|

市场调查报告书

商品编码

1536886

资料中心液体冷却:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Data Center Liquid Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

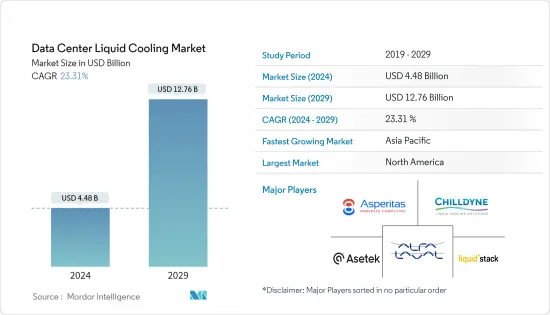

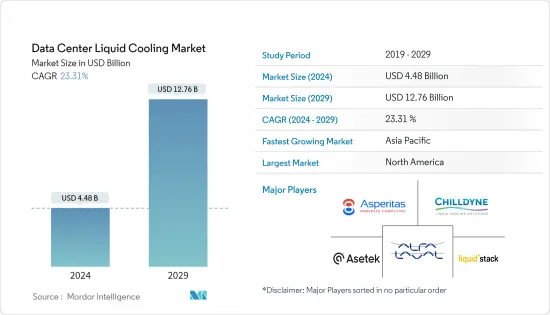

预计2024年全球资料中心液冷市场规模将达44.8亿美元,2024年至2029年复合年增长率为23.31%,2029年将达到127.6亿美元。

随着人口的增长和对数位基础设施的更加依赖,资料中心的需求也在增长。迫切需要有效的冷却解决方案,以确保最佳效能并避免因资料中心的快速发展和成长而造成代价高昂的停机。

主要亮点

- 云端运算解决方案的采用和巨量资料分析的普及极大地促进了资料中心的发展。企业越来越依赖云端基础的服务来储存大量资料以进行处理和研究。例如,亚马逊网路服务 (AWB)、微软 Azure 和Google云端平台等云端产业巨头正在不断扩展资料中心,以满足不断增长的需求。

- 印度、香港、中国和印尼等新兴经济体拥有先进的IT基础设施发展,可能会推动资料中心需求。由于云端模型的采用,资料中心的需求预计会增加,这为 IT 产业带来成本和营运优势。

- 资料中心营运商在迁移到新的冷却系统时对潜在的停机损失保持警惕。因此,他们忽视了营运成本并继续使用过时的冷却系统。这种趋势减缓了新技术和可能检验的技术的采用。

- 疫情后企业数位转型的新浪潮预计将推动市场。许多公司开始依赖第三方主机代管设施作为资料中心,混合IT 的趋势不断增长,它将託管中心的强大功能与多重云端环境相结合。

资料中心液冷市场趋势

边缘运算将经历显着成长

- 在预测期内,企业预计将见证 IP 连接行动和机器对机器 (M2M) 设备的激增,这些设备将处理大量 IP 流量。

- 对线上提供者提供的更快 Wi-Fi 服务和应用程式交付的需求预计将会增加。此外,一些 M2M 设备(例如自动驾驶汽车)需要与本地处理资源进行即时通讯以确保安全。

- 部署边缘资料中心将使许多新技术受益,包括第五代(5G)网路和物联网(IoT)。物联网连线的普及率预计将增加一倍以上,到 2028 年将达到 60 亿个广域物联网连线。

- 此外,5G 无线基础设施的出现促使资料中心营运商选择边缘运算基础设施以及提供低延迟和高弹性的网路。多接取边缘运算(MEC)可协助网路服务与使用者更紧密地连接。因此,由于多种因素的影响,包括5G技术在全球范围内的引入、自动驾驶汽车的兴起以及智慧城市趋势,对高效边缘资料中心的需求预计将会增加。

- 然而,大规模边缘运算部署的一个关键要求是低营运成本。众所周知,浸入式冷却可以在边缘部署中显着节省能源。

- 液体冷却解决方案的可靠性和非接触式功能满足了增加平均维护时间和延长干预间隔的需求,以实现远端位置设备的可行操作和管理。

北美占最大市场占有率

- 北美是最早采用新技术的国家之一。资料中心投资者越来越多地投资于浸入式和片下冷却解决方案。全球 5G 网路的出现推动了边缘资料中心的重要性,美国是最早采用该技术的国家之一。许多美国业者已开始投资这些中心,包括 EdgePresence、EdgeMicro 和 American Towers。

