|

市场调查报告书

商品编码

1536943

地工织物:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Geotextile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

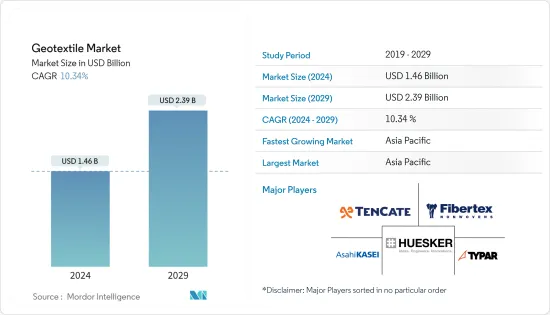

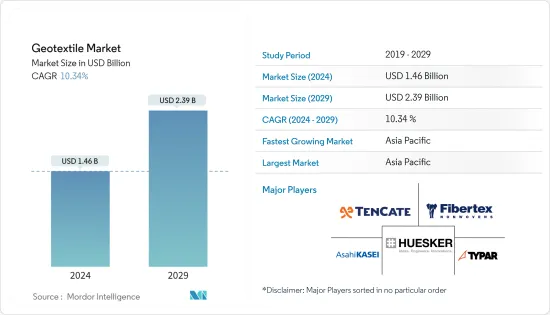

地工织物市场规模预计到 2024 年为 14.6 亿美元,预计到 2029 年将达到 23.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 10.34%。

由于封锁、社交距离和贸易制裁对全球供应链网路造成重大干扰,COVID-19 大流行阻碍了市场。由于活动停止,道路建设产业出现下滑。然而,这种情况预计将在 2021 年恢復,并在预测期内使市场受益。

主要亮点

- 推动市场的主要因素是地工织物在建设产业和采矿活动中的使用不断增加,以及严格的环境保护法规结构。

- 原物料价格的波动预计将阻碍市场成长。

- 製造业节水意识的增强预计将成为未来市场的机会。

- 预计亚太地区将主导全球市场,政府投资建设公路和铁路计划将导致中国、日本和印度等国家对地工织物的巨大需求。

地工织物市场趋势

道路建设需求增加

- 地工织物主要由聚丙烯、聚酯和聚乙烯等合成聚合物製成,具有极强的抗生物和化学过程腐烂能力。

- 这项特性使得地工织物适用于道路建设和维护。在过去的十年中,地工织物在全球建设产业的使用大幅增长。

- 根据欧洲一次性不织布协会(EDANA)的资料,每年生产和销售的地工织物不织布约750公里,其中60%用于道路建设。

- 这些材料具有透水性编织结构,主要用于建筑应用。地工织物在建筑领域的可能应用已成功开发。地工织物在经济性、性能和耐用性方面具有显着的优势。

- 此外,全球建筑支出和建筑活动的增加可能会导致对地工织物的需求增加。例如,在 2024 财年,联邦公路管理局将向 12 个官方项目投资 610 亿美元,以支持道路、桥樑、隧道、碳排放和安全改进等关键基础设施的投资。基础设施投资和就业法案 (IIJA) 资金分配给所有 50 个美国、哥伦比亚特区和波多黎各。

- 此外,预计2024年美国公路桥樑建设额将与前一年同期比较增23%,达1,471亿美元。此外,到2024年,该国交通建设工程总价值可能达到2,140亿美元,成长14%。

- 大多数可用的地工织物由聚丙烯或聚酯製成。聚丙烯材料坚固、耐用且比水轻。据全球领先材料製造商之一的HUBS称,聚丙烯占全球产量的35-40%,其次是聚乙烯(15%)、ABS(25%)和聚苯乙烯(10%)等其他材料。

- 多家公司正在投资建造聚丙烯 (PP) 製造厂,以增加 PP 材料的产量,这些材料越来越多地用于建设活动。例如,2022年7月,加拿大Heartland Polymers公司位于加拿大亚伯达Heartland石化联合体的聚丙烯(PP)装置运作全面运营,规划年产聚丙烯产能52.5万吨。

