|

市场调查报告书

商品编码

1536847

兆赫技术:市场占有率分析、产业趋势/统计、成长预测(2024-2030)Terahertz Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

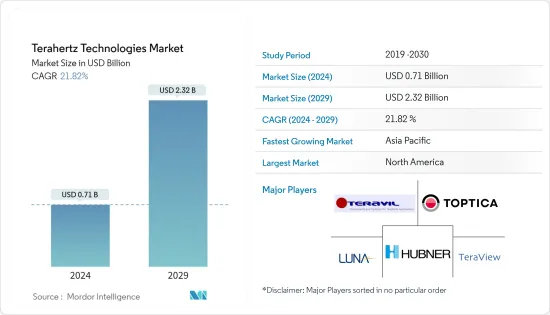

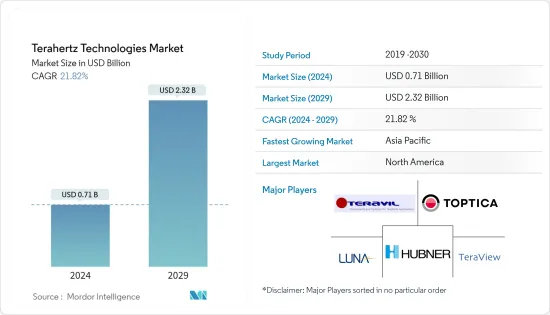

预计2024年全球兆赫技术市场规模将达7.1亿美元,2024-2029年预测期间复合年增长率为21.82%,2029年将达23.2亿美元。

兆赫技术是一个新兴且不断发展的领域,具有开发广泛应用的潜力,从机场乘客扫描到大容量数位资料传输。兆赫系统在半导体产业的采用是促进兆赫技术产业成长的因素之一。

主要亮点

- 基于兆赫的技术目前正在进入各行业的商业市场,包括安全、无损检测、汽车和通讯。这正在为市场创造更多机会。 Research and Development 开发了一种兆赫发射器,其数位资料传输速度比第五代行动网路 (5G) 快 10 倍以上。兆赫频段是一种新的、巨大的频率资源,有望用于未来超高速无线通讯,并正在推动市场成长。

- 5G和6G网路的实施需要使用与光收发器整合的面向宽频的光缆,以确保资料传输的安全可靠。因此,中低收入国家光纤通讯基础设施的扩张预计将推动未来光纤网路设备市场的发展。

- 由于兆赫技术具有高频宽和频率,因此有望应用于短程通讯服务。加强无线通讯系统和增加对5G市场的投资也可能有助于市场发展。此外,现有的农产品检验技术耗时且复杂,因此需要开发安全、快速、无损的检验技术。

- 对兆赫技术应用的认识和认识不足阻碍了该市场的成长。由于兆赫成像仍然是一项相对较新的技术,因此很难取代目前主导市场的现有技术。

- COVID-19期间,兆赫技术市场成长,主要应用在医疗保健、生物医学和安全领域。此外,在大流行后时期,预计各种组织和供应商将投资于适用于多种最终用户应用的兆赫技术解决方案的研发,从而推动所研究市场的成长。

兆赫技术市场趋势

市场细分预计通讯终端用户领域将显着成长

- 兆赫频宽(0.3 至 10兆赫)作为无线通讯的新前沿而备受关注,因为它可以显着扩展未使用的频宽。儘管已知的 100 GHz 以上无线电频道很少,但最近已经展示了几种高速兆赫通讯链路。

- 目前,业界对毫米波频段 (30-300GHz) 着迷,以为 5G 行动装置提供每秒数千兆Gigabit(Gbps) 的资料速率。然而,与毫米波通讯类似,兆赫频段也可以用作行动回程,在基地台之间传输大频宽讯号。

- 处理多 GHz 通道的兆赫通讯系统可能需要数位域中更大的运算能力,其中基频系统包括物理层 (PHY) 通道编码等任务。同样,类比领域需要改进类比数 (ADC) 和数位类比 (DAC) 部分,以有效捕捉更高频率的讯号。此外,6G通讯将是最大的技术投资之一,并将广泛支援2030年连网型机器的快速成长。

- 2022 年在全球扩大 5G 合约预计将为 6G 网路创造新的机会,其高速网路功能预计将在未来几年提高消费者的受欢迎程度并推动市场成长。例如,爱立信表示,2019 年至 2028 年间,全球整体5G 用户数量预计将从 1,200 万以上增加到 45 亿以上。