- 根据思科系统公司的报告,美国的行动资料流量逐年大幅成长,从2017年的每月1.26Exabyte资料流量增加到2022年的每月7.75Exabyte资料流量。据爱立信称,到 2030 年,这笔资料流量预计将进一步增加两倍。因此,分散式云端正在成为实用化,有可能提供轻鬆连接这种规模所需的低延迟和高频宽。

- 美国的个人和企业的网路使用量正在显着成长。该国是最大的资料中心营运市场,并且由于最终用户资料消耗的增加而持续增长。物联网 (IoT) 的日益普及是美国超大规模资料中心市场的关键驱动力,导致能够支援企业用户和消费者产生的Exabyte资料的设施不断扩展。

- 未来几年,美国可能成为该地区成长最快的资料中心市场。美国资料中心建设的主要驱动力是最近的经济和税收优惠政策。大约 27 个州正在利用这些因素来吸引资料中心计划。此外,美国实施的大规模税收减免显示政府正在主导建造新的超级资料中心和维修现有资料中心。这些市场趋势进一步增加了该地区资料中心对液体冷却服务的需求。

资料中心液冷产业概况

资料中心液体冷却市场分散且竞争激烈,包括 Alfa Laval Corporate AB、LiquidStack Inc. A/S 和 AsperitasChilldyne Inc. 等公司。从市场占有率来看,目前该市场由少数重要参与者主导。广泛使用的冷却系统仍然是空气冷却,液体冷却系统在整个冷却系统中所占的份额仍然相对较小。由于相对较高的成本被认为是一个市场挑战,预计液体浸入式冷却系统市场具有很高的替代威胁。

- 2024 年 3 月 - Summer 是由工业冷却剂製造商、目的地设备製造商、目的地设备製造商、高性能计算应用运营商和资料中心提供商等相关人员组成的重要工业论坛,宣布加入最近成立的液体冷却联盟(LCC)。

- 2024 年 3 月 - 关键基础设施和连续性解决方案的领先供应商 Vertiv 获得解决方案顾问认证。 :成为解决方案顾问:Nvidia 合作伙伴网路 (NPN) 中的顾问合作伙伴,让您能够更全面地了解 Vertiv 的经验以及完整的电源和冷却解决方案组合。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 资料中心冷却的演变

- 空调/处理器

- 冷却器和节热器系统

- 液体冷却系统

- 立柱/机架/门/天花板冷却系统

- 资料中心冷却市场概述

- 能耗、计算密度指标和液体冷却的关键考虑因素

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 区域内IT基础设施的发展

- 绿色资料中心的出现

- 市场限制因素

- 成本、调适要求、停电

- 评估 COVID-19 对产业的影响

第 6 章.资料中心后门热交换器 (RDHx) 的前景

- 资料中心 RDHx 和液冷(直接和间接)技术比较

- 与RDHx和液体冷却市场相关的资料中心冷却技术供应商的最新发展

- RDHx 的全球市场占有率大致(十亿美元)

- RDHx主要供应商清单(业务概述、产品组合、最新趋势)

第七章 直冷式或浸没式冷却市场

- 直冷市场概述与预测

- 浸入式冷却 - 主要应用

- 高效能运算

- 边缘运算

- 加密货币挖矿

- 浸入式冷却液

- 氟碳液

- 碳氢化合物流体

第八章间接/直接晶片冷却市场

- 间接冷却市场概况及预测

- 间接和直接晶片冷却的主要应用

第九章市场区隔

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第10章竞争格局

- 公司简介

- Alfa Laval Corporate AB

- LiquidStack Inc.

- Asetek Inc. A/S

- Asperitas

- Chilldyne Inc.

- CoolIT Systems Inc.

- Fujitsu Ltd.

- Mikros Technologies

- Kaori Heat Treatment Co. Ltd

- Lenovo Group Limited

- LiquidCool Solutions Inc.

- Midas Green Technologies

- Iceotope Technologies Ltd

- USystems Ltd(Legrand Group)

- Rittal GmbH & Co. KG

- Schneider Electric

- Submer Technologies & Submer Inc.

- Vertiv Group Corp.

- Wakefield Thermal Solutions Inc.

- Wiwynn Corporation

- 3M Company

- Engineered Fluids Inc.

