|

市场调查报告书

商品编码

1536937

乙烯醋酸乙烯酯 (EVA) -市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

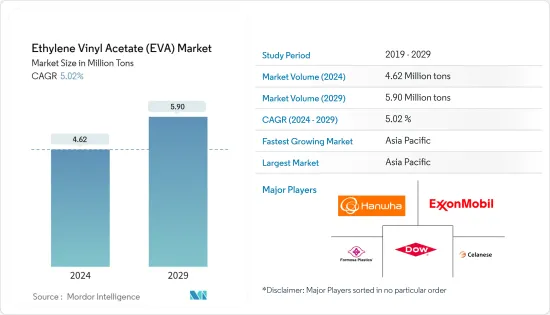

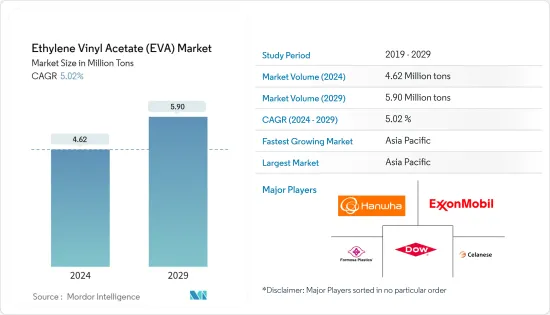

2024年乙烯醋酸乙烯酯市场规模预估为462万吨,预计2029年将达到590万吨,在预测期间(2024-2029年)复合年增长率为5.02%。

主要亮点

- COVID-19 大流行严重影响了各行业的市场成长。为遏制疫情而导致的计划暂停和放缓、运输限制、生产暂停以及劳动力短缺导致乙烯醋酸乙烯酯市场成长放缓。然而,由于薄膜、黏剂和发泡体等各种应用的消耗增加,2021年显着恢復。

- 短期内,包装产业和农业应用对乙烯醋酸乙烯酯(EVA)需求的增加预计将推动市场发展。

- 替代品威胁的日益增加预计将阻碍市场成长。

- 光伏 (PV) 太阳能电池封装需求的增加预计将为 2024 年至 2029 年市场提供成长机会。

- 亚太地区占据市场主导地位,预计 2024 年至 2029 年复合年增长率最高。这是因为该地区的经济正在成长,推动了薄膜、黏剂和发泡体的消费。

乙烯醋酸乙烯酯(EVA)市场趋势

电影领域预计将主导市场

- 乙烯醋酸乙烯酯(EVA)是一种共聚物树脂,加热、充分混合后製成EVA薄膜,然后透过平晶粒挤出。该薄膜有白色、透明和其他颜色可供选择,并提供不黏、光滑的表面光洁度。 EVA 薄膜通常夹在两片塑胶或玻璃片之间作为中间层。

- 在EVA薄膜的生产中,热塑性树脂通常与LLDPE、LDPE、其他树脂共聚,或作为多层薄膜的一部分生产。一般来说,对于共聚物和共混物来说,乙烯醋酸乙烯酯的百分比在2至25之间。

- 添加EVA可增强烯烃的密封性能和透明度,改善低温性能,降低熔点。此外,增加醋酸乙烯酯的含量会显着影响机械性能并降低对水分和气体的阻隔性,同时提高透明度。

- EVA薄膜的优点包括拉伸强度较高、隔音、透明性好、附着力好、本质防水、防紫外线等。在高温、强风、潮湿环境下也表现出优异的抵抗力和耐久性。

- 当EVA薄膜使用率较低时,用于冷冻食品包装(EVA 6%)、麵包袋(EVA 2%)、冰袋(EVA 4%)等,以提高密封性能。此外,EVA 含量高达 20% 的薄膜还可用于低熔点/全批次封装袋等应用。同样,在太阳能电池板中,高达 33% 的 EVA 薄膜被用作面板的黏合层。

