|

市场调查报告书

商品编码

1536972

工业控制系统 (ICS) 安全 -市场占有率分析、行业趋势和统计、成长预测 (2024-2029)Industrial Control Systems (ICS) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

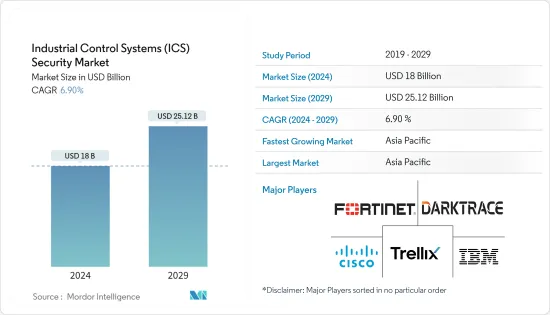

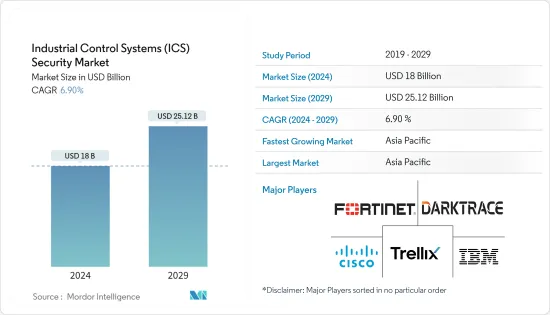

预计2024年工业控制系统安全市场规模将达180亿美元,预计2029年将达251.2亿美元,预测期内(2024-2029年)复合年增长率为6.90%。

主要亮点

- 由于工业公司越来越多地采用工业物联网、自动化和机器人技术等先进工业技术,工业控制系统 (ICS) 市场预计将在各个最终用户行业中成长。此外,供应商为开发创新解决方案和增强 ICS 安全解决方案功能所做的努力预计将在预测期内推动市场成长。

- 大规模、连续且高度参数化的工业设备不断增加对工业自动化系统的需求,导致对先进工业自动化和机器人解决方案的大量投资。例如,根据国际机器人联合会(IFR)的数据,全球整体每年引进的工业机器人数量预计将从2017年的40万台增加到2026年的71.8万台。

- 当今的工业控制系统已经从现有的物理系统发展到增加了IT功能,通常取代或补充物理控制机制。因此,需要各种工业产品和生产系统的无缝自动化,以满足工业生产系统安全启动、稳定运作和最佳化运作的要求。

- 然而,实施ICS安全系统的复杂性和高昂的初始成本对该市场的成长构成了重大挑战。例如,实施ICS安全系统需要高速连接、资讯和通讯网路等支援基础设施以及熟练的劳动力,这需要大量投资。这导致 ICT 安全解决方案的采用缓慢,尤其是在中小企业领域。

- 这次疫情对大众对自动化、机器人、人工智慧和工业物联网等先进工业技术的认识产生了重大的正面影响。随着公司寻求在保持生产力的同时最大限度地减少体力劳动的选择,对这些技术的接触显着增加。

- 由于这些趋势,工业控制的采用也有所增加。儘管大流行时期已经过去,但该行业对先进工业技术的态度仍然积极,预计将导致其采用持续成长,进而推动预测期内的市场成长。

工控系统安全市场趋势

汽车工业实现显着成长

- 汽车工业是全球拥有大量自动化製造设施的重要产业之一。在汽车产业,各汽车製造商正在对其生产设备进行自动化以保持效率。 ICS 使汽车产业能够快速回应市场需求、提高供应链效率、减少製造停机时间并扩大生产力。

- 在汽车产业,包括物联网(IoT)、云端处理和行动运算的运算和网路技术越来越多地与ICS系统并行部署,而ICS解决方案是这些先进解决方案的关键。儘管工业生产能力不断提高,但连网型技术往往会增加安全风险。

- 电气化是汽车产业的另一个主要趋势,推动了对新车的需求和对新生产工厂的投资。汽车产业的电气化趋势受到多种因素的支持,包括日益增长的环境问题以及政府对低排放气体的支持前景。

- 近年来,世界各国纷纷制定脱碳目标,而汽车电动化是汽车和交通领域的重要组成部分,也是环境排放的主要原因之一。例如,欧盟 (EU) 的目标是大幅加速零排放汽车的采用。最新的欧盟法规旨在确保到 2035 年在欧盟註册的新车和货车实现零排放。

- 由于这些倡议,全球对电动车的需求不断增加。根据国际能源总署(IEA)的数据,中国、欧洲和美国是电动车的主要市场。预计 2024 年中国电动车销量将达到 1,010 万辆,而 2022 年将达到 600 万辆。

