|

市场调查报告书

商品编码

1686537

二苯基甲烷二异氰酸酯(MDI) - 市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

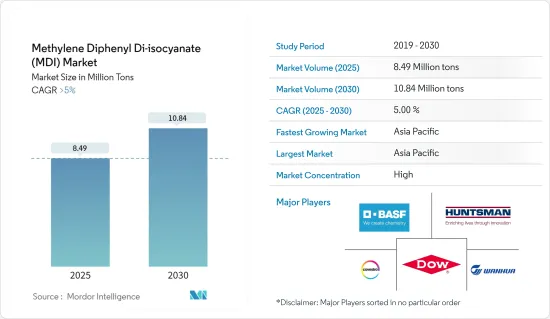

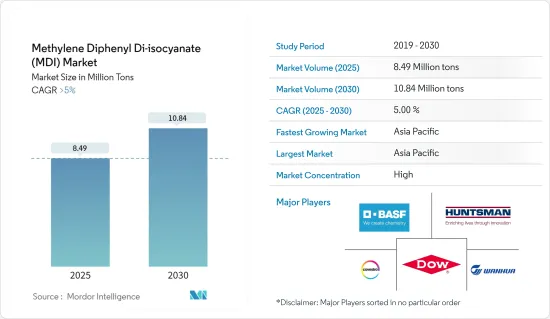

预计2025年二苯基甲烷二异氰酸酯市场规模为849万吨,2030年将达到1,084万吨,预测期间(2025-2030年)的复合年增长率将超过5%。

市场从 2020 年因新冠疫情而导致的衰退中恢復后,在 2021 年呈现成长。建筑、汽车等各终端用户产业的 MDI 消费量都有所增加。在这些最终用户产业中,MDI 用于各种应用,包括 PU 泡棉、被覆剂、黏合剂、弹性体和黏合剂。

主要亮点

- 短期内,建设产业对聚氨酯隔热材料的需求不断增长预计将推动市场成长。

- 另一方面,与 MDI 及其毒性相关的严格规定可能会成为市场成长的障碍。

- 无光气 MDI 製造流程预计将为市场成长提供丰厚的机会。

- 亚太地区占据全球市场主导地位,其中中国、日本和韩国等国家占最大消费量。在预测期内,亚太地区很可能以最高的复合年增长率成长。

二苯基甲烷二异氰酸酯(MDI)市场趋势

建筑业预计将主导市场

- 建筑业是MDI市场最大的终端用户产业。 MDI 用于各种家庭、商业和工业用途。

- 最大的应用之一是使用硬质聚氨酯泡棉作为墙壁和屋顶的隔热材料、隔热板以及门窗周围的缝隙填充材。聚异氰酸酯层压板主要用作屋顶和墙壁的隔热材料,占建筑应用硬质聚氨酯泡沫总量的大部分。

- 一些硬质聚氨酯泡沫可用于填充缝隙或覆盖不规则形状,包括喷雾泡沫、可浇注泡沫和单组分泡沫。硬质聚氨酯泡棉的环境效益显着,包括提高能源效率和减轻计划重量。

- PU 黏合剂是该终端用户产业中 PU 材料的另一个主要市场。由于其固化速度快、黏合强度高且耐候性好,聚氨酯黏合剂可用于屋顶、地板材料、墙板和门窗应用。

- 根据牛津经济研究院的预测,到 2037 年,全球建筑终端用户产业的价值将达到 13.9 兆美元。

- 根据美国人口普查局的数据,2023 年 11 月的建筑支出经季节性已调整的后预计年率为 2.0501 兆美元,较 2022 年 11 月增长 11.3%。这导致各种建筑应用中 MDI 的消费量增加。

- 根据国家统计局的数据,中国建设产业商务活动指数(BASI)从2023年11月的55.9上升至12月的56.9。 BASI 分数高于 50 表示建设产业正在成长。 2023 年 10 月的 BASI 评分为 53.5。