- 然而,最近茂金属 PE 已在食品包装应用中用作 EVA 薄膜的替代品。使用茂金属PE可以使薄膜更薄,整体包装更薄,同时仍具有相对较好的防潮和气体阻隔性。

- EVA 仍广泛用于各种薄膜应用。通常,EVA 树脂与其他薄膜树脂结合以获得所需的性能。其他主要应用包括用于乳製品和肉类包装的密封剂、太阳能封装、电线和电缆绝缘以及提高抗衝击性的玻璃层压。

- 由于关键应用领域对 EVA 薄膜的需求不断增长,一些主要 EVA 薄膜製造商正在加大对扩产计划的投资。例如,中国最大的光电模组EVA薄膜供应商SVECK于2023年2月宣布决定投资约13.6亿元人民币(约2.03亿美元)用于扩产计划。新厂将在中国江苏省盐城市分两期建设,年产能将达4.2亿平方公尺。第一期计画于2023年第三季开始商业运营,年产能1.2亿平方公尺,共有16条生产线。

- 非食品应用、光伏封装和太阳能板对 EVA 薄膜的需求不断增加,预计将在 2024 年至 2029 年增强 EVA 薄膜市场。

亚太地区预计将主导市场

- 亚太市场是最大的乙烯醋酸乙烯酯(EVA)市场。预计从 2024 年到 2029 年,它仍将是最大的市场。这是由于中国和印度的高需求,主要是黏剂和包装产业的应用。

- 乙烯醋酸乙烯酯共聚物(EVA)常用于包装应用,是取代聚氯乙烯最常用的树脂。 EVA 共聚物不需要硬化剂或塑化剂,无味。由于其相对于传统包装塑胶的优越性,EVA在包装领域的使用量大幅增加。

- 中国包装产业预计将成长。据政府预测,该产业预计将实现近6.8%的成长率。中国政府发布的报告预计,到2025年,该产业的价值将达到2兆元(约2,900亿美元)。中国食品工业位居世界前列,其成长预计将对 EVA 市场产生影响。

- 而且,印度拥有庞大的包装产业。由于出口增加以及微波炉、零食和冷冻食品等食品行业的客製化包装,预计该国从 2024 年到 2029 年将持续成长。

- 根据印度包装工业协会(PIAI)预测,2024年至2029年印度包装产业预计将成长22%。印度包装市场预计到 2025 年复合年增长率为 26.7%,达到 2,048.1 亿美元。因此,该地区的EVA市场预计将成长。

- 由于其减震性能,EVA 也越来越多地应用于鞋类、曲棍球垫片、武术手套和其他运动器材。

- 中国鞋业有企业14400多家。中国是世界上最大的鞋类生产国。中国占鞋类出口的50%以上。 2022年,鞋子出口量将超过90亿双。

- 此外,印度贸易、工业、消费者事务、食品、公共分配和纺织品部长表示,在政府和工业界的努力下,印度有潜力成为鞋类和皮革领域的世界领导者。例如,由于与阿拉伯联合大公国签订自由贸易协定(FTA),皮革业预计将成长,2022年11月出口量将成长64%。

- 印度是世界第二大鞋类和皮革服饰生产国,拥有约 30 亿平方英尺的製革厂。此外,2021 年,该中心还为印度鞋类和皮革发展计画 (IFLDP) 拨款 170 亿印度卢比(2.058 亿美元),该计画将于 2021 年至 2026 年实施。

- 所有上述因素预计将在 2024 年至 2029 年期间提振所研究市场的需求。

乙烯醋酸乙烯酯(EVA)产业概况

全球乙烯醋酸乙烯酯市场已部分整合,主要企业占了重要的全球市场占有率。乙烯醋酸乙烯酯 (EVA) 的主要製造商包括埃克森美孚、韩华解决方案、陶氏化学、台塑和塞拉尼斯。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求增加

