|

市场调查报告书

商品编码

1537587

全球混凝土黏剂市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Concrete Bonding Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

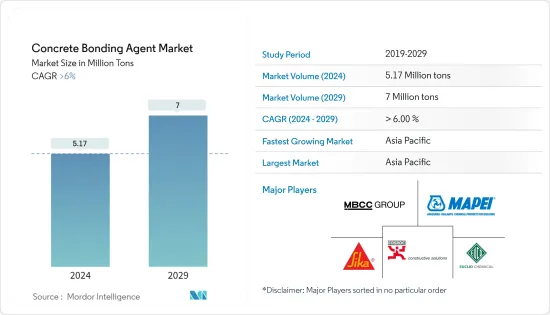

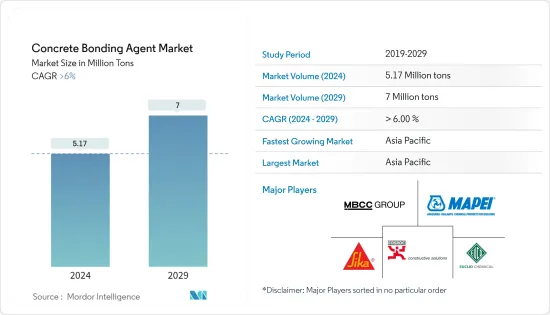

预计2024年全球混凝土黏剂市场规模将达到517万吨,2029年将达到700万吨,在预测期间(2024-2029年)复合年增长率将超过6%。

主要亮点

- COVID-19 已停止了建筑重建和建设活动,减少了对修復、地板材料、装饰和其他几种应用的黏剂的需求。然而,由于全球建筑业的成长,预计市场在预测期内将稳定成长。

- 短期内,建筑领域应用的扩大正在推动市场成长。然而,消费者意识的缺乏预计将阻碍市场的成长。

- 然而,混凝土黏剂市场的未来性是光明的,在修復、地板材料、装饰和海事等领域的应用前景广阔。亚太地区主导全球市场,其中中国、印度和日本的消费量最高。

混凝土黏剂市场趋势

建筑和建造领域的需求增加

- 在建筑领域,混凝土黏剂用于修復、地板材料、装饰和其他一些应用,以帮助维修建筑物。

- 这些黏剂提高了内聚力。其侵蚀性接着强度超过主体混凝土的拉伸强度。

- 建筑业在混凝土黏剂的应用方面处于领先地位。新兴国家住宅建设和重建活动的增加正在增加对混凝土黏剂的需求。

- 中国政府正在推出一项大规模建设计画,其中包括在未来 10 年内将 2.5 亿人迁移到新的特大城市。

- 由于当前的多户住宅趋势和向城市移民的增加,美国人口普查局正在增加新住宅的建筑许可。

- 根据美国人口普查局的数据,商业完工量已反弹至景气衰退的水平,并于 2022 年达到 1,150 亿美元。在美国开始的最常见的商业建筑类型是仓库和私人办公室。

- 此外,2023年1-8月建筑支出达12,847亿美元,比2022年同期的12,334亿美元成长4.2%。

- 此外,根据欧盟统计局的数据,由于欧盟復苏基金的新投资,欧洲建筑业在 2022 年成长了 2.5%。 2022年的主要建设计划将是非住宅(办公室、医院、饭店、学校、工业建筑),占总活动的31.3%。

- 德国是欧洲最大的建筑国。德国政府已拨款约 3,750 亿欧元(4,091.7 亿美元)用于未来几年的建设活动。此外,该市还宣布建设计画250,000 至 400,000 套住宅,使该计划成为城市、私人开发人员和公共住宅当局的绝佳投资机会。

- 因此,由于建设活动的增加,预计在预测期内对混凝土黏剂的需求将会增加。

亚太地区主导市场

- 预计亚太地区将在预测期内主导混凝土黏剂市场。在中国、印度和东南亚国协等建设活动不断增加的国家,混凝土黏剂市场正在迅速扩大。

- 最大的混凝土黏剂製造商在亚太地区拥有大量业务。生产混凝土黏剂的领先公司包括 Fosroc Inc.、Flowcrete Group Ltd.、Sika AG 和BASF SE。

