|

市场调查报告书

商品编码

1536915

小型风力发电机-市场占有率分析、产业趋势/统计、成长预测(2024-2029)Small Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

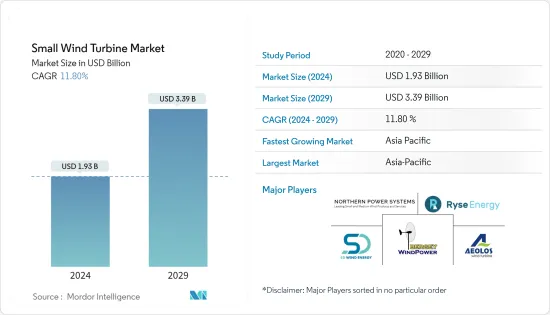

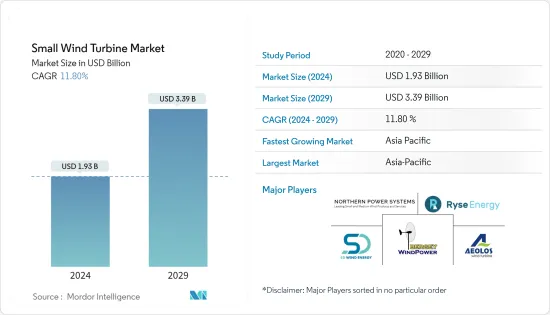

小型风力发电机市场规模预计到2024年为19.3亿美元,预计到2029年将达到33.9亿美元,在预测期内(2024-2029年)复合年增长率为11.80%。

*从中期来看,由于尺寸小、占地面积小以及资本支出和营运支出要求低,对环境的影响较小,预计将推动市场成长。

*同时,来自屋顶太阳能光电(PV)等替代分散式电源的竞争对市场成长产生负面影响,是主要限制因素之一。

*然而,建筑一体化风力发电机的商业化和无叶片风力发电机的开发预计将在预测期内提供成长机会。

*亚太地区主导市场,并可能在预测期内维持最高的复合年增长率。成长主要是由支持小型风电开发的现有政策框架所推动的。

小型风力发电机市场趋势

水平轴风力风力发电机产业将强劲成长

*目前製造的大多数小型风力发电机(SWT)都是水平轴迎风型,具有两个或三个叶片,通常由玻璃纤维等复合材料製成。

*水平轴风力发电机(HAWT)的主转子轴和发电机位于塔顶,一个简单的风速计引导涡轮机朝向或远离盛行风。

*小型风力发电机主要包括生产历史超过30年的水平轴风力发电机,而大多数小型垂直轴风力发电机(VAWT)是在过去10年内生产的。小型HWAT因其技术和经济优势而备受关注。除了风力发电成本低外,小型水平轴风力发电机也易于维护,无需熟练人员。

*此外,还有两种小型HAWT。一种是典型的三叶片型,另一种是动态较复杂的护罩型。两种类型的输出功率相同,约为 3kW。

*小型HAWT的优点之一是塔基高,因此在风切时可以接收更强的风(风速变化与风向成直角的地方,转动力更容易起作用) 。风力发电的增加可能会导致发电量的增加。因此,小型风力发电机的引入可能会在预测期内逐步进行。

*小型风力发电机主要用于开发中国家和已开发国家的农村和偏远地区。根据美国能源局《分散式风电市场报告》历史资料,2022年风电增速是2022年的1.5倍:根据美国能源局历史资料,2022年SWT市场成长仅限于英国、丹麦、义大利和德国等国家。

*此外,根据美国能源局预计,2022年美国小型风力发电机数量将达到1,745台,投资额为1,460万美元。展望未来,由于政府透过计划和补贴提供财政支持,小型太阳能和小型风电驱动的分散式计划的投资预计将增加。

*此外,各公司正在进行小型风力发电的研究和开发。 2024年4月,全球小型风力发电机製造商Emerging Nations开始调查小型风力发电在开发中国家的前景。这些倡议可能为未来的市场前景增添动力。

*鑑于上述情况,水平轴风力发电机预计将在预测期内主导市场。

亚太地区预计将主导市场

*预计亚太地区将在2023年主导风电市场,并在未来保持主导地位。该地区具有扩大小型风力发电机发电机市场的巨大潜力,特别是离网和住宅规模小型风力发电机发电机。

*小型风力发电机可以在低至每秒2公尺的风速下运转。它可以连接到电网、独立、与太阳能混合或安装在屋顶上。

*中国拥有全球最大的风力发电能力,截至2023年风力发电设施装置容量为441.89GW。此外,2022年,我们将安装小型风力发电机6,000万千瓦,累积设置容量达到704.32万千瓦。该国于2009年首次引入陆上风电上网电价补贴,目前为小型风力发电机提供13.4至20.1克拉/千瓦时的上网电价补贴。

