|

市场调查报告书

商品编码

1536870

玻璃包装:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

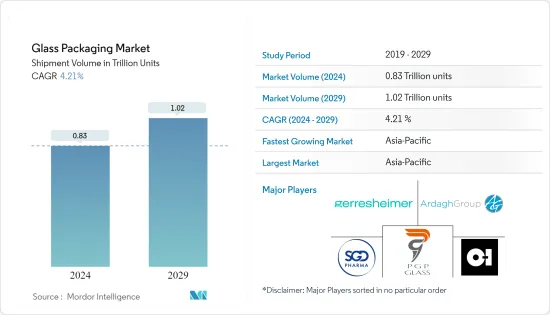

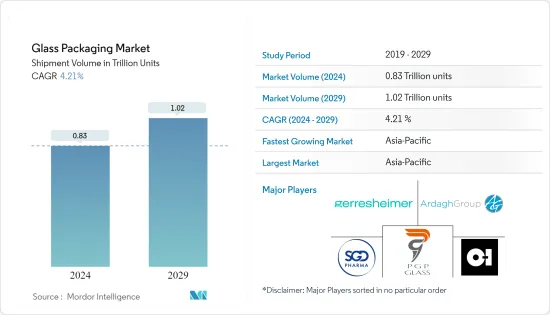

预计2024年全球玻璃包装出货量规模将达到8,300亿台,2029年将成长至1.2兆台,2024-2029年预测期间复合年增长率为4.21%。

主要亮点

- 玻璃包装被认为是在健康、口味和环境安全方面最值得信赖的包装形式之一。高檔玻璃包装可保持产品新鲜和安全。因此,儘管面临其他包装形式的激烈竞争,但它仍继续在各种最终用户行业中使用。

- 消费者对安全健康包装的需求不断增长,促进了各个类别玻璃包装的成长。此外,在玻璃上添加压花、成型和艺术饰面的创新技术使玻璃包装更受最终用户欢迎。由于对环保产品的需求不断增加以及食品和饮料行业的需求不断增加,该市场正在不断增长。

- 由于其可回收性质,玻璃被广泛认为是最环保的包装类型。轻质玻璃已成为一项关键创新,提供可与传统玻璃材料相媲美的耐用性和高稳定性,同时减少原材料用量和二氧化碳排放。

- 随着消费者人均支出的增加和生活方式的改变,印度和中国等新兴市场对啤酒、无酒精饮品和苹果酒的需求量很大。然而,营运成本的增加以及塑胶和锡等替代产品的使用增加正在限制市场的成长。

- 市场面临的主要挑战之一是铝罐和塑胶容器等替代包装形式的竞争日益激烈。这些产品比笨重的玻璃更轻,因此运输和运输成本更低,因而受到製造商和客户的欢迎。此外,由于原物料价格飙升,费用增加,使得大规模生产的产品不再具有经济可行性。

- 随着消费者对永续性的兴趣增加,啤酒公司正在与玻璃瓶和容器製造商采取合作和伙伴关係策略,提供玻璃瓶啤酒产品,以实现永续性目标。 2023 年 5 月,Ardagh Glass Packaging(Ardagh 集团)与 Sprecher Brewing Company 宣布建立合作伙伴关係。此次合作将支持酿酒厂继续成为一家立足本地、永续的公司,并持续供应 Ardagh Glass Packaging 的啤酒和饮料玻璃瓶。我们也透过用高品质玻璃瓶提供啤酒来帮助啤酒公司实现其品牌和永续性目标。

玻璃瓶市场趋势

饮料业市场占有率最高

- 优质化趋势正在影响各种饮料类别(包括无酒精饮品)的玻璃包装选择。无酒精饮品在全球广受欢迎并占有很大的市场占有率。软性饮料有多种口味和形式,适合所有饮用场合。

- 酒精饮料行业的玻璃包装市场面临来自罐形金属包装行业的激烈竞争。然而,由于其用于高级产品,预计在预测期内将保持其份额。预计各种饮料产品将出现成长,包括果汁、咖啡、茶、汤和非乳类饮料。

- 在酒精饮料中,啤酒近年来经历了显着增长。大部分啤酒销售都是玻璃瓶装,这推动了玻璃包装行业增加产量的需求。对优质酒精饮料不断增长的需求正在推动玻璃瓶的成长。

- 可回收玻璃瓶对于企业运送产品来说是一种经济高效的选择。这种包装形式主要用于非酒精饮料行业。大约 70% 用于天然矿泉水的瓶子是由塑胶製成的。考虑到环境因素,瓶装水包装材料的选择越来越多。