亚太地区实现显着成长

- 随着企业对工控系统IT安全的认知逐步提高,并持续增加在该领域的技术投入,中国市场未来几年的成长速度将会更快。

- 在中国,数位化和工业4.0措施对所有产业的自动化扩展产生了重大影响,需要机器人和控制系统等自动化解决方案的创新和自动化来增强生产流程。由于其製造能力以及中国政府对工厂、基础设施和机械的投资,中国经济正在经历令人印象深刻的成长。

- 印度各行业的工业自动化正在经历显着成长,包括製造业、能源、石油和天然气以及公共产业。随着业界采用先进技术和互连繫统来提高效率和生产力,需要强有力的安全措施来保护关键基础设施和控制系统。因此,对ICS安全解决方案和服务的需求不断增加。

- 随着工业系统数位化和互联程度的不断提高,威胁产业格局不断扩大,工业控制系统成为网路攻击的潜在目标。针对关键基础设施的网路安全事件可能会造成严重后果,包括营运中断、财务损失和潜在的安全风险。组织投资 ICS 安全解决方案来减轻这些风险并保护其工业流程和资产。

工控系统安防产业概况

工业控制系统安全市场分散、市场占有率激烈,由几家大公司组成:Darktrace Holdings Limited、Trellix、IBM Corporation 和Cisco Systems Inc.。

- 2024 年 5 月 - Trellix 推出 Trellix Wise,这是一套强大的传统和产生人工智慧工具,可大幅降低网路风险。为了更有效地识别和消除威胁,同时降低保全行动成本,Trellix Wise 已在 Trellix XDR 平台上进行了扩展。这个由人工智慧主导的平台可实现工作流程自动化,提高分析人员的工作效率,并改善威胁预防、侦测、调查和解决。

- 2024 年 4 月 - Darktrace 宣布推出 ActiveAI 安全平台。该平台包括 Darktrace 一流的安全产品,并辅以电子邮件和操作技术等领先业界的创新和功能。该平台基于人工智慧,将保全行动从被动转变为有效,并提高网路稳健性。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 网路攻击增加

- IT 与 OT 网路融合

- 市场挑战

- 安全系统实施的复杂性

- ICS安全产业多元经营模式的出现

第六章 市场细分

- 按最终用户产业

- 车

- 化学/石化

- 电力/公共产业

- 药品

- 饮食

- 石油和天然气

- 其他最终用户产业

- 按地区*

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Darktrace Holdings Limited

- Trellix

- IBM Corporation

- Cisco Systems Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd

- Honeywell International Inc.

- Broadcom Inc.(Symantec Corporation)

- AhnLab Inc.

- ABB Ltd

- Rockwell Automation

- Dragos Inc.

第八章投资分析

第9章 市场的未来

The Industrial Control Systems Security Market size is estimated at USD 18 billion in 2024, and is expected to reach USD 25.12 billion by 2029, growing at a CAGR of 6.90% during the forecast period (2024-2029).

Key Highlights

- The growing proliferation of advanced industrial technologies such as IIoT, automation, and robotics by industrial enterprises is expected to drive the growth of the industrial control system (ICS) market across various end-user industries. Furthermore, efforts being made by the vendors to develop innovative solutions and enhance the capability of ICS security solutions are poised to fuel the market's growth during the forecast period.

- With large-scale, continuous, and highly parameterized industrial devices, the need for industrial automation systems is continually increasing, leading to notable investments in advanced industrial automation and robotics solutions. For instance, according to the International Federation of Robotics (IFR), the annual installation of industrial robots is anticipated to reach 718 thousand units globally by 2026, from 400 thousand units in 2017.

- Present-day industrial control systems have also evolved from existing physical systems to the addition of IT capabilities, often replacing or supplementing physical control mechanisms. Thus, to independently meet the requirements of safe start-stop, stable operation, and optimal operation of industrial production systems, it has become necessary to seamlessly automate various industrial products and manufacturing systems.

- However, factors such as the complexity of implementing an ICS security system and high initial costs are among the major challenges for the growth of the market studied. For instance, to adopt ICS security systems, it is required to have supporting infrastructure like high-speed connectivity, information and communication networks, and a skilled workforce, which require significant investments. This, in turn, slows down the adoption of ICT security solutions, especially in the small and medium business segment.

- A significant positive impact of the pandemic was observed in the general awareness of advanced industrial technologies, such as automation, robotics, AI and IIoT, as the exposure to these technologies grew significantly as businesses were looking for options to minimize the use of manual workforce while maintaining the productivity.

- As a result of such trends, the uptake of industrial control also increased. Although the pandemic phase has surpassed, the approach of the industrial sector toward advanced industrial technologies continues to remain positive, leading to sustained growth in their adoption, which, in turn, is anticipated to bolster the market's growth during the forecast period.

