|

市场调查报告书

商品编码

1536995

汽车电池管理系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Battery Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

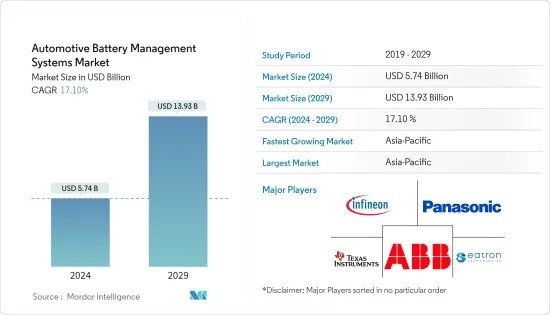

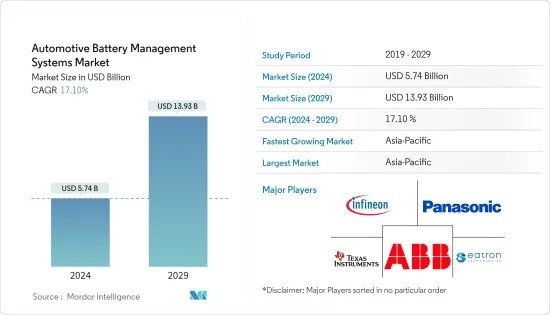

预计2024年汽车电池管理系统市场规模为57.4亿美元,在预测期内(2024-2029年)复合年增长率为17.10%,到2029年将达到139.3亿美元。

汽车电池管理系统的需求大幅成长,预计在预测报告期间内将继续成长。地方政府有关电动车采用的政策主要推动了商业动态。公司专注于进入国际贸易,并大力投资研发计划。

由于世界上大多数电动车都使用锂离子电池,因此电动车的需求预计将增加,并可能在预测期内主要推动市场发展。电池管理系统对于锂离子电池的安全和最佳性能至关重要。

电动汽车电池管理系统定期记录煞车、加速、减速和充电过程中的资料。

汽车製造商已经推出了多项推出更多电动车的计画。我们也参与合作伙伴关係和投资,以提高我们在市场上的竞争力。

主要亮点

- 例如,2023 年 1 月,德克萨斯) 宣布推出新的电池和电池组管理工具,声称将使电动车的续航里程增加 20%。

预计这些因素将对市场产生正面影响。

汽车电池管理系统市场趋势

乘用车占比最高

近年来,乘用车因其时尚的设计、紧凑的尺寸和经济价值而受到驾驶者的广泛欢迎。乘用车已成为许多已开发国家最常见的交通途径。在全球范围内,由于生活方式的改善、购买力平价可支配收入的增加、品牌知名度的提高和经济成长,客户偏好正在发生变化,乘用车销售量也在增加。

印度汽车工业协会称,2022-23 年乘用车销量将从 14,67,039 辆增加到 17,47,376 辆。

亚太地区对电动车的需求不断增长也带动了市场的成长。 2023 年第一季印度电动车销量较 2022 年同期成长一倍。

对运动型多用途车 (SUV) 的需求不断增长,为市场公司创造了商机,并成为市场成长的关键驱动力。根据我们的分析,SUV 在乘用车 (PV) 总销量中的份额将从 2016 年的 18% 增加到 2023 年的 41%。

启动/停止、电动方向盘和电子煞车系统等功能增加了电池的功率负载。因此,从舒适度到安全等级对所有这些电气负载进行优先排序是汽车电气系统的关键挑战。智慧电池管理系统(IBMS)正在受到汽车製造商的青睐,并在所有地区广泛采用。 IBMS 由先进的电子设备组成,例如测量电池充电状态 (SOC)、健康状态 (SOH) 和温度的电池感测器,并以串联和并联阵列连接到车辆电池组。

IBMS 的所有三项测量同时进行,即使在快速变化的车辆条件下也能确保准确的测量。 IBMS 的使用有助于以逻辑顺序关闭这些电动车系统,并提醒驾驶员即将发生的电池问题,以保护驾驶员安全免受电池爆炸的影响。智慧电池感测器的知名供应商包括大陆集团、海拉和博世,它们在开发先进技术方面投入了大量资金,并致力于产品的进步。

亚太地区占比最高

预计在预测期内,亚太地区将在全球乘用车市场中占据重要份额。该地区的成长主要由印度、中国和日本等顶级汽车生产国推动。这些市场对乘用车的需求增加是由于人口可支配收入的增加、汽车工业的崛起以及购买新车的贷款和资金筹措的增加等因素。

除传统内燃机汽车外,电动车的需求预计将推动电池管理系统市场的成长。由于各地区排放法规收紧,预测期内电动车的需求可能会增加。根据国际能源总署(IEA)预计,2022年,电动车占中国国内汽车总销量的份额将达29%,高于2021年的16%,2018年至2020年则不足6%。

电池是电动车的主要动力来源,推动了对高效能、先进电池管理系统的需求。

- 2023 年 5 月,森萨塔科技宣布推出一款新型紧凑型电池管理系统,具有适用于工业应用和低压电动车的先进软体功能。

汽车电池管理系统产业概况

汽车电池管理系统市场由全球和地区知名公司整合和主导。公司采用新产品发布、联盟和合併等策略来维持其市场地位。

- 例如,2022 年 7 月,Neutron Controls 和英飞凌科技合作开发了先进的汽车电池管理平台。 Neutron Controls 推出 ECU8 系统平台,加速以英飞凌晶片组为基础的 BMS 的开发。

