市场成长。工业安全措施的不断加强、工业领域应用的增加以及整个全部区域因二氧化碳导致的死亡人数不断增加,都进一步增加了对二氧化碳气体感测器的需求。

- 据安大略省消防队长协会称,加拿大各地每年有 50 多人死于一氧化碳中毒。人们在冬天经常使用燃油器具取暖,寒冷的天气条件是导致死亡的一个主要原因。因此,采用一氧化碳(CO)气体感测器是有利的。这些电器产品可能会在不知不觉中使您家中的二氧化碳气体浓度达到危险水平。 CO气体感测器主要应用于CO气体侦测器和警报器。

- 根据 IEA 的《2022 年年度能源展望》,预计到 2050 年,石油和天然气将成为美国消耗最多的能源。相比之下,可再生能源预计将成长最快。太阳能和风力发电的奖励不断增加,技术成本不断下降,与天然气发电的竞争日益激烈。预计这些努力将在预测期内增加对二氧化碳气体感测器的需求。

- 在预测期内,北美将成为一个有利的市场,因为製造商正在对新环保产品的研发活动进行巨额投资。

- 该地区的许多州和省都有法律要求在家庭和其他建筑物中安装二氧化碳气体感测器,以预防二氧化碳气体中毒。由于与感测器设备相关的所有法规,该地区对 CO 气体感测器的需求显着增加。

- 近期,多起一氧化碳中毒事件发生。加拿大安大略省有9人被送往医院,亚伯达省1人在车内死亡。有鑑于此,加拿大卫生署警告加拿大人在家中和其他地方保持警惕,并注意二氧化碳气体的危险。预计此类事件将推动北美对二氧化碳气体感测器的需求。

CO气体感测器产业概况

CO 气体感测器市场已成为半固体,在过去 30 年里不断涌现竞争者,并由几家主要企业组成。从市场占有率来看,目前该市场由少数主要企业主导。然而,随着燃气洩漏事件导致技术创新和安全法规的增加,市场参与者正在进行策略创新,以提供符合法规和政策的感测器。

2024 年 4 月:霍尼韦尔宣布成为「沙乌地阿拉伯製造」倡议中的首家气体探测器製造商,重申其致力于促进沙乌地阿拉伯在地化和经济多元化的决心。该公司将在其达曼工厂本地组装和校准三种气体检测解决方案。在这些解决方案中,HoneywellBW Max XT II 是一款可携式多气体检测仪,工作人员使用它来检测危险环境中的硫化氢和一氧化碳等气体。

2023 年 10 月:ABB 宣布扩大与帝国学院的碳捕获合作,以支持未来的劳动力和能源转型。 ABB 旨在透过在实际应用中展示最新技术如何帮助优化工厂性能和管理紧急情况下的安全,为学生提供操作工业流程所需的技能。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 确保职场安全的政府法规

- 废气法规的需求日益增加

- 市场限制因素

- 中小企业安全意识欠缺

- 低维护成本和产品差异化

第六章 市场细分

- 依技术

- 半导体感测器

- 电化学感测器

- 固态/MOS感测器

- PID

- 催化型

- 红外线的

- 按用途

- 医疗保健

- 石化

- 建筑自动化

- 工业的

- 环境

- 车

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Aeroqual Ltd

- ABB Ltd

- Siemens AG

- Yokogawa Electric Corporation

- Robert Bosch GmbH

- GfG Europe Ltd

- Alphasense

- Dynament Ltd

- NGK Insulators Ltd

- Trolex Ltd

- Honeywell

第八章投资分析

第9章 市场的未来

The CO Gas Sensors Market size is estimated at USD 1.38 billion in 2025, and is expected to reach USD 1.87 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Industries have different applications, with some industries using CO gas for their process-related works and other sectors releasing it as a byproduct. To ensure a secure working environment and avoid any life-threatening exposure to the workers, stringent regulations are followed in the industries. These regulations have been critical in the high-paced and early adoption of CO gas alarms and detectors. Thus, this has directly impacted the increased demand for CO gas sensors in industries.

These sensors play a vital role in safeguarding human lives by providing early warnings when carbon monoxide levels rise to hazardous concentrations. These sensors enable swift evacuation and intervention by alerting people to potential dangers and preventing carbon monoxide poisoning and fatalities.

Government regulations to ensure workplace safety primarily increase the growth of the carbon monoxide gas sensors market. For instance, the United Kingdom, Germany, and France have all implemented various rules to avoid the release of dangerous gasses into the atmosphere. Chemical industrial gasses are employed at low flashpoints with lower explosive limits (LEL) and a broad flammable/combustible spectrum. On the other hand, hazards induced by such gases can be minimized by continually using these gas sensors and monitors.

Additionally, the IIoT is advancing in various regions. Customers are becoming more interested in IoT carbon monoxide gas detectors, and players in the enterprise are working on launching a product range tailored to IoT solutions. The necessity for wireless sensors owing to the requirement of constant and real-time monitoring and detection of emissions is anticipated to drive up demand for CO gas detectors in the coming years.

Further, product miniaturization has helped develop portable gas sensor devices that provide carrying flexibility. In these industries, there is a high focus on adopting automation and collecting all the data. Such a requirement has resulted in increased demand for wireless sensors that are enabled with two-way communication features.

