|

市场调查报告书

商品编码

1536917

零售市场中的人工智慧 -市场占有率分析、行业趋势和统计、成长预测(2024-2029)AI In Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

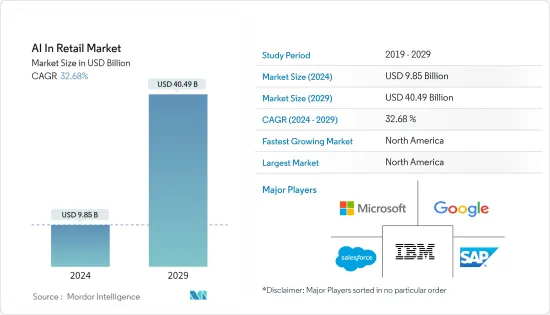

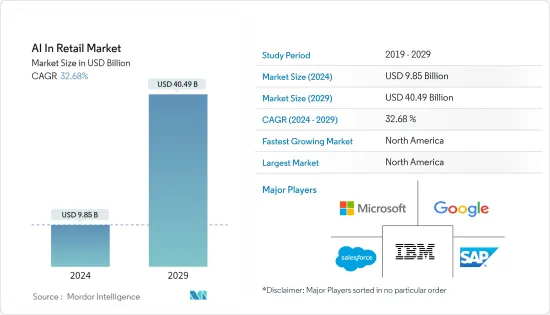

零售业人工智慧市场规模预计到 2024 年为 98.5 亿美元,预计到 2029 年将达到 404.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 32.68%。

人工智慧是由大量可靠资料驱动的演算法集合,越来越多地被零售业采用,以实现个人化的购物体验。透过利用客户偏好,零售商可以提供量身订製的产品推荐、改善客户体验并推动销售。

主要亮点

- 在先进资料分析和预测系统整合的推动下,零售业正在经历一场重大的数位转型。这种由人工智慧和物联网融合推动的转型为零售商提供了先进的见解,以优化业务并发现利润丰厚的商机。零售商正在转向人工智慧驱动的解决方案来应对不断变化的消费行为、劳动力限制、供应链中断和成本上升等挑战。

- 零售公司意识到人工智慧在降低成本和提高业务效率方面的潜力,越来越多地将人工智慧纳入其流程中。随着人工智慧驱动的聊天机器人彻底改变互动,这种转变正在改变客户服务的面貌。在线上购物时,聊天机器人可以根据客户的偏好(例如价格分布、功能和用户评论)提案产品。透过结合建议演算法,零售商可以增加销售额,同时客户可以找到符合他们口味的产品。

- 此外,零售商正在将数位元素引入销售、支援、商品行销和财务业务,以加深与客户的关係。除了人工智慧之外,物联网、自动化、区块链和虚拟实境等技术正在以数位方式颠覆零售业格局。人工智慧驱动的零售商将利用敏锐的预测工具做出更明智的决策,而增强的视觉识别和扩增实境将重新定义网路购物,并让客户能够虚拟地体验产品。

- 全球零售业人工智慧的使用激增,科技巨头和小型企业都在加强。因此,对人工智慧工程师的需求正在迅速增加,但仍需要该领域经验丰富的专业人员。

- COVID-19 大流行加速了这些趋势,零售商正在努力应对。随着消费行为转向线上,传统零售商正在增强其技术力。疫情带来了以客户为中心的范式,采用数位转型原则的公司加强了营运并获得了显着的效益。

零售市场的人工智慧趋势

软体领域将经历显着成长

- 领先的零售公司正在采用人工智慧软体来提供个人化的购物体验。透过分析客户资料和行为,这些零售商利用人工智慧演算法来支援复杂的建议引擎。这些引擎提案根据个人偏好製化产品,从而增加销售量并提高客户参与。

- 随着全通路零售的发展,零售商正在增加对人工智慧软体的投资。该软体整合了来自多个管道的资料,以创建无缝的线上、行动和店内购物体验。人工智慧驱动的解决方案使零售商能够统一客户资料、个人化行销讯息并优化所有管道的库存管理。

- 人工智慧软体使零售商能够创建有针对性的行销宣传活动和个人化广告。透过分析大量客户资料,人工智慧演算法可以识别趋势、偏好和购买模式。这使得零售商可以客製化行销讯息和促销活动,从而提高参与度和销售量。因此,越来越多的零售商正在采用基于人工智慧的软体。

- 由于电子商务采用率增加、网路普及率和智慧型手机使用率增加等因素,亚太地区对人工智慧软体的需求正在迅速增长。根据 GSMA 的《2023 年行动经济》,到 2030 年,亚太地区的智慧型手机普及率预计将增至 94%,数位付款选项将推动这一成长。该地区的零售商正在利用人工智慧软体来改善网路购物体验。这包括提供个人化的产品建议、优化定价策略、简化订单履行流程等等。

北美占据主要市场占有率

- 由于个人化购物体验、库存管理和优化以及供应链优化等多种因素,北美零售市场对人工智慧的需求正在显着增长。

- 该地区的许多零售商正在实施基于人工智慧的解决方案来优化供应链业务和库存。人工智慧帮助零售商管理和留住客户并了解消费者的购买模式。线下和线上零售公司也正在部署人工智慧技术来吸引客户并增加周转率。

