|

市场调查报告书

商品编码

1689846

加密货币 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Cryptocurrency - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

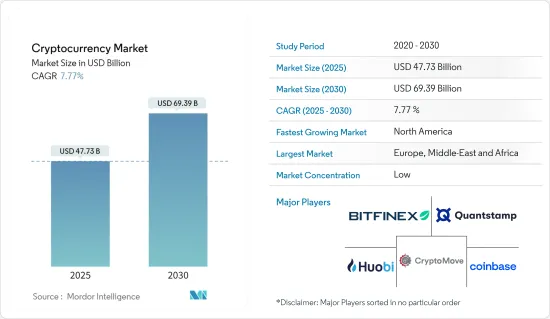

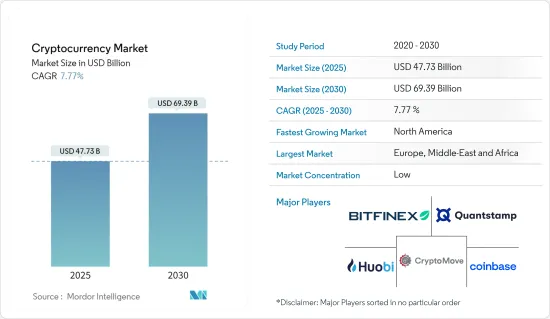

加密货币市场规模预计在 2025 年为 477.3 亿美元,预计到 2030 年将达到 693.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.77%。

加密货币(虚拟货币)没有任何监管机构监督,并且仅在数位领域运作。使用区块链和加密货币等分散式帐本技术可确保交易检验。由于分散式帐本技术的快速采用,加密货币市场预计将成长。此外,加密货币在跨境汇款的使用日益增多,预计将透过降低消费者的费用和外汇成本来扩大市场。加密货币市场根据多种加密货币的市值进行细分。这些数位货币与我们的货币和金融体系的关键方面相互交叉。鑑于其快速扩张、复杂性、高波动性以及进行非法交易的可能性,世界各地的监管机构和政策制定者都对其融入现有体係以及相应调整的必要性表示担忧。

加密货币最初是为了促进不受政府或中央银行监管的P2P交易而开发的,并成为一种尖端的金融创新。这些数位资产目前正在检验,以评估其在金融业中的潜在风险和回报以及其多样化的设计目标。现存多种加密货币,每种都有特定的用途。有些旨在成为传统货币的替代品(例如比特币、门罗币、比特币现金),而有些则专注于支援具有成本效益的付款系统(例如瑞波币、粒子币、公共产业付款币)。此外,某些加密货币透过代币创建实现P2P交易(例如 RMG 和 Maecenas),而其他加密货币则透过直接交易提供对商品和服务的安全存取(例如 Golem 和 Filecoin)。一些加密货币支援底层平台或通讯协定(例如 Ether 和 NEO)。重要的是要认识到这个设计目标清单是不完整的,因为新的加密货币正在不断被开发出来。

加密货币市场趋势

数位资产的日益普及将推动市场成长

数位资产采用的激增正在推动加密货币市场向前发展。由于加密货币在安全、高效交易和防止通货膨胀方面的优势得到认可,它们正在迅速被个人和企业所接受。此外,金融机构也透过整合加密服务加入了这一趋势,增加了市场的合法性。这种接受度不仅限于比特币和以太坊,还涵盖了各种Altcoin和代币,提供了多样化的投资机会。与传统金融体系相比,加密货币的去中心化结构具有许多优势,包括降低交易成本和提高金融服务的可用性,尤其是在银行服务有限的地区。随着技术进步和监管条件变得更加清晰,预计这一趋势将持续下去,进一步加强加密货币在全球金融格局中的地位。

北美占据市场主导地位

预计预测期内北美将为全球市场成长贡献48%。由于北美市场参与企业众多且技术创新不断,北美占据加密货币市场的最大份额。对数位付款的不断增长的需求进一步推动了北美加密货币市场的成长。美国处于数位货币技术进步的前沿,被认为是该地区的主要企业之一。预计供应商在北美扩大业务的投资将在预测期内推动该地区加密货币市场的成长。

此外,NFT 中加密货币的使用以及加密货币作为价值储存形式的日益被接受也促进了该地区市场的扩张。此外,该地区对专注于区块链技术和加密货币挖矿系统创新解决方案的公司的投资显着增加。这些投资旨在提供更高的哈希率并提高电源效率。

加密货币行业概览

加密货币市场也高度分散。现存的加密货币有数千种,每种都有自己独特的功能、使用案例和社群。例如,比特币是最知名和最广泛采用的加密货币,但还有许多其他加密货币,包括以太币、瑞波币和莱特币。每种加密货币都独立运作,并拥有自己的用户和开发者网路。重要的参与企业包括 Bitfinex、Quantstamp Inc.、CryptoMove Inc.、Coinbase 和 Huobi Global。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 金融付款系统营运效率和透明度的需求日益增加

- 新兴国家汇款需求不断成长

- 市场限制

- 各国政府法规的差异影响市场

- 由于市场规模波动,持有加密货币的风险增加

- 市场机会

- 增加企业创造新数位资产的机会

- 加密货币正在成为投资报酬率更高的资金的机会

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 影响全球加密货币市场的趋势

- 全球加密货币市场的技术创新

- COVID-19对市场的影响

第五章市场区隔与分析

- 按市值

- 比特币

- 以太坊

- 波纹

- 比特币现金

- 卡尔达诺

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Bitfinex

- Quantstamp Inc.

- CryptoMove Inc.

- Coinbase

- Huobi Global

- CoinCheck

- Gemini

- Bitfury

- Binance

- Cannan Inc*

第七章 市场机会与未来趋势

第八章 免责声明

The Cryptocurrency Market size is estimated at USD 47.73 billion in 2025, and is expected to reach USD 69.39 billion by 2030, at a CAGR of 7.77% during the forecast period (2025-2030).