- 可口可乐和百事可乐等饮料公司也努力避免使用塑胶包装。百事公司的目标是到 2025 年消除 670 亿个宝特瓶的使用,这些塑胶瓶将被玻璃瓶取代。

- 在消费者对环保牛奶的需求推动下,全球乳製品产业正从塑胶瓶转向玻璃瓶。 Milk & More 和 Parker Dairies 等乳製品公司注意到对玻璃瓶的需求显着增加。消费者愿意为这项服务支付更多费用,因为他们寻求减少塑胶的使用并帮助环境。

- 根据欧盟委员会统计,2020年葡萄酒产量为1.44亿公顷,2023年将增加至1.59亿公顷。葡萄酒包装首选彩色玻璃瓶,以防止阳光破坏里面的葡萄酒。预计在预测期内,葡萄酒消费量的成长将带动玻璃包装的需求。酿酒师变得越来越创新,开发新的概念和设计,以透过包装吸引顾客。

亚太地区占最大市场占有率

- 对药品的需求不断增长以及製药技术的进步正在推动对玻璃瓶、安瓿和其他玻璃包装解决方案的需求。随着慢性病的增加和疫苗的大规模生产,对初级包装,特别是玻璃容器的需求预计将激增。

- 酒精饮料消费量的成长正在推动亚太地区的市场成长。亚太地区的啤酒包装产业主要受到文化趋势变化、人口成长、都市化以及啤酒在年轻人中日益普及的推动。

- 在印度,大多数烈酒如威士忌、琴酒、兰姆酒和白兰地都采用玻璃瓶包装。根据《经济时报》报道,由于烈酒消费量增加,2023 年销量有所增长,其中威士忌销量最高,达 2.5318 亿箱,其次是 8195 万箱,杜松子酒销量为 4720 万箱。

- 中国是全球最大的医药市场之一。与许多已开发国家相比,医疗保健支出仍然不多。中国政府正在提高国内药品研发能力。因此,为更多人提供负担得起的医疗保健成为可能。

- 此外,近年来,中国的酒精消费量大幅增加。总部位于巴西的北欧银行表示,中国的酒精饮料消费预计将在未来几年增加对玻璃包装的需求。许多酒精饮料製造商也希望向国内扩张,以抓住这个机会。

- 日本非常重视回收玻璃容器和瓶子以减少碳排放,并在全国各地建立了多个玻璃回收工厂。超过 18 家玻璃回收厂接受玻璃瓶和容器并将其製成玻璃刮匙和粉末。强大的回收基础设施因其卓越的功能特性而促进玻璃包装的发展。

- 此外,印度等国家的啤酒消费量也正在增加。出于健康考量,印度消费者越来越多地选择玻璃包装,尤其是瓶子。玻璃包装优于其他选择,因为它可以防止表面浸出。

- 印度製药业高度重视研发。近年来,印度透过扩大研发生态系统和增加药品出口,成为全球公认的医疗强国。

- 各种最终用途领域的玻璃容器出货量的增加正在推动日本市场的成长。玻璃容器非常适合包装液体药品、化学物质以及各种易腐烂和不易腐烂的产品。人们对环保包装解决方案的日益偏好正在对药用玻璃包装的采用产生积极影响。

玻璃包装产业概况

全球玻璃包装市场呈现分散状态,主要企业如 Piramal Glass Private Limited、Owens-Illinois Inc.、Westpack LLC、Gerresheimer AG 和 Ardagh Group 均占有一席之地。由于替代产品的存在,竞争也很激烈,业内许多公司试图持续创新以保持市场占有率。

2024 年 4 月,我们对位于Zipaquira(哥伦比亚)的製造地进行了重大维修,以提高永续性、灵活性和生产力。 OI Glass此次维修投资约1.2亿美元,符合永续性策略、工厂升级的持续投资以及先前宣布的资本支出计画。维修包括安装最先进的熔炉,该熔炉采用经过验证的氧气/燃料燃烧和废热回收技术。

2024 年 2 月,Telangana 宣布与 SGD Pharma 和康宁公司建立合作伙伴关係,为该地区带来最新的技术和製造专业知识。此次合作将康宁公司的高品质製药管道技术与 SGD Pharma 的管瓶製造和转换专业知识相结合。这将使 SGD Pharma 能够确保印度 Telangana 州的管材製造能力,为印度和国外的客户提供初级包装。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 产业政策

第五章市场动态

- 市场驱动因素

- 对环保产品的需求不断增加

- 食品和饮料行业需求增加

- 市场限制因素

- 营运成本增加

- 扩大替代产品(塑胶)的使用

第六章 市场细分

- 按最终用户产业

- 食品

- 饮料

- 个人护理

- 卫生保健

- 家居用品

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Piramal Glass Private Limited

- Owens-Illinois Inc.

