|

市场调查报告书

商品编码

1536895

网路频宽管理软体 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Network Bandwidth Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

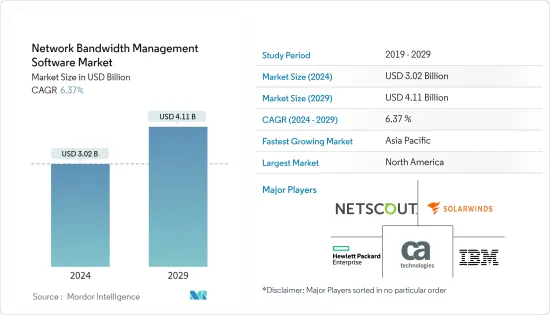

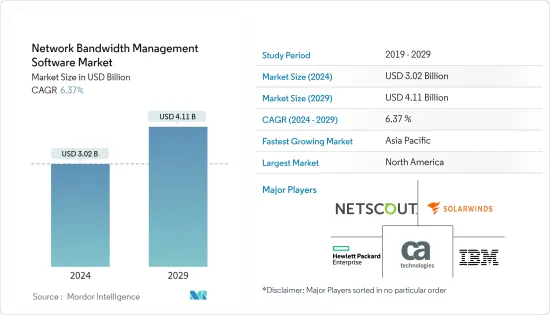

网路频宽管理软体市场规模预计到 2024 年为 30.2 亿美元,预计到 2029 年将达到 41.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.37%。

如果网路的任何部分过度使用,整体网路效能就会受到负面影响,导致延迟和中断。即时监控和管理在企业中已变得司空见惯,因为企业中未使用的网路的效能也会受到影响。

随着互联网的发展,自动化和分析也在不断发展。因此,商业领域对能够不间断地处理大量资料的高速网路服务的需求正在迅速增长。必须保持依赖专用网路的应用程式的效能及其速度,以确保隐私和资料保护。

网路服务供应商和行动电话营运商在过去十年中看到了对网路管理软体的巨大需求,而通讯服务供应商则因工业IoT设备(尤其是行动电话)的快速成长而成长。因此,频宽管理预计将增加,并成为预测期内市场成长的驱动力。

网路频宽利用率是资料流经网路的速率。传统上以每秒位数 (bps) 来衡量,更高的频宽意味着更多的流量可以从一台装置流向另一台装置。

然而,预测期内的市场成长将受到预算限制的限制,例如由于 IAM 解决方案的维护和部署以及对 IAM 解决方案知识的需求而导致的实施成本上升。

此外,在 COVID-19 大流行之后,资料流有所增加。很多人已经转向互联网,转向电子化学习和工作。这增加了市场对改进的网路频宽管理软体的需求。因此,越来越多的企业正在实施网路管理解决方案来保护资料并优化复杂的网路流程。

网路频宽管理软体市场趋势

通讯/IT板块实现显着成长

- 在当今世界,数位化正在彻底改变企业的运作方式。数位化是指资讯、资料传输和通讯过程的数位化。 IT 领域敏捷和 DevOps 趋势的出现正在增加跨职能通讯和资料传输的流行。低网路延迟会损害流程效率。

- 从电讯到资讯和通讯技术,互联网使用量的增加几乎渗透到每个行业。根据国际电信联盟的数据,截至 2023 年,欧洲的网路普及率全球最高,在最近一年的测量中成长了约 91%。因此,客户开始转向 OTT 和 IPTV。

- 电信业者也与 OTT 营运商合作以增加市场占有率。因此,这些公司必须使用网路频宽管理软体来平滑地管理其网路频宽,以满足其效能要求。

- 网路频宽管理软体可让 IT 管理员追踪和管理公司网路频宽。网路延迟是企业在使用网路时遇到的许多问题的根本原因。该软体提供减少传输过程中的延迟和分配规格的服务。

- 企业资料外洩经常发生,网路犯罪分子有效地针对许多政府机构和大型企业的网路。当凭证被盗或遗失时,企业专注于确保员工的身分识别和访问,以避免资料外洩和其他安全漏洞。

- 由于市场占有率不断增加,对频宽使用情况和应用程式引起的延迟进行即时分析,网路频宽管理软体的采用越来越受到关注。

亚太地区将经历显着成长

- 与其他亚太地区不同,亚太地区的成长预计最快。特别是,越来越多的中小企业将其活动转移到更广泛的网络,推动了该地区的成长。然而,管理网路很困难。

- 此外,由于经济成长带来的成本优势,该地区对许多企业具有吸引力,并且随着一些组织采用当今最先进的网路管理系统,增加了对整合网路管理的需求,该地区已成为一个受欢迎的市场。