- 这些材料用于道路、高速公路、土坝、铁路、土壤稳定、排水控制、隧道施工等建设。

- 因此,预计上述因素将在预测期内推动地工织物市场的发展。

亚太地区主导市场

- 在全球地工织物整体市场中,亚太地区占据最大的市场占有率。建设产业的持续市场开拓是该地区地工织物市场的主要驱动因素。

- 由于中国全年承接大型基础设施计划,预计中国将成为该地区地工织物的主要市场。例如,中国政府的目标是到2025年将高铁网路扩展至5万公里。

- 中国国家统计局数据显示,2023年全国基础建设投资较2022年成长5.9%。

- 据印度品牌股权基金会称,由于政府不断倡议改善该国的交通基础设施,印度公路和高速公路市场预计到 2025 年复合年增长率将达到 36.16%。

- 根据印度国家投资促进和便利化局统计,公路网总长度为637万公里,包括所有类别的公路(国道、邦道、城市和乡村公路),是世界第二大公路网。此外,该国于2020年推出了国家基础设施管道(NIP),预计2020年至2025年将投资13,380亿美元。

- 其他亚太国家的建筑业也与前一年同期比较成长。例如,根据韩国央行的数据,2023年韩国建筑业将累计约671亿美元,较2022年成长4%。

- 因此,上述因素可能会在预测期内推动亚太地区对地工织物的需求。

地工织物行业概况

地工织物市场部分分散。主要企业(排名不分先后)包括 Fibertex Non-fabric AS (Schouw &Co.)、HUESKER、TYPAR Geosynthetics、Tencate Geosynthetics 和 Asahi Kasei Advance。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大地工织物在建筑业的使用

- 采矿业中地工织物的使用增加

- 严格的环境保护法规结构

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 按材质

- 聚丙烯

- 聚酯纤维

- 聚乙烯

- 其他材料

- 按类型

- 织物

- 不织布

- 针织

- 其他类型

- 按用途

- 道路建设与路面修復

- 侵蚀

- 引流

- 铁路建设

- 农业

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 北欧的

- 西班牙

- 土耳其

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 埃及

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AFITEXINOV

- AGRU AMERICA INC.

- Asahi Kasei Advance Corporation.

- Carthage Mills Inc.

- Fibertex Nonwovens AS(Schouw & Co.)

- GSE Environmental

- HUESKER

- Kaytech

- Low & Bonar

- Mattex Geosynthetics

- Naue GmbH & Co. KG

- Officine Maccaferri SpA

- Owens Corning

- Swicofil AG

- Tencate Geosynthetics

- Thrace Group

- TYPAR Geosynthetics

第七章 市场机会及未来趋势

- 製造业节水意识增强

- 其他机会

The Geotextile Market size is estimated at USD 1.46 billion in 2024, and is expected to reach USD 2.39 billion by 2029, growing at a CAGR of 10.34% during the forecast period (2024-2029).

The COVID-19 pandemic hindered the market because lockdowns, social distancing, and trade sanctions caused significant disruptions to global supply chain networks. The road construction industry witnessed a decline due to the halt in activities. However, the condition recovered in 2021, which is expected to benefit the market during the forecast period.

Key Highlights

- Major factors driving the market are the increasing use of geotextiles in the construction industry and mining activities and the stringent regulatory framework for environmental protection.

- The fluctuating prices of raw materials are expected to hinder the market's growth.

- Rising awareness about water conservation in the manufacturing sector is expected to act as an opportunity for the market in the future.

- Asia-Pacific is expected to dominate the global market due to government investments in the construction of roads and rail projects, leading to a huge demand for geotextiles from countries such as China, Japan, and India.

Geotextile Market Trends

Increasing Demand in Road Construction

- Geotextiles are made from synthetic polymers, mainly polypropylene, polyester, polyethylene, and others, that are very unlikely to decay under biological and chemical processes.

- This feature makes geotextiles suitable for the construction and maintenance of roads. In the past decade, there has been considerable growth in the usage of geotextiles in the construction industry worldwide.

- According to data from the European Disposables and Non-wovens Association (EDANA), around 750 km of geotextile non-wovens are manufactured and sold every year, of which 60% is used for the construction of roads.

- These materials have permeable textile structures and are used primarily in construction applications. The possible applications of geotextiles in the construction sector have been successfully developed. They offer significant benefits in terms of financial feasibility, performance, and durability.

- Moreover, the increase in construction spending and work worldwide may lead to increased demand for geotextiles. For instance, the Federal Highway Administration for the fiscal year 2024 allocated USD 61 billion for 12 formula programs to aid investment in critical infrastructure, including roads, bridges, tunnels, carbon-emission reduction, and safety improvements. This funding from the IIJA (Infrastructure Investment and Jobs Act) was allocated for all 50 US states, the District of Columbia, and Puerto Rico.

