|

市场调查报告书

商品编码

1537585

电木全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Bakelite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

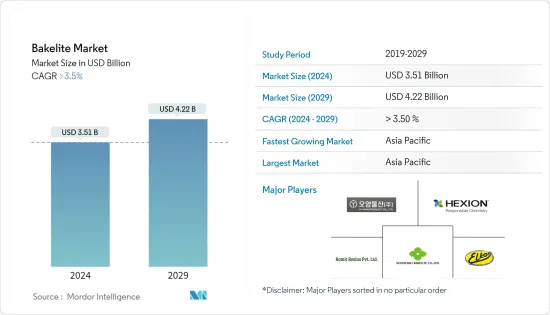

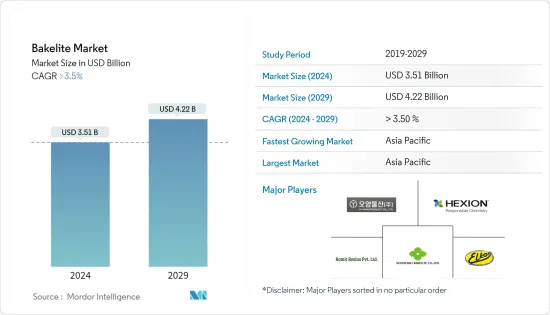

预计2024年全球电木市场规模为35.1亿美元,2029年达42.2亿美元,在预测期(2024-2029年)复合年增长率将超过3.5%。

COVID-19 大流行对各个行业产生了重大影响。汽车和飞机生产受到干扰,导致汽车产业损失惨重。电木的需求大幅下降,影响了各地区的市场成长。疫情过后,市场大幅反弹,随着有前景的人们重返工作岗位,需求也随之成长。

对电气元件的需求不断增长以及汽车行业不断增长的需求正在推动市场的成长。

电木中的石棉是危险的,其处置会对永续构成威胁。此外,环氧树脂等替代品的可用性也可能阻碍所研究市场的成长。

永续电木配方的开发可能会在预测期内为电木市场提供机会。

亚太地区在电木市场占据主导地位,因为它在汽车行业的碳刷架、引擎附件、真空泵、活塞等製造领域占据主导地位。这些因素可能会增加对电木的需求。

电木市场趋势

主导市场的汽车细分市场

- 随着对更轻重量、更高燃油效率和更低排放气体的需求不断增长,汽车产业预计将成为主导产业。

- 使用电木的复合材料比铝轻 30% 至 40%,这是汽车行业公司考虑确保燃油效率的重要方面之一。

- 根据国际汽车工业协会(OICA)预测,2022年全球汽车产量将达85,016,728辆,与前一年同期比较增长5.9%。

- 同样,根据 OICA 的数据,2022 年商用车产量达到 5,749 万辆,较 2021 年的 5,644 万辆有所增长。

- 同时,根据美国商务部经济分析局的数据,2022 年年轻型汽车零售为 13,754,300 辆,与 2021 年的 14,946,900 辆相比最低。

- 此外,德国工业协会(Verband der Automobilindustrie)预计,2022年德国汽车产量将达340万辆,较2021年的310万辆成长9.6%。

- 因此,汽车产业的这种有利趋势可能会增加预测期内对电木材料的需求。

亚太地区主导市场

- 亚太地区预计将成为电子和发电行业最大且成长最快的市场。电子产业的技术创新和先进技术的出现等因素预计将推动市场成长。

- 由于半导体、廉价游戏和汽车煞车皮等主要最终用户领域的消费不断增加,电木消费正经历快速成长。

- 据OICA称,近年来亚太地区的汽车产量一直领先全球。最大的汽车生产国是中国。 2022年,中国乘用车产量超过2,384万辆,持续维持领先地位,日本紧追在后,产量为657万辆。

- 根据中国工业协会(CAAM)的数据,2022年,中国销售约2,356万辆乘用车和330万辆商用车。

- 此外,清洁能源部长级会议 (CEM) 下的倡议,例如电动车倡议和电动车的日益普及,可能会在不久的将来推动电木消费。

- 同样,根据印尼工业部的预测,2022年电子製造业的投资额将大幅增加,从前一年的3.3兆印尼盾达到2022年约7.5兆印尼盾,成长127%。这推动了工业薄膜市场的发展,工业薄膜对于电子製造业的保护和製程增强至关重要。

- 因此,所有这些市场趋势预计将在预测期内推动该地区电木市场的需求。

电木产业概况

电木市场本质上是整合的,少数大型企业占据了市场需求的很大一部分。主要公司包括(排名不分先后)Sumitomo Bakelite、Elkor、Hexion、Romit Resins Pvt. Ltd. 和 O-Yang Product。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车产业的需求不断增加

- 电气零件需求增加

- 其他司机

- 抑制因素

- 对环境和健康的负面影响

- 替代产品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 形式

- 床单

- 桿

- 木板

- 其他形式

- 类型

- 油溶性

- 可溶性醇

- 退化

- 其他类型

- 最终用户产业

- 航太

- 车

- 电力/电子

- 发电

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Elkor

- Hengshui Chemical Plant

- Hexion

- Krishna Hylam Bakelite Products

- Nimrod Plastics

- O-Yang Product Co. Ltd.

