|

市场调查报告书

商品编码

1850067

汽车悬吊系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Suspension System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

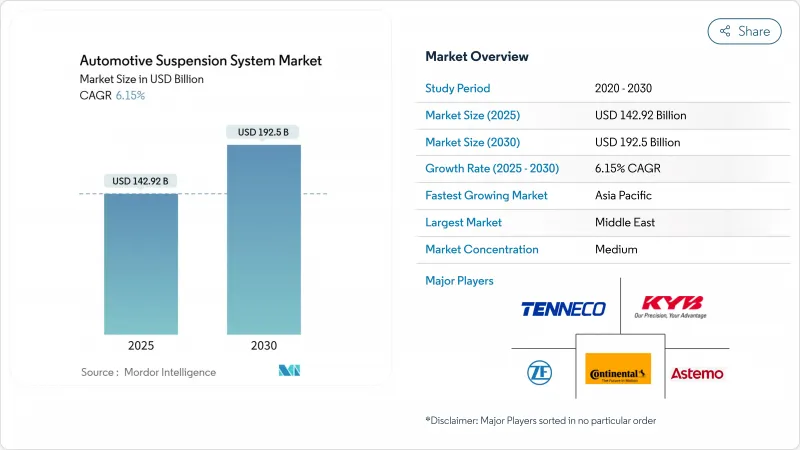

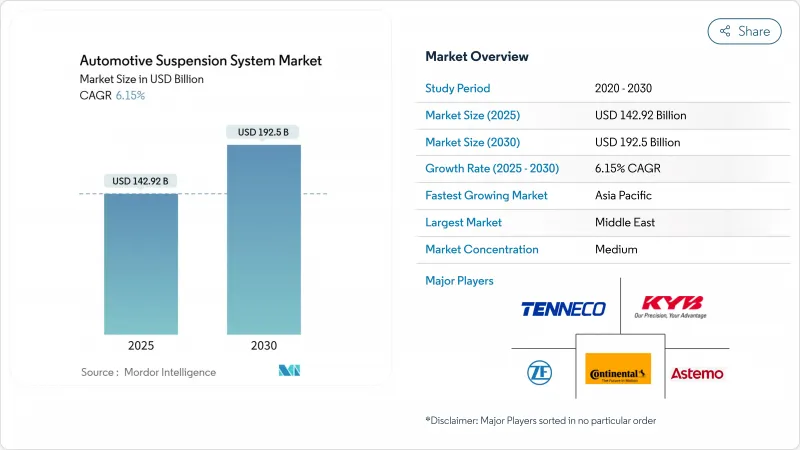

预计到 2025 年,汽车悬吊系统市场规模将达到 1,429.2 亿美元,到 2030 年将达到 1,925 亿美元,年复合成长率为 6.15%。

此次市场扩张反映了各地区底盘部件的重塑,而这主要得益于电气化、软体定义车辆架构以及日益严格的安全法规。汽车製造商正从纯机械布局转向电子控制的半主动和主动设计,以平衡乘坐舒适性、能量回收以及电池电动平台的封装限制。感测器、控制单元和云端连接是悬吊策略的核心,能够实现持续的效能更新。同时,稀土材料和半导体供应链的不确定性迫使重新设计降低材料密集度并实现多元化。在此背景下,能够将机械技术与先进的电子、软体和数据分析相结合的厂商将继续在汽车悬吊系统市场中占据优势。

全球汽车悬吊系统市场趋势与洞察

对更佳驾乘体验和操控性能的需求日益增长

消费者对静谧无振动车厢的期望日益提高,促使汽车製造商在所有价格分布中都加入了即时阻尼控制技术。磁流变阻尼器可在毫秒内调节流体黏度,这项技术已在MagneRide等系统中实用化。电动车对这项技术的关注更为显着,因为没有引擎噪音,即使是最轻微的悬吊颠簸也会传递给车内乘客。共享出行车队和自动驾驶原型车则增加了另一层监控,因为乘客在驾驶过程中会更敏锐地感知到乘坐舒适性。供应商正透过整合加速计、行程感测器和边缘处理器来应对这一需求,从而在最大限度降低能耗的同时,调节每个车轮的阻尼。

