|

市场调查报告书

商品编码

1536871

硬脂酸钙:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Calcium Stearate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

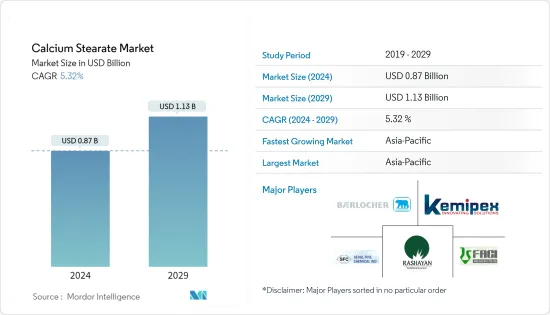

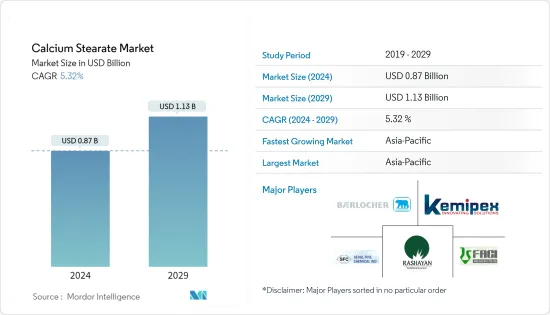

预计2024年全球硬脂酸钙市场规模将达8.7亿美元,2024-2029年预测期间复合年增长率为5.32%,2029年将达11.3亿美元。

2020年,COVID-19大流行对市场产生了负面影响。然而,目前已达到大流行前的水平,预计将继续稳定成长。

主要亮点

- 中期推动市场的主要因素是全球建设活动的增加以及对 PVC 和其他塑胶的需求的增加。

- 转向硬脂酸镁预计将阻碍市场成长。

- 硬脂酸钙在食品和饮料行业中的使用量不断增加预计将创造市场机会。

- 亚太地区是全球最大的市场,印度和中国等国家是主要消费国。

硬脂酸钙市场趋势

对建设活动的需求增加

- 硬脂酸钙常用于建筑业作为防水剂和抗风化剂。

- 硬脂酸钙与混凝土混合,用于建筑地板和预製工业。它也用作砂浆和腻子中的粉末以及组装系统中的乳液。

- 建筑物、生产设施和新办公室建设等计划的增加正在推动建筑业对硬脂酸钙的需求。

- 住宅和商业建筑的快速扩张是推动中国市场成长的主要因素。据世界银行称,中国正在鼓励并持续推进都市化进程,预计到 2030 年将成长 70%。

- 根据土木工程师学会估计,到2025年,中国、印度和美国这三大国家将占全球建筑业的近60%,并将成为市场成长的驱动力。

- 据Industry Sources称,2022年全球建筑市场规模预计为9.7兆美元,以中国、美国和印度为主导,预计2037年将达到13.9兆美元。

- 美国在北美建筑业中占有很大份额。

- 根据美国人口普查局统计,2023年美国年度建筑业价值为19,787亿美元,较2022年成长约7.03%。

- 中国和印度不断扩大的住宅建筑市场预计将导致亚太地区住宅最高。到2030年,这两个国家的中产阶级预计将占全球中阶的43.3%以上。

- 上述因素可能会影响预测期内建筑业市场中的硬脂酸钙。

亚太地区主导市场

- 亚太地区在全球市场占有率占据主导地位。由于拥有低成本的原料和劳动力,中国被认为是硬脂酸钙最有利的市场之一。

- 中国蓬勃发展的经济为消费品製造企业提供了在全球发展的机会。受中国消费品市场巨大潜力的吸引,许多外资企业纷纷进军中国并设立生产基地,推动了市场的成长。

- 中国、印度和越南等亚太国家的建设活动成长强劲,预计将在预测期内推动该地区的涂料消费。

- 根据美国国际贸易管理局的数据,中国是全球最大的建筑市场,预计到2030年将以年均8.6%的速度成长。据国家发展和改革委员会称,到2025年,中国将在重大建设计划上投资1.43兆美元。