- Furthermore, highway and bridge construction in the United States is expected to increase by 23% to USD 147.1 billion in 2024 over the previous year. Additionally, the country's total value of transportation construction work may grow by 14% to USD 214 billion in 2024.

- Most of the available geotextiles are made of polypropylene or polyester. Polypropylene material is strong and durable and is lighter than water. According to a globally leading material manufacturing company, HUBS polypropylene accounts for 35% to 40% of worldwide output, followed by other materials like polyethylene (15%), ABS (25%), and polystyrene (10%).

- Various companies are investing in their polypropylene (PP) manufacturing plants to increase the output of PP material that will be used more in construction activities. For instance, in July 2022, the Canadian company Heartland Polymers fully commissioned its polypropylene (PP) plant with a planned production capacity of 525,000 tons of polypropylene per year at the Heartland Petrochemical Complex in Alberta, Canada.

- These materials are used in the construction of roads, highways, earth dams, and railroads, in the stabilization of soil, control of drainage, tunnel construction, etc.

- Thus, the above-mentioned factors are expected to drive the geotextile market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific held the largest market share in the overall geotextile market worldwide. The ongoing developments in the construction industry are the main drivers of the geotextile market in the area.

- China is expected to be the major market for geotextiles in the region as the country has mega-scale infrastructure projects year-round. For instance, the Chinese government is working to expand its high-speed railway network to 50,000 km by 2025.

- According to the National Bureau of Statistics of China, the country's infrastructure investment in 2023 increased 5.9% in value compared to 2022.

- According to the India Brand Equity Foundation, the Indian roads and highways market is projected to register a CAGR of 36.16% in 2025 on account of growing government initiatives to improve transportation infrastructure in the country.

- According to the National Investment Promotion and Facilitation Agency, India, the total road network is 6.37 million km, comprising all categories of roads (national and state highways, urban and rural roads), which is the second largest in the world. Furthermore, the country launched the National Infrastructure Pipeline (NIP) in 2020, which envisages an investment of USD 1,338 billion between 2020 and 2025.

- The construction sector of other Asia-Pacific countries is also growing Y-o-Y. For instance, according to the Bank of Korea, South Korea's construction sector accounted for approximately USD 67.1 billion in 2023, representing a 4% growth rate over 2022.

- Therefore, the aforementioned factors may fuel the demand for geotextiles in Asia-Pacific during the forecast period.

Geotextile Industry Overview

The geotextile market is partially fragmented in nature. The major companies (not in any particular order) include Fibertex Non-woven AS (Schouw & Co.), HUESKER, TYPAR Geosynthetics, Tencate Geosynthetics, and Asahi Kasei Advance Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Geotextiles in Construction Industry

- 4.1.2 Increase Usage of Geotextiles in Mining Activities

- 4.1.3 Stringent Regulatory Framework for Environmental Protection

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Material

- 5.1.1 Polypropylene

- 5.1.2 Polyester

- 5.1.3 Polyethylene

- 5.1.4 Other Materials

- 5.2 By Type

- 5.2.1 Woven

- 5.2.2 Non-woven

- 5.2.3 Knitted

- 5.2.4 Other Types

- 5.3 By Application

- 5.3.1 Road Construction and Pavement Repair

- 5.3.2 Erosion

- 5.3.3 Drainage

- 5.3.4 Railworks

- 5.3.5 Agriculture

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC

- 5.4.3.7 Spain

- 5.4.3.8 Turkey

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Qatar

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AFITEXINOV

- 6.4.2 AGRU AMERICA INC.

- 6.4.3 Asahi Kasei Advance Corporation.

- 6.4.4 Carthage Mills Inc.

- 6.4.5 Fibertex Nonwovens AS (Schouw & Co.)

- 6.4.6 GSE Environmental

- 6.4.7 HUESKER

- 6.4.8 Kaytech

- 6.4.9 Low & Bonar

- 6.4.10 Mattex Geosynthetics

- 6.4.11 Naue GmbH & Co. KG

- 6.4.12 Officine Maccaferri SpA

- 6.4.13 Owens Corning

- 6.4.14 Swicofil AG

- 6.4.15 Tencate Geosynthetics

- 6.4.16 Thrace Group

- 6.4.17 TYPAR Geosynthetics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness about Water Conservation in the Manufacturing Sector

- 7.2 Other Opportunities