|

市场调查报告书

商品编码

1536944

夫喃甲醇:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Furfural - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

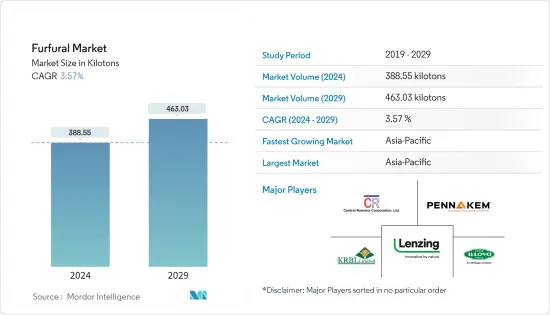

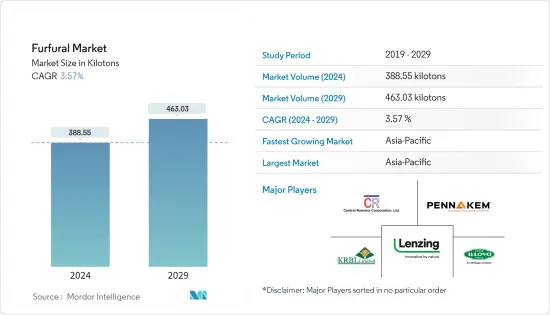

夫喃甲醇市场规模预计到2024年为388.55千吨,预计到2029年将达到463.03千吨,在预测期内(2024-2029年)复合年增长率为3.57%。

由于供应链中断和工业活动减少,COVID-19 大流行最初扰乱了夫喃甲醇市场。然而,随着全球经济逐渐復苏,对夫喃甲醇的需求增加,特别是在医药、农业化、生质燃料等领域。对永续生物基化学品的兴趣日益浓厚,推动了成长,夫喃甲醇源自于农业残留物。

主要亮点

- 从中期来看,糠醇需求的增加和工业化学品製造中夫喃甲醇用量的增加是推动市场成长的关键因素。

- 然而,原物料价格的波动预计将阻碍市场成长。

- 也就是说,越来越多地采用生物基化学品是夫喃甲醇市场的主要动力,因为来自生物质来源的夫喃甲醇正面临着各行业对永续替代品不断增长的需求,这是一个机会。

- 在预测期内,亚太地区预计将占据最大的市场占有率,复合年增长率也最高。

夫喃甲醇市场趋势

糠醇需求增加

- 夫喃甲醇的主要用途是生产糠醇,这是在工业环境中透过夫喃甲醇在高压下催化加氢完成的过程。

- 糠醇是研究最深入的由夫喃甲醇製成的医药产品之一。糠醇是在 CuCr 催化剂存在下大规模生产的,但该过程对环境有负面影响。

- 糠醇在黑色金属铸造厂,特别是砂芯和模具的生产中发挥重要作用。它广泛应用于铸铁厂作为树脂结合剂砂型铸造过程中的黏合剂。糠醇与其他材料结合使用,有助于製造耐用且耐热的模具,有助于提高黑色金属零件生产中铸件的精度和品质。

- 根据美国人口普查局的预测,到 2024 年,美国代工收益预计将达到约 288 亿美元,从而增强夫喃甲醇市场。

- 根据德国联邦统计局(Statistisches Bundesamt)统计,2022年德国药品产值达374亿欧元(405.8亿美元),较上年资料录得成长。

- 此外,从农业废弃物中提取的夫喃甲醇醇因其甜美的花香而被用于香料工业。其多才多艺的香气使其成为香水中的宝贵成分,为香水成分增添深度和温暖。

- 根据化妆品、洗护用品和香料协会的数据,2022 年 12 月英国香水市场价值将达到 18.387 亿英镑(23.311 亿美元),创下历史资料最高值。

- 糠醇广泛用于塑胶和树脂。根据中国国家统计局统计,2023年中国塑胶製品产量达7,489万吨。

- 亚太地区在糠醇消费和生产方面均占市场的很大一部分,这是由于前面概述的因素造成的。因此,全球夫喃甲醇市场预计在预测期内将成长。

亚太地区主导市场

- 预计在预测期内,亚太地区将占据全球夫喃甲醇市场的最大份额。这是因为中国、印度和日本都在经历经济成长。

- 中国是化学品製造中心,世界上生产的化学品大部分都是在中国製造的。它占全球化学品销售额的35%以上。许多市场领先公司在中国设有化工厂。随着全球对各种生物基化学品的需求不断增长,该行业对夫喃甲醇的需求预计在预测期内将增长。

