|

市场调查报告书

商品编码

1536861

电池回收:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

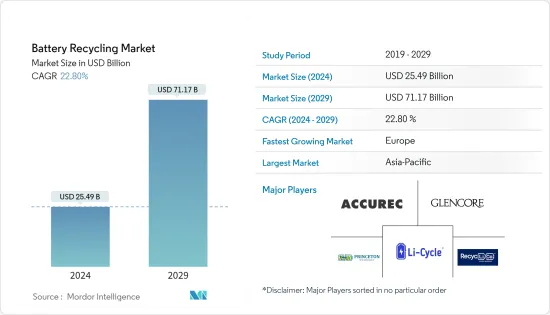

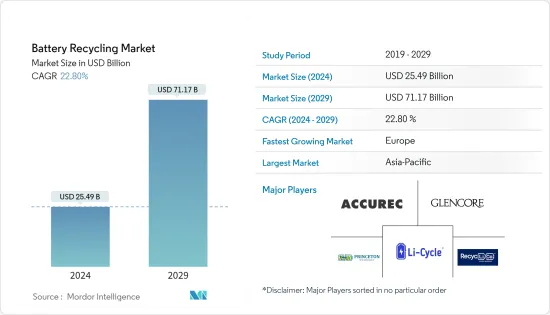

电池回收市场规模预计到 2024 年将达到 254.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 22.80%,预计到 2029 年将达到 711.7 亿美元。

电动车普及率的提高、对电池废弃物处理的日益担忧以及严格的政府政策等因素预计将在预测期内推动电池回收市场的发展。

另一方面,高成本、缺乏强大的供应链以及与电池回收相关的低产量比率预计将阻碍未来几年的市场成长。

然而,电池回收策略的技术创新为市场开拓提供了重大机会。

由于电池应用的增加,预计欧洲将成为预测期内成长最快的市场。这一增长归因于电动车 (EV) 中电池使用的增加。

电池回收市场趋势

锂离子电池领域可望大幅成长

- 锂离子电池技术在汽车 (EV) 和可再生能源产业特别受欢迎。低廉的价格和有利的化学成分正在推动对该技术的需求。锂电池的使用寿命为3-4年,之后可回收更换新电池。

- 根据国际能源总署(IEA)电动车展望报告,2023年全球电动车(BEV和PHEV)销量将超过1,330万辆,预计到2024年将进一步成长35%至1700万辆。电动车在整个汽车市场的份额从2020年的约4%上升到2023年的18%。在预测期内,由于需要回收锂离子电池,因此电动车的成长预计将为电池回收市场带来动力。

- 世界各地的公司正在推出各种计划来加强电池回收。例如,2023 年 6 月,美国能源局尖端材料和製造技术 (AMMTO) 部门宣布了一项由阿贡国家实验室 (ANL) ReCell 中心运营的锂离子电池回收、再循环和再利用计划)宣布将拨款200万美元。

- 此外,2023 年 12 月,根据阿联酋能源和基础设施部、中东创新和永续解决方案提供商 BEEAH 与印度领先的电池回收公司 Lohum Cleantech Pvt. 之间的共同开发契约条款, Lohum 将建立一个占地80,000 平方英尺的设施来回收和再生锂电池。该设施预计每年回收3,000吨锂离子电池,并将15MWh电池容量转化为永续能源储存系统(ESS)。

- 此外,为了降低成本并提高回收过程的效率,Umicore、Glencore PLC、Cirba Solutions 和 Raw Materials Company Inc. 预计这将导致未来电池回收量的增加。

- 因此,政府推动电池回收活动以及锂离子电池在电动车和能源储存系统中的利用的倡议预计将在预测期内推动全球锂离子电池回收市场的发展。

预计欧洲将进一步成长

- 在欧洲,由于新兴企业的崛起,电池回收市场不断成长。电池回收的其他主要推动力是该地区不断增长的电动车市场和能源储存计划。

- 根据国际能源总署(IEA)的数据,2023年纯电动车销量为220万辆,比2019年成长4.95倍。随着世界各国关注净零碳排放目标并以清洁燃料能源来源取代碳氢化合物,这一数字正在显着增加。