- 亚太地区的建筑业是世界上最大的。中国和印度建筑市场的扩张正在增加基础设施投资和复杂结构的建设,预计将推动混凝土黏剂市场的发展。

- 根据中国国家统计局的数据,建筑业产值将从2021年的29.31兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。此外,根据住宅部的预测,到2025年,中国建筑业预计将维持GDP的6%。

- 中国政府允许的计划投资金额接近去年的 70%,显示北京正在加大基础设施支出,以帮助受新冠疫情打击的经济。结果,国家发展和改革委员会核准了2022 年 32 个计划,总金额达 5,200 亿元人民币(816 亿美元),包括交通、能源和高科技。

- 印度建筑业预计到2025年将成为世界第三大建筑市场。随着智慧城市计划、基础建设等多项政府政策的实施,印度建设产业可望大幅提振。

- 印度政府宣布投资 31.65 兆美元,根据智慧城市计画建造 100 个城市。此外,未来五年,100个智慧城市和500个城市可能会吸引价值2兆印度卢比(约281.8亿美元)的投资,为这些混凝土黏剂。

- FASTag 计划将促进高速公路的商业化,并使印度国家高速公路管理局 (NHAI) 能够获得更多收入。到2024年,预计将至少12个总长度超过6000公里的公路束收益。在这份预算中,政府累计了 1,963.943 亿印度卢比(23.8959 亿美元)用于道路基础建设。

- 上述因素和政府的支持导致预测期内混凝土黏剂需求的增加。

混凝土黏剂产业概况

混凝土黏剂市场本质上是部分分散的,少数大型企业控制着该行业的很大一部分。着名公司(排名不分先后)包括 Fosroc Inc.、Sika AG、MAPEI Corporation、MBCC Group 和 The Euclid Chemical Company。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在建筑领域的应用

- 混凝土黏剂与波特兰水泥和其他水硬性水泥的高相容性

- 其他司机

- 抑制因素

- 消费者认知度低

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(基于数量的市场规模)

- 黏剂型

- 水泥乳胶

- 环氧型

- 目的

- 维修

- 地板材料

- 装饰

- 其他用途(防水等)

- 最终用户产业

- 住宅

- 非住宅

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Adhesives Technology Corporation(ATC)

- ChemCo Systems Inc.

- Flowcrete Group Ltd

- Fosroc Inc.

- GCP Applied Technologies Inc.

- LafargeHolcim

- MAPEI Corporation

- MBCC Group

- SIKA AG

- The Euclid Chemical Company

第七章 市场机会及未来趋势

- 维修、地板材料、装饰和海事应用前景

- 其他机会

简介目录

Product Code: 68456

The Concrete Bonding Agent Market size is estimated at 5.17 Million tons in 2024, and is expected to reach 7 Million tons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

Key Highlights

- Due to COVID-19, building renovation and construction activities were halted, decreasing the demand for bonding agents for repairing, flooring, decorative, and a few other applications. However, the market was projected to grow steadily in the forecast period due to global construction sector growth.

- Over the short term, the growing application in building and construction is driving the market growth. However, a lack of awareness among consumers is expected to hinder the market's growth.

- Nevertheless, the market for concrete bonding agents has a bright future, with prospects in repairing, flooring, ornamental, and maritime applications. The Asia-Pacific region dominates the global market, with the largest consumption registered in China, India, and Japan.

Concrete Bonding Agent Market Trends

Increasing Demand from the Building and Construction Sector

- In building and construction, these bonding agents are used for repairing, flooring, decorating, and a few other applications, which, in turn, help renovate the buildings.

- These bonding agents improve cohesion. Its positive adhesion exceeds that of the tensile strength of the host concrete.

- The building and construction sector leads the way in applying concrete bonding agents. The increasing residential construction and renovation activities in developing countries are increasing the demand for concrete bonding agents.

- The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years.

- The US Census Bureau has been providing more permits for constructing new residential buildings due to the current trend of multi-family buildings and a rise in migration to cities.