- 农业应用需求增加

- 抑制因素

- 替代品的威胁日益增大

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 年级

- 低密度

- 中等密度

- 高密度

- 目的

- 电影

- 黏剂

- 发泡体

- 太阳能电池封装

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers

- Braskem

- Celanese Corporation

- China Petrochemical Corporation

- Clariant

- Dow

- Exxonmobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- HD Hyundai

- Innospec

- Jiangsu Sailboat Petrochemical Co. Ltd

- Levima Advanced Materials Corporation

- Lotte Chemical Corporation

- LG Chem

- Lyondellbasell Industries Holdings BV

- Repsol

- Saudi Arabian Oil Co.(Arlanxeo)

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical Co. Ltd

第七章 市场机会及未来趋势

- 对太阳能电池封装的需求不断增加

简介目录

Product Code: 64084

The Ethylene Vinyl Acetate Market size is estimated at 4.62 Million tons in 2024, and is expected to reach 5.90 Million tons by 2029, growing at a CAGR of 5.02% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic severely impacted market growth in various sectors. Stoppage or slowdown of projects, movement restrictions, production halts, and labor shortages to contain the pandemic have led to a decline in the ethylene vinyl acetate market growth. However, it recovered significantly in 2021, owing to rising consumption from various applications, including films, adhesives, and foams.

- In the short term, the increasing demand for ethylene-vinyl acetate (EVA) from the packaging industry and agricultural applications is expected to drive the market.

- The increasing threat of substitutes is expected to hinder the market's growth.

- The increasing demand for photovoltaic (PV) solar cell encapsulants is expected to offer growth opportunities for the market between 2024 and 2029.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR from 2024 to 2029, as the economies in the region are growing, driving the consumption of films, adhesives, and foams.

Ethylene Vinyl Acetate (EVA) Market Trends

The Films Segment is Expected to Dominate the Market

- Ethylene vinyl acetate (EVA) is a copolymer resin that, when heated and mixed thoroughly before being extruded through a flat die, forms EVA films. These films are available in white, clear, and other colors, providing a non-sticky and smooth surface finish. EVA films are generally sandwiched between two plastic or glass sheet pieces as an interlayer.

- During the manufacturing of EVA films, the thermoplastic resin is typically copolymerized with LLDPE, LDPE, or other resins, or it is manufactured as a part of a multi-layer film. Generally, the percentage of ethylene vinyl acetate ranges between 2 and 25 in the case of copolymers and blends.

- Adding EVA helps to enhance the sealability and clarity of olefins, improve the low-temperature performance, and reduce the melting point. Further, a higher percentage of vinyl acetate content can significantly impact the mechanical properties and lower the barrier to moisture and gas while improving the clarity.

- Some of the advantages of EVA films are relatively higher tensile strength, sound barrier properties, excellent transparency, superior adhesion, waterproofing in nature, and UV protection. It also exhibits good resistance and durability at high temperatures, strong winds, and humid environments.

- In lower percentages, EVA films have been used for frozen food packaging (at 6% EVA), bread bags (at 2% EVA), and ice bags (at 4% EVA), as they help provide enhanced sealability for such applications. Further, in higher percentages, with up to 20% EVA, these films are used in applications involving low melt/total batch inclusion bags. Similarly, in solar panels, films with up to 33% EVA are used as a bonding layer for these panels.

- However, recently, food packaging applications have seen increased consumption of metallocene PE as an alternative to EVA films, as it offers superior down-gauging properties and faster hot tack. The use of mPE allows for thinner films and overall packaging while providing a relatively better barrier to moisture and gases.

- EVA is still extensively used across several film applications. Usually, EVA resin is combined with other film resins to obtain the desired properties. Some of the other key applications include using EVA films as sealants in dairy and meat packaging applications, photovoltaic encapsulation, wire and cable insulation, and glass lamination to help improve its impact resistance.

- Some of the key manufacturers of EVA films have been increasingly investing in production expansion projects, given the growing demand for EVA films in critical applications. For instance, in February 2023, SVECK, one of the largest suppliers of EVA films for PV modules in China, announced its decision to invest around CNY 1.36 billion (~USD 203 million) into its production expansion project. The new factory will be built in two phases, in Yancheng, China's Jiangsu, at a planned annual capacity of 420 million sq. m. The first phase is expected to begin commercial operations by Q3 2023, with an annual capacity of 120 million sq. m spread across 16 production lines.