- 根据世界能源资料统计回顾,在欧洲,由于全部区域多个太阳能和风电通道的发展,2022年发电量较2021年下降了3.5%。大部分发电来自可再生能源发电。多年来,发电和消费量之间的差距不断扩大,预计将增加预测期内电池回收的需求。

- 由于多种因素,法国锂离子电池回收市场正在经历显着成长。成长的主要驱动力之一是该国对永续能源和交通实践的关注。例如,2023年3月,Li-Cycle宣布计划在法国哈内斯建造一座1万吨/年的锂离子电池回收设施。该设施计划于 2024 年完工,隔年产能将增加至多 25,000 吨。

- 同样,2023年3月,Altium Metals宣布计画加速开发该国最大的锂离子回收厂,年产能近3万吨。 2022年英国蓄电池产能将达2.3GW。作为国家电池储存目标的一部分,到 2030 年将安装约 20GW。这为各种公共和私人开发人员投资电池能源储存计划提供了机会。

- 西班牙设定了2023年便携式电池回收率达到45%、2027年达到63%、2030年达到73%、2028年轻型交通电池回收率达到51%、2031年达到61%的目标。增加电池收集是正确回收电池的必要步骤。

- 随着欧洲能源储存市场的持续成长,电池回收市场也将产生重大影响。随着越来越多的家庭和企业投资能源储存解决方案来储存太阳能的剩余能源或在高峰时段使用,对电池的需求不断增加,需要回收的电池数量也会增加。

- 由于这些发展,欧洲预计在未来几年将显着成长。

电池回收业概况

电池回收市场适度分散。市场主要企业包括(排名不分先后)Accurec Recycling GmbH、Glencore PLC、Princeton NuEnergy Inc.、Li-Cycle Holdings Corp. 和 Recyclo Battery Materials Inc.。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车的扩张

- 人们对电池废弃物处理的兴趣日益浓厚,政府政策也越来越严格

- 抑制因素

- 回收作业高成本

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依电池类型

- 铅酸电池

- 镍电池

- 锂离子电池

- 其他电池类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 埃及

- 奈及利亚

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Accurec Recycling GmbH

- Aqua Metals Inc.

- Battery Recycling Made Easy

- Battery Solutions Inc.

- Call2Recycle Inc.

- Eco-Bat Technologies Ltd

- Exide Technologies

- Neometals Ltd

- Raw Materials Company

- Recupyl SAS

- 市场排名分析

第七章 市场机会及未来趋势

- 电池回收的创新

The Battery Recycling Market size is estimated at USD 25.49 billion in 2024, and is expected to reach USD 71.17 billion by 2029, growing at a CAGR of 22.80% during the forecast period (2024-2029).

Factors such as the increasing adoption of electric vehicles, rising concerns over battery waste disposal, and stringent government policies are likely to drive the battery recycling market in the forecast period.

On the other hand, higher costs, lack of a strong supply chain, and low yield related to battery recycling are expected to hinder market growth in the coming years.

Nevertheless, technological innovations in battery recycling strategies create tremendous opportunities for market development.

Europe is expected to be the fastest-growing market during the forecast period due to the rising number of battery applications. This growth is due to the growing battery usage in electric vehicles (EVs).

Battery Recycling Market Trends

The Lithium-ion Battery Segment is Expected to Witness Significant Growth

- Lithium-ion battery technology has gained prominence, particularly in the automobile (EV) and renewable energy industries. Low pricing and favorable chemistry enhanced technology demand. A lithium battery has a lifetime of three to four years, after which it can be recycled and replaced with a new one.

- According to the International Energy Agency Electric Vehicle Outlook Report, more than 13.3 million electric cars (BEV and PHEV) were sold worldwide in 2023, and sales are expected to grow by another 35% in 2024 to reach 17 million. This significant growth in electric cars' share of the overall car market rose from around 4% in 2020 to 18% in 2023. The rise in electric vehicles is likely to give impetus to the battery recycling market, as there is a need for Li-ion batteries to be recycled during the forecast period.

- The companies across the world are launching various projects to enhance battery recycling. For instance, in June 2023, the Advanced Materials and Manufacturing Technologies (AMMTO) branch of the US Department of Energy announced that USD 2 million would be allocated to programs for the rejuvenation, recycling, and reuse of lithium-ion batteries run by the ReCell Center at Argonne National Laboratory (ANL).

