|

市场调查报告书

商品编码

1536884

气凝胶:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Aerogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

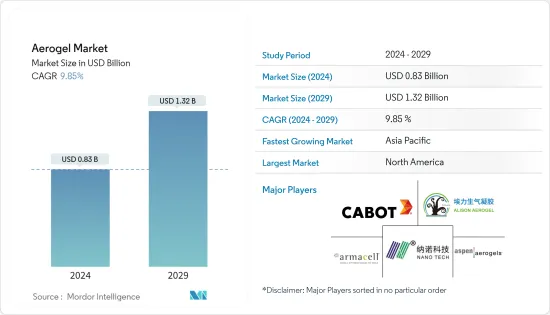

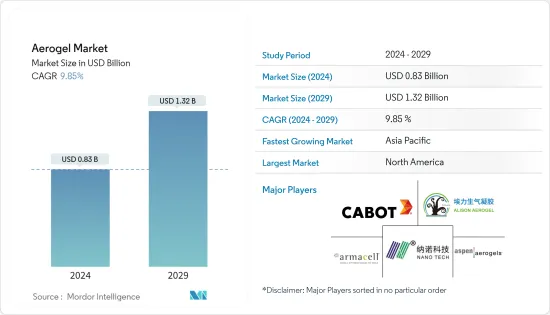

预计2024年全球气凝胶市场规模将达8.3亿美元,2029年将达13.2亿美元,2024-2029年预测期间复合年增长率为9.85%。

COVID-19 大流行对全球气凝胶市场产生了显着影响。需求最初下降是由于建筑和製造业的中断,这些行业是隔热气凝胶的主要消费者。然而,限制解除后,市场出现了显着的成长,疫情后人们更加关注节能建筑材料,带动了对气凝胶隔热材料的需求。

*从中期来看,随着建筑和石油和天然气行业需求的激增,可重复使用和可回收气凝胶的采用越来越多,预计将推动市场需求。

*另一方面,高製造成本预计将阻碍市场发展。

*技术进步和投资增加为市场成长提供了各种机会。

*预计北美将主导市场,亚太地区预计将在 2024 年至 2029 年保持最高复合年增长率。

气凝胶市场趋势

石油和天然气产业主导市场

*气凝胶因其优异的性能而广泛应用于石油和天然气行业。气凝胶可用于管道隔热、选择性吸收污染物和碳氢化合物等特定分子的吸收剂以及提高采收率。

*气凝胶具有结构轻质、耐腐蚀、降噪、过滤能力等多种优点,使其成为油气管道产业很有前景的材料。

*气凝胶产品有多种形式,可以满足石油和天然气行业的各种需求。气凝胶产品易于安装,可为加工商和安装商节省成本,而营运商则受益于更低的资本成本、更长的冷却时间、稳定的生命场U 值和更低的风险,并透过卓越的热性能提供多种优势。它提供最佳的热性能、防止腐蚀并提供机械强度。

*根据国际能源总署 (IEA)资料,到 2026 年,世界石油消费量预计将达到每天 1.041 亿桶以上。这将比目前水准高出 440 万桶/日。

*根据美国能源情报署报告,2023年全球原油产量将达到10175万桶/日,较2022年的9999万桶/日增加。

*美国、俄罗斯、加拿大、沙乌地阿拉伯和中国是全球市场的主要石油生产国。

*根据美国能源情报署的数据,2023年全球原油产量增加1.76%至101,749,000桶/日。

*到 2045 年,印度预计每天需要 1,100 万桶石油,是目前数量的两倍。此外,多家公司正在投资扩大全国各地的勘探设施。例如,ONGC于2022年5月宣布计划在2022财年和2025财年投资40亿美元,扩大在印度的勘探活动。

*沙乌地阿拉伯拥有世界已探明石油蕴藏量的约17%,是最大的石油净出口国之一。沙乌地阿拉伯已探明的石油蕴藏量位居世界第二。沙特阿美公司继续在其上游领域采取重大扩张措施和渠道投资,包括原油、冷凝油油、天然气和液态天然气(NGL) 的勘探和生产。

*在欧洲,英国正在探索扩大石油和天然气生产的新领域。例如,该国政府预计在 2023 年至 2027 年间示范 66 个新的石油和天然气发电计划。此外,2023年7月,该国宣布计划在北海发放多个新的石油和天然气许可证,以确保其能源蕴藏量。

*因此,由于上述因素,石油和天然气行业预计将显着增长,这反过来又会增加所研究市场的需求。

北美市场占据主导地位

*在北美,美国预计将引领市场。

*美国政府更严格的环境标准、环保产品意识的增强以及对气凝胶製造产品和工艺开拓的广泛研究是美国在调查市场中保持领先地位的关键因素。气凝胶广泛用作隔热材料、隔音材料。