- 美国和加拿大的许多零售商也正在实施预测分析和机器学习等人工智慧技术,以帮助零售商优化其供应链。透过分析来自供应商、物流提供者等的资料,人工智慧可以识别效率低下的情况,缩短前置作业时间,并提高整个供应链的绩效。因此,零售商越来越多地采用这些技术。

- 此外,许多美国零售商正在利用人工智慧来分析客户资料和行为,以提供个人化的购物体验。人工智慧驱动的建议引擎可以根据过去的购买历史、浏览历史和人口统计资讯提案产品,从而提高客户满意度和忠诚度。

零售市场人工智慧概述

零售市场的人工智慧是碎片化的。物联网、电子商务行销和巨量资料分析的日益普及为零售市场中的人工智慧提供了利润丰厚的机会。现有竞争对手之间的竞争非常激烈。此外,SAP SE、微软公司、IBM公司、Salesforce公司和Google有限责任公司等大公司预计将进行收购并与专注于创新的新兴企业合作。

- 2024 年 3 月,IBM 宣布扩大在印度的技术专业实验室能力。 IBM 致力于协助客户充分利用人工智慧、混合云端和网路安全技术。

- 2024 年 1 月, Oracle宣布在 Oracle 云端基础架构 (OCI) 上全面推出生成式 AI 服务以及让企业更轻鬆地利用生成式 AI 最新进展的创新。 OCI 生成式 AI 服务是一项完全託管的服务,可无缝整合 Cohere 和 Meta Llama 2 大型语言模型 (LLM),以解决各种业务用例。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 零售连锁店技术的快速进步

- 零售业的新兴企业趋势

- 市场限制因素

- 缺乏文化准备的专业和内部知识

- COVID-19 对市场的影响

第六章 重大技术投入

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

第七章 市场区隔

- 按频道

- 全通路

- 实体店面

- 网路零售商

- 按成分

- 软体

- 服务(管理、专业)

- 按发展

- 云

- 本地

- 按用途

- 供应炼和物流

- 产品优化

- 店内导航

- 付款/价格分析

- 库存管理

- 客户关係管理(CRM)

- 依技术

- 机器学习

- 自然语言处理

- 聊天机器人

- 影像/视讯分析

- 群体智能

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东/非洲

第八章 竞争格局

- 公司简介

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Salesforce Inc.

- Oracle Corporation

- ViSenze Pte Ltd

- Amazon Web Services Inc.

- BloomReach Inc.

- Symphony AI

- Daisy Intelligence Corporation

- Conversica Inc.

第九章投资分析

第十章市场机会与未来趋势

The AI In Retail Market size is estimated at USD 9.85 billion in 2024, and is expected to reach USD 40.49 billion by 2029, growing at a CAGR of 32.68% during the forecast period (2024-2029).

Artificial intelligence, a collection of algorithms harnessing vast and reliable data, is increasingly adopted in retail to personalize the shopping experience. By leveraging customer preferences, retailers can offer tailored product recommendations, elevating the customer experience and driving sales.

Key Highlights

- Retail has witnessed a profound digital transformation, propelled by the integration of advanced data analytics and forecasting systems. This, bolstered by the convergence of artificial intelligence and the Internet of Things, has empowered retailers with sophisticated insights to optimize operations and identify lucrative business opportunities. Retailers are turning to AI-powered solutions to tackle challenges like evolving consumer behavior, labor constraints, supply chain disruptions, and escalating costs.

- Recognizing the potential of AI to reduce costs and enhance operational efficiency, retailers are increasingly integrating it into their processes. This shift is reshaping customer service, with AI-powered chatbots revolutionizing interactions. During online purchases, chatbots can suggest products based on customers' preferences, including price range, features, and user reviews. By incorporating recommendation algorithms, retailers can boost sales while customers find products tailored to their preferences.

- Moreover, retailers are forging deeper customer relationships, infusing digital elements into sales, support, merchandising, and finance operations. Beyond AI, technologies like IoT, automation, blockchain, and virtual reality are digitally disrupting the retail landscape. AI-equipped retailers leverage sharp forecasting tools for smarter decision-making while enhanced visual recognition and augmented reality redefine online shopping, enabling customers to experience products virtually.

- The global retail sector is witnessing a surge in AI applications, with both tech giants and SMBs ramping up their efforts. Consequently, the demand for AI engineers has soared, but more experienced professionals are still needed in this field.

- The COVID-19 pandemic has accelerated these trends, leaving retailers grappling to adapt. As consumer behavior tilts toward online, traditional retailers are grappling to bolster their technological capabilities. The pandemic has ushered in a customer-centric paradigm, and companies embracing digital transformation principles are fortifying their operations and reaping significant profits.

AI in Retail Market Trends

Software Segment to Witness Major Growth

- Leading retailers are adopting AI software to offer personalized shopping experiences. By analyzing customer data and behavior, these retailers leverage AI algorithms to power advanced recommendation engines. These engines suggest products tailored to individual preferences, driving sales and boosting customer engagement.