- The increasing demand for EVA films in non-food applications, photovoltaic encapsulations, and solar panels is anticipated to strengthen the EVA films market between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific market is the largest ethylene vinyl acetate (EVA) market. It is also expected to remain the largest market between 2024 and 2029, owing to the major demand from China and India, mainly for the adhesive and packaging industry applications.

- Ethylene vinyl acetate copolymers (EVA) are commonly used in packaging applications, replacing polyvinyl chloride as the most used resin. EVA copolymers require no curing or plasticizer and have no odor. The use of EVA in the packaging sector is increasing significantly, owing to its advantages over the conventional packaging plastics used.

- The Chinese packaging industry is expected to grow. As projected by the government, the industry is expected to achieve a growth rate of nearly 6.8%. The report published by the Chinese government foresees the industry achieving a valuation of CNY 2 trillion (approximately USD 290 billion) by 2025. The growing Chinese food industry, which ranks among the largest globally, is expected to affect the EVA market.

- Moreover, India has a huge packaging industry. The country is expected to witness consistent growth between 2024 and 2029, owing to the rise of customized packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow by 22% between 2024 and 2029. The Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% till 2025. Therefore, the EVA market is expected to grow in the region.

- EVA is also increasingly used in footwear, hockey pads, martial arts gloves, and other sports goods due to its shock absorber properties.

- The Chinese footwear industry consists of over 14,400 businesses. China is the largest footwear producer in the world. China accounts for over 50% of footwear exports. The country exported more than 9,000 million pairs of shoes in 2022.

- Furthermore, according to the Union Minister for Trade Industries, Consumer Affairs, Food, and Public Distribution and Textiles, India has the potential to become a world leader in the footwear and leather sector due to government and industry efforts. For instance, the leather industry is expected to grow, owing to a free trade agreement (FTA) with the United Arab Emirates, which saw exports increase by 64% in November 2022.

- India is the second largest producer of footwear and leather garments, boasting nearly 3 billion sq. ft of tanneries worldwide. In addition, in 2021, the Center passed an expenditure of INR 1,700 crore (USD 205.8 million) to the Indian Footwear and Leather Development Program (IFLDP) for implementation from 2021 to 2026.

- All the aforementioned factors are expected to boost the demand for the market studied between 2024 and 2029.

Ethylene Vinyl Acetate (EVA) Industry Overview

The global ethylene vinyl acetate market is partially consolidated, with top-level players accounting for a sizeable global market share. The major manufacturers of ethylene vinyl acetate (EVA) are Exxon Mobil Corporation, Hanwha Solutions, Dow, Formosa Plastics Corporation, and Celanese Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Increasing Demand from Agricultural Applications

- 4.2 Restraints

- 4.2.1 Increasing Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of the Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asia Polymer Corporation

- 6.4.2 BASF-YPC Company Limited

- 6.4.3 Benson Polymers

- 6.4.4 Braskem

- 6.4.5 Celanese Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 Clariant

- 6.4.8 Dow

- 6.4.9 Exxonmobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Hanwha Solutions

- 6.4.12 HD Hyundai

- 6.4.13 Innospec

- 6.4.14 Jiangsu Sailboat Petrochemical Co. Ltd

- 6.4.15 Levima Advanced Materials Corporation

- 6.4.16 Lotte Chemical Corporation

- 6.4.17 LG Chem

- 6.4.18 Lyondellbasell Industries Holdings BV

- 6.4.19 Repsol

- 6.4.20 Saudi Arabian Oil Co. (Arlanxeo)

- 6.4.21 Sinochem Holdings Corporation Ltd

- 6.4.22 Sipchem Company

- 6.4.23 Sumitomo Chemical Co. Ltd

- 6.4.24 Zhejiang Petroleum & Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants

02-2729-4219

+886-2-2729-4219