- 预计到 2025 年,印度建筑业的规模将达到 1.4 兆美元。到 2030 年,预计将有 6 亿人居住在城市中心,这将需要额外 2,500 万套中高端住宅。根据国家投资计画(NIP),印度的基础设施投资预算为1.4兆美元,其中24%用于可再生能源、道路、高速公路和城市基础设施,12%用于铁路。

- 因此,预计所有上述与建设产业相关的因素都将对未来几年的市场需求产生重大影响。

亚太地区可望主导市场

- 亚太地区占据全球 MDI 市场的主导地位。中国、印度和日本等国家的建筑、家具、电器产品和汽车等行业的需求不断增长,推动了该地区 MDI 使用量的成长。

- 在亚太地区,中国是MDI的主要市场。 MDI主要用于聚氨酯,中国是世界上最大的聚氨酯产品生产国和消费国。

- 据国际贸易办公室称,以年销量和製造产量计算,中国仍然是世界上最大的汽车市场。预计到2025年,国内产量将达3,500万辆。根据OICA预测,2023年韩国汽车产量将达3,016万辆,年增率为16%。

- 中国也拥有全球最大的建筑市场,占全球整体建筑投资的20%。预计到 2030 年,光是中国在建筑上的支出就将达到约 13 兆美元。

- 日本是电子产业最大的国家之一。根据日本电子情报技术产业协会(JEITA)预测,2023年电子产业产值将达到10.7兆日圆(7,232万美元)。

- 印度有超过 2,500 家装饰涂料製造商和超过 800工业涂料製造商。根据阿克苏诺贝尔印度公司的年度报告,印度的油漆和涂料行业规模预计将从2023年的75亿美元扩大到未来五年的121亿美元。预计这将进一步增加该国对MDI的需求。

- 因此,所有上述因素都可能对未来几年亚太地区的MDI需求产生重大影响。

二苯基甲烷二异氰酸酯(MDI)产业概况

二苯基甲烷二异氰酸酯(MDI) 市场正在整合,主要企业占据大部分市场份额。市场的主要企业包括 Kaleidoscope、 BASF SE、Covestro AG、Dow 和 Huntsman Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建设产业对聚氨酯隔热材料的需求不断增加

- 扩大适用范围

- 限制因素

- 与MDI相关的严格法规

- MDI的毒性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 生产流程分析

- 技术授权和专利分析

- 价格趋势情景

- 监理政策分析

第五章市场区隔

- 应用

- 硬质泡沫

- 柔软泡沫

- 涂层

- 弹性体

- 黏合剂和密封剂

- 其他用途

- 最终用户产业

- 建筑学

- 家具和室内装饰

- 电子产品

- 车

- 鞋类

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- BASF SE

- Covestro AG

- Dow

- Hexion

- Huntsman Corporation

- Kumho Mitsui Chemicals Corp.

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Wanhua

- Chongqing ChangFeng Chemical Co. Ltd

- KAROON Petrochemical Company

第七章 市场机会与未来趋势

- 无光气MDI生产工艺

The Methylene Diphenyl Di-isocyanate Market size is estimated at 8.49 million tons in 2025, and is expected to reach 10.84 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The market witnessed growth in 2021 after recovering from the dip caused by the COVID-19 pandemic in 2020. The consumption of MDI increased in various end-user industries, such as construction, automotive, and others. In these end-user industries, MDI is used in various applications, including PU foam, coatings, adhesives, elastomers, and binders.

Key Highlights

- Over the short term, the growing demand for PU in insulation in the construction industry is expected to drive the market's growth.

- On the other side, stringent regulations associated with MDI and the toxic effects of MDI may act as barriers to the growth of the market.

- The phosgene-free MDI production process is expected to offer lucrative opportunities for market growth.

- Asia-Pacific dominates the global market, with the most significant consumption in countries like China, Japan, and South Korea. Asia-Pacific is likely to witness the highest CAGR during the forecast period.

Methylene Diphenyl Di-isocyanate (MDI) Market Trends

The Construction Segment is Expected to Dominate the Market

- Construction is the largest end-user industry for the MDI market. MDI is used in various household, commercial, and industrial applications in the construction end-user industry.

