|

市场调查报告书

商品编码

1536867

汽车开关:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Switch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

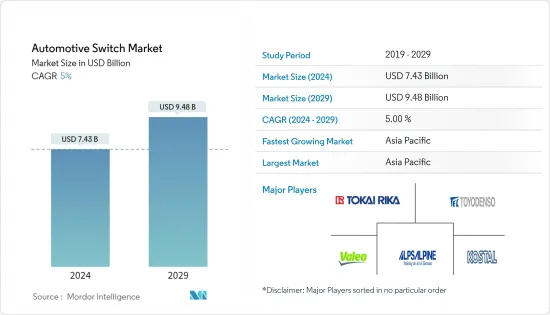

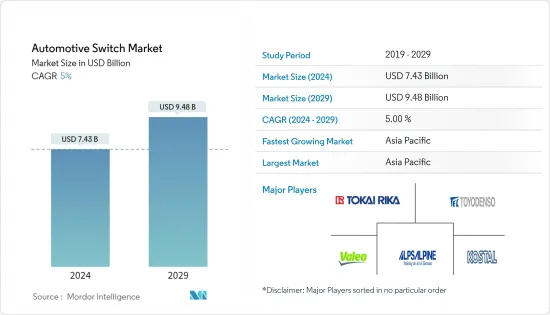

预计2024年汽车开关市场规模为74.3亿美元,2029年达94.8亿美元,在市场预测期间(2024-2029年)复合年增长率为5%。

从中期来看,汽车产量和电子设备使用量的增加可能会增加对开关的需求。此外,人们日益渴望使汽车变得更轻也将支持市场成长。

由于汽车中安装的电子元件数量的增加以及燃油效率和废气法规的收紧,汽车开关的需求预计将增加。然而,由于虚拟助理的普及以及语音辨识技术整合到汽车中,未来市场可能会面临障碍。

全球汽车服务中心的快速扩张推动了对汽车开关的需求。随着汽车维修服务的持续成长,预计在预测期内对开关的需求也会增加。

由于汽车行业的成长以及对安全功能、资讯娱乐系统和暖通空调系统等技术先进车辆的需求不断增长,亚太地区将继续主导市场并在预测期内实现最高成长率。

汽车开关市场趋势

电子系统开关正在经历显着成长

汽车产业正在经历从硬体定义汽车到软体定义汽车的重大转变,每辆车的软体和电子产品的平均数量不断增加。这一转变是由政府法规和消费者对系统控制更加自动化的愿望所推动的,从而导致电子产品在汽车中的广泛使用。

由于疫情和供应链中断而导致的汽车产销激增以及晶片短缺,预计将为预测期内的市场带来积极前景。

人们越来越希望透过允许汽车与其他车辆和基础设施通讯来使汽车变得更加智慧和方便,从而导致对新车电子系统的需求可能会迅速增加。

由于中檔和入门级汽车中的技术的可用性以及消费者购买基于该技术的售后市场产品,对汽车电子的需求正在增加。

动力传动系统电气化,特别是全电动汽车,可提供高能源效率和零废气排放。因此,纯电动车市场将出现各种各样的微控制器、功率半导体、开关和感测器,预计将推动汽车开关市场的扩张。

亚太地区占主要市场占有率

亚太地区引领汽车开关市场,其次是欧洲和北美。中国在亚太地区汽车开关市场占据主导地位。该地区作为汽车市场占有重要地位。此外,车辆电气化程度的不断提高以及电子稳定控制(ESC)和高级驾驶辅助系统(ADAS)等先进安全技术的兴起正在主导亚太地区的汽车产业。

该国对乘用车的需求正在增加,未来几年对开关的需求可能会增加。国家推出了安全法规,并实施了新车评估计画(C-NCAP),其标准与欧洲标准相当。自从实施该规定以来,中国发生了重大的法律和社会变化。

汽车电气化趋势是推动汽车开关市场的关键因素。因此,汽车製造商越来越多地与电子製造商合作,以满足消费者的需求。较低的系统价格也支持先进功能和半导体产品在中国的快速采用,这将对目标市场的成长产生积极影响。