Industrial Control Systems Security Market Trends

Automotive to Witness Major Growth

- The automotive industry is among the prominent sectors with a significant number of automated manufacturing facilities worldwide. In the automotive sector, the production facilities of various automakers are usually automated to maintain efficiency. ICS enables the automotive industry to react faster to market requirements, enhance the efficiency of supply chains, reduce manufacturing downtimes, and expand productivity.

- In the automotive industry, computer and network technologies, including the Internet of Things (IoT), cloud computing, and mobile computing, are increasingly being implemented parallel to the ICS systems, creating a significant demand for ICS solutions to be compatible with these advanced solutions. Despite enhancing industrial production capacity, connected technologies often increase security risks.

- Electrification is another major trend in the automotive industry, driving the demand for new vehicles and investments in new production plants. The electrification trend in the automotive sector is supported by several factors, including growing environmental concerns and a supportive government outlook toward low-emission vehicles.

- In recent years, countries worldwide have launched their decarbonization targets, of which electrification of vehicles is a crucial part of the automotive and transportation sector and is among the key contributors to environmental emissions. For instance, the European Union aims to drive the adoption of zero-emission vehicles significantly. The latest EU regulation aims to ensure that new cars and vans registered in the EU are zero emission by 2035.

- Due to such initiatives, the demand for electric vehicles has been increasing globally. According to the International Energy Agency (IEA), China, Europe, and the United States are among the major markets for electric vehicles. Sales of electric cars in China are estimated to reach 10.1 million units in 2024, compared to 6 million units in 2022.

Asia Pacific to Witness Significant Growth

- The Chinese market will grow more rapidly in the coming years as enterprises progressively improve their understanding of IT security for industrial control systems and continue to increase technical investment in this area.

- In China, the digitization and Industry 4.0 initiatives have significantly impacted increasing automation in all sectors by requiring more innovation and automated solutions like robots and control systems to enhance production processes. Due to its manufacturing capabilities and investments by the Chinese state in factories, infrastructure, and machinery, China's economy has been experiencing impressive growth.

- India has been witnessing significant growth in industrial automation across various sectors, such as manufacturing, energy, oil and gas, and utilities. As industries adopt advanced technologies and interconnected systems for improved efficiency and productivity, robust security measures are necessary to protect critical infrastructure and control systems. This drives the demand for ICS security solutions and services.

- With the increasing digitization and connectivity of industrial systems, the threat landscape has expanded, and industrial control systems have become potential targets for cyberattacks. Cybersecurity incidents targeting critical infrastructure can have severe consequences, including operational disruptions, financial losses, and potential safety hazards. Organizations invest in ICS security solutions to mitigate these risks and safeguard their industrial processes and assets.

Industrial Control Systems Security Industry Overview

The Industrial Control System Security Market is fragmented and highly competitive and consists of several major players: Darktrace Holdings Limited, Trellix, IBM Corporation, Cisco Systems Inc., and Fortinet Inc. Many companies are introducing new products, entering partnerships, or acquiring companies to increase their market share.

- May 2024 - Trellix announced Trellix Wise, a robust set of traditional and generative artificial intelligence tools to reduce cyber risk significantly. To identify and neutralize threats more effectively while reducing the costs of security operations, Trellix Wise is extending across the Trellix XDR Platform. The AI-driven platform automates workflows, increasing analyst productivity and improving threat prevention, detection, investigation, and resolution.

- April 2024 - Darktrace announced the launch of the ActiveAI Security Platform. The platform includes Darktrace's best-in-class security products, complemented by new industry-first innovations and features like email and operational technology. The platform is based on artificial intelligence, enabling the transformation of security operations from reactive to effective and improving cyber robustness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidence of Cyberattacks

- 5.1.2 Convergence of IT and OT Networks

- 5.2 Market Challenges

- 5.2.1 Complexity in Implementing the Security Systems

- 5.2.2 Emergence of Various Business Models in ICS Security Industry

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive

- 6.1.2 Chemical and Petrochemical

- 6.1.3 Power and Utilities

- 6.1.4 Pharmaceuticals

- 6.1.5 Food and Beverage

- 6.1.6 Oil and Gas

- 6.1.7 Other End-user Industries

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Darktrace Holdings Limited

- 7.1.2 Trellix

- 7.1.3 IBM Corporation

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Fortinet, Inc.

- 7.1.6 Check Point Software Technologies Ltd

- 7.1.7 Honeywell International Inc.

- 7.1.8 Broadcom Inc. (Symantec Corporation)

- 7.1.9 AhnLab Inc.

- 7.1.10 ABB Ltd

- 7.1.11 Rockwell Automation

- 7.1.12 Dragos Inc.