- WestPack LLC

- Gerresheimer AG

- Hindustan National Glass & Industries Ltd

- Ardagh Group

- HEINZ-GLAS GmbH & Co. KGaA

- Agrado Sa

- SGD SA(SGD Pharma)

- AAPL Solutions Pvt. Ltd

- Crestani Srl

第八章投资分析

第九章 市场机会及未来趋势

The Glass Packaging Market size in terms of shipment volume is expected to grow from 0.83 Trillion units in 2024 to 1.02 Trillion units by 2029, at a CAGR of 4.21% during the forecast period (2024-2029).

Key Highlights

- Glass packaging is considered one of the most trusted forms of packaging for health, taste, and environmental safety. Glass packaging, considered premium, maintains the freshness and safety of the product. This can ensure its continuous usage across various end-user industries despite the heavy competition from other packaging forms.

- Rising consumer demand for safe and healthier packaging helps glass packaging grow in different categories. Also, innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end users. The market is growing due to the increasing demand for eco-friendly products and the rising demand from the food and beverage industry.

- Glass is widely considered the most environmentally friendly packaging type due to its recyclable nature. Lightweight glass has become a significant innovation, offering the same resistance as conventional glass materials and higher stability, reducing the volume of raw materials and CO2 emitted.

- Emerging markets like India and China are witnessing high demand for beer, soft drinks, and ciders due to the consumers' increasing per capita spending and changing lifestyles. However, the increasing operational costs and growing usage of substitute products, such as plastics and tin, are restraining the market growth.

- One of the main challenges for the market is the increased competition from alternative forms of packaging, such as aluminum cans and plastic containers. As these items are lighter in weight than bulky glass, they are gaining popularity among manufacturers and customers because of the lower cost of their carriage and transportation. Moreover, the increasing costs of raw materials and other factors have led to higher expenses, making it economically unfeasible for mass-produced goods.

- With consumers' increasing focus on sustainability concerns, brewing companies are adopting collaboration and partnership strategies with glass bottle and container manufacturers to offer beer products in glass bottles to meet sustainability goals. In May 2023, Ardagh Glass Packaging (Ardagh Group) and Sprecher Brewing Company announced the partnership. The partnership will help the brewery's commitment to stay local and sustainable with the continuous supply of glass beer and beverage bottles from Ardagh Glass Packaging. Also, this will help the brewing company meet the brand and sustainability goals by providing beer in high-quality glass bottles.

Glass Packaging Market Trends

The Beverage Industry to Hold the Highest Market Share

- Premiumization trends have played a role in selecting glass packaging for various beverage categories, including soft drinks. Soft drinks hold a significant market share, owing to the popularity of such drinks worldwide. Soft drinks offer various flavors and formats to suit every drinking occasion.

- The market for glass packaging in the alcoholic beverage industry faces intense competition from the metal packaging segment in the form of cans. However, it is expected to maintain its share during the forecast period due to its usage of premium products. The growth is expected across different beverage products, like juices, coffee, tea, soups, and non-dairy beverages.

- Among alcoholic beverages, beer has witnessed tremendous growth in the past few years. Most beer volume is sold in glass bottles, driving the need for increased production rates in the glass packaging industry. The increasing demand for premium variants of alcoholic drinks is driving the growth of glass bottles.

- Returnable glass bottles are a cost-effective option for companies to deliver their products. This form of packaging is used mainly in the non-alcoholic beverage industry. About 70% of the bottles used for natural mineral water are plastic. The choice of bottled water packaging material is increasing, considering environmental considerations.

- Beverage companies like Coke and PepsiCo also try to avoid plastic packaging. By 2025, PepsiCo aims to eliminate the use of 67 billion plastic bottles, which glass bottles will replace.

- The global dairy industry has been witnessing a shift from plastic to glass bottles, driven by consumer demand for environmentally friendly milk. Dairy companies like Milk & More and Parker Dairies have noticed a significant rise in demand for glass bottles. Consumers are willing to pay more for this service as they attempt to reduce their use of plastic and help the environment.

- According to the European Commission, wine production in 2020 was 144 million hectares, which increased to 159 million hectares in 2023. The preferred wine packaging is a colored glass bottle to prevent sunlight from spoiling the wine inside. The increasing consumption of wine is expected to spearhead the demand for glass packaging during the forecast period. Wine manufacturers are becoming increasingly innovative in attracting customers with their packaging and are developing new concepts and designs.