However, the absence of regulatory requirements limits market growth as the urgency to adopt these sensors decreases. CO gas sensors have improved significantly, but there are certain technological limitations. For example, some sensors have difficulty detecting low levels of carbon monoxide, have a limited lifespan, and require frequent calibration. These technical limitations are expected to hinder the carbon monoxide gas sensor market.

Additionally, the Russia-Ukraine war is impacting the supply chain of semiconductors and electronic components, being a significant supplier of raw materials for producing semiconductors and electronic components, including sensors. The dispute has disrupted the supply chain, causing shortages and price increases for these materials, impacting carbon monoxide (CO) gas sensor manufacturers and potentially leading to higher costs for end users.

Carbon Monoxide Gas Sensors Market Trends

The Petrochemical Segment to Witness Growth

- Carbon monoxide sensors are being rapidly deployed in the LPG and LNG sectors since these industries require a check at every stage of gas storage, production, or transportation. The demand for safety and security at processing installations has also been increasing while natural gas production is growing worldwide. The growth of this segment is expected to be driven by the continued increase in gas products, and according to MOSPI, petrochemicals accounted for 37% of India's total energy consumption that year.

- With a current TWA of only 5,000 ppm, carbon dioxide is more than twice as heavy as air. Currently, 40,000 ppm or 4% by volume of IDLH is in use. Toxic exposure symptoms are headache, trouble breathing, increased heart rate, and convulsions.

- In the petrochemical industry, oil recovery and urea and methanol production require CO2 gas monitoring with a sensor that continuously detects CO2 levels and issues constant alarm commands when the gas is in toxic quantities.

- They are also used to detect gas leaks and monitor air quality. Carbon monoxide sensors can be used with other instruments, such as a thermal imager or an infrared camera, to help identify the source of the gas leak.

North America is Expected to Hold Significant Market Share

- The region is investing significantly in market growth. The rising industrial safety measures, increasing applications in the industrial sector, and an increasing number of deaths due to CO across the region further create demand for CO gas sensors.

- In addition, according to the Ontario Association of Fire Chiefs, more than 50 people die yearly from CO poisoning across Canada; as people use fuel-burning appliances more often to keep warm in winter, the deaths are mainly due to cold weather conditions. As a result, adopting carbon monoxide (CO) gas sensors is beneficial, as these appliances can unknowingly cause dangerous levels of CO gas to build up in the home. The CO gas sensors are primarily used in carbon monoxide detectors and alarms.

- According to IEA's Annual Energy Outlook 2022, petroleum and natural gas are expected to be the most-consumed power sources in the United States through 2050. In contrast, renewable energy is expected to be the fastest growing. The increasing incentives for solar and wind energy and declining technology costs support robust competition with natural gas for electricity generation. Such initiatives will drive the demand for CO gas sensors during the forecast period.

- North America will be a lucrative market during the forecast period due to huge investments by manufacturers in R&D activities concerning new environmentally friendly products.

- There are laws in many states and provinces of the region that require CO gas sensors to be installed in homes and other buildings as a precautionary measure against carbon monoxide poisoning. The demand for CO gas sensors in the region has increased significantly owing to all regulations relating to sensor devices.

- There have been a few incidents of CO poisoning recently. Nine people were sent to a hospital in Ontario, Canada, and one person died in a vehicle in Alberta. In light of such events, Health Canada is warning Canadians to be alert in their homes and elsewhere and aware of carbon monoxide's dangers. Such events will drive North America's demand for CO gas sensors.

Carbon Monoxide Gas Sensors Industry Overview

The carbon monoxide gas sensors market is semi-consolidated, has gained a competitive edge in the past three decades, and consists of several major players. In terms of market share, few of the prominent players currently dominate the market. However, with increasing innovations and safety regulations due to gas leakage incidents, the companies in the market are strategically innovating in providing these sensors, which meet the rules and policies.

April 2024: Honeywell announced that it will be the first gas detector manufacturer in the 'Made in Saudi' initiative, reaffirming its dedication to fostering localization and economic diversification in Saudi Arabia. It will locally assemble and calibrate three distinct gas detection solutions at its Dammam facility. Among these solutions is the Honeywell BW Max XT II, portable multi-gas detector workers use to detect gases like hydrogen sulfide and carbon monoxide in hazardous environments.

October 2023: ABB announced extending its carbon capture collaboration to support the future workforce and energy transition with Imperial College. ABB aims to equip the students with the skills needed to run industrial processes by demonstrating how the latest technology can help optimize plant performance and safely manage emergencies in real-life applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations to Ensure Safety in Work Places

- 5.1.2 Increasing Need for Emission Control Standards

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of Safety Gains in SME

- 5.2.2 Cost of Maintenance and Low Product Differentiation

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Semiconductor Sensor

- 6.1.2 Electrochemical Sensor

- 6.1.3 Solid State/MOS Sensor

- 6.1.4 PID

- 6.1.5 Catalytic

- 6.1.6 Infrared

- 6.2 By Application

- 6.2.1 Medical

- 6.2.2 Petrochemical

- 6.2.3 Building Automation

- 6.2.4 Industrial

- 6.2.5 Environmental

- 6.2.6 Automotive

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aeroqual Ltd

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 Robert Bosch GmbH

- 7.1.6 GfG Europe Ltd

- 7.1.7 Alphasense

- 7.1.8 Dynament Ltd

- 7.1.9 NGK Insulators Ltd

- 7.1.10 Trolex Ltd

- 7.1.11 Honeywell