|

市场调查报告书

商品编码

1536905

空气清净机:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

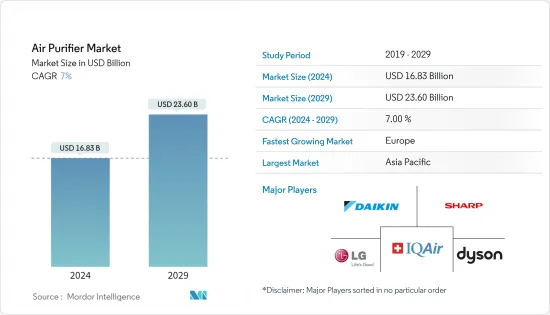

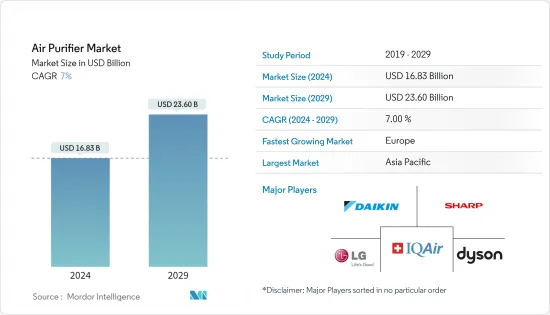

空气清净机市场规模预计到 2024 年为 168.3 亿美元,预计到 2029 年将达到 236 亿美元,在预测期内(2024-2029 年)复合年增长率为 7%。

主要亮点

- 空气传播疾病的增加、工业活动排放的增加以及消费者健康意识的增强等因素正在推动市场的发展。

- 另一方面,儘管技术不断发展,但由于安装和维护成本高昂,空气清净机在欠发达经济体和新兴经济体中仍然是奢侈品,尤其是在商业和住宅领域。反过来,这预计将阻碍市场成长。

- 空气污染是人口稠密的亚太地区面临的严峻挑战,损害环境、公共卫生和农作物产量。然而,这些问题未来可能会为空气清净机市场创造一些机会。

- 预计亚太地区将在预测期内主导市场,其中大部分需求来自孟加拉、印度和越南等国家。

空气清净机市场趋势

高效颗粒空气 (HEPA) 领域预计将主导市场

- 机械空气过滤器(例如 HEPA 过滤器)透过将颗粒捕获在过滤材料中来去除颗粒。捕捉空气中的大颗粒,例如灰尘、花粉、霉菌孢子、动物皮屑以及含有尘螨和蟑螂过敏原的颗粒。

- HEPA 过滤器是一种扩展表面过滤器,具有较大的表面积,能够有效去除空气中的颗粒,无论其大小如何。此外,此空气过滤器比折迭式滤网更有效地去除可吸入颗粒。 HEPA 空气清净机所需的两个最常见的标准包括去除大于 0.3微米颗粒的能力,即 99.95%(欧洲标准)或 99.97%(ASME 标准)。

- 在过去的十年中,HEPA 过滤器已被证明可以在各种医疗保健设施和生命科学应用中减少空气中的颗粒和生物体(例如病毒和细菌)的传播。许多专业工程协会建议在医院、感染控制诊所和其他医疗机构使用 HEPA 过滤器,以去除微生物和其他危险颗粒。

- 此外,近年来,世界各地的污染水平急剧增加。因此,从事该行业的公司专注于开发和推出创新产品。

- 例如,2023 年 10 月,空气清净机製造商 ISO-Aire 推出了名为 RSF500 的新型 HEPA 清净机变体。此型号每分钟输送 500 立方英尺,适合中小型办公室。它还提供 3 级空气过滤保护,去除有害污染物和空气传播的细菌。此类 HEPA 空气清净机很可能在未来变得流行。

- 根据《世界空气品质报告》,2023 年孟加拉的粒状物 (PM) 2.5 浓度最高,为 79.9 微克/立方公尺 (Tg/m3),其次是巴基斯坦,为 73.7 Tg/m3 和 54.4 Tg/m3。 ,塔吉克为49托克/立方米,布吉纳法索为46.6托克/立方米。