- 许多国家都推出了6G通讯发展计划,预计将推动市场成长。例如,2023年10月,爱立信在清奈研发中心成立了印度6G研究团队,并启动了「印度6G计画」。印度研究团队与美国和瑞典的爱立信研发团队将协助实现网实整合连续体,使网路提供身临其境型通讯、关键服务和无所不在的物联网,同时保持分散式资料的完整性。

- 2024年2月,中国最大的通讯业者中国移动宣布发射首颗卫星,在太空测试6G架构。此外,2023年2月,韩国宣布计画于2028年推出6G网路服务,比原计画提早了两年。该国的目标是确保未来无线电频谱的早期主导地位。韩国启动了一项为期五年的国家计划,斥资约2,200亿韩元(1.93亿美元)开发6G通讯核心技术,同时加强与美国的联合研究与合作。韩国的目标是在2028年成为世界上第一个实现6G行动通讯商业化的国家。

预计北美将占据较大市场占有率

- 美国是兆赫技术的主要市场,这主要是由于国防安全保障疑虑、国防投资和研发的不断增加。此外,美国政府对航太技术安全和生产的严格监管、不断增长的汽车和航太工业正在推动该区域市场的兆赫技术市场。

- 根据航太工业协会提供的资料,2023年美国航空航太工业总销售额超过9,520亿美元,比2021年成长6.7%。总合而言,飞机工业创造了4,180亿美元的经济价值,相当于美国名义GDP的1.65%,比2021年成长近7.0%。飞机工业的高速成长是基于兆赫技术的检测系统成长的主要推动力。

- 美国航太工业出口占所有航太产品的 60% 以上。

- 由于各种公共场所对安全筛检设备的需求增加,预计加拿大对该技术的需求将大幅增加。例如,加拿大航空公司在乘客登机前往该国之前对其进行筛选。加拿大航空公司的工会—加拿大公共僱员工会 (CUPE) 宣布将增加飞行前筛检,让空服人员负责筛检。

- 为了减少国内航班出发的等候时间,机场 B 号码头附近设立了一条新的安检通道。随着新通道的开通,筛检能力增加了 30%。 PBS-B 是一种临时解决方案,机场和加拿大航空运输安全局 (CATSA) 正在考虑长期解决方案,以在未来将国内筛检整合到一个地点。

- 加拿大政府正在投资机场基础设施,以改善乘客和居民的流动性、安全性和保障。例如,2024 年 2 月,蒙特娄大都会机场 (YHU) 获得加拿大基础设施银行 (CIB) 9,000 万美元的投资,用于建造新的客运航站楼。这项投资预计将开发一个新的国内机场航站大楼,增强加拿大人往返蒙特利尔的旅行选择,并支持蒙特利尔地区的经济机会。此类投资可能会增加兆赫扫描仪等不断发展的技术的机会,这些技术有望促进机场基础设施的正常运作。

兆赫技术产业概况

兆赫科技市场较为分散,主要公司包括 Luna Innovations、Teravil Ltd、TeraView Limited、Toptica Photonics AG 和 HUBNER GmbH & Co.KG。市场竞争者正在利用合作伙伴关係、创新、扩张和收购等各种策略来增加产品系列併获得永续的竞争优势。

- 2023年12月-Luna Innovations宣布获得White Hat Capital Partners 5,000万美元投资。透过这项投资,该公司将专注于利用光纤感测解决方案采用的曲折点,提高製造能力以满足战略合作伙伴的需求,并增加创新投资。

- 2023 年 12 月 - TeraView Limited 在其英国总部欢迎来自马来西亚的代表团。此次访问预计将为未来的合作伙伴关係和兆赫技术应用的机会铺平道路。此次访问旨在探索 Terraview 与马来西亚技术和研究领域主要利益相关人员之间的潜在合作。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 和宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 医疗领域和无损检测应用的需求不断增长

- 使用兆赫技术的整体安全方法

- 市场限制因素

- 市场对兆赫技术缺乏认识

- 缺乏支援兆赫技术采用的设备基础设施

第六章 市场细分

- 依技术类型

- 兆赫成像系统

- 主动系统

- 被动系统

- 兆赫光谱系统

- 时域

- 频域

- 通讯系统

- 兆赫成像系统

- 按最终用户

- 卫生保健

- 国防/安全

- 通讯

- 产业

- 食品/农业

- 研究所

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Luna Innovations

- Teravil Ltd

- TeraView Limited

- Toptica Photonics AG

- HUBNER GmbH & Co. KG

- Advantest Corporation

- BATOP GmbH

- Terasense GP Inc.

- Microtech Instrument Inc.

- Menlo Systems GmbH

- Gentec Electro-optics Inc.