- 根据中国国家统计局的数据,2023年中国建筑业总产值成长1.99%,达到712,847.2亿元人民币(约108,677.8亿美元)。

- 根据住宅及城乡建设部预测,2025年中国建筑业预计将维持GDP的6%。基于这些预测,2022年1月,中国政府宣布了五年计划,透过品质主导发展提高建筑业的永续性。

- 印度的住宅产业也不断成长,政府的支持和倡议进一步提振了需求。在2022-2023年预算中,住房与城市发展部(MoHUA)已拨款约98.5亿美元用于住宅建设,并为完成停滞的计划创造资金。

- 未来几年,橡胶、塑胶、建筑、製药等产业对硬脂酸钙的需求很可能受到上述所有因素的推动。

硬脂酸钙产业概况

硬脂酸钙市场较为分散。市场的主要参与者包括(排名不分先后)Mittal Dhatu Rashayan Udyog、Faci Asia Pacific Pte Ltd、Baerlocher GmbH、SEOUL FINE CHEMICAL IND. 和 Kemipex。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- PVC 和其他塑胶的需求增加

- 扩大在个人护理和製药行业的应用

- 其他司机

- 抑制因素

- 转向硬脂酸镁

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 按最终用户产业

- 塑胶/橡胶

- 建造

- 个人护理/药品

- 纸

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Baerlocher GmbH

- Barium & Chemicals, Inc.

- Coorporacion Sierra Madre

- DOVER CHEMICAL CORPORATION

- Faci Asia Pacific Pte Ltd

- Hummel Croton Inc.

- Hunan Shaoyang Tiantang auxiliaries Chemical Co. Ltd

- Kemipex

- Mittal Dhatu Rashayan Udyog

- Nantong Xinbang Chemical Technology Chemical Co. Ltd

- Peter Greven GmbH & Co. KG

- PMC Group Inc.

- SEOUL FINE CHEMICAL IND. CO. LTD

- Sun Ace Kakoh(Pte.)Ltd

第七章 市场机会及未来趋势

- 硬脂酸钙在食品和饮料行业的使用增加

- 其他机会

The Calcium Stearate Market size is estimated at USD 0.87 billion in 2024, and is expected to reach USD 1.13 billion by 2029, growing at a CAGR of 5.32% during the forecast period (2024-2029).

In 2020, the COVID-19 pandemic negatively impacted the market. However, the market has now reached pre-pandemic levels, and it is expected to grow steadily in the future.

Key Highlights

- Over the medium term, major factors driving the market are the increasing construction activities and the increasing demand for PVC and other plastics worldwide.

- The shift toward magnesium stearate is expected to hinder the growth of the market.

- The rising usage of calcium stearate in the food and beverage industry is expected to create opportunities for the market.

- Asia-Pacific is the biggest market in the world, with countries like India and China being the primary consumers.

Calcium Stearate Market Trends

Increasing Demand for Construction Activities

- Calcium stearate is used in abundance in the construction industry as a waterproofing agent and to stop efflorescence.

- It is mixed with concrete and used in building floors and in the prefabrication industry. It is also used as a powder in mortars and putties and as an emulsion in systems that are already put together.

- The growing number of projects like the construction of buildings, production houses, and new offices is driving the demand for calcium stearate in the construction sector.

- The rapid expansion of residential and commercial buildings is the main factor driving the market's growth in China. According to the World Bank, China has been encouraging and enduring a continuous urbanization process, which is estimated to grow by 70% in 2030.

- As per the estimates of the Institution of Civil Engineers, the top three countries, i.e., China, India, and the United States, will register almost 60% growth in the global construction industry by 2025, thus fueling market growth.

