|

市场调查报告书

商品编码

1689910

碘:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Iodine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

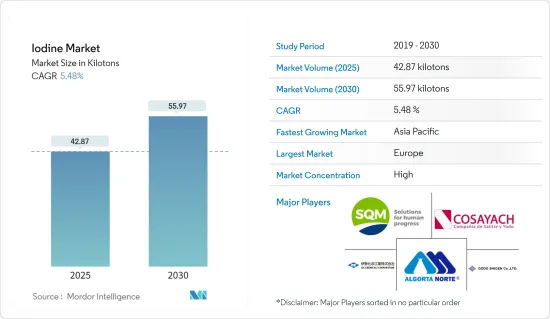

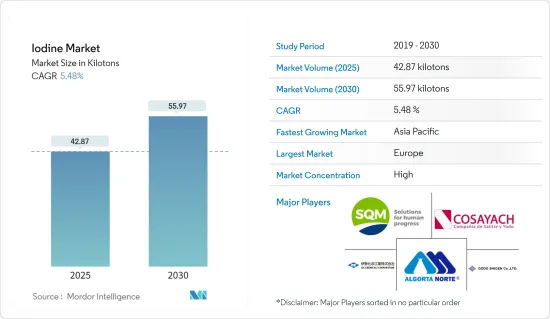

碘市场规模预计在 2025 年为 42.87 千吨,预计在 2030 年达到 55.97 千吨,预测期(2025-2030 年)的复合年增长率为 5.48%。

COVID-19对碘市场产生了负面影响。主要原因是监管力度加大以及製造工厂大规模关闭。然而,自从限制解除以来,对碘产品的需求增加了,因此碘市场也得到了成长,并且在预测期内可能会遵循类似的轨迹。

主要亮点

- 短期内,预计碘需求将受到X射线显影剂需求增加和碘缺乏症加剧导致碘摄入量增加的推动。

- 然而,碘毒性和过量摄取导致的健康问题是研究市场成长的主要限制因素。

- 另一方面,除生物剂中对碘的需求不断增长以及对碘回收的需求不断增加可能会在未来几年创造有利可图的市场机会。

- 预计欧洲将成为最大的碘市场,而亚太地区预计将在 2024 年至 2029 年间见证最高成长。

碘市场趋势

医疗领域预计将主导市场

- 碘是医药产业的关键元素,在诊断和治疗方面有许多应用。其最常见的用途是生产防腐剂和消毒剂,碘杀死细菌、病毒和真菌的能力使其成为预防感染疾病的有效工具。

- 此外,碘也用于生产用于电脑断层扫描、X 光和血管造影术等医学影像处理的放射显影剂。这些材料含有吸收X射线的碘原子,使得人体内部结构在产生的影像中清晰可见。

- 碘原子序数高、毒性低,且易与有机化合物结合,因此随着X射线显影剂需求的增长,其需求也不断增加。

- 对于在市政水处理不可靠的地区旅行或工作的人来说,碘是一种简单、有效且经济的水消毒方法。在饮用水消毒方面,碘通常以锭剂或溶液的形式在紧急情况下和旅行者使用。近年来,随着旅行者数量的增加,对碘作为消毒剂的需求也随之增加。

- 2024年1月,根据马里兰大学医学院的研究,一项由马里兰大学医学院研究人员共同主导的大型多中心临床试验发现,与另一种常用的皮肤消毒剂相比,含碘的消毒剂(酒精中的碘伏)可使肢体骨折患者术后感染疾病减少约四分之一。

- 2024年1月,中国工业集团公司开始建造强大液体医用同位素试验反应器。该计划将生产碘-131和碘-125以及其他医用同位素。医用同位素是用于医疗目的的典型放射性同位素。例如,碘-131用于放射治疗和诊断成像。它也用于破坏功能失调的甲状腺组织和许多其他医疗用途。根据中核集团介绍,医用同位素核子反应炉预计2027年建成,届时碘-131产能将达到年产2万居里,超过目前国内的需求。

- Astra Zeneca预计,2024年北美将以6,330亿美元的医药销售额领先,其次是欧盟(不包括英国),销售额为2,870亿美元,东南亚和东亚为2,320亿美元。此外,2020 年药品总支出为 1,2,652 亿美元,预计到 2025 年将产生 15,950 亿美元的收益。

- 因此,由于上述因素,预计医疗终端用户产业将在 2024 年至 2029 年期间主导碘市场。

预计欧洲将主导市场

- 预计欧洲将在 2024 年至 2029 年期间主导碘市场。德国、英国和义大利等国家对动物饲料、医疗和除生物剂应用的碘的需求不断增长。

- 根据德国动物饲料协会(DVT)的数据,2023 日历年德国饲料产量为 2,170 万吨(mmt),比前 12 个月下降 1.6%,约 36 万吨(mt)。 DVT主席宣布,与前一年同期比较减代表德国饲料产业长期收缩的势头得到部分缓解。国内饲料产量下降主要是因为猪饲料销售量下降。预计 2023 年该产业产量将减少约 50 万吨(5.8%),至 800 万吨。