- 糠醇由于其作为溶剂的有效性以及增强某些农药製剂的能力而常用于农药生产。其化学特性使其适合用于农药製剂,以提高稳定性和功效。

- 根据中国国家统计局统计,2022年中国化学农药产量达249.71万吨,与去年资料基本持平。

- 由于对化学品和农药的需求不断增加,印度的化学工业预计将成长。政府预测到 2025 年化学工业将达到 3,040 亿美元,未来五年需求预计将以每年 9% 左右的速度成长,从而提供了这个机会。化工产业投资机会约7.0197亿美元,其中投资前景约168个,计划中约29个。

- 化学工业在夫喃甲醇市场的成长中发挥重要作用。印度是全球第六大化学品生产国、亚洲第三大化学品生产国,占印度GDP的7%,预计2025年将成长至3,040亿美元,到2040年将成长至1兆美元。

- 同样,根据经济产业省的数据,2022年日本香水和古龙水的库存将达到103.8公斤,与前一年的资料相比大幅增加。

- 由于这些因素,预计该地区的夫喃甲醇市场在未来几年将稳定成长。

夫喃甲醇行业概况

夫喃甲醇市场已部分整合。市场主要参与者包括(排名不分先后)Central Romana Corporation、Illovo Sugar Africa (Pty) Ltd、KRBL、LENZING AG 和 Pennakem LLC。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 糠醇需求增加

- 工业化学品製造需求增加

- 其他的

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 原料

- 玉米

- 稻壳

- 棉壳

- 甘蔗渣

- 其他原料

- 目的

- 糠醇

- 溶剂

- 中间的

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Central Romana Corporation

- Hongye Holding Group Corporation Limited

- Illovo Sugar Africa(Pty)Ltd

- KRBL Limited

- LENZING AG

- Pennakem LLC

- Silvateam SpA

- Tanin dd

- TransFurans Chemicals bvba

- Xingtai Chunlei Furfuryl Alcohol Co. Ltd(hebeichem)

- Zibo Xinye Chemical Co. Ltd

第七章 市场机会及未来趋势

- 增加生物基化学品的采用

The Furfural Market size is estimated at 388.55 kilotons in 2024, and is expected to reach 463.03 kilotons by 2029, growing at a CAGR of 3.57% during the forecast period (2024-2029).

The COVID-19 pandemic initially disrupted the furfural market due to supply chain interruptions and reduced industrial activities. However, as global economies gradually recovered, there was an increased demand for furfural, particularly in sectors like pharmaceuticals, agricultural chemicals, and biofuels. The growth was driven by the rising interest in sustainable and bio-based chemicals, with furfural being derived from agricultural residues.

Key Highlights

- Over the mid-term, the significant factors driving the growth of the market studied are the increasing demand for furfuryl alcohol and the rising usage of furfural for industrial chemical manufacturing.

- However, fluctuations in raw material prices are expected to hinder market growth.

- Nevertheless, the increasing adoption of bio-based chemicals represents a significant opportunity for the furfural market, given that their derivation from biomass sources aligns with the growing demand for sustainable alternatives in various industries.

- During the forecast period, Asia-Pacific is expected to capture the largest market share and the highest CAGR.

Furfural Market Trends

Increasing Demand for Furfuryl Alcohol

- Furfural finds its main application in the production of furfuryl alcohol, a process achieved through the catalytic hydrogenation of furfural under elevated pressures in industrial settings.

- Furfuryl alcohol is one of the most well-studied drugs that can be made from furfural. It is manufactured on a large scale in the presence of a CuCr catalyst, but the process has a negative environmental effect.

- Furfuryl alcohol plays a significant role in ferrous metal foundries, particularly in the production of sand cores and molds. It is widely used as a binder for resin-bonded sand-casting processes in ferrous foundries. Furfuryl alcohol, when combined with other materials, helps create durable and heat-resistant molds, contributing to the precision and quality of castings in the production of ferrous metal components.