由于政府的参与和消费者对系统更加自动控制的需求,电子产品在汽车中的使用正在增加。电子产品为提高能源效率和减少排放气体提供了新的机会。汽车电子在所有车型中的高渗透率受到三个主要方面的影响:生产力、品质和创新。

多家中国汽车製造商正在转型,以实现 2030 年碳峰值目标。东风计画到 2024 年,其新乘用车 100% 实现电动化。据该公司称,从2022年4月起,比亚迪将只生产纯电动车和插电式混合动力车。

随着全部区域的发展,汽车开关的需求预计在未来几年将会成长。

汽车开关产业概况

汽车开关市场由多家主要企业主导,例如:东海理化(Tokai Rika)、奥托立夫(Autoliv Inc.)、大陆集团(Continental AG)、阿尔卑斯电气(Alps Electric Co.)、松下电器(Panasonic Corporation)、海拉(Hella KGaA Hueck & Co.)、德昌电机(Johnson Electric Holdings Limited) 和法雷奥(Valeo) 等汽车零件製造商在全球范围内的快速扩张可能会为汽车零件製造商创造机会。

- 2024年2月,卡莫尼产业宣布计画在2026年投资3,400万美元,在庆尚北道庆州市兴建电气元件工厂。新工厂将生产座椅电源模组开关和其他零件。

- 2024 年 2 月,随着印度电动轻型商用车和公车前景的增强,Ashok Leyland 向 Optare PLC/Switch 投资了 8,000 万美元。

- 2022 年 5 月,Marvell 发布了第三代 Marvell Brightlane 乙太网路交换器。这是汽车业最先进的安全託管交换器。此交换器具有双核臂处理冗余和锁步功能,可确保支援车辆安全和性能的关键任务应用的高可靠性。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车电气化进展

- 市场限制因素

- 开关製造所用原料成本较高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按开关类型

- 旋钮

- 按钮

- 垫片

- 按用途

- 指示系统开关

- 电子系统开关

- 空调

- EMS开关

- 按车型

- 客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- Hella KGaA Hueck & Co.

- Omron Corporation

- Panasonic Corporation

- Tokai Rika Co. Ltd

- Minda Corporation Limited

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co. Ltd

第七章 市场机会及未来趋势

第八章 主要供应商讯息

The Automotive Switch Market size is estimated at USD 7.43 billion in 2024, and is expected to reach USD 9.48 billion by 2029, growing at a CAGR of 5% during the forecast period (2024-2029).

Over the medium term, the production of vehicles and their use of electronics may increase, thus boosting the demand for switches. The growing preference for lightweight vehicles will also drive the market's growth.

The demand for automotive switches is expected to increase due to the rising electronic content in vehicles and the enactment of stricter fuel economy and emission regulations. However, the market may face obstacles in the future due to the growing popularity of virtual assistants and the integration of voice recognition technology in vehicles.

Demand for automotive switches accompanies the rapid expansion of vehicle service centers worldwide. As vehicle maintenance services continue to grow, the demand for switches will also rise during the forecast period.

Asia-Pacific is expected to continue to dominate the market studied and witness the highest growth rate during the forecast period, owing to the growing automotive industry and rising demand for technologically advanced vehicles, which include safety features, infotainment systems, and HVAC systems.

Automotive Switch Market Trends

Electronic System Switches Witnessing Major Growth

The automotive industry is undergoing a significant shift from hardware-defined to software-defined vehicles, leading to an increase in the average software and electronics content per vehicle. This shift is driven by government regulations and consumer demand for greater automatic control of systems, resulting in the widespread use of electronics in vehicles.

A surge in automotive production and sales following the pandemic and supply chain disruptions, along with chip shortages, is expected to create a positive outlook for the market during the forecast period.

There is a growing trend toward making cars more intelligent by allowing them to communicate with other vehicles and infrastructure through electronic systems, ensuring convenience for consumers, which may result in a rapid increase in the demand for electronic systems in new cars.