以电气化主导的底盘重新设计

电池组虽然降低了车辆的重心,但也增加了数百公斤的重量,因此悬吊工程师采用了复合材料连桿和中空稳定器来抵消增加的重量,同时又不影响强度。对静电再生阻尼器的研究表明,其尖峰时段能源回收可达45%,与车辆的能量管理逻辑相结合,相当于每公里减少5.25克二氧化碳排放。

智慧悬吊架构的初始成本和生命週期成本都很高

主动式系统结合了马达、电磁阀、加速感应器和网域控制器等组件,与被动式系统相比,每辆车的成本会增加数百美元。除非受到强制要求或获得巨额补贴,否则汽车製造商不愿在利润微薄、销售量庞大的主流细分市场中捆绑这些成本。此外,主动式系统还会增加总拥有成本,因为服务提供者需要专门的诊断工具和校准钻机。这些经济因素限制了主动式系统的应用,使其仅限于高阶车型,即使底层技术日趋成熟,也难以在大众市场中广泛应用。

细分市场分析

到2024年,减震器的市占率将达到39.07%,巩固了其作为能量耗散核心元件的持久地位。然而,电控系统和感测器将以9.82%的复合年增长率实现最快增长,这主要得益于ADAS整合、边缘处理能力的提升以及云端更新的普及。汽车悬吊系统市场受益于如今整合多种安全功能的控制模组,这些模组支援空中校准,并减少了硬体升级的需求。因此,到2030年,电子驱动的汽车悬吊系统市场规模预计将在2024年的基准上翻倍。虽然螺旋弹簧和钢板弹簧在商用运输领域仍然占据主导地位(因为耐用性比技术先进性更重要),但空气弹簧正在豪华轿车和高顶厢式货车领域不断扩大市场份额。

软体定义的车辆蓝图协调来自车轮行程感测器、荷重元和转向编码器的数据,将控制单元转换为符合ASIL-D安全标准的模组化电脑节点。人工智慧驱动的预测演算法将云端获取的路面资讯回馈到阻尼策略中,从而实现对复杂路面的主动控制,并提升乘客舒适度。机械部件与数位智慧的融合加剧了能够大规模生产两者的供应商之间的竞争,推动了汽车悬吊系统市场的发展。

由于结构简单、运作成本低,被动式悬吊系统预计在2024年仍将占据汽车悬吊系统市场65.28%的份额。然而,半主动式悬吊系统预计将以12.04%的复合年增长率成长,因为它们能够在不增加全主动式悬吊系统能耗和零件数量的情况下,显着提升乘坐舒适性。这种趋势也推动了新型转向系统的研发,例如采埃孚(ZF)的EasyTurn车桥,该车桥可实现高达80度的方向盘锁,从而提升车辆在城市道路上的操控灵活性。

磁流变阀和电子机械阀能够实现毫秒级的阻尼力变化,从而在高速行驶过程中有效抑制车身侧倾和俯仰。结合基于众包路面坑洞地图的预测分析,半主动悬吊系统能够达到接近主动悬吊系统的性能水准。随着电池能量密度的提升和再生减震器对运行损耗的补偿,主动悬吊系统在预测期内有望获得更广泛的应用,但由于半主动悬吊系统具有更优的性价比,预计仍将占据汽车悬吊系统市场成长的大部分份额。

区域分析

到2024年,亚太地区将占据全球汽车悬吊系统市场48.96%的份额,这主要得益于中国庞大的市场规模和印度产能的快速扩张。北京的新能源汽车补贴政策和严格的乘坐舒适性标准正在推动大众市场轿车采用半主动阻尼技术。同时,印度汽车製造商正在轻型商用车中采用轻量化复合材料弹簧,以提高负载效率。印度政府的各项倡议,例如“2047年汽车发展规划”,支持高价值底盘总成的本地化生产,从而增强了区域供应链的韧性。日本和韩国的供应商则提供精密阀门、智慧衬套和软体堆迭等产品,丰富了先进悬吊套件出口到全球的生态系统。