- 越来越多的区域企业正在利用云端解决方案来开展业务运营,对管理复杂网路的专业知识不断增长的需求可能会推动市场成长。

- 该地区越来越多地采用物联网网路和私人商业网络,特别是在金融服务领域,对网路频宽管理软体产生了巨大的需求。与世界上大多数已开发国家不同,亚太地区的某些交易严重依赖现金,特别是在零售领域。满足该地区的现金需求需要不断扩大 ATM 机和允许循环服务的高频网路。

- 由于行动装置的使用量不断增加,预计该地区对网路频宽管理软体的需求将在预测期内增加,特别是在印度、中国和印尼等国家。

网路频宽管理软体产业概述

随着越来越多的供应商提供网路管理软体,网路频宽管理软体市场变得支离破碎。由于频宽管理软体是综合网路管理软体的一部分,市场竞争非常激烈。主要企业采取的主要策略是产品/服务创新和併购。

2024 年 3 月,Viasat Inc. 宣布推出 Videosoft Global,透过无线网路向 Velaris 合作伙伴网路提供自我调整编码和安全即时视讯传输。此次合作将透过卫星通讯实现即时视讯串流功能,让地面覆盖较差和网路环境充满挑战的地区的地勤人员安心无忧。这可以增强地球上一些最具挑战性的环境中的情境察觉。

2024年2月,NEC成功展示了其开放虚拟无线接取网路(vRAN)和5G核心虚拟用户平面功能(vUPF)产品的端到端运作。这是与 Arm、Qualcomm Technologies Inc.、Red Hat 和 Hewlett Packard Enterprise (HPE) 合作实现的。该演示使用了 HPE ProLiant 伺服器,配备基于 Arm Neoverse 的 CPU 和 Qualcomm X100 5G RAN 加速卡。测试是在相当于商业环境的条件下进行的,并使用Red Hat OpenShift作为示范平台。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 企业对物联网网路和商业专网的需求不断增长

- 商业领域对高速网路服务的需求增加

- 市场限制因素

- 免费网路流量工具的可用性

第六章 市场细分

- 按发展

- 本地

- 云

- 按公司规模

- 小型企业

- 大公司

- 按行业分类

- 通讯/IT

- 教育

- 零售

- 卫生保健

- BFSI

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- CA Technologies

- Hewlett Packard Enterprise Company

- NetScout Systems Inc.

- SolarWinds Corporation

- Alcatel-Lucent Enterprise Holding

- GFI Software SA

- Axence Software Inc.

- Zoho Corporation

- BMC Software Inc.

- InfoVista SA

- Juniper Networks Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Network Bandwidth Management Software Market size is estimated at USD 3.02 billion in 2024, and is expected to reach USD 4.11 billion by 2029, growing at a CAGR of 6.37% during the forecast period (2024-2029).

The overall network performance is adversely affected by excessive use of one part of the network, resulting in more delays and interruptions. The performance of networks not used by businesses is also influenced; therefore, real-time monitoring and management have become common practices in enterprises.

Automation and analytics are also rising with the increase in internet penetration. This leads to a surge of demand for high-speed Internet services in the commercial sector, which can cope with massive amounts of data without delay. The performance of private networks and the applications that rely on them for speed must be maintained to ensure privacy and data protection.

A considerable demand has been experienced by Internet service providers and mobile operators for network management software over the past decade, and telecom services vendors have grown due to an exponential growth of industrial IoT devices, in particular mobile phones. This is expected to increase and drive market growth bandwidth management during the forecast period.

Network bandwidth utilization is the rate at which data can flow through the network. Traditionally measured in bits per second (bps), higher bandwidth allows more traffic flow from one device to another.

However, market growth during the forecast period will be limited by budget constraints, including higher installation costs due to the maintenance and deployment of IAM solutions and a need for more knowledge about them.

Moreover, data flows increased in the wake of this COVID-19 pandemic. Many people have turned to the Internet and electronic learning and work. This increased demand for improved network bandwidth management software in the market. Therefore, several enterprises increasingly deploy network management solutions to protect data and optimize complex network processes.

Network Bandwidth Management Software Market Trends

The Telecommunication and IT Segment to Witness Significant Growth

- In today's world, digitization is revolutionizing how businesses operate. Digitalization means the digitization of information and the digitalization of data transmission and communication processes. The proliferation of cross-functional communication and data transfers is increasing with the emergence of agile and DevOps trends in IT. The low latency of the network compromises the process's effectiveness.