- As omnichannel retailing gains prominence, retailers are increasingly investing in AI software. This software helps integrate data from multiple channels, ensuring a seamless shopping experience across online, mobile, and brick-and-mortar stores. With AI-driven solutions, retailers can unify customer data, personalize marketing messages, and optimize inventory management across all channels.

- AI software equips retailers with the ability to craft targeted marketing campaigns and personalized advertisements. By analyzing vast amounts of customer data, AI algorithms identify trends, preferences, and buying patterns. This enables retailers to tailor marketing messages and promotions, resulting in higher engagement and sales. Consequently, an increasing number of retailers are embracing AI-based software.

- Asia-Pacific is witnessing a surge in demand for AI software, driven by rising e-commerce adoption and factors such as increasing internet penetration and smartphone usage. According to GSMA, Mobile Economy 2023, Asia-Pacific is expected to see its smartphone adoption rate increase to 94% by 2030, and digital payment options are fueling this growth. Retailers in the region are leveraging AI software to enhance the online shopping experience. This includes offering personalized product recommendations, optimizing pricing strategies, and streamlining order fulfillment processes.

North America to Hold Significant Market Share

- The demand for artificial intelligence (AI) in the retail sector in North America is experiencing significant growth driven by various factors such as personalized shopping experiences, inventory management and optimization, supply chain optimization, and others.

- Many retailers in this region have deployed AI-based solutions to optimize their supply chain operations and inventory. AI helps retailers manage and maintain customers and understand consumers' buying patterns. Also, AI technologies are being adopted by offline and online retail businesses to engage customers and improve sales turnover.

- Many retailers in the United States and Canada are also adopting AI technologies, such as predictive analytics and machine learning, helping retailers optimize their supply chains. AI can identify inefficiencies, reduce lead times, and improve overall supply chain performance by analyzing data from suppliers, logistics providers, and other sources. Due to this, retailers are focusing on the adoption of such technologies.

- Furthermore, many retail companies in the US leverage AI to analyze customer data and behavior to offer personalized shopping experiences. AI-powered recommendation engines may suggest products based on past purchases, browsing history, and demographic information, enhancing customer satisfaction and loyalty.

AI in Retail Industry Overview

Artificial intelligence in the retail market is fragmented. The growing adoption of IoT, e-commerce marketing, and big data analytics provides lucrative opportunities for artificial intelligence in the retail market. The competitive rivalry among existing competitors is high. Moreover, large companies such as SAP SE, Microsoft Corporation, IBM Corporation, Salesforce Inc., and Google LLC are expected to make acquisitions and collaborate with startups focused on innovation.

- In March 2024, IBM announced the expansion of its technical expert laboratory capacity in India to ensure that businesses remain strong in a highly competitive environment. It focuses on helping clients take full advantage of artificial intelligence, hybrid cloud, and cyber security technologies.

- In January 2024, Oracle announced the general availability of the Oracle Cloud Infrastructure (OCI) Generative AI service and innovations that make it easier for enterprises to take advantage of the latest advancements in generative AI. OCI Generative AI service is a fully managed service that seamlessly integrates large language models (LLMs) from Cohere and Meta Llama 2 to address various business use cases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Advances in Technology Across Retail Chain

- 5.1.2 Emerging Trend of Startups in the Retail Space

- 5.2 Market Restraints

- 5.2.1 Lack of Professionals as well as In-house Knowledge for Cultural Readiness

- 5.3 Impact of COVID-19 on the Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Channel

- 7.1.1 Omnichannel

- 7.1.2 Brick and Mortar

- 7.1.3 Pure-play Online Retailers

- 7.2 By Component

- 7.2.1 Software

- 7.2.2 Service (Managed and Professional)

- 7.3 By Deployment

- 7.3.1 Cloud

- 7.3.2 On-premise

- 7.4 By Application

- 7.4.1 Supply Chain and Logistics

- 7.4.2 Product Optimization

- 7.4.3 In-Store Navigation

- 7.4.4 Payment and Pricing Analytics

- 7.4.5 Inventory Management

- 7.4.6 Customer Relationship Management (CRM)

- 7.5 By Technology

- 7.5.1 Machine Learning

- 7.5.2 Natural Language Processing

- 7.5.3 Chatbots

- 7.5.4 Image and Video Analytics

- 7.5.5 Swarm Intelligence

- 7.6 By Geography***

- 7.6.1 North America

- 7.6.2 Europe

- 7.6.3 Asia

- 7.6.4 Australia and New Zealand

- 7.6.5 Latin America

- 7.6.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 SAP SE

- 8.1.2 IBM Corporation

- 8.1.3 Microsoft Corporation

- 8.1.4 Google LLC

- 8.1.5 Salesforce Inc.

- 8.1.6 Oracle Corporation

- 8.1.7 ViSenze Pte Ltd

- 8.1.8 Amazon Web Services Inc.

- 8.1.9 BloomReach Inc.

- 8.1.10 Symphony AI

- 8.1.11 Daisy Intelligence Corporation

- 8.1.12 Conversica Inc.