- As per the projections from the US Census Bureau, it is anticipated that the revenue of foundries in the United States will reach around USD 28.8 billion by 2024, thereby bolstering the furfural market.

- According to the Statistisches Bundesamt, the value of pharmaceutical production in Germany reached EUR 37.4 billion (USD 40.58 billion) in 2022 and registered growth compared to the previous year's data.

- Furthermore, furfural alcohol, derived from agricultural waste, is used in the fragrance industry for its sweet and floral notes. Its versatile aroma makes it a valuable component in perfumes, adding depth and warmth to fragrance compositions.

- As per the Cosmetic, Toiletry, and Perfumery Association, the market value of fragrances in the United Kingdom reached GBP 1,838.7 million (USD 2331.10 million ) in December 2022, registering the highest value compared to previous data.

- Furfuryl alcohol is widely used in plastics and resins. According to the National Bureau of Statistics of China, the production volume of plastic products in China amounted to 74.89 million metric tons in 2023.

- Asia-Pacific commands a substantial portion of the market in both the consumption and production of furfuryl alcohol, attributed to the factors outlined earlier. Consequently, the global furfural market is anticipated to witness growth during the forecast period.

Asia-Pacific to Dominate the Market

- During the forecast period, Asia-Pacific is expected to have the largest share of the global furfural market. This is because China, India, and Japan are all growing economies.

- China is a center for making chemicals, and most of the chemicals made in the world are made there. The country contributes more than 35% to global chemical sales. Many major companies in the market have their chemical plants in China. With the growing demand for various bio-based chemicals globally, the demand for furfural from this sector is projected to grow during the forecast period.

- Furfuryl alcohol is often utilized in the production of pesticides due to its effectiveness as a solvent and its ability to enhance the formulation of certain agrochemicals. Its chemical properties make it suitable for use in pesticide formulations to improve stability and efficacy.

- According to the National Bureau of Statistics of China, the production of chemical pesticides in China reached 2497.1 thousand metric tons in 2022, registering almost similar value when compared to previous years' data.

- India's chemical industry is expected to increase because there is a growing need for chemicals and agrochemicals. The government predicts the chemical industry will reach USD 304 billion by 2025, with opportunities offered by the anticipated increase in demand of about 9% per annum over the next five years. The chemical industry holds an investment opportunity worth about USD 701.97 million, with about 168 investment prospects and 29 projects under development.

- The chemical industry plays a vital role in the growth of the furfural market. India is the 6th largest producer of chemicals in the world and 3rd in Asia, contributing 7% to India's GDP, and it is anticipated to grow to USD 304 billion by 2025 and USD 1 trillion by 2040.

- Similarly, according to the Ministry of Economy, Trade and Industry (METI), the inventory volume of perfume and eau de cologne in Japan reached 103.8 kg in 2022, registering considerable growth compared to the previous year's data.

- Because of all of these factors, the furfural market in the region is expected to grow steadily over the next few years.

Furfural Industry Overview

The furfural market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Central Romana Corporation, Illovo Sugar Africa (Pty) Ltd, KRBL, LENZING AG, and Pennakem LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Furfuryl Alcohol

- 4.1.2 Increasing Demand from Industrial Chemicals Manufacturing

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Corncobs

- 5.1.2 Rice Hulls

- 5.1.3 Cotton Hulls

- 5.1.4 Sugarcane Bagasse

- 5.1.5 Other Raw Materials

- 5.2 Application

- 5.2.1 Furfuryl Alcohol

- 5.2.2 Solvent

- 5.2.3 Intermediate

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Central Romana Corporation

- 6.4.2 Hongye Holding Group Corporation Limited

- 6.4.3 Illovo Sugar Africa (Pty) Ltd

- 6.4.4 KRBL Limited

- 6.4.5 LENZING AG

- 6.4.6 Pennakem LLC

- 6.4.7 Silvateam SpA

- 6.4.8 Tanin d.d.

- 6.4.9 TransFurans Chemicals bvba

- 6.4.10 Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem)

- 6.4.11 Zibo Xinye Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Bio-based Chemicals