Asia-Pacific to Hold the Largest Market Share

- The escalating need for pharmaceutical drugs and advancements in pharmaceutical technology drive the demand for glass bottles, ampules, and other glass packaging solutions. With an upsurge in chronic illnesses and the substantial production of vaccine doses, the demand for primary packaging, particularly glass containers, is expected to surge.

- The increasing consumption of alcoholic beverages drives market growth in the Asia-Pacific region. The beer packaging industry in the Asia-Pacific region is mainly driven by changing cultural trends, growing populations, urbanization, and the growing popularity of beer among the younger populations.

- In India, most spirits, including whiskey, gin, rum, and brandy, are packed in glass bottles. Due to the increasing consumption of spirits, there was an increase in sales in 2023; whiskey had the highest number of cases sold, with 253.18 million cases, followed by 81.95 million cases, and gin at 47.2 million cases, according to Economic Times.

- China is one of the world's largest pharmaceutical markets. Compared to many industrialized countries, healthcare spending is still modest. The Chinese government is improving its ability to research and develop medicines domestically. As a result, it can provide affordable healthcare to more citizens.

- Additionally, alcohol consumption in China has been significantly increasing over the years. As per the Brazil-based bank Banco do Nordeste, the consumption of alcoholic beverages in China is expected to increase the demand for glass packaging in the coming years. Also, many alcoholic beverage companies seek to expand in the country to seize the opportunity.

- Japan has been emphasizing recycling glass containers and bottles to reduce its carbon footprint and has built multiple glass recycling plants nationwide. Over 18 glass recycling plants accept glass bottles and containers to form glass culets and powder. The robust recycling infrastructure promotes glass packaging due to its functional property advantages.

- Also, countries such as India have increased beer consumption. Indian consumers are increasingly opting for glass packaging, particularly bottles, due to health concerns. Glass packaging is preferred over other options as it prevents surface leaching.

- India's pharmaceutical sector places a high value on research and development. In recent years, India achieved global recognition as a medical powerhouse by expanding its R&D ecosystem and boosting pharmaceutical exports, offering growth prospects for various domestic glass packaging providers.

- Increased shipments of glass containers in various end-use sectors are driving market growth in Japan. Glass containers are highly favored for packaging liquid pharmaceuticals, chemicals, and a range of perishable/non-perishable products. The growing preference for eco-friendly packaging solutions positively impacts the adoption of pharmaceutical glass packaging.

Glass Packaging Industry Overview

The global glass packaging market is fragmented due to the strong presence of major players worldwide, like Piramal Glass Private Limited, Owens-Illinois Inc., Westpack LLC, Gerresheimer AG, and Ardagh Group. The competition is also intense due to the presence of substitutes, as many companies in the industry are trying to innovate consistently to retain their market share.

April 2024: O-I Glass Inc. (O-I Glass) significantly refurbished its Zipaquira (Colombia) manufacturing site to improve sustainability, flexibility, and productivity. O-I Glass invested approximately USD 120 million in this refurbishment, which aligns with sustainability strategy, ongoing investments in plant upgrades, and a previously announced capital expenditure plan. The refurbishment included installing a state-of-the-art furnace with proven oxy/fuel combustion and waste heat recovery technology.

February 2024: Telangana announced that it will collaborate with SGD Pharma and Corning Inc. to bring modern technology and manufacturing expertise to this area. This collaboration will combine Corning's high-quality pharmaceutical tubing technology with SGD Pharma's glass vial manufacturing and conversion expertise. This will secure SGD Pharma's tubing capacities to supply primary packaging to its Indian and international customers from Telangana, India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Products

- 5.1.2 Increasing Demand from the Food and Beverage Industries

- 5.2 Market Restraints

- 5.2.1 Rising Operational Costs

- 5.2.2 Growing Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Food

- 6.1.2 Beverage

- 6.1.3 Personal Care

- 6.1.4 Healthcare

- 6.1.5 Household Care

- 6.2 By Geography ***

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.4.3 Argentina

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Piramal Glass Private Limited

- 7.1.2 Owens-Illinois Inc.

- 7.1.3 WestPack LLC

- 7.1.4 Gerresheimer AG

- 7.1.5 Hindustan National Glass & Industries Ltd

- 7.1.6 Ardagh Group

- 7.1.7 HEINZ-GLAS GmbH & Co. KGaA

- 7.1.8 Agrado Sa

- 7.1.9 SGD SA (SGD Pharma)

- 7.1.10 AAPL Solutions Pvt. Ltd

- 7.1.11 Crestani Srl