- According to Industrial Sources, global construction was valued at USD 9.7 trillion in 2022, and it is forecasted to reach USD 13.9 trillion by 2037, driven by superpower construction markets China, the United States, and India.

- The United States includes a significant share of the construction industry in North America.

- According to the US Census Bureau, the annual value for construction in the United States accounted for USD 1,978.7 billion in 2023, which is an increase of about 7.03% compared to that of 2022.

- Due to the increasing housing construction markets in China and India, Asia-Pacific is expected to record the highest house prices. By 2030, these two countries are expected to represent more than 43.3% of the world's middle class.

- During the forecast period, the above factors are likely to have an effect on the market for calcium stearate in the building industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global market share. China is considered one of the most lucrative markets for calcium stearate due to the availability of low-cost raw materials and labor.

- The booming economy of China has given companies that make consumer goods market opportunities to grow in the world. Attracted by the huge potential of the Chinese consumer goods market, many foreign companies entered China and set up production units, thus boosting the market's growth.

- Asia-Pacific countries, such as China, India, and Vietnam, are registering strong growth in construction activities, which is expected to drive the consumption of these coatings in the region during the forecast period.

- As per the US International Trade Administration, China is the largest global construction market and is expected to grow at an average annual rate of 8.6% by 2030. According to the National Development and Reform Commission (NDRC), China will invest USD 1.43 trillion in significant construction projects by 2025.

- According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in the year 2023 increased by 1.99% and was valued at CNY 71,284.72 billion (~USD 10,086.78 billion).

- According to the Ministry of Housing and Urban Rural Development's forecast, China's construction sector is projected to remain at 6 % of its GDP in 2025. In view of these forecasts, in January 202, the Chinese government announced a five-year plan to improve sustainability in the construction industry through quality and driven development.

- In addition, the residential sector in India is growing, and government support and initiatives are further boosting demand. In the budget of 2022-2023, the Ministry of Housing and Urban Development (MoHUA) allocated about USD 9.85 billion to construct houses and create funds to complete the halted projects.

- Over the next few years, the demand for calcium stearate in rubber, plastics, construction, pharmaceuticals, and other industries is likely to be driven by all of the above factors.

Calcium Stearate Industry Overview

The calcium stearate market is fragmented in nature. Some of the major players in the market include (not in any particular order) Mittal Dhatu Rashayan Udyog, Faci Asia Pacific Pte Ltd, Baerlocher GmbH, SEOUL FINE CHEMICAL IND. CO. LTD, and Kemipex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for PVC and Other Plastics

- 4.1.2 Growing Usage in Personal Care and Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Shift Toward Magnesium Stearate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By End-user Industry

- 5.1.1 Plastic and Rubber

- 5.1.2 Construction

- 5.1.3 Personal Care and Pharmaceutical

- 5.1.4 Paper

- 5.1.5 Other End-user Industries (Food, Automotive, Paints and Coatings, and Petrochemicals)

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 NORDIC

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Baerlocher GmbH

- 6.4.2 Barium & Chemicals, Inc.

- 6.4.3 Coorporacion Sierra Madre

- 6.4.4 DOVER CHEMICAL CORPORATION

- 6.4.5 Faci Asia Pacific Pte Ltd

- 6.4.6 Hummel Croton Inc.

- 6.4.7 Hunan Shaoyang Tiantang auxiliaries Chemical Co. Ltd

- 6.4.8 Kemipex

- 6.4.9 Mittal Dhatu Rashayan Udyog

- 6.4.10 Nantong Xinbang Chemical Technology Chemical Co. Ltd

- 6.4.11 Peter Greven GmbH & Co. KG

- 6.4.12 PMC Group Inc.

- 6.4.13 SEOUL FINE CHEMICAL IND. CO. LTD

- 6.4.14 Sun Ace Kakoh (Pte.) Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Use of Calcium Stearate in the Food and Beverage Industry

- 7.2 Other Opportunities