|

市场调查报告书

商品编码

1536875

黏剂:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Hot-melt Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

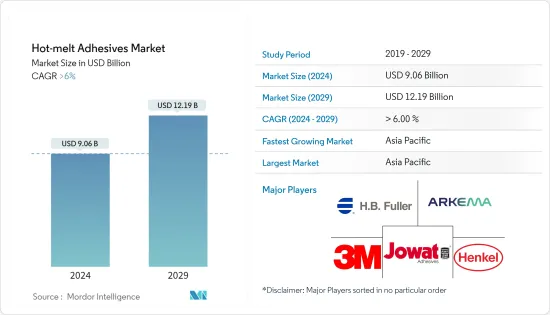

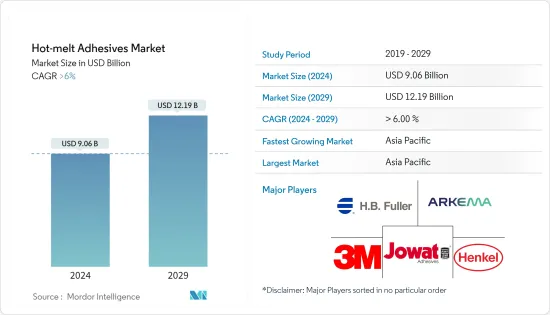

预计2024年全球黏剂市场规模将达90.6亿美元,2024-2029年预测期间复合年增长率将超过6%,2029年将达到121.9亿美元。

COVID-19 阻碍了黏剂市场。由于政府法规、消费者需求下降和供应链中断,黏剂的各种最终用途行业,包括汽车製造、建筑和不织布卫生用品,都经历了生产放缓或停顿。由于封城措施和法规的放鬆,许多行业已经恢復运营,导致对黏剂的需求增加。

*包装行业对黏剂需求的增加、建筑行业需求的增加以及不织布卫生产品中黏剂的采用的增加预计将推动市场的发展。

*然而,原材料价格的波动预计将阻碍黏剂市场的成长。

*汽车製造的扩张和建筑技术的进步预计将在未来一段时间内提供机会。

*由于印度、日本和中国等经济体快速成长,亚太地区预计将在未来几年成为主导市场。

黏剂市场趋势

纸张、纸板和包装产业主导市场

*包装产业是黏剂最大的消费者之一。这些黏剂广泛用于黏合纸板、纸板、塑胶薄膜和箔片等包装材料,适用于箱子和纸箱密封、托盘成型、标籤和层压等应用。黏剂在工业中的大规模使用正在推动巨大的需求和市场主导地位。

*由于食品消费和各种应用的增加,包装领域对黏剂的需求正在增加。例如,在印度,包装是成长最快的行业之一。该行业在过去几年中经历了稳定成长,预计将迅速扩张,特别是在出口领域。

*例如,根据印度纸张工业协会 (IPMA) 报告的资料,在印度,2023 年 4 月至 12 月的纸张进口量增加了 37%,达到 147 万吨。

*此外,根据德国联邦统计局2023年3月发布的估计,2022年德国包装产业收益的约46%来自纸包装。近 34% 是塑胶包装。

*此外,根据德国联邦统计局2023年发布的估计,德国包装业的收益约为350亿欧元(379.4亿美元)。与上年度的 296 亿欧元(320.9 亿美元)相比有所增加。

*食品和饮料业是包装的主要消费者之一。随着世界各地日益增长的趋势,烘焙行业正在不断发展,这推动了包装产品的销售。

*因此,由于上述因素,纸张、纸板和包装行业对黏剂的需求预计将增长。

亚太地区主导市场

*亚太地区正在经历快速的工业化、都市化和基础设施发展,特别是在新兴经济体。这种成长正在推动建筑、包装、汽车和其他产业对黏剂的需求。

*亚太地区政府和私营部门正在投资各种基础设施计划,包括交通、公共工程以及住宅和商业设施的建设。黏剂用于各种建筑应用,包括安装壁板、地板材料、隔热材料绝缘材料和重新屋顶,并且正在推动该地区建筑业的需求。

*根据印度品牌股权基金会的数据,2023-2024年预算中基础设施的资本投资将成长33%,达到约1,220亿美元,占GDP的3%。

*此外,为了吸引私人投资,印度政府正在开发多种途径,特别是在道路和高速公路、机场、商业园区以及高等教育和技能开发领域。截至2023年5月,私人公司和创业投资已向印度企业投资35亿美元,完成71笔交易。

*自2008年以来,中国一直是最大的纸包装和纸板生产国。中国造纸工业协会调查显示,2023年我国纸及纸板生产企业总数为2500家,全国纸及纸板产量12965万吨,与前一年同期比较增长4.35% 。

*因此,上述因素预计将在预测期内推动该地区的黏剂市场。

黏剂产业概况

全球黏剂市场分散。市场上的主要企业包括(排名不分先后)3M、Jowat SE、汉高公司、阿科玛和 HB Fuller。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求增加

- 建筑业需求增加

- 其他司机

- 抑制因素

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 树脂型

- 乙烯醋酸乙烯酯

- 苯乙烯嵌段共聚物

- 热塑性聚氨酯

- 其他树脂类型

- 最终用户产业

- 建筑/施工

- 纸/纸板/包装材料

- 木工/细木工

- 汽车/交通

- 鞋类/皮革

- 卫生保健

- 电气/电子设备

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 土耳其

- 西班牙

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Alfa International

- Arkema

- Ashland

- AVERY DENNISON CORPORATION

- Beardow Adams

- Dow

- DRYTAC

- Franklin International

- HB Fuller Company

- Henkel Corporation

- Hexcel Corporation

- Huntsman International LLC

- Jowat SE

- Mactac

- Master Bond Inc.