- Green Revolution Cooling Inc.

- Solvay SA

第十一章 价值链冷却技术创新

第十二章投资分析及市场展望

The Data Center Liquid Cooling Market size is estimated at USD 4.48 billion in 2024, and is expected to reach USD 12.76 billion by 2029, growing at a CAGR of 23.31% during the forecast period (2024-2029).

The need for data centers has grown as the population grows increasingly connected and dependent on digital infrastructure. Effective cooling solutions are urgently needed to ensure optimal performance and avoid expensive downtime due to the data center development and growth spike.

Key Highlights

- Data center growth has been significantly aided by the uptake of cloud computing solutions and the spread of big data analytics. Businesses increasingly rely on cloud-based services and storing enormous amounts of data for processing and research. For instance, to meet the rising demand, cloud industry giants like Amazon Web Services (AWB), Microsoft Azure, and Google Cloud Platform continuously extend their data center footprints.

- Growing developments in IT infrastructure in emerging economies, such as India, Hong Kong, China, Indonesia, and other emerging countries, are likely to boost the demand for data centers. The demand for data centers is expected to increase due to the adoption of the cloud model, which has cost and operational benefits for the IT industry.

- Data center operators are wary of potential downtime losses while shifting to new cooling systems. Hence, they overlook operational expenditures and continue using outdated cooling systems. This trend slows the adoption of new technologies that are perceived to be untested.

- A new wave of post-pandemic digital transformation among businesses is expected to drive the market. Many companies have started to rely on third-party colocation facilities to house their data centers, and there's a growing trend towards hybrid IT - combining the power of hosted centers with multi-cloud environments.

Data Center Liquid Cooling Market Trends

Edge Computing to Witness Significant Growth

- In the forecast period, organizations are expected to witness rapid growth in the number of IP-connected mobile and machine-to-machine (M2M) devices, which will handle significant amounts of IP traffic.

- The demand is expected to rise for faster Wi-Fi service and application delivery from online providers. Also, some M2M devices, such as autonomous vehicles, will require real-time communications with local processing resources to guarantee safety.

- The deployment of edge data centers benefits many new technologies, including fifth-generation (5G) networks and the Internet of Things (IoT), as the adoption of (IoT) connections is expected to more than double, with the number of wide-area IoT 6 billion by 2028. and Industrial Internet of Things (IIoT) of devices, autonomous vehicles, virtual and augmented reality, artificial intelligence and machine learning, data analytics, and video streaming and surveillance.

- Moreover, the emergence of 5G wireless infrastructure has urged data center operators to opt for edge computing infrastructure to work with networks offering lower latency and higher resiliency. Multi-access edge computing (MEC) aids network services in connecting to users closely. Hence, the demand for efficient edge data centers is expected to be augmented by many factors, including the introduction of 5G technology across the world and the growing trend of autonomous or self-driving vehicles and smart cities.

- However, a key requirement of large-scale edge computing roll-outs will be low operating costs. In edge deployments, immersive liquid cooling is known to provide dramatic energy-saving benefits.

- The reliability and no-touch features of liquid cooling solutions will match the need for extended mean time to maintenance and longer intervention intervals needed for viable operation and management of remotely located equipment.

North America to Hold the Largest Market Share

- North America is an early adopter of newer technologies. The data center investors are increasingly investing in liquid immersion and direct-to-chip cooling solutions. The importance of edge data centers has been aided by the emergence of 5G networks worldwide, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, have started investing in these centers.

- The mobile data traffic in the United States increased considerably over the years, from 1.26 exabytes per month of data traffic in 2017 to 7.75 exabytes per month of data traffic by 2022, as reported by Cisco Systems. Ericsson says this data traffic is expected to triple further by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to connect such scale easily is coming into action.

- The United States is witnessing massive growth in internet usage by people and businesses. The country is the largest market in data center operations, and it continues to grow due to the higher consumption of data by end-users. The growing popularity of the Internet of Things (IoT) is a significant driver for the US hyper-scale data center market, leading to additional facilities that can support exabytes of data generated by both business users and consumers.

- The United States will be the fastest-growing data center market in the region in the coming years. The significant drivers of data center construction in the United States. have been recent economic incentives and tax benefits. Approximately 27 states leverage these factors to attract data center projects. In addition, the heavy tax breaks implemented in the United States indicate a government-front aim to construct new mega data centers or renovate existing ones. Such instances in the market create more of a need for data center liquid cooling services in the region.