Cryptocurrency, or virtual currency, operates solely in the digital realm without any overseeing regulatory body. Utilizing distributed ledger technology like blockchain and cryptocurrency ensures transaction validation. The surge in distributed ledger technology adoption is forecasted to drive growth in the cryptocurrency market. Additionally, the rising use of cryptocurrencies for cross-border remittances is projected to expand the market by lowering consumer fees and exchange costs. The market capitalization of numerous cryptocurrencies is used to segment the cryptocurrency market. These digital currencies intersect with crucial aspects of the monetary and financial systems. Due to their rapid expansion, intricate nature, significant fluctuations, and potential for enabling unlawful transactions, regulators and policymakers worldwide express apprehension regarding their integration into the current system and the need to adapt the system accordingly.

Cryptocurrencies, developed initially to facilitate peer-to-peer transactions independent of government or central bank oversight, have emerged as a cutting-edge financial innovation. These digital assets are currently under examination to assess their potential risks and rewards within the financial industry and their diverse design objectives. There are numerous cryptocurrencies, each serving a specific purpose. Some seek an alternative to traditional currency (such as Bitcoin, Monero, and Bitcoin Cash), while others focus on supporting cost-effective payment systems (like Ripple, Particl, and Utility Settlement Coin). Additionally, specific cryptocurrencies enable peer-to-peer trading through token creation (such as RMG and Maecenas), while others provide secure access to goods or services in direct transactions (like Golem and Filecoin). Some cryptocurrencies support underlying platforms or protocols (such as Ether and NEO). It is essential to recognize that new cryptocurrencies are continually being developed, so this list of design objectives is incomplete.

Cryptocurrency Market Trends

Increasing Adoption of Digital Assets is Expected to Drive the Growth of this Market

The surge in the adoption of digital assets is propelling the cryptocurrency market forward. The growing recognition of the advantages of cryptocurrencies in terms of secure and efficient transactions and their ability to safeguard against inflation has resulted in a surge in their acceptance among individuals and enterprises. Moreover, financial institutions are joining the trend by integrating crypto services, thereby enhancing the legitimacy of the market. This acceptance is not limited to Bitcoin and Ethereum but also includes a wide range of altcoins and tokens, providing diverse investment opportunities. Cryptocurrencies' decentralized structure offers benefits compared to conventional financial systems, including reduced transaction costs and enhanced availability of financial services, especially in areas with limited banking access. This trend is expected to continue as technology advances and regulatory frameworks become more defined, further solidifying cryptocurrencies in the global financial landscape.

North America Region Dominates the Market

During the forecast period, North America is projected to contribute 48% to the global market growth. The cryptocurrency market in North America holds the largest share due to numerous market players and continuous innovations in the region. The growing demand for digital payments has further fueled the growth of the North American cryptocurrency market. The United States, being at the forefront of technological advancements in digital currencies, is considered one of the key players in the region. Investments by vendors to expand their operations in North America are expected to drive the growth of the cryptocurrency market in the area during the forecast period.

Additionally, the use of cryptocurrencies in NFTs and the increasing acceptance of cryptocurrencies as a form of value storage contribute to the regional market's expansion. Additionally, there has been a notable increase in regional investments towards companies focusing on blockchain technology and innovative solutions for cryptocurrency mining systems. These investments aim to provide higher hash rates and enhance power efficiency.

Cryptocurrency Industry Overview

The cryptocurrency market is also highly fragmented. Thousands of cryptocurrencies are available, each with unique features, use cases, and communities. Bitcoin, for example, is the most well-known and widely adopted cryptocurrency, but there are numerous others, such as Ethereum, Ripple, Litecoin, and many more. Each cryptocurrency operates independently and has a network of users and developers. Some significant players are Bitfinex, Quantstamp Inc., CryptoMove Inc., Coinbase, and Huobi Global.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Operational Efficiency and Transparency in Financial Payment Systems

- 4.2.2 Increasing Demand for Remittances in Developing Countries

- 4.3 Market Restraints

- 4.3.1 Varying Government Regulations in Different Countries Affecting the Market

- 4.3.2 Volatility in Market Value Increases the Risk of Holding Cryptocurrency

- 4.4 Market Opportunities

- 4.4.1 Rising Opportunities for Companies to Create New Digital Assets

- 4.4.2 Cryptocurrency Emerging as an Opportunity to Invest Money with Higher Returns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Trends Influencing Global Cryptocurrency Market

- 4.7 Technological Innovations in Global Cryptocurrency Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION AND ANALYSIS

- 5.1 By Market Capitalization

- 5.1.1 Bitcoin

- 5.1.2 Ethereum

- 5.1.3 Ripple

- 5.1.4 Bitcoin Cash

- 5.1.5 Cardano

- 5.1.6 Others

- 5.2 Geography

- 5.3 North America

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

- 5.4 Europe

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Russia

- 5.4.5 Italy

- 5.4.6 Spain

- 5.4.7 Rest of Europe

- 5.5 Asia-Pacific

- 5.5.1 India

- 5.5.2 China

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 Rest of Asia-Pacific

- 5.6 South America

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Rest of South America

- 5.7 Middle East & Africa

- 5.7.1 United Arab Emirates

- 5.7.2 South Africa

- 5.7.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Bitfinex

- 6.2.2 Quantstamp Inc.

- 6.2.3 CryptoMove Inc.

- 6.2.4 Coinbase

- 6.2.5 Huobi Global

- 6.2.6 CoinCheck

- 6.2.7 Gemini

- 6.2.8 Bitfury

- 6.2.9 Binance

- 6.2.10 Cannan Inc*