- Bakman Technologies LLC

第八章投资分析

第九章 市场机会及未来趋势

The Terahertz Technologies Market size is estimated at USD 0.71 billion in 2024, and is expected to reach USD 2.32 billion by 2029, growing at a CAGR of 21.82% during the forecast period (2024-2029).

Terahertz technology is an emerging and growing field with the potential for developing applications ranging from passenger scanning at an airport to large digital data transfers. The adoption of terahertz systems in the semiconductor industry is one factor contributing to the growth of the terahertz technology industry.

Key Highlights

- Terahertz-based technologies are now entering the commercial markets in various industries, such as security, non-destructive testing, automotive, and telecommunication. This further creates an opportunity for the market. Researchers have developed a terahertz (Terahertz) transmitter capable of transmitting digital data at a rate ten times or faster than that offered by fifth-generation mobile networks (5G). The terahertz band is a new and vast frequency resource expected to be used for future ultrahigh-speed wireless communications, driving the market's growth.

- The implementation of the 5G network and 6G network necessitates the use of high-bandwidth oriented fiber optical cables integrated with optical transceivers to ensure secure and dependable data transfers. Consequently, the expanding optical communication infrastructure in low and middle-income countries is expected to drive the optical communication and networking equipment market in the future.

- Due to higher bandwidth and frequency, Terahertz technology has greater prospective applications for short-distance communication services. The increasing investments in the enhancement of wireless communication systems and the 5G market might also help develop the market. Furthermore, the existing technologies for inspecting agricultural products are time-consuming and complex, and there is an inclination to develop a safe, rapid, and non-destructive inspection technology.

- Insufficient knowledge and awareness about terahertz technology's applications hinder this market's growth. Since terahertz imaging is still a relatively new technology, replacing the existing technologies currently dominating the market is difficult.

- During COVID-19, the terahertz technology market witnessed growth, with its major applications in healthcare, biomedical, and security. Furthermore, in the post-pandemic period, various organizations and vendors are expected to invest in R&D of the terahertz technology solution that can be applied in multiple end-user applications, thereby driving the growth of the market studied.

Terahertz Technology Market Trends

Telecommunications End User Segment is Expected to Witness Significant Growth in the Market

- The terahertz band (0.3 Terahertz to 10 Terahertz) is the successive frontier in wireless communications for its capability to unlock significantly broader segments of unused bandwidth. Though radio channels above 100 GHz are slightly known, several high-speed terahertz communication links have been demonstrated recently.

- Nowadays, the industry is preoccupied with mmWave frequency bands (30 to 300 GHz) to deliver multi-gigabit-per-second (Gbps) data rates for 5G mobile devices. However, like mmWave communications, terahertz bands can be used as mobile backhaul for transferring significant bandwidth signals between base stations.

- A terahertz communication system processing a multi-GHz channel is likely to demand more significant computational capacity in the digital domain, where the baseband subsystem contains tasks like physical layer (PHY) channel coding. Similarly, the analog domain requires improvements in analog-to-digital (ADC) and digital-to-analog (DAC) parts to capture higher-frequency signals efficiently. Moreover, 6G Communications will become one of the largest technology investments, which can widely serve the exponential growth with connected machines in 2030.

- The growing 5G subscriptions worldwide in 2022 are expected to create new opportunities for the 6G network and are expected to gain popularity among consumers in coming years due to its high-speed network capability, which will fuel the market growth. For instance, according to Ericsson, 5G subscriptions are forecast to increase globally from 2019 to 2028, from over 12 million to over 4.5 billion subscriptions, respectively.

- Many countries are launching projects to develop 6G telecommunications, which is expected to boost market growth. For instance, in October 2023, Ericsson launched the 'India 6G program' with the creation of an India 6G Research Team at its Chennai Research & Development Center. India's research team, along with Ericsson research teams in the United States and Sweden, will work together to develop the technology that will help to bring a cyber-physical continuum, where networks will provide immersive communications, critical services, and omnipresent IoT while maintaining the integrity of the delivered data.

- In February 2024, China Mobile, the largest telecom operator in China, stated that it launched the first satellite to test 6G architecture in space. Further, in February 2023, South Korea announced a plan to launch a 6G network service in 2028, two years prior to its original schedule. The country aims to secure an early dominance of future wireless frequencies. South Korea launched a five-year state project to spend around 220 billion won (USD 193 million) on developing core technologies for 6G telecommunication while stepping up joint research and cooperation with the United States. The country aims to achieve the world's first commercialization of 6G mobile telecommunication in 2028.