- One of the largest applications is the usage of rigid PU foam as wall and roof insulation, insulated panels, and gap fillers for the space around doors and windows. Polyiso laminate board stock, used primarily in roofing and wall insulation, accounts for the majority share of total rigid PU foam in construction applications.

- Some rigid PU foams, such as spray, pour-in-place, and one-component foams, can be applied to seal gaps and cover irregular shapes. The environmental benefits of rigid PU foam are significant, including increased energy efficiency and reduced project weight.

- PU adhesives represent another large market for PU materials in this end-user industry. Owing to their fast cure time, bond strength, and weather resistance, PU adhesives are used in roofing, flooring, wallboard, and window/door installations.

- According to Oxford Economics, the global construction end-user industry will likely reach a value of USD 13.9 trillion by 2037.

- According to the US Census Bureau, construction spending during November 2023 was estimated at a seasonally adjusted annual rate of USD 2,050.1 billion, representing an 11.3% growth over November 2022. This led to an increase in the consumption of MDI across various construction applications.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. The BASI score above 50 indicates growth in the industry; the BASI score for October 2023 was 53.5.

- India's construction industry is projected to reach a value of USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- Therefore, all the aforementioned factors related to the construction industry are expected to significantly impact the market demand in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominates the global MDI market. With the increasing demand from industries such as construction, furniture, electronic appliances, and automotive in countries like China, India, and Japan, the usage of MDI is increasing in the region.

- In the Asia-Pacific region, China is the major market for MDI. MDI is primarily used for polyurethane in China, and the country is the world's largest producer and consumer of polyurethane products.

- According to the International Trade Administration, in terms of annual sales and manufacturing production, China remains the biggest automotive market globally. Domestic production is anticipated to reach 35 million cars by 2025. According to OICA, motor vehicle production in the country reached 30.16 million units in 2023, registering an annual increase of 16%.

- Also, China has the largest market for buildings in the world, making up 20% of all construction investments globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030.

- Japan is one of the largest countries in the electronics industry. According to the Japan Electronics and Information Technology Industries Association (JEITA), the production value of the electronics industry in 2023 reached JPY 10.7 trillion (USD 72.32 million).

- India is home to over 2,500 decorative coatings and 800 industrial coatings manufacturers. According to Akzo Nobel India's annual report, the size of the Indian paints and coatings industry is estimated to increase to USD 12.1 billion in the next five years from USD 7.5 billion in 2023. This is further expected to increase the demand for MDI in the country.

- Therefore, all the above-mentioned factors are likely to significantly impact MDI demand in the Asia-Pacific region in the years to come.

Methylene Diphenyl Di-isocyanate (MDI) Industry Overview

The methylene diphenyl diisocyanate (MDI) market is consolidated in nature, with top players accounting for a major share of the market. Some of the key players in the market include Wanhua Chemical Co. Ltd, BASF SE, Covestro AG, Dow, and Huntsman Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for PU in Insulation in the Construction Industry

- 4.1.2 Expanding Scope of Application

- 4.2 Restraints

- 4.2.1 Stringent Regulations Associated with MDI

- 4.2.2 Toxic Effects of MDI

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Process Analysis

- 4.6 Technology Licensing and Patent Analysis

- 4.7 Price Trend Scenario

- 4.8 Regulatory Policy Analysis

5 Market Segmentation (Market Size in Volume)

- 5.1 Application

- 5.1.1 Rigid Foam

- 5.1.2 Flexible Foam

- 5.1.3 Coatings

- 5.1.4 Elastomers

- 5.1.5 Adhesive and Sealants

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Furniture and Interiors

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion

- 6.4.5 Huntsman Corporation

- 6.4.6 Kumho Mitsui Chemicals Corp.

- 6.4.7 Sadara

- 6.4.8 Shanghai Lianheng Isocyanate Co. Ltd

- 6.4.9 Sumitomo Chemical Co. Ltd

- 6.4.10 Tosoh Corporation

- 6.4.11 Wanhua

- 6.4.12 Chongqing ChangFeng Chemical Co. Ltd

- 6.4.13 KAROON Petrochemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Phosgene-free MDI Production Process