*美国能源局(DOE) 正在投资创新隔热材料节省工业领域的能源和成本。

*此外,由于建筑业以及石油和天然气行业的快速增长,预计美国市场在预测期内将迅速扩张。

*美国石油和天然气产业最近取得了重大发展。根据美国能源情报署预计,2023年美国原油产量将达到1,290万桶/日,比2022年的1,190万桶/日成长8.5%。二迭纪地区的产量增加和墨西哥湾(GOM)的产量增加正在推动预期的产量增加。增加石油产量需要全面运作的炼油厂和高效率的运输网路来支援市场需求。

*根据加拿大建筑协会的数据,建筑业是加拿大最大的雇主之一,也是加拿大经济成功的主要贡献者。该产业每年产值约 1,410 亿美元,占国内生产总值(GDP) 的 7.5%。 2023年,加拿大的建筑开工量增加了5.8%。新开非住宅建筑成长15.4%,土木工程成长16.2%。

*为了实现永续目标,联邦政府已投资 1.5 亿加元(1.114 亿美元)来制定加拿大永续建筑战略。该策略预计将动员国家行动来降低成本和转变市场,以在 2023 财年实现这一目标。

*墨西哥的战略定位、有利的商业环境和熟练的劳动力使其成为寻求建立生产设施的汽车公司的重要目的地。对无排放气体汽车的需求不断增加,导致德国、中国和美国等国家对汽车製造业,特别是电动车製造业的外国直接投资增加,从而增加了电动车对气凝胶的需求。

*由于所有这些因素,预计北美地区将在预测期内影响市场。

气凝胶产业概况

气凝胶市场已部分整合。市场主要企业(排名不分先后)包括Aspens Aerogels Inc.、Cabot Corporation、Armacell、Nano Tech和广东艾利森高科。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 由于再生性和可回收性,气凝胶的采用率增加

- 建筑业需求快速成长

- 石油和天然气产业主导气凝胶需求

- 抑制因素

- 生产成本高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 类型

- 二氧化硅

- 碳

- 氧化铝

- 其他类型

- 形状

- 毯子

- 粒子

- 堵塞

- 控制板

- 最终用户产业

- 石油和天然气

- 建造

- 车

- 海洋

- 航太

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 合併、收购、合资、合作伙伴关係和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Active Aerogels

- Aerogel Technologies LLC

- Aerogel-it Gmbh

- Amracell

- Aspen Aerogels Inc.

- Cabot Corporation

- Enersens

- Guangdong Alison Technology Co. Ltd

- Jios Aerogel

- Nano Tech Co. Ltd

- Ningbo Surnano Aerogel Co. Ltd

- Sino Aerogel

- Svenska Aerogel

- Taasi Corporation

- Thermablok Aerogels Limited

第七章 市场机会及未来趋势

- 技术进步和投资增加拉动市场需求

The Aerogel Market size is estimated at USD 0.83 billion in 2024, and is expected to reach USD 1.32 billion by 2029, growing at a CAGR of 9.85% during the forecast period (2024-2029).

The COVID-19 pandemic had a notable impact on the global aerogel market. Initially, demand declined due to disruptions in the construction and manufacturing sectors, which are key consumers of aerogel for insulation purposes. However, the market registered a significant growth rate after the restrictions were lifted due to increased focus on energy-efficient building materials post-pandemic, which is driving demand for aerogel insulation.

* Over the medium term, a rise in the adoption of aerogel due to its reusability and recyclability, as well as rapidly growing demand from the construction and oil and gas industries, is expected to drive the market demand.

* On the flip side, the high cost of production is expected to hinder the market.

* Technological advancements and increasing investments offer various opportunities for the growth of the market studied.

* North America is expected to dominate the market, while Asia-Pacific is expected to witness the highest CAGR between 2024 and 2029.

Aerogel Market Trends

The Oil and Gas Industry to Dominate the Market

* Aerogels are widely used in the oil and gas industry due to their exceptional properties. They are used for insulating pipelines, as an absorbent to selectively absorb specific molecules, such as contaminants or hydrocarbons, and for enhanced oil recovery.

* They offer a range of advantages, such as lightweight construction, corrosion resistance, noise reduction, and filtration capabilities, making them a promising material for the oil and gas pipeline industry.

* Aerogel products are available in a wide range of forms to meet the different requirements of the oil and gas sector. Aerogel products are easy to install, which results in cost savings for fabricators and installers while delivering operators various benefits of exceptional thermal performance, such as lower capital costs, longer cool-down times, consistent life-offield U-values, and reduced risk. They offer the highest thermal performance, prevent corrosion, and offer mechanical strength.

* Global oil consumption is expected to reach over 104.1 million barrels per day by 2026, as per the International Energy Agency data. This would be a 4.4 mb/d increase over current levels.

* As per the US Energy Information Administration report, global crude oil production reached 101.75 million barrels per day in 2023, as compared to 99.99 million barrels per day in 2022, registering a growth.