North America is Expected to Hold Significant Market Share

- The United States is a key market for terahertz technologies, primarily owing to the growing homeland security issues, investments in defense, and R&D. In addition, the stringent government regulations regarding the safety and production of aerospace technologies in the United States and the growing automotive and aerospace industries are driving the market for Terahertz technologies in the regional market.

- According to the data provided by the Aerospace Industry Association, in 2023, the American A&D industry generated over USD 952 billion in total sales, which is up 6.7%over 2021 levels, and of this, USD 537 billion was generated through direct industry output, and USD 415 billion was generated through indirect output, demonstrating the value of the domestic A&D supply chain. In total, the industry generated USD 418 billion in economic value or 1.65% of the total nominal GDP of the United States, which is up nearly 7.0% above 2021. Such heightened growth from the aircraft industry is a significant driver for the growth of inspection systems based on terahertz technology.

- The increase in helicopters and commercial aircraft production in the United States is expected to drive the market-the aerospace industry of the US exports more than 60% of all aerospace production.

- Canada is expected to witness significant growth in demand for the technology due to increased demand for security screening equipment across various public places. For instance, Canadian airlines screen passengers before they board flights bound for the country. Air Canada's union, the Canadian Union of Public Employees (CUPE), announced additional pre-flight screening by making flight attendants responsible for the screening.

- New screening lanes were added near the airport's B Pier to reduce the wait time for domestic departures. The new lanes were open, representing a 30% increase in screening capacity. PBS-B is an interim solution, while the airport and Canadian Air Transport Security Agency (CATSA) look at long-term solutions for consolidating domestic screening into one location in the future.

- The Canadian government is investing in airport infrastructure to provide passengers and residents with better mobility, safety, and security. For instance, in February 2024, Montreal Metropolitan Airport (YHU) received a USD 90-million investment from the Canada Infrastructure Bank (CIB) for a new passenger terminal. The investment is expected to enable the development of a new domestic airport terminal to enhance mobility options for Canadians traveling to and from Montreal while supporting economic opportunities in the Montreal region. Investments like these are likely to add opportunities for evolving technologies that are expected to promote the proper functioning of airport infrastructures, including terahertz scanners.

Terahertz Technology Industry Overview

The terahertz technology market is fragmented, with the presence of major players like Luna Innovations, Teravil Ltd, TeraView Limited, Toptica Photonics AG, and HUBNER GmbH & Co. KG. Market players are utilizing various strategies to increase their product portfolio and gain sustainable competitive advantages, such as partnerships, innovation, expansion, and acquisitions.

- December 2023 - Luna Innovations announced that it received a USD 50 million investment from White Hat Capital Partners. Through this investment, the company would focus on capitalizing on the inflection point for adopting fiber optic sensing solutions, increasing manufacturing capacity to meet the demand from strategic partnerships, and enhancing its investments in innovations.

- December 2023 - TeraView Limited hosted a delegation from Malaysia at its headquarters in the United Kingdom. The visit promises to pave the way for future partnerships and opportunities in applying terahertz technology. The visit aimed to explore potential collaborations between TeraView and critical stakeholders in Malaysia's technology and research sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in the Medical Sector and Non-destructive Testing Applications

- 5.1.2 Holistic Approach to Security Through the Usage of Terahertz Technology

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of the Technology in the Market

- 5.2.2 Lacking the Device Infrastructure to Support the Adoption of Terahertz Technology

6 MARKET SEGMENTATION

- 6.1 By Type of Technology

- 6.1.1 Terahertz Imaging Systems

- 6.1.1.1 Active System

- 6.1.1.2 Passive System

- 6.1.2 Terahertz Spectroscopy Systems

- 6.1.2.1 Time Domain

- 6.1.2.2 Frequency Domain

- 6.1.3 Communication Systems

- 6.1.1 Terahertz Imaging Systems

- 6.2 By End User

- 6.2.1 Healthcare

- 6.2.2 Defense and Security

- 6.2.3 Telecommunications

- 6.2.4 Industrial

- 6.2.5 Food and Agriculture

- 6.2.6 Laboratories

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Luna Innovations

- 7.1.2 Teravil Ltd

- 7.1.3 TeraView Limited

- 7.1.4 Toptica Photonics AG

- 7.1.5 HUBNER GmbH & Co. KG

- 7.1.6 Advantest Corporation

- 7.1.7 BATOP GmbH

- 7.1.8 Terasense GP Inc.

- 7.1.9 Microtech Instrument Inc.

- 7.1.10 Menlo Systems GmbH

- 7.1.11 Gentec Electro-optics Inc.

- 7.1.12 Bakman Technologies LLC