- 因此,由于这些因素,高效颗粒空气(HEPA)技术预计将在预测期内主导市场。

亚太地区预计将主导市场

- 亚太地区是空气清净机市场需求的驱动力。由于工业化活动活性化和人口成长,印度、孟加拉、塔吉克、印尼、越南和中国等开发中国家正经历工业成长高峰。预计这将在预测期内推动需求。

- 根据《世界空气品质报告》,PM2.5平均浓度最高的是印度为92.7微克/立方米,孟加拉为80.2微克/立方米,塔吉克为46微克/立方米,中国为34.1微克/立方米,印尼为43.8微克/m3。

- 另一方面,在印度,空气清净机的市场主要局限于大城市。然而,预计在预测期内将会成长。 2023年11月,Nirvana推出了印度首款基于微型静电除尘设备(MESP)技术的空气杀菌净化器。 MESP 技术被认为在印度大气条件下表现最佳,可防护 PM2.5、灰尘、烟雾、病毒、细菌和花粉。

- 越南空气清净机市场正在迅速扩大,主要是由于消费者越来越关注细粉尘,需求激增。 2024年2月,空气清净机製造商Rebois推出了一款名为Rebois Core 200S的住宅和商务用新产品。 Revowatt Core 200S 配备 3 层过滤器:Essential Nylon Core、H13 True HEPA Core 和内部活性碳Core。去除 99.97% 的空气中小至 0.3 微米的微粒。在越南,此类产品可能会保护人们免受有害废气的影响。

- 因此,这些因素预计将推动亚太地区在预测期内主导空气清净机市场。

空气清净机产业概况

空气清净机市场较为分散。该市场的主要企业(排名不分先后)包括Daikin Industries Ltd.、Sharp Corporation、IQAir、LG电子公司和戴森有限公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029 年之前的市场规模与需求预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 过滤技术

- 高效能颗粒空气 (HEPA)

- 其他过滤技术(静电除尘设备(ESP)、离子产生器、臭氧产生器等)

- 类型

- 独立的

- 感应

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- Companies Profiles

- Daikin Industries Ltd

- Sharp Corporation

- Resideo Technologies Inc.

- LG Electronics Inc.

- Unilever PLC

- Dyson Ltd

- Whirlpool Corporation

- AllerAir Industries Inc.

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co. Ltd

- Winix Inc.

- Xiaomi Corp.

- 市场排名分析

第七章 市场潜力及未来趋势

简介目录

Product Code: 61329

The Air Purifier Market size is estimated at USD 16.83 billion in 2024, and is expected to reach USD 23.60 billion by 2029, growing at a CAGR of 7% during the forecast period (2024-2029).

Key Highlights

- Factors such as increasing airborne diseases, rising emissions due to industrial activities, and growing consumer health consciousness are driving the market.

- On the other hand, despite the various technological developments, air purifiers have been perceived as a luxury item in both underdeveloped and emerging economies, particularly in the commercial and residential segments, owing to the high installation and maintenance costs. This, in turn, is expected to hinder the market's growth.

- Growing air pollution in the densely populated Asia-Pacific region has emerged as a significant challenge, damaging the environment, public health, and agricultural crop yields. However, such problems will likely create several future opportunities for the air purifier market.

- Asia-Pacific is expected to dominate the market during the forecast period, with most of the demand coming from countries like Bangladesh, India, and Vietnam.

Air Purifier Market Trends

The High-efficiency Particulate Air (HEPA) Segment is Expected to Dominate the Market

- Mechanical air filters, such as HEPA filters, remove particles by capturing them on filter materials. They capture large airborne particles, such as dust, pollen, mold spores, animal dander, and particles containing dust mite and cockroach allergens.

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these air filters remove respirable particles more efficiently than pleated filters. The two most common standards required for HEPA air purifiers include the capability to remove particles, i.e., 99.95% (European Standard) or 99.97% (ASME Standard), which have a size greater than or equal to 0.3 micrometers.