* The United States, Russia, Canada, Saudi Arabia, and China are the leading oil producers in the global market.

* According to the United States Energy Information Administration, global crude oil production in 2023 increased by 1.76% and was valued at 101.749 million barrels per day.

* By 2045, India is expected to need 11 million barrels of oil per day, which is double what it needs now. Moreover, various companies are investing in expanding exploration facilities across the country. For instance, in May 2022, ONGC announced plans to invest USD 4 billion in FY 2022 and FY 2025 to increase its exploration efforts in India.

* Saudi Arabia has approximately 17% of the world's proven petroleum reserves and is one of the largest net petroleum exporters. Saudi Arabia has the world's second-largest proven oil reserves. Saudi Aramco continues its primary expansionary phase and channel investments in its upstream segment, which includes exploration & production of crude oil, condensate, natural gas, and natural gas liquids (NGL).

* In Europe, the United Kingdom is exploring new grounds to produce more oil and gas. For instance, the government expects the country to witness 66 new oil and gas generation projects between 2023 and 2027. Moreover, the country announced in July 2023 that it plans to issue several new oil and gas licenses in the North Sea to secure energy reserves.

* Thus, due to the abovementioned factors, the oil and gas industry is expected to grow significantly, which, in turn, will enhance the demand for the market studied.

North America to Dominate the Market

* The United States is expected to be the leading country in North America for the studied market.

* The growing stringent environmental norms by the United States government, growing awareness of eco-friendly products, and extensive research on product and process development to manufacture aerogel are the key factors helping the United States remain in the top position in the market studied. Aerogel is highly used in thermal and acoustic insulation.

* The US Department of Energy (DOE) is investing in innovative insulation materials that save energy and money in the industrial sector.

* Furthermore, with the rapidly growing building and construction sector and oil and gas industries, the market studied in the United States is expected to increase rapidly over the forecast period.

* The oil and gas sector in the United States has witnessed significant developments in recent years. According to the United States Energy Information Administration, the US crude oil production reached 12.9 million barrels per day (b/d) in 2023, an increase of 8.5% compared to 2022, which was 11.9 million barrels per day. Increased production in the Permian region and increased production of the Gulf of Mexico (GOM) are driving projected production growth. Increasing oil production requires fully operational refineries and an efficient transport network to work consistently, thus supporting the demand for the market studied.

* According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a significant contributor to the country's economic success. The industry generates about USD 141 billion annually and contributes 7.5% of the country's Gross Domestic Product (GDP). In 2023, Canadian construction starts rose by 5.8%. Both new non-residential building and civil engineering increased by 15.4% and 16.2%, respectively.

* To achieve sustainable goals, the federal government has committed CAD 150 million (USD 111.40 million) to developing the Canada Sustainable Buildings Strategy. This strategy is projected to reduce costs and mobilize national action to transform markets to meet this goal in FY 2023.

* Owing to its strategic location, favorable business environment, and skilled labor force, Mexico has become an important destination for automotive companies looking to establish their production facilities. As the demand for non-emission vehicles is increasing, FDIs from countries such as Germany, China, the United States, and others into automotive manufacturing, especially electric vehicle manufacturing in the country, are increasing, thereby boosting the demand for aerogels in electric vehicles.

* The North American region is expected to influence the market during the forecast period due to all these factors.

Aerogel Industry Overview

The aerogel market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Aspens Aerogels Inc., Cabot Corporation, Armacell, Nano Tech Co. Ltd, and Guangdong Alison Hi-tech Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Adoption of Aerogel due to their Reusability and Recyclability

- 4.1.2 Rapid Growing Demand from Construction Industry

- 4.1.3 Oil and Gas Industry Dominating the Aerogel Demand

- 4.2 Restraints

- 4.2.1 High Cost of Production

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Silica

- 5.1.2 Carbon

- 5.1.3 Alumina

- 5.1.4 Other Types

- 5.2 Form

- 5.2.1 Blanket

- 5.2.2 Particles

- 5.2.3 Blocks

- 5.2.4 Panels

- 5.3 End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Construction

- 5.3.3 Automotive

- 5.3.4 Marine

- 5.3.5 Aerospace

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Active Aerogels

- 6.4.2 Aerogel Technologies LLC

- 6.4.3 Aerogel-it Gmbh

- 6.4.4 Amracell

- 6.4.5 Aspen Aerogels Inc.

- 6.4.6 Cabot Corporation

- 6.4.7 Enersens

- 6.4.8 Guangdong Alison Technology Co. Ltd

- 6.4.9 Jios Aerogel

- 6.4.10 Nano Tech Co. Ltd

- 6.4.11 Ningbo Surnano Aerogel Co. Ltd

- 6.4.12 Sino Aerogel

- 6.4.13 Svenska Aerogel

- 6.4.14 Taasi Corporation

- 6.4.15 Thermablok Aerogels Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Increasing Investments Propelling the Market Demand