中东和非洲地区正以7.65%的复合年增长率成长,并逐渐成为高端SUV和商用车的需求中心,这些车辆必须能够承受沙漠的酷热和崎岖的地形。海湾航空公司向赛车运动娱乐领域多元化发展,以及对沙乌地阿拉伯大奖赛的投资,推动了对能够应对严苛热负荷的高性能减震器技术的需求。供应商正积极回应,推出专为磨蚀性沙地环境设计的专用密封件、长行程气囊和耐腐蚀涂层。本地化计划和自由贸易区的实施降低了进口关税,提升了该地区对汽车悬吊系统一级製造商的吸引力。

北美和欧洲市场凭藉着监管政策和高阶车型的集中度,保持着强劲的市场份额。美国《通膨降低法案》提供的电池补贴将推动对轻量化多连桿后轴的需求,这种后轴能够保护电动皮卡中安装在底盘上的电池组。欧洲对「零愿景」(Vision Zero)和「通用安全法规II」(General Safety Regulation II)的重视,已将半主动阻尼和高度控制纳入其认证清单,有效地将智慧悬吊确立为汽车製造商的合规要求。凭藉成熟的供应链、先进的模拟基础设施和完善的测试场地,这两个地区持续树立性能和安全标桿,并对全球汽车悬吊系统市场产生深远影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对更佳驾乘体验和操控性能的需求日益增长

- 重新设计的底盘以适应电气化(轻量化自我调整悬吊)

- 加强对ADAS联动底盘安全性的监管

- 新兴国家SUV和豪华车销售激增

- 透过订阅式无线升级解锁主动悬吊功能

- 3D列印复合材料悬吊零件可降低模具成本

- 市场限制

- 智慧悬吊架构的初始成本和生命週期成本都很高

- 恶劣条件下的可靠性与维护挑战

- 网路安全和功能安全合规的负担

- 稀土元素磁流变液和半导体感测器的供应瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依组件类型

- 螺旋弹簧

- 钢板弹簧

- 空气弹簧

- 避震器

- 稳定器/防倾桿

- 悬臂和连桿

- 电控系统和感测器

- 其他部件

- 按悬吊悬吊系统类型

- 被动悬吊

- 半主动悬吊

- 主动悬浮

- 按几何/建筑

- 麦花臣式悬臂梁

- 双横臂

- 多链路

- 扭梁/扭转梁

- 其他形状

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 按销售管道

- OEM

- 售后市场

- 透过推广

- 内燃机车辆

- 电动和混合动力汽车

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Co. Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO(ZF CVS)

第七章 市场机会与未来展望

The Automotive Suspension Systems Market is valued at USD 142.92 billion in 2025 and is forecast to reach USD 192.50 billion by 2030, advancing at a 6.15% CAGR.

The expansion reflects how electrification, software-defined vehicle architectures, and tightening safety mandates reshape chassis components in every region. Automakers are switching from purely mechanical layouts to electronically controlled semi-active and active designs that balance ride comfort, energy recuperation, and packaging constraints in battery-electric platforms. Sensors, control units, and cloud connectivity now center suspension strategies, enabling continuous performance updates delivered over the air. At the same time, supply-chain uncertainty in rare-earth materials and semiconductors is forcing redesigns that lessen material intensity and diversify sourcing. Against this backdrop, the automotive suspension systems market continues to reward players capable of blending mechanical know-how with advanced electronics, software, and data analytics.

Global Automotive Suspension System Market Trends and Insights

Increasing Demand for Enhanced Ride Comfort and Handling

Rising consumer expectations for quiet, vibration-free cabins push automakers to embed real-time damping control across all price points. Magnetorheological dampers modulate fluid viscosity within milliseconds, a capability commercialized in systems such as MagneRide that first appeared in luxury models and now migrate into high-volume crossovers. Electric vehicles magnify this focus because the absence of engine noise exposes even slight suspension harshness to occupants. Shared-mobility fleets and autonomous prototypes add another layer of scrutiny, as passengers disengaged from driving become acutely aware of ride quality. Suppliers respond by integrating accelerometers, stroke sensors, and edge processors that adjust damping on a wheel-by-wheel basis while minimizing energy draw.