- In almost all sectors, from telecoms to information and communication technologies, the increase in Internet usage has penetrated its use. As per ITU, as of 2023, internet penetration in Europe was the highest worldwide, growing around 91% in the latest measured year. Due to this, the customers are becoming interested in the shift to OTT and IPTV.

- Also, telecommunications companies have partnered with OTT operators to gain market share. Therefore, these companies must manage their network bandwidth to cope with the smooth performance requirements of network bandwidth management software.

- Network bandwidth management software enables IT administrators to track and control the bandwidth of the enterprise network. Network delay is the root cause of many problems companies encounter when using the Internet. This software provides a service to reduce the delay during transmission and assign specifications.

- Corporate data breaches are frequent, and cybercriminals have effectively targeted many government and large-scale business networks. When credentials have been stolen or lost, companies will focus on securing the identification and access of their staff to avoid data exposure and other security breaches.

- With the real-time analysis of bandwidth usage and delays caused by the applications enabled by the increase in market share, the implementation of network bandwidth management software is gaining traction.

Asia-Pacific to Witness Major Growth

- Asia-Pacific's growth is expected to be the fastest, unlike the Rest of the World. In particular, the increasing number of small and medium-sized enterprises shifting their activities to a more extensive network is driving growth in this region. However, there are difficulties associated with managing networks.

- Moreover, this region is becoming an attractive market for numerous companies due to the cost advantage of growing economies and because several organizations have adopted today's state-of-the-art network management systems to increase their demand for unified network management.

- More regional organizations are taking advantage of cloud solutions to operate their business activities, which is likely to drive market growth due to the increasing demand for expertise in managing complex networks.

- In this region, a huge demand for network bandwidth management software arises due to the growing adoption of Internet of Things networks and other privately operated commercial networks, particularly in the financial services sector. Asia-Pacific relies heavily on cash for several transactions, notably in the retail sector, unlike most advanced economies worldwide. In order to meet the region's cash needs, ATMs and high-frequency networks that allow services to operate on a cycle basis should be constantly expanded.

- The demand for network bandwidth management software in this region is anticipated to increase during the forecast period due to the increased use of mobile devices, especially in countries such as India, China, and Indonesia.

Network Bandwidth Management Software Industry Overview

The network bandwidth management software market is fragmented, with increasing players offering network management software. As bandwidth management software is one of the parts of integrated network management software, the market competition is increasing. The key strategies adopted by the major players are product and service innovation and mergers and acquisitions.

In March 2024, Viasat Inc. announced Videosoft Global, which provides adaptive encoding and secure real-time video transmission over wireless networks, to its Velaris Partner Network, where the partnership will enable real-time video streaming capabilities over satellite communications, providing peace of mind to ground crews even in areas of poor terrestrial coverage, or tough network environments. This brings enhanced situational awareness to some of the most challenging environments on the planet.

In February 2024, NEC Corporation successfully demonstrated the end-to-end operation of their Open Virtual Radio Access Network (vRAN) and 5G Core Virtual User Plane Function (vUPF) products. This was achieved with Arm, Qualcomm Technologies Inc., Red Hat, and Hewlett Packard Enterprise (HPE). The demonstration used HPE ProLiant servers with Arm Neoverse-based CPUs and the Qualcomm X100 5G RAN Accelerator Card. The test was performed under conditions equivalent to a commercial environment, and Red Hat OpenShift was used as the platform for the demonstration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for IoT Networks and Commercial Private Networks in Enterprises

- 5.1.2 Increasing Demand for High-speed Internet Service in the Commercial Sector

- 5.2 Market Restraints

- 5.2.1 Availability of Free Network Traffic Tools

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large enterprises

- 6.3 By End-user Vertical

- 6.3.1 Telecommunication & IT

- 6.3.2 Education

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 BFSI

- 6.3.6 Other End-user Verticals

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 CA Technologies

- 7.1.3 Hewlett Packard Enterprise Company

- 7.1.4 NetScout Systems Inc.

- 7.1.5 SolarWinds Corporation

- 7.1.6 Alcatel- Lucent Enterprise Holding

- 7.1.7 GFI Software SA

- 7.1.8 Axence Software Inc.

- 7.1.9 Zoho Corporation

- 7.1.10 BMC Software Inc.

- 7.1.11 InfoVista SA

- 7.1.12 Juniper Networks Inc.