*中国小型风力发电机的应用正在从农村电气化转向城市街道照明和电讯的独立电力系统。中国小型风力发电机的应用正在从农村电气化转向城市街道照明和通讯的独立电力系统,并且在这些新的应用领域正在快速发展。

*另一方面,印度的风力发电能力位居世界第四。截至2023年,该国风力发电装置容量为44.7GW。就 SWT 而言,印度目前安装的大多数系统都是离网或独立的。马哈拉斯特拉邦占该国 SWT 装置的大部分。在泰米尔纳德邦和古吉拉突邦等「多风」的邦,SWT 的安装较少。

*随着中国和印度风电装置容量的持续增加,预计该地区未来将出现更多小型风发电工程。因此,小型风电基础设施开发的投资预计在未来几年将会增加。

*鑑于上述情况,亚太地区预计在预测期内将主导小型风力发电机市场。

小型风力发电机产业概况

小型风力发电机市场适度分散。市场主要企业(排名不分先后)包括 Northern Power Systems Inc.、Bergey Wind Power Co.、SD Wind Energy、Aeolos Wind Energy Ltd. 和 Ryse Energy。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029 年之前的市场规模与需求预测

- 最新趋势和发展

- 政府法规政策

- 投资机会

- 市场动态

- 促进因素

- 企业、社区和家庭越来越多地采用小型风力发电机

- 降低资本支出和营运支出需求

- 抑制因素

- 与替代分散式发电的竞争

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 轴型

- 水平轴风力发电机

- 垂直轴风力发电机

- 目的

- 在併网

- 离网

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 马来西亚

- 印尼

- 越南

- 泰国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Aeolos Wind Energy Ltd

- Bergey Wind Power Co.

- City Windmills Holdings PLC

- Wind Energy Solutions

- SD Wind Energy Limited

- UNITRON Energy Systems Pvt. Ltd

- Northern Power Systems Inc.

- Shanghai Ghrepower Green Energy Co. Ltd

- TUGE Energia OU

- Ryse Energy

- Market Ranking/Share(%)Analysis

第七章 市场机会及未来趋势

- 建筑一体化风力发电机的商业化和无叶片风力发电机的开发

The Small Wind Turbine Market size is estimated at USD 1.93 billion in 2024, and is expected to reach USD 3.39 billion by 2029, growing at a CAGR of 11.80% during the forecast period (2024-2029).

* Over the medium term, the market's growth is expected to be driven by lower environmental impact due to its smaller size and land footprint and lower CAPEX and OPEX requirements.

* On the other hand, competition from alternative distributed generation sources such as rooftop solar photovoltaic (PV) would negatively impact the market's growth and is one of the major restraints.

* Nevertheless, the commercialization of building-integrated wind turbines and the development of bladeless wind turbines are expected to provide growth opportunities in the forecast period.

* The Asia-Pacific region dominates the market and will likely witness the highest CAGR during the forecast period. The growth is mainly driven by the existing framework of policies supporting the adoption of small-scale wind power developments.

Small Wind Turbine Market Trends

The Horizontal Axis Wind Turbine Segment is Expected to Witness Significant Growth

* A majority of small wind turbines (SWT) manufactured today are horizontal-axis, upwind machines that have two or three blades, usually made of composite materials such as fiberglass.

* A horizontal axis wind turbine (HAWT) has its main rotor shaft and electrical generator at the top of the tower, and a simple wind vane is used to point the turbine toward or away from the prevailing wind.

* Small wind turbines consist primarily of horizontal axis wind turbines that have been in production for over three decades, whereas most small vertical axis wind turbines (VAWTs) have been produced within the last decade. Due to the technological and economic advantages associated with the small HWAT, it receives considerable attention. In addition to low-cost wind energy generation, small horizontal-axis wind turbines can be maintained easily and without a skilled workforce.

* Furthermore, there are two types of small HAWTs. The first is a typical three-bladed design, while the second is an aerodynamically complex, shrouded type. Both types have a similar rate power of approximately three kW.