- Polychem International

- Romit Resins Pvt. Ltd.

- Sumitomo Bakelite Co. Ltd.

- ZheJiang Wan An Plastic Co. Ltd.

第七章 市场机会及未来趋势

- 开发永续电木配方

- 其他机会

The Bakelite Market size is estimated at USD 3.51 billion in 2024, and is expected to reach USD 4.22 billion by 2029, growing at a CAGR of greater than 3.5% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on various industries. The production of automobiles and airplanes was disruptively stopped, contributing to a significant loss in the automotive sector; the demand for bakelite significantly fell, affecting the market growth in various regions. After the pandemic, the market picked up speed, and the demand grew as prominent people got back to work.

Growing demand for electrical components and the rising demand from the automotive industry are driving the market growth.

The presence of asbestos in bakelite is hazardous and poses a sustainability threat to its disposal. The availability of substitutes, like epoxy resin, is also likely to hinder the growth of the studied market.

The development of sustainable bakelite formulations is likely to provide opportunities for the bakelite market over the forecast period.

Asia-Pacific region dominates the bakelite market because of its prominence in making carbon brush holders, engine attachments, vacuum pumps, and pistons in the automotive industry. These factors are likely to augment the demand for bakelite.

Bakelite Market Trends

Automotive Segment to Dominate the Market

- The automotive industry is expected to be the dominating segment, and the growing need for lightweight, high fuel efficiency, and low emission vehicles widely drives its requirements.

- Composites made with bakelite are 30%-40% lighter than aluminum, as it is one of the key aspects considered by firms engaged in the automotive industry to ensure fuel efficiency.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production reached 85,016,728 units in 2022, and the production increased by 5.9 percent when compared to the previous year's data-and motor vehicle production growth year-on-year between the 2021 and 2022 markets at 6 percent.

- Similarly, as per OICA, commercial vehicle production reached 57.49 million units in 2022 and registered growth when compared to 56.44 in 2021.

- Meanwhile, as per The Bureau of Economic Analysis of the United States Department of Commerce, light vehicle retail sales reached 13,754.3 thousand units, registering the lowest production when compared to 14,946.9 thousand units in 2021.

- Further, according to the German Association of the Automotive Industry (Verband der Automobilindustrie), automobile production in Germany reached 3.4 million in 2022 and registered a growth of 9.6 percent when compared to 3.1 million in 2021.

- Hence, such favorable trends in the automotive industry are likely to enhance the demand for bakelite materials during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to be the largest and fastest-growing market for the electronics and power generation industry. Factors such as innovations and the emergence of advanced technologies in the electronics industry are expected to drive market growth.

- Bakelite consumption has witnessed rapid growth on account of increasing consumption in major end-user segments, such as semiconductors, inexpensive games, and automotive brake pads.

- According to the OICA, Asia-Pacific has led global automobile production in recent years. China is the largest producer of automobiles in the country. In 2022, China produced over 23.84 million units of passenger cars and remained at the top, followed by Japan with 6.57 million units,

- According to the China Association of Automobile Manufacturers(CAAM), In 2022, approximately 23.56 million passenger cars and 3.3 million commercial vehicles were sold in China.

- Additionally, initiatives under the Clean Energy Ministerial (CEM), like the electric vehicle initiative and the growing popularity of electric vehicles, are likely to drive the consumption of bakelite in the near future.

- Similarly, As per the Ministry of Industry in Indonesia in 2022, there was a significant increase in the investment value of the electronics manufacturing industry, reaching approximately IDR 7.5 trillion (USD 535.7 ) in 2022 from IDR 3.3 trillion (USD 235.7 ) the previous year, indicating a growth of 127%. This boosts the industrial film market as it is essential in the electronics manufacturing sector for protection and process enhancement.

- Hence, all such market trends are expected to drive the demand for the bakelite market in the region during the forecast period.

Bakelite Industry Overview

The bakelite market is consolidated in nature, with a few major players dominating a significant share of the market demand. Some of the major companies include (not in any particular order) Sumitomo Bakelite Co. Ltd., Elkor, Hexion, Romit Resins Pvt. Ltd., and O-Yang Product Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Automotive Industry

- 4.1.2 Growing Demand from Electrical Components

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 Environmental and Health Hazards

- 4.2.2 Availability of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Form

- 5.1.1 Sheet

- 5.1.2 Rod

- 5.1.3 Board

- 5.1.4 Other Forms

- 5.2 Type

- 5.2.1 Oil Soluble

- 5.2.2 Alcohol Soluble

- 5.2.3 Modified

- 5.2.4 Other Types

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Electrical and Electronics

- 5.3.4 Power Generation

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle-East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Elkor

- 6.4.2 Hengshui Chemical Plant

- 6.4.3 Hexion

- 6.4.4 Krishna Hylam Bakelite Products

- 6.4.5 Nimrod Plastics

- 6.4.6 O-Yang Product Co. Ltd.

- 6.4.7 Polychem International

- 6.4.8 Romit Resins Pvt. Ltd.

- 6.4.9 Sumitomo Bakelite Co. Ltd.

- 6.4.10 ZheJiang Wan An Plastic Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Sustainable Bakelite Formulations

- 7.2 Other Opportunities