Data Center Liquid Cooling Industry Overview

The data center liquid cooling market is fragmented and highly competitive and consists of several significant players like Alfa Laval Corporate AB, LiquidStack Inc., Asetek Inc. A/S, AsperitasChilldyne Inc., etc. In terms of market share, few important players currently dominate the market. The widely deployed cooling system is still air cooling, and liquid cooling systems have a relatively small share in the overall cooling landscape. As relatively high costs are considered market challenges, the immersion cooling systems market is estimated to have a significant threat of substitutes.

- March 2024 - Summer announced its membership in the recently established Liquid Cooling Coalition (LCC), a premier industry forum comprised of stakeholders, including industrial coolant producers, original equipment manufacturers, original device manufacturers, high-performance computing application operators, and data center providers.

- March 2024 - Vertiv, a significant provider of critical infrastructure and continuity solutions, is now a Solution Advisor: Consultant partner in the Nvidia Partner Network (NPN), providing more comprehensive access to Vertiv's experience and complete power and cooling solutions portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Evolution Of Data Center Cooling

- 4.1.1 Air Conditioners/Handlers

- 4.1.2 Chillers And Economizer Systems

- 4.1.3 Liquid Cooling Systems

- 4.1.4 Row/Rack/Ddoor/Over-head Cooling Systems

- 4.2 Overview of Data Center Cooling Market

- 4.3 Energy Consumption, Computing Density Metrics and Key Considerations For Liquid Cooling

- 4.4 Industry Stakeholder Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Degree of Competition

- 4.5.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of IT Infrastructure in the Region

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.3 Assessment of COVID-19 Impact on the Industry

6 OUTLOOK OF REAR DOOR HEAT EXCHANGERS (RDHX) IN DATA CENTERS

- 6.1 Technical Comparison of RDHx and Liquid Cooling (Direct and Indirect) in Data Centers

- 6.2 Recent Developments by Data Center Cooling Technology Vendors in the Context Of RDHx and Liquid Cooling Market

- 6.3 Approximate Global Market Share of RDHx (in USD Billion)

- 6.4 List of Key RDHx Vendors (Business Overview, Portfolio and Recent Developments)

7 DIRECT COOLING OR IMMERSION COOLING MARKET

- 7.1 Direct Cooling Market Overview And Estimate

- 7.2 Immersion Cooling - Key Application

- 7.2.1 High-performance Computing

- 7.2.2 Edge Computing

- 7.2.3 Cryptocurrency Mining

- 7.3 Immersion Cooling Fluids

- 7.3.1 Fluorocarbon-based Fluids

- 7.3.2 Hydrocarbons Fluids

8 INDIRECT OR DIRECT-TO-CHIP COOLING MARKET

- 8.1 Indirect Cooling Market Overview and Estimates

- 8.2 Indirect or Direct-to-chip Cooling Key Applications

9 MARKET SEGMENTATION

- 9.1 By Geography***

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia

- 9.1.4 Australia and New Zealand

- 9.1.5 Latin America

- 9.1.6 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 Alfa Laval Corporate AB

- 10.1.2 LiquidStack Inc.

- 10.1.3 Asetek Inc. A/S

- 10.1.4 Asperitas

- 10.1.5 Chilldyne Inc.

- 10.1.6 CoolIT Systems Inc.

- 10.1.7 Fujitsu Ltd.

- 10.1.8 Mikros Technologies

- 10.1.9 Kaori Heat Treatment Co. Ltd

- 10.1.10 Lenovo Group Limited

- 10.1.11 LiquidCool Solutions Inc.

- 10.1.12 Midas Green Technologies

- 10.1.13 Iceotope Technologies Ltd

- 10.1.14 USystems Ltd (Legrand Group)

- 10.1.15 Rittal GmbH & Co. KG

- 10.1.16 Schneider Electric

- 10.1.17 Submer Technologies & Submer Inc.

- 10.1.18 Vertiv Group Corp.

- 10.1.19 Wakefield Thermal Solutions Inc.

- 10.1.20 Wiwynn Corporation

- 10.1.21 3M Company

- 10.1.22 Engineered Fluids Inc.

- 10.1.23 Green Revolution Cooling Inc.

- 10.1.24 Solvay SA