* Among the advantages of small HAWTs is their tall tower bases, which allow them to gain greater access to wind at sites with wind shear (where variations in wind velocity occur at right angles to the wind direction and tend to exert a turning force). As a result of stronger wind access, power generation is likely to increase. This is likely to result in moderate deployment of these units during the forecast period.

* Small wind turbines are used throughout the developing and developed nations across the region and are used mainly in rural or remote settings. As per the historical data by the US Department of Energy in their Distributed Wind Market Report: 2022 Edition, the growth in the SWT market is restricted to countries like the United Kingdom, Denmark, Italy, and Germany.

* Further, according to the United States Department of Energy, the number of small wind turbines in the United States reached 1,745 units in 2022, having an investment of USD 14.6 million. In the future, investment in distributed projects attributing small-scale solar and small-scale wind is expected to increase with the efforts of the government to provide financial support through schemes and subsidies.

* Moreover, companies are undergoing research & development to develop small wind installations. In April 2024, FREEN, a global small wind turbine manufacturer, started examining the promising landscape of small wind energy in developing countries. Such an initiative will fuel the scope of the market in the future.

* Therefore, owing to the above points, the horizontal axis wind turbine segment is expected to dominate the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

* Asia-Pacific dominated the wind power generation market in 2023 and is expected to continue its dominance in the coming years. The region holds vast potential for expanding the small wind turbine market, notably in the form of off-grid and residential-scale small wind turbines.

* Small wind turbines can run at wind speeds as low as two meters per second. They can be connected to the grid or stand-alone systems, hybridized with solar, or mounted on rooftops.

* China holds the largest wind power generation capacity globally, with 441.89 GW of installed capacity as of 2023. The country also installed 60 MW of small wind turbines in 2022, reaching a cumulative installed capacity of 704.32 MW. The country first introduced FiT from onshore wind in 2009; it currently offers FiT for small wind turbines ranging from USD 13.4-20.1 ct/kWh.

* Chinese small wind turbine applications are shifting from rural electrification oriented to city street illumination and telecom stand-alone power systems. It is developing rapidly in these new application fields.

* On the other hand, India holds the fourth-largest wind power installed capacity in the world. The country's wind power installed capacity stood at 44.7 GW as of 2023. Regarding SWTs, almost all the systems installed in India today are off-grid or stand-alone. The state of Maharashtra has the majority of the SWT installations in the country. The otherwise 'windy' states like Tamil Nadu and Gujarat fare poorly in the SWT installations.

* The region is expected to have more small wind turbine projects in the future, owing to the continuous increase in China and India's wind generation capacity. Thus, investments in developing small wind infrastructure are expected to grow in the upcoming years.

* Therefore, owing to the above points, Asia-Pacific is expected to dominate the small wind turbine market during the forecast period.

Small Wind Turbine Industry Overview

The small wind turbine market is moderately fragmented. Some of the major players in the market (not in particular order) include Northern Power Systems Inc., Bergey Wind Power Co., SD Wind Energy, Aeolos Wind Energy Ltd, and Ryse Energy., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Investment Opportunities

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Growing Adoption of Small Wind Turbines for Businesses, Communities and Homes

- 4.6.1.2 Lower CAPEX and OPEX Requirements

- 4.6.2 Restraints

- 4.6.2.1 Competition from Alternative Distributed Generation Source

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Axis Type

- 5.1.1 Horizontal Axis Wind Turbine

- 5.1.2 Vertical Axis Wind Turbine

- 5.2 Application

- 5.2.1 On-grid

- 5.2.2 Off-grid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 NORDIC

- 5.3.2.8 Rest of the Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Malaysia

- 5.3.3.5 Indonesia

- 5.3.3.6 Vietnam

- 5.3.3.7 Thailand

- 5.3.3.8 Australia

- 5.3.3.9 Rest of the Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aeolos Wind Energy Ltd

- 6.3.2 Bergey Wind Power Co.

- 6.3.3 City Windmills Holdings PLC

- 6.3.4 Wind Energy Solutions

- 6.3.5 SD Wind Energy Limited

- 6.3.6 UNITRON Energy Systems Pvt. Ltd

- 6.3.7 Northern Power Systems Inc.

- 6.3.8 Shanghai Ghrepower Green Energy Co. Ltd

- 6.3.9 TUGE Energia OU

- 6.3.10 Ryse Energy

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Commercialization of Building-Integrated Wind Turbines and Development of Bladeless Wind Turbines