该市场的主要参与者包括英飞凌科技公司、伊顿科技公司、德州仪器公司、ABB 有限公司和松下公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动车的扩张

- 市场限制因素

- 电池维护高成本

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部分

- 电池IC

- 电池感应器

- 其他部件(IBMS 中使用的电子装置和材料)

- 推进类型

- 内燃机车

- 电动车(HEV、PHEV、BEV)

- 车辆类型

- 客车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Panasonic Corporation(Ficosa)

- LG Chem

- ABB Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- Texas Instruments

- Preh GmbH

- Eatron Technologies

- Infineon Technologies AG

第七章 市场机会及未来趋势

The Automotive Battery Management Systems Market size is estimated at USD 5.74 billion in 2024, and is expected to reach USD 13.93 billion by 2029, growing at a CAGR of 17.10% during the forecast period (2024-2029).

The demand for battery management systems from the automotive industry has been growing significantly, and it is expected to continue to grow during the forecast report. Regional government policies regarding EV adoption have primarily driven the business dynamics. Companies are focusing on entering international deals and are heavily investing in R&D projects.

The anticipated increase in demand for electric vehicles may primarily drive the market during the forecast period, as most electric vehicles worldwide utilize lithium-ion batteries. The battery management system is essential for the safe and optimal performance of lithium-ion batteries.

Battery management systems in electric cars regularly record data during braking, acceleration, deceleration, and charging.

Automakers are initiating several plans to launch a greater number of electric vehicles. They are also entering partnerships and making investments to have a competitive edge in the markets.

Key Highlights

- For instance, in January 2023, Texas Instruments introduced new battery cell and battery pack management tools, which claim to increase the range of an electric vehicle by 20%.

These factors are expected to have a positive impact on the market.

Automotive Battery Management Systems Market Trends

Passenger Cars Holds Highest Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity disposable income, raising brand awareness, and growing economy are leading to changes in customer preferences globally, resulting in high sales of passenger cars.

According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units in 2022-23.

The increase in demand for electric vehicles in Asia-Pacific also resulted in the market's growth. Electric car sales in India in the first quarter of 2023 doubled compared to the same period in 2022.

The rise in the demand for sports utility vehicles (SUVs) creates profitable opportunities for the market players and acts as a major driving factor for the market's growth. According to our analysis, the share of SUVs in the overall passenger vehicle (PV) sales increased from 18% in 2016 to 41% in 2023,

Features like start/stop, electric power steering, and electronic braking systems have increased the battery's power load. Therefore, prioritizing all these electrical loads on a scale from comfort to safety level has been a significant issue in a vehicle's electrical system. Intelligent battery management systems (IBMSs) have been gaining attention among automakers and are being widely adopted across all regions. IBMS consists of advanced electronics, such as battery sensors that measure the state of charge (SOC), state of health (SOH), and temperature across a cell, connected in series and parallel arrays in a vehicle battery pack.

All three measurements by IBMS have been taken simultaneously to ensure accurate measurements, even during rapidly changing vehicle conditions. The usage of IBMS aids in shutting down these electric vehicle systems in a logical order and warns the drivers about the impending battery problem to keep them safe from battery explosions. The prominent suppliers of intelligent battery sensors include Continental AG, Hella, and Bosch, which are heavily investing in developing advanced technologies and focusing on advancing their products.

Asia-Pacific Holds the Highest Share

During the forecast period, Asia-Pacific is expected to hold a major share of the global passenger vehicle market. The growth in the region is mainly driven by the top-producing automotive countries like India, China, and Japan. The growing demand for passenger vehicles in these markets is owing to the increasing disposable income of the population, the rising automotive industry, the growing availability of loans and funding to purchase new vehicles, etc.

Apart from conventional IC engine vehicles, the demand for electric vehicles is anticipated to boost the growth of the battery management system market. With stringent emission regulations across every region, the demand for electric vehicles is likely to increase during the forecast period. According to the International Energy Agency, in 2022, the share of electric cars in total domestic car sales reached 29% in China, up from 16% in 2021 and under 6% between 2018 and 2020.

The battery is the primary source of power for electric vehicles, driving the demand for efficient and advanced battery management systems.

- In May 2023, Sensata Technologies launched a new compact battery management system with advanced software features for industrial applications and low-voltage electric vehicles.

Automotive Battery Management Systems Industry Overview

The automotive battery management system market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in July 2022, Neutron Controls and Infineon Technologies partnered for an advanced automotive battery management platform. Neutron Controls announced its ECU8 system platform, which enables accelerated development of BMS based on Infineon chipsets.

Some of the major players in the market include Infineon Technologies AG, Eatron Technologies, Texas Instruments, ABB Ltd, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost related to Maintenance of Batteries

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Components

- 5.1.1 Battery IC

- 5.1.2 Battery Sensors

- 5.1.3 Other Components (Electronics and Materials Used in IBMS)

- 5.2 Propulsion Type

- 5.2.1 IC Engine Vehicle

- 5.2.2 Electric Vehicle (HEV, PHEV, and BEV)

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Panasonic Corporation (Ficosa)

- 6.2.3 LG Chem

- 6.2.4 ABB Ltd

- 6.2.5 Hitachi Ltd

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.7 Continental AG

- 6.2.8 Texas Instruments

- 6.2.9 Preh GmbH

- 6.2.10 Eatron Technologies

- 6.2.11 Infineon Technologies AG