- For the last decade, HEPA filters have been proven to control the spread of airborne particles and organisms, such as viruses and bacteria, across various healthcare facilities and life sciences applications. Many professional engineering organizations recommend HEPA filters in hospitals, infection control clinics, and other healthcare facilities to eliminate microbes and other dangerous particles.

- Further, pollution levels around the globe have increased dramatically in recent years. Hence, companies operating in the industry have focused on developing and introducing innovative products.

- For instance, in October 2023, the air purifier manufacturing company ISO-Aire launched its new HEPA purifier variant called RSF500. The model delivers 500 cubic feet per minute and is feasible for small to medium-sized offices. It also offers three levels of air filtration protection to eliminate harmful pollutants and airborne germs. Such HEPA air purifier variants are likely to get traction in the future.

- As per the World Air Quality Report, the highest concentration of particulate matter (PM) 2.5 in 2023 was noted in Bangladesh at 79.9 micrograms per cubic meter (µg/m3), followed by Pakistan at 73.7 µg/m3, 54.4 at µg/m3, Tajikistan at 49 µg/m3 and Burkina Faso at 46.6 µg/m3.

- Therefore, owing to such factors, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has been a catalyst for demand in the air purifier market. In developing nations such as India, Bangladesh, Tajikistan, Indonesia, Vietnam, and China, industrial growth is at its peak owing to increased industrialization activities and population growth. This is expected to drive demand during the forecast period.

- As per the World Air Quality Report, the highest average PM 2.5 concentration in India stood at 92.7 µg/m3, Bangladesh at 80.2 µg/m3, Tajikistan at 46 at µg/m3, China at 34.1 µg/m3, and Indonesia at 43.8 µg/m3.

- On the other hand, in India, the market for air purifiers is mainly confined to metropolises. However, it is expected to grow during the forecast period. In November 2023, Nirvana rolled out India's first-ever Micro-electrostatic precipitator (MESP) technology-based air sterilizing purifier. The MESP technology is deemed to perform best in Indian atmospheric conditions and protect against PM 2.5, dust, smoke, viruses, bacteria, and pollen.

- The air purifier market in Vietnam is expanding rapidly, mainly due to surging demand as consumers become more concerned about fine dust. In February 2024, the air purifier company Levoit launched a new one called Levoit Core 200S for residential and commercial use. Levoit Core 200S has a 3-layer filter with an essential Nylon core, an H13 True HEPA core, and an inner activated carbon core. It filters up to 99.97% of airborne particles with a size of 0.3 microns. Such products are likely to protect people from harmful emission levels in Vietnam.

- Therefore, such factors are expected to make Asia-Pacific the dominant air purifier market during the forecast period.

Air Purifier Industry Overview

The air purifier market is fragmented. Some key players in this market (not in a particular order) include Daikin Industries Ltd, Sharp Corporation, IQAir, LG Electronics Inc., and Dyson Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Filtration Technologies (Electrostatic Precipitators (ESPs), Ionizers and Ozone Generators, etc.)

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 NORDIC

- 5.4.2.5 Russia

- 5.4.2.6 Turkey

- 5.4.2.7 Italy

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Malaysia

- 5.4.3.5 Thailand

- 5.4.3.6 Indonesia

- 5.4.3.7 Vietnam

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Qatar

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Daikin Industries Ltd

- 6.3.2 Sharp Corporation

- 6.3.3 Resideo Technologies Inc.

- 6.3.4 LG Electronics Inc.

- 6.3.5 Unilever PLC

- 6.3.6 Dyson Ltd

- 6.3.7 Whirlpool Corporation

- 6.3.8 AllerAir Industries Inc.

- 6.3.9 Panasonic Corporation

- 6.3.10 Koninklijke Philips NV

- 6.3.11 IQAir

- 6.3.12 Samsung Electronics Co. Ltd

- 6.3.13 Winix Inc.

- 6.3.14 Xiaomi Corp.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES and FUTURE TRENDS

02-2729-4219

+886-2-2729-4219