Electrification-Driven Chassis Redesign

Battery packs lower a vehicle's center of gravity but add hundreds of kilograms, prompting suspension engineers to adopt composite links and hollow stabilizer bars that counteract mass increases without compromising strength. Research on electro-hydrostatic regenerative dampers shows 45% peak energy recovery, equating to 5.25 g/km CO2 savings when integrated with vehicle energy-management logic.

High Upfront & Lifecycle Cost of Smart Suspension Architectures

Active systems combine motors, solenoid valves, acceleration sensors, and domain controllers, inflating the bill-of-materials by several hundred USD per vehicle compared with passive setups. OEMs hesitate to bundle such costs in mainstream segments with thin margins unless mandated or heavily subsidized. Total ownership expenses also rise, as specialized diagnostic tools and calibration rigs become necessary for service providers. These economics restrict penetration to premium trims, slowing mass-market adoption even when the underlying technology matures.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for ADAS-Linked Chassis Safety

- Rapid SUV & Premium-Vehicle Sales in Emerging Economies

- Rare-earth MR-fluid and Semiconductor Sensor Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 39.07% share held by shock absorbers in 2024 confirms their enduring role as the core energy-dissipation element. Yet, electronic control units and sensors are the fastest climbers at a 9.82% CAGR, supported by ADAS integration, edge-processing power gains, and the pivot toward cloud-linked updates. The automotive suspension systems market benefits from control modules that now host multiple safety functions, allowing OTA calibration and reducing the need for hardware revisions. As a result, the automotive suspension systems market size attributed to electronics is on track to double its 2024 baseline by 2030. Coil and leaf springs remain prevalent in commercial transport where durability outweighs finesse, while air springs gain share in luxury sedans and high-roof vans.

Software-defined vehicle roadmaps turn control units into modular compute nodes that meet ASIL-D safety levels while orchestrating data from wheel-travel sensors, load cells, and steering encoders. AI-assisted predictive algorithms feed cloud-derived road information into damping strategies, delivering proactive control and elevating occupant comfort even on unpredictable surfaces. This convergence between mechanical parts and digital intelligence reinforces the competitive moat of suppliers capable of manufacturing both domains at scale, propelling the automotive suspension systems market forward

Passive configurations retained a 65.28% share of the automotive suspension systems market size in 2024 due to simplicity and low running costs. Semi-active setups, however, are registering an 12.04% CAGR because they deliver meaningful ride gains without the energy draw and component count of fully active designs. Their adoption also underpins new steering innovations such as ZF's EasyTurn axle, which increases steering lock to 80 degrees, improving urban agility.

Magnetorheological and electromechanical valves allow millisecond-scale damping shifts that flatten body roll and pitch during high-speed maneuvers. Paired with predictive analytics drawn from cloud-sourced pothole maps, semi-active systems achieve near-active performance envelopes. Over the forecast horizon, active suspensions may gain greater visibility as battery energy density rises and regenerative dampers offset operational losses, but semi-active designs are expected to capture the bulk of incremental volume thanks to favorable cost-benefit ratios within the automotive suspension systems market.

The Automotive Suspension Systems Market Report is Segmented by Component Type (Coil Spring, Leaf Spring, and More), Suspension System Type (Passive Suspension and More), Geometry (MacPherson Strut, Double Wishbone, and More), Vehicle Type (Passenger Cars, LCV, and More), Sales Channel (OEM and Aftermarket), Propulsion (ICE and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchors the automotive suspension systems market with a 48.96% share in 2024, underpinned by China's scale and India's rapid capacity additions. Beijing's new-energy-vehicle subsidies and stringent ride-comfort benchmarks drive the adoption of semi-active damping in mass-market sedans. At the same time, Indian OEMs integrate lightweight composite springs to improve payload efficiency in small commercial trucks. Government schemes such as India's Automotive Mission Plan 2047 support local production of high-value chassis assemblies, reinforcing regional supply resilience. Japanese and South Korean suppliers contribute precision valves, smart bushings, and software stacks, lending depth to an ecosystem that now exports advanced suspension kits worldwide.