The demand for automotive electronics has increased due to technology availability in mid-range and entry-level cars and consumer purchase of technology-based aftermarket products.

The electrification of drivetrains, particularly in fully electric vehicles, offers high energy efficiency and zero tailpipe emissions. As a result, the emergence of a wide range of microcontrollers, power semiconductors, switches, and sensors for the pure electric vehicle market is expected to fuel the expansion of the automotive switch market.

Asia-Pacific Holds the Major Market Share

Asia-Pacific leads the automotive switch market, followed by Europe and North America. China dominates the Asia-Pacific automotive switch market. The country is a significant vehicle market in the region. It also dominates the Asia-Pacific automotive industry due to increased vehicle electrification and a rise in advanced technology for safety, such as ESC and advanced driver assistance systems (ADAS).

Rising demand for passenger cars across the country will likely increase the demand for switches in the coming years. The country has introduced safety regulations to run a new car assessment program (C-NCAP) with standards that will match Europe's standards. There have been significant legal and social changes in China since the implementation of these regulations.

The growing trend of vehicle electrification is a significant factor driving the automotive switch market. As a result, automotive manufacturers are increasingly collaborating with electrical component manufacturers to suit the needs of their consumers. Lower system prices have also aided in the rapid adoption of advanced features and semiconductor products in China, which will positively impact the target market's growth.

The usage of electronics in vehicles has increased due to government involvement and consumers' demand for greater automatic control of systems. Electronics provide new opportunities to improve energy efficiency and reduce emissions, as several functions can be consolidated into fewer and smaller electronic control superunits, reducing weight. The high penetration rate of automobile electronics across all vehicle classes is influenced by three major aspects: productivity, quality, and innovation.

Several automakers in China are making changes to match the 2030 carbon peaking aim. By 2024, Dongfeng intends to electrify 100% of its new passenger car models. According to the company, from April 2022 onwards, BYD will only produce BEVs and PHEVs.

With such development across the region, the demand for automotive switches is likely to grow in the coming years.

Automotive Switch Industry Overview

The automotive switch market is dominated by several key players such as Tokai Rika Co. Ltd, Autoliv Inc., Continental AG, Alps Electric Co., Panasonic Corporation, Hella KGaA Hueck & Co., Johnson Electric Holdings Limited, and Valeo. The rapid expansion of automotive component manufacturers across the world is likely to create an opportunity for the market in the coming years. For instance,

- In February 2024, Duck Il Industry Co. Ltd announced its plan to invest USD 34 million by 2026 to construct an electrical component factory in Gyeongju, Gyeongsangbuk-do. The new facility will manufacture seat power module switches and other components.

- In February 2024, Ashok Leyland invested USD 80 million in Optare PLC/Switch as prospects of e-LCVs and buses strengthened in India.

- In May 2022, Marvell introduced its third-generation Marvell Brightlane Ethernet Switch, the most advanced secure managed switch in the automotive industry. The switch features dual-core arm processing redundancy with lockstep to ensure high reliability for mission-critical applications that support vehicle safety and performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Vehicle Electrification

- 4.2 Market Restraints

- 4.2.1 The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Switch Type

- 5.1.1 Knob

- 5.1.2 Button

- 5.1.3 Touchpad

- 5.2 By Application

- 5.2.1 Indicator System Switches

- 5.2.2 Electronic System Switches

- 5.2.3 HVAC

- 5.2.4 EMS Switches

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Alps Alpine Co. Ltd

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental AG

- 6.2.4 Hella KGaA Hueck & Co.

- 6.2.5 Omron Corporation

- 6.2.6 Panasonic Corporation

- 6.2.7 Tokai Rika Co. Ltd

- 6.2.8 Minda Corporation Limited

- 6.2.9 ZF Friedrichshafen AG

- 6.2.10 Leopold Kostal GmbH & Co. KG

- 6.2.11 Valeo SA

- 6.2.12 Toyodenso Co. Ltd