- Paramelt RMC BV

- Pidilite Industries Limited

- Sika AG

第七章 市场机会及未来趋势

- 扩大汽车製造

- 建筑技术的进步

The Hot-melt Adhesives Market size is estimated at USD 9.06 billion in 2024, and is expected to reach USD 12.19 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

COVID-19 hampered the hot melt adhesive market. Various end-use industries for hot melt adhesives, such as automotive manufacturing, construction, and nonwoven hygiene products, experienced slowdowns or shutdowns in production due to government-mandated restrictions, reduced consumer demand, and supply chain disruptions. With the easing of lockdown measures and restrictions, many industries have resumed operations, leading to increased demand for hot melt adhesives.

* Increasing demand for hot melt adhesives from the packaging industry, rising demand from the construction sector, and increased adoption of hot melt adhesives in nonwoven hygiene products are expected to drive the market.

* However, volatility in raw material prices is expected to hamper the growth of the hot melt adhesive market.

* Expansion in automotive manufacturing and the advancements in construction technologies are expected to provide opportunities in the upcoming period.

* Due to rapidly growing economies like India, Japan, and China, Asia-Pacific is expected to emerge as a dominant market in the coming years.

Hot Melt Adhesives Market Trends

Paper, Board, and Packaging Segment to Dominate the Market

* The packaging industry is one of the largest consumers of hot melt adhesives. These adhesives are widely used for bonding packaging materials such as paperboard, corrugated cardboard, plastic films, and foils in applications such as case and carton sealing, tray forming, labeling, and lamination. The industry's large-scale use of hot melt adhesives drives significant demand and market dominance.

* The demand for hot melt adhesives in the packaging sector is increasing due to increased food consumption and various applications. For instance, in India, packaging is one of the fastest-growing industries. The sector has witnessed steady growth over the past several years and is expected to expand rapidly, particularly in the export sector.

* For instance, in India, paper imports rose by 37% to 1.47 million tonnes from April to December 2023, according to data reported by The Indian Paper Manufacturers Association (IPMA).

* Further, according to the estimate published by the Statistisches Bundesamt in March 2023, in 2022, around 46 percent of the packaging industry revenue in Germany was generated by paper packaging. Almost 34 percent was made up of plastic packaging.

* Moreover, according to the estimate published by the Statistisches Bundesamt in 2023, the German packaging industry generated around EUR 35 billion (USD 37.94 billion) in revenue. This was an increase compared to the previous year at EUR 29.6 billion (USD 32.09 billion).

* The food and beverage sector is one of the major consumers of packaging. In order to cope with the increasing trend around the world, the bakery sector is growing, and this is driving sales of packaging products.

* Thus, the factors mentioned above are expected to grow the demand for hot melt adhesives from the paper, board, and packaging industries.

Asia-Pacific to Dominate the Market

* Asia-Pacific is experiencing rapid industrialization, urbanization, and infrastructure development, particularly in emerging economies in the region. This growth fuels the demand for hot melt adhesives in construction, packaging, automotive, and other industries, as these adhesives are essential for bonding materials and components in manufacturing and construction processes.

* Governments and private sectors in the Asia Pacific are investing in various infrastructure projects such as transportation, utilities, and residential and commercial construction. Hot melt adhesives are used in various construction applications, including paneling, flooring installation, insulation bonding, and roofing, driving the demand for these adhesives in the region's construction industry.

* According to the Indian Brand Equity Foundation, the capital investment in infrastructure is set to increase by 33%, amounting to about USD 122 billion, for the budget of 2023-24, and this accounts for 3% of GDP.

* Further, in order to attract private investment, the government of India has developed a number of ways, particularly for roads and highways, airports, business parks, and higher education and skills development sectors. Private Equity and Venture Capital Firms invested USD 3.5 billion in Indian companies between May 2023 with 71 deals.

* China has been the most extensive paper packaging and paperboard producer since 2008. According to a survey conducted by the China Paper Association, in 2023, the total number of paper and paperboard manufacturing enterprises in China stood at 2,500, with a nationwide paper and paperboard output of 129.65 Million tons, a 4.35% increase from the previous year.

* Thus, the above factors are expected to drive the hot-melt adhesives market in the region during the forecast period.

Hot-melt Adhesives Industry Overview

The global hot-melt adhesives market is fragmented in nature. Some of the major players in the market (not in any particular order) include 3M, Jowat SE, Henkel Corporation, Arkema, and H.B. Fuller, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Packaging Industry

- 4.1.2 Rising Demand from Construction Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Ethylene Vinyl Acetate

- 5.1.2 Styrenic Block Co-polymers

- 5.1.3 Thermoplastic Polyurethane

- 5.1.4 Other Resin Types (Polyolefin, polyamide)

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Paper, Board, and Packaging

- 5.2.3 Woodworking and Joinery

- 5.2.4 Automotive and Transportation

- 5.2.5 Footwear and Leather

- 5.2.6 Healthcare

- 5.2.7 Electrical and Electronic Appliances

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Spain

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Alfa International

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 AVERY DENNISON CORPORATION

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DRYTAC

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel Corporation

- 6.4.12 Hexcel Corporation

- 6.4.13 Huntsman International LLC

- 6.4.14 Jowat SE

- 6.4.15 Mactac

- 6.4.16 Master Bond Inc.

- 6.4.17 Paramelt RMC B.V.

- 6.4.18 Pidilite Industries Limited

- 6.4.19 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Automotive Manufacturing

- 7.2 Advancements in Construction Technologies