- Additionally, in December 2023, the UAE's Ministry of Energy & Infrastructure, BEEAH, the Middle East's provider of innovative and sustainable solutions, and Lohum Cleantech Pvt. Ltd (Lohum), India's top battery recycling company, inked a deal to construct the country's first electric vehicle (EV) battery recycling facility. According to the terms of the joint development agreement, Lohum will establish an 80,000-square-foot facility for recycling and refurbishing lithium batteries. This facility is anticipated to recycle 3000 tons of lithium-ion batteries annually and convert 15 MWh of battery capacity into sustainable energy storage systems (ESS).

- Furthermore, to cut costs and boost efficiency in the recycling processes, leading industry participants like Umicore, Glencore PLC, Cirba Solutions, Raw Materials Company Inc. (RMC), and RecycLiCo Battery Materials Inc. are employing various technological advancements. This is expected to lead to an increase in battery recycling in the future.

- Therefore, government initiatives to boost battery recycling activities and lithium-ion battery utilization for electric vehicles and energy storage systems are anticipated to drive the global lithium-ion battery recycling market during the forecast period.

Europe Expected to Witness Faster Growth

- The battery recycling market has been witnessing continuous growth in Europe due to the blooming start-ups in the field. Other big drivers for battery recycling are the growing electric vehicle market and energy storage projects in the region.

- According to the International Energy Agency (IEA), in 2023, battery electric vehicle sales were recorded at 2.2 million, an increase of 4.95 times compared to 2019. The number has risen significantly as countries worldwide focus on NET zero carbon emission targets and replace hydrocarbons with clean fuel energy sources.

- According to the Statistical Review of World Energy Data, in Europe, electricity generation reduced by 3.5% in 2022, compared to 2021, due to the maintenance of several solar and wind channels across the region. The majority of electricity generation comes from renewable sources of energy. The difference between generations and consumption is increasing every year, and this is likely to increase the demand for battery recycling during the forecast period.

- The lithium-ion battery recycling market in France is experiencing significant growth due to several factors. One of the primary drivers of growth is the country's strong focus on sustainable energy and transportation practices. For instance, in March 2023, Li-Cycle announced its plans to build a 10,000 mt/year lithium-ion battery recycling facility in Harnes, France. The facility is expected to be completed by 2024 and will boost capacity by up to 25,000 mt/year in the following years.

- Similarly, in March 2023, Altilium Metals announced plans to accelerate the development of the country's largest lithium-ion recycling plant, with a capacity of nearly 30,000 tonnes per year. The battery storage capacity in the United Kingdom was 2.3 GW as of 2022. As a part of the national battery storage target, about 20 GW of power will be installed by 2030. This signifies an opportunity for various public and private developers to invest in battery energy storage projects.

- Spain has set a target of portable battery collection for recycling to 45% in 2023, 63% in 2027, and 73% in 2030, and for batteries from light means of transport, the target is set at 51% in 2028 and 61% in 2031. An increase in battery collection is a necessary step for the proper recycling of batteries.

- As the energy storage market continues to grow in Europe, there will be a significant impact on the battery recycling market. With more and more households and businesses investing in energy storage solutions to store excess solar energy or to use during peak hours, the demand for batteries will increase, leading to an increase in the volume of batteries that need to be recycled.

- Owing to such developments, Europe is expected to witness significant growth in the coming years.

Battery Recycling Industry Overview

The battery recycling market is moderately fragmented. Some of the major players in the market (in no particular order) include Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., and Recyclico Battery Materials Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Electric Vehicles

- 4.5.1.2 Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Recycling Operations

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid Battery

- 5.1.2 Nickel Battery

- 5.1.3 Lithium-ion battery

- 5.1.4 Other Battery Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Accurec Recycling GmbH

- 6.3.2 Aqua Metals Inc.

- 6.3.3 Battery Recycling Made Easy

- 6.3.4 Battery Solutions Inc.

- 6.3.5 Call2Recycle Inc.

- 6.3.6 Eco-Bat Technologies Ltd

- 6.3.7 Exide Technologies

- 6.3.8 Neometals Ltd

- 6.3.9 Raw Materials Company

- 6.3.10 Recupyl SAS

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in the Battery Recycling