The Middle East and Africa, advancing at 7.65% CAGR, is emerging as a focal point for premium-SUV and commercial-vehicle demand that must withstand desert heat and rugged terrain. Gulf airlines' diversification into motorsport entertainment and Saudi Arabia's Grand Prix investments spur interest in high-performance damper technology capable of coping with severe thermal loads. Suppliers respond with specialized seals, long-stroke air bellows, and corrosion-resistant coatings designed for abrasive sand environments. Localization programs and free-trade zones lower import duties, enhancing the region's appeal for tier-1 manufacturing lines within the automotive suspension systems market.

North America and Europe maintain strong value shares through regulatory pull and premium-model concentration. The U.S. Inflation Reduction Act's domestic-battery incentives amplify demand for lightweight multi-link rear axles that protect floor-mounted packs in electric pickups. Europe's focus on Vision Zero and General Safety Regulation II embeds semi-active damping and ride-height control into homologation checklists, making intelligent suspensions a de facto requirement for OEM compliance. Mature supply chains, advanced simulation infrastructure, and robust test tracks ensure both regions continue to set performance and safety benchmarks that ripple across the global automotive suspension systems market.

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Co. Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO (ZF CVS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for enhanced ride comfort & handling

- 4.2.2 Electrification-driven chassis redesign (lightweight adaptive suspensions)

- 4.2.3 Regulatory push for ADAS-linked chassis safety

- 4.2.4 Rapid SUV & premium-vehicle sales in emerging economies

- 4.2.5 Subscription-based OTA upgrades unlocking active-suspension features

- 4.2.6 3-D printed composite suspension parts reducing tooling cost

- 4.3 Market Restraints

- 4.3.1 High upfront & lifecycle cost of smart suspension architectures

- 4.3.2 Reliability & maintenance challenges in harsh conditions

- 4.3.3 Cyber-security & functional-safety compliance burden

- 4.3.4 Rare-earth MR-fluid & semiconductor sensor supply bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Component Type

- 5.1.1 Coil Springs

- 5.1.2 Leaf Springs

- 5.1.3 Air Springs

- 5.1.4 Shock Absorbers

- 5.1.5 Stabilizer / Anti-roll Bars

- 5.1.6 Suspension Arms & Links

- 5.1.7 Electronic Control Units & Sensors

- 5.1.8 Other Components

- 5.2 By Suspension System Type

- 5.2.1 Passive Suspension

- 5.2.2 Semi-Active Suspension

- 5.2.3 Active Suspension

- 5.3 By Geometry / Architecture

- 5.3.1 MacPherson Strut

- 5.3.2 Double Wishbone

- 5.3.3 Multi-Link

- 5.3.4 Torsion Beam / Twist Beam

- 5.3.5 Other Geometries

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Propulsion

- 5.6.1 Internal-Combustion-Engine Vehicles

- 5.6.2 Electric & Hybrid Vehicles

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Aisa-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 South Africa

- 5.7.5.1.4 Egypt

- 5.7.5.1.5 Turkey

- 5.7.5.1.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Tenneco Inc.

- 6.4.4 KYB Corporation

- 6.4.5 Hitachi Astemo Ltd.

- 6.4.6 Thyssenkrupp AG

- 6.4.7 Mando Corporation

- 6.4.8 Marelli Corporation

- 6.4.9 Hyundai Mobis Co. Ltd.

- 6.4.10 BWI Group

- 6.4.11 Sogefi SpA

- 6.4.12 Parker LORD Corporation

- 6.4.13 Benteler International AG

- 6.4.14 Fox Factory Holding Corp.

- 6.4.15 Hendrickson International

- 6.4.16 Ohlins Racing AB

- 6.4.17 Showa Corporation

- 6.4.18 Multimatic Inc.

- 6.4.19 SAF-HOLLAND SE

- 6.4.20 WABCO (ZF CVS)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment