|

市场调查报告书

商品编码

1687391

人造板市场占有率分析、产业趋势与统计、成长预测(2025-2030)Wood-based Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

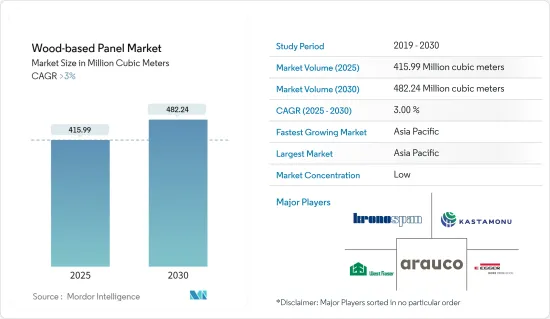

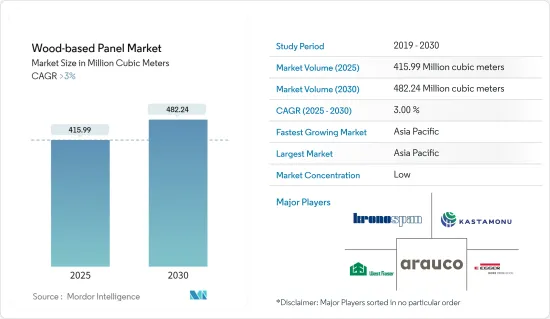

预计2025年人造板市场规模为4.1599亿立方米,到2030年将达到4.8224亿立方米,预测期内(2025-2030年)的复合年增长率将超过3%。

受调查的市场在2020年受到了新冠疫情的负面影响。一些国家对用于家具的某些种类的纤维板的进口征收反倾销税,以支持国内生产商。为了遏制病毒传播,所有建筑工程和其他活动都停止了,对市场造成了不利影响。然而,由于建筑建设活动的增加,预计市场将从 2021 年起稳步增长。

主要亮点

- 短期内,住宅和商业建筑的看涨成长趋势以及家具产业需求的增加是推动市场成长的主要因素。

- 然而,预计预测期内木质板材的甲醛排放量将成为限制市场成长的主要因素。

- 然而,OSB 在结构绝缘板 (SIPS) 中的使用日益增多,预计很快将为全球市场创造丰厚的成长机会。

- 预计在评估期内,亚太地区的人造板市场将出现成长,这是因为人造板因其优良的性能而被广泛应用于家具、建筑和包装等终端使用领域。

人造板市场趋势

家具业需求增加

- 由于其多种优点,人造板被广泛应用于住宅家具。儘管木製家具有多种替代品,但其需求仍处于高峰。人造板耐用、经济、易于清洁且用途广泛。

- 民用家具占全球家具市场的65%,其次是商业(包括办公室、饭店等)。亚太地区是全球最大的家俱生产地区,其中中国、印度和日本占据领先地位。

- 宜家是世界上最大的家具製造商之一。根据该公司发布的资料,预计2023年的年收益将成长约6.73%,达到476亿欧元(约502.9亿美元)。

- 中国是世界领先的家居装饰生产国。都市化趋势促使中国家具产业新兴品牌不断涌现。最热情的顾客是年轻一代,他们更了解新趋势,购买力更强。此外,该国日益增长的技术进步正在培育家具行业的新一代。

- 印度家具业最大的细分市场是家居家具。卧室家具占印度家居家具市场的最大份额,其次是客厅家具。然而,衣柜和厨房是最昂贵的购买品,顾客在厨房家具上的花费约为 7,000-10,000 美元。

- 欧洲家居装饰产业严重依赖亚洲国家的进口,最近的供应链中断使筹资策略变得复杂。因此,零售商越来越多地从邻国而不是亚洲国家进口,以降低运输成本和交货时间。

- 2022 年 10 月,MoKo Home+Living 在由美国投资基金 Talanton 和瑞士投资者 AlphaMundi Group 共同领主导的B 轮债务和股权资金筹措中筹集了 65 亿美元。目的是增加家具产量并保持良好的品质。这项倡议正在推动家居装饰领域的成长。

- 在家工作等工作模式的改变,推动了对紧凑、耐用且易于操作的家具的需求。从办公室工作空间到住宅环境的转变推动了对更实用、更灵活的家具的需求。一些製造商已经开始提供采用木质镶板的高效家具。无论是符合人体工学的椅子、办公桌或学习桌,在家工作将焦点重新转移到家居装饰上,从而促进了家具行业的成长。

- 预计上述因素将在未来几年推动人造板市场的发展。

亚太地区占市场主导地位

- 亚太地区在全球市场占有重要份额。中国、印度和日本等国家建设活动的增加,加上家具需求的增加,推动了该地区对人造板的需求。

- 根据国际热带木材组织(ITTO)预测,2022年中国无甲醛人造板产品产量预计将年增与前一年同期比较%,达到约810万立方米,其中无甲醛胶合板160万立方米,纤维板20万立方米,塑合板630万立方米。

- 我国木质板材生产主要集中在山东、江苏、广西等省区,约占全国总产量的60%。根据中国木材与木製品流通协会统计,去年中国约44%的人造板用于家具製造、装饰和翻新。

- 中国正经历建筑业的繁荣。根据中国国家统计局的预测,2023年中国建筑业总产值将成长1.99%,达到人民币712,847.2亿元(约108,678.0亿美元)。此外,预计到2030年中国将在建筑方面投资近13兆美元,这对人造板来说是一个利好。

- 据印度投资局称,印度是世界第五大家俱生产国和第四大家具消费国。 2022 年,印度家具市场价值为 231.2 亿美元。此外,预计 2023-28 年印度家具市场的复合年增长率为 10.9%,到 2026 年将达到 327 亿美元。

- 印度政府的「印度製造」倡议吸引了多家跨国公司在该国投资,预计这将在预计的时间内增加对新办公大楼的需求,并支持对用于家俱生产的塑合板等各种人造板的需求。

- 预计到2022年,印度建筑业将成为世界第三大建筑市场。印度政府正在实施的政策包括智慧城市计划和2022年实现全民住宅计画。这些政策预计将为陷入困境的建设产业提供急需的提振。

- 上述因素将导致预测期内该地区人造板消费需求增加。

人造板产业概况

人造板市场本质上是高度分散的。主要企业(不分先后顺序)包括 Kronoplus Limited、West Fraser、ARAUCO、EGGER 和 Kastamonu Entegre。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 住宅和商业建筑强劲成长

- 家具业需求增加

- 其他驱动因素

- 限制因素

- 人造板的甲醛释出量

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 产品类型

- 中密度纤维板(MDF)/高密度纤维板(HDF)

- 定向纤维板(OSB)

- 塑合板

- 硬质纤维板

- 合板

- 其他产品类型(木板、软板、刨花板、轮胎边缘)

- 应用

- 家具

- 住宅

- 商业的

- 建筑学

- 地板和屋顶

- 墙

- 门

- 其他结构(装饰用途、木製框架、配件)

- 包装

- 其他用途(艺术品、工业原型、玩具等)

- 家具

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ARAUCO

- CenturyPly

- VRG Dongwha MDF

- DEXCO

- EGGER

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Langboard Inc.

- Louisiana-Pacific Corporation

- Pfleiderer

- Roseburg Forest Products

- SWISS KRONO Group

- West Fraser

- Weyerhaeuser Company

第七章 市场机会与未来趋势

- 扩大OSB在结构绝缘板(SIPS)的应用

- 其他机会

The Wood-based Panel Market size is estimated at 415.99 million cubic meters in 2025, and is expected to reach 482.24 million cubic meters by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The market studied was negatively impacted by COVID-19 in 2020. Several countries imposed anti-dumping duty on the import of a certain variety of fiberboard used in furniture in order to aid domestic producers. All the construction work and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market studied is projected to grow steadily, owing to increased building and construction activities since 2021.

Key Highlights

- Over the short term, bullish growth trends in residential and commercial construction, coupled with increasing demand from the furniture industry, are major factors driving the growth of the market studied.

- However, formaldehyde emission from wood-based panels is a key factor anticipated to restrain the growth of the market studied over the forecast period.

- Nevertheless, the increasing application of OSB in structural insulated panels (SIPS) is expected to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is estimated to experience growth over the assessment period in the wood-based panel market due to the wide usage of wood-based panels in end-use application segments, such as furniture, construction, and packaging, due to their desirable properties.

Wood-based Panel Market Trends

Increasing Demand from the Furniture Industry

- Due to their several benefits, wood-based panels are extensively used in residential furniture. There are various alternatives to wooden furniture, but the demand for it is still at its peak. Wooden panels are long-lasting, economically friendly, easy to clean, and highly versatile.

- The global furniture market comprises 65% of domestic home furniture, followed by commercials (including offices, hotels, and others). Asia-Pacific is the world's largest home furniture producer, among which China, India, Japan, and others are the leading producers.

- IKEA is one of the largest furniture manufacturers globally. According to public data published by the company, its annual revenue in 2023 increased by about 6.73% and was valued at EUR 47.6 billion (~USD 50.29 billion).

- China is the leading producer of home furniture globally. Due to the growing trend of urbanization, new brands have emerged in the Chinese furniture industry. Their most dedicated customers are younger people who adopt new trends and have tremendous purchasing power. Moreover, the growing technological advancement in the country has brought up a new generation in the furniture industry.