- According to the US Census Bureau, the value of completed commercial construction has rebounded to pre-recession levels, reaching USD 115 billion in 2022. The most popular types of commercial development started in the United States were warehouses and private offices.

- Additionally, during the first eight months of 2023, construction spending amounted to USD 1,284.7 billion, which increased by 4.2% to USD 1,233.4 billion for the same period in 2022.

- Furthermore, according to Eurostat, the European construction sector grew by 2.5% in 2022 due to new investments from the EU Recovery Fund. The major construction projects in 2022 accounted for non-residential construction (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3% of total activity.

- Germany has the largest construction industry in Europe. The German government has allocated around EUR 375 billion (~USD 409.17 billion) in construction activities in the coming years. In addition, it also revealed plans to build 250,000 to 400,000 housing units, making this project a great investment opportunity for the city, private developers, and public housing authorities.

- Hence, owing to the growing construction activities, the demand for concrete bonding agents is expected to increase over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for concrete bonding agents during the forecast period. In countries like China, India, and ASEAN Countries with growing construction activities, the market for concrete bonding agents has been increasing rapidly.

- The largest producers of concrete bonding agents have a significant presence in the Asia-Pacific region. Some leading companies in producing concrete bonding agents are Fosroc Inc., Flowcrete Group Ltd, Sika AG, and BASF SE.

- The construction sector in the Asia-Pacific region is the largest in the world. The growing infrastructure investment and building of complex structures are expected to drive the market for concrete bonding agents, owing to the expanding construction markets in China and India.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (~USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (~USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- The Chinese government has authorized investment in projects worth nearly 70% of what was permitted last year, showing that Beijing is raising infrastructure expenditure to help an economy pummelling by Covid. Consequently, for 2022, the National Development and Reform Commission has approved 32 projects totaling CNY 520 billion (USD 81.6 billion) in industries including transportation, energy, and high-tech.

- India's construction sector is expected to become the world's third-largest construction market by 2025. The implementation of various government policies, such as the Smart Cities project and boosting infrastructure, is set to bring significant impetus to the Indian construction industry.

- The Indian government announced an investment worth USD 31,650 billion for constructing 100 cities under the smart cities plan. Additionally, 100 smart and 500 cities will likely invite investments worth INR 2 trillion (~USD 28.18 billion) over the coming five years, creating scope for applying these concrete bonding agents.

- The FASTag scheme encourages highway commercialization, allowing the National Highways Authority of India (NHAI) to collect more revenue. It was expected to monetize at least 12 highway bundles totaling more than 6,000 kilometers by 2024. In the budget, the government has put up INR 196,394.3 million (~USD 2,389.59 million) for road infrastructure.

- The above factors and government support contribute to the increasing demand for concrete bonding agents during the forecast period.

Concrete Bonding Agent Industry Overview

The concrete bonding agent market is partially fragmented in nature, with a few major players holding a significant portion of the industry. Some of the major players (not in any particular order) are Fosroc Inc., Sika AG, MAPEI Corporation, MBCC Group, and The Euclid Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Building and Construction Sector

- 4.1.2 High Compatibility of Concrete Bonding Agent with Portland Cement and Other Hydraulic Cements

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Dearth of Awareness among the Consumers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Bonding Agent Type

- 5.1.1 Cementitious Latex-based

- 5.1.2 Epoxy-based

- 5.2 Application

- 5.2.1 Repairing

- 5.2.2 Flooring

- 5.2.3 Decorative

- 5.2.4 Other Applications (waterproofing, etc)

- 5.3 End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adhesives Technology Corporation (ATC)

- 6.4.2 ChemCo Systems Inc.

- 6.4.3 Flowcrete Group Ltd

- 6.4.4 Fosroc Inc.

- 6.4.5 GCP Applied Technologies Inc.

- 6.4.6 LafargeHolcim

- 6.4.7 MAPEI Corporation

- 6.4.8 MBCC Group

- 6.4.9 SIKA AG

- 6.4.10 The Euclid Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Prospects in Repairing, Flooring, Ornamental, and Maritime Applications

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219