- The Indian furniture industry's largest segment is home furniture. Bedroom furniture has the highest share of the Indian home furniture market, followed by living room furniture. However, wardrobes and kitchens are the most expensive purchases, with customers spending around USD 7,000-10,000 on kitchen furniture.

- The European home furniture industry is heavily dependent on products imported from Asian countries, and recent supply chain interruptions complicate their sourcing strategies. As a result, retailers have increased their share of imports from neighboring countries compared to Asian countries to reduce transportation costs and delivery times.

- In October 2022, MoKo Home + Living raised USD 6.5 billion in a Series B debt-equity funding round, co-led by US-based investment fund Talanton and Swiss investor AlphaMundi Group. The aim is to increase home furniture production and maintain good quality. This initiative has driven the growth of the home furniture segment.

- The ongoing working pattern, such as work-from-home, has increased the demand for compact, durable, and easy-to-handle home furniture. The shift from office workspaces to house settings has increased the demand for more functional and flexible home furniture. Several manufacturers have started offering efficient furniture using wood panels. Whether it is an ergonomic chair, office desk, or study table, working from home puts the focus back on home decor, increasing the growth of the furniture segment.

- All the above factors are expected to drive the market for wood-based panels in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region held a major share of the global market. With growing construction activities and the increasing demand for furniture in countries such as China, India, and Japan, the demand for wood-based panels is increasing in the region.

- According to the International Tropical Timber Organisation (ITTO), the production of formaldehyde-free wood-based panel products in China increased by about 36% in 2022 as compared to the previous year and stood at about 8.1 million cubic meters, including formaldehyde-free plywood (1.6 million cubic meters), fibreboard (0.2 million cubic meters) and particleboard (6.3 million cubic meters).

- China's wood-based paneling production is concentrated in the Shandong, Jiangsu, and Guangxi provinces, which account for about 60% of the total production. According to the China Timber and Wood Products Distribution Association, around 44% of China's wood-based panels were used for furniture manufacturing, decoration, or renovation last year.

- China is amid a construction mega-boom. According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in 2023 increased by 1.99% and was valued at CNY 71,284.72 billion (~USD 10,086.78 billion). Furthermore, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for wood-based panels.

- According to Invest India, India is the 5th largest producer and 4th largest consumer of furniture globally. The furniture market in the country was valued at USD 23.12 billion in 2022. Furthermore, the Indian furniture market is expected to grow at a CAGR of 10.9% during 2023-28 and reach USD 32.7 billion by 2026.

- The Make in India initiative by the government attracted several multinational companies to invest in the country, which is expected to increase the demand for new office buildings in the estimated time, supporting the demand for various wood-based panels, such as particle boards for furniture production.

- The Indian construction sector is expected to become the world's third-largest construction market by 2022. The Smart Cities project and Housing For All by 2022 are policies implemented by the Indian government. These policies are expected to bring the needed impetus to the slowing construction industry.

- The factors above are contributing to the increasing demand for wood-based panel consumption in the region during the forecast period.

Wood-based Panel Industry Overview

The wood based panel market is highly fragmented in nature. The major players (not in any particular order) include Kronoplus Limited, West Fraser, ARAUCO, EGGER, and Kastamonu Entegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Bullish Growth Trends in Residential and Commercial Construction

- 4.1.2 Increasing Demand from the Furniture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Formaldehyde Emission from Wood-based Panels

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Medium-density Fiberboard (MDF)/High-density Fiberboard (HDF)

- 5.1.2 Oriented Strand Board (OSB)

- 5.1.3 Particleboard

- 5.1.4 Hardboard

- 5.1.5 Plywood

- 5.1.6 Other Product Types (Lumber Panels, Softboard, Chipboard, and Beadboard)

- 5.2 Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Other Constructions (Decorative Applications, Wooden Frames, and Accessories)

- 5.2.3 Packaging

- 5.2.4 Other Applications (Artistry, Industrial Prototyping, Toys, etc.)

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARAUCO

- 6.4.2 CenturyPly

- 6.4.3 VRG Dongwha MDF

- 6.4.4 DEXCO

- 6.4.5 EGGER

- 6.4.6 Georgia-Pacific Wood Products LLC

- 6.4.7 GREENPANEL INDUSTRIES LIMITED

- 6.4.8 Kastamonu Entegre

- 6.4.9 Kronoplus Limited

- 6.4.10 Langboard Inc.

- 6.4.11 Louisiana-Pacific Corporation

- 6.4.12 Pfleiderer

- 6.4.13 Roseburg Forest Products

- 6.4.14 SWISS KRONO Group

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)

- 7.2 Other Opportunities