- 此外,德国的污水处理和回收率居欧洲首位。超过96%的家庭和公共设施产生的污水排放至附近的污水处理厂进行处理。随着国家处理的废水量不断增加,预计这些工厂将在 2024 年至 2029 年期间使用大量含碘除生物剂。

- 医疗产业是碘的最大消费者。根据英国製药工业12月发布的资料,英国生命科学产业预计2022年的销售额将达到1,081亿欧元(1,154亿美元),较2022年的959亿欧元(1,023.7亿美元)成长13%。自2013年以来,销售额一直呈上升趋势,但在2021年至2022年期间急剧增加。核心生物製药部门的收入份额最大,占生命科学产业总收入的43%。其次是生物製药服务和供应以及医疗技术核心部门,各占 2022 年销售额的 25%。这些趋势也对碘消耗有影响。

- 义大利製药业拥有庞大且可靠的製造基地,拥有约 67,000 名敬业的员工。其技术先进,不仅在欧洲而且在世界范围内处于主导地位。

- 根据Farmindustria-Prometeia 2023的调查资料,义大利製药业是义大利经济背后的驱动力量。到 2023 年,该产业价值将达到 500 亿欧元(553 亿美元)。义大利的药品生产在欧洲製药业中占有重要地位。根据 Farmindustria-Prometeia 2023 年的研究,2023 年该产业的产量与 2022 年相比增加了 7.3%。

- 由于上述因素,预计2024年至2029年间欧洲碘市场将大幅成长。

碘业概况

碘市场高度整合。市场上的主要企业(不分先后顺序)包括 SQM SA、ISE CHEMICALS CORPORATION、Cosayach、GODO SHIGEN 和 Algorta Norte。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- X 光显影剂的需求不断增加

- 碘缺乏情况加剧

- 限制因素

- 碘毒性和健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 原料

- 地下盐水

- 钾矿

- 回收利用

- 海藻

- 形式

- 无机盐及错合

- 有机化合物

- 元素和同位素

- 最终用户产业

- 动物饲料

- 医疗

- 除生物剂

- 光学偏光片

- 氟化学

- 尼龙

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Algorta Norte

- Calibre Chemicals Pvt. Ltd

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- Godo Shigen Co. Ltd

- Iochem Corporation

- Iofina

- ISE Chemicals Corporation

- Itochu Chemical Frontier Corporation

- K&O Energy Group Inc.

- Nippoh Chemicals Co. Ltd

- Parad Corporation Pvt. Ltd

- Proto Chemical Industries

- Salvi Chemical Industries Ltd

- Samrat Pharmachem Limited

- SQM SA

- TOHO Earthtech Inc.

第七章 市场机会与未来趋势

- 回收碘的需求不断增加

- 增加除生物剂的使用

The Iodine Market size is estimated at 42.87 kilotons in 2025, and is expected to reach 55.97 kilotons by 2030, at a CAGR of 5.48% during the forecast period (2025-2030).

COVID-19 had a negative influence on the market for iodine. It was mostly owing to the enforced limits, as well as large-scale shutdowns of manufacturing units. However, with rising demand for the goods, since the restrictions were lifted, the market for iodine is also growing and is likely to continue a similar trajectory over the projection period.

Key Highlights

- In the short term, the increasing demand for X-ray contrast media and increasing requirements for iodine uptake with growing iodine deficiency among people are expected to drive the demand for iodine.

- However, the toxicity of iodine and health-related issues due to excessive consumption pose major restraints to the studied market growth.

- On the other hand, the rising demand for iodine in biocides and the growing demand for recycling iodine will likely create lucrative market opportunities in the coming years.

- Europe emerged as the largest market for iodine, while Asia-Pacific is expected to witness the highest growth between 2024 and 2029.

Iodine Market Trends

The Medical Segment is Expected to Dominate the Market

- Iodine is a crucial element in the medical industry, with many applications in diagnosis and treatment. Its most common use is in producing antiseptics and disinfectants, where iodine's ability to kill bacteria, viruses, and fungi makes it an effective tool for preventing infections.

- In addition, iodine is used to produce radiocontrast materials, which are used in medical imaging procedures such as CT scans, X-rays, and angiograms. These materials contain iodine atoms, which absorb X-rays and make the internal structures of the body visible in the resulting images.

- The demand for iodine has been increasing over the rising need for X-ray contrast media because of its high atomic number, low toxicity, and ease of adjunction with organic compounds.

- Iodine is a simple, effective, and cost-efficient means of water disinfection for people who travel or work in areas where municipal water treatment is unreliable. In terms of the disinfection of drinking water, iodine is commonly used in the form of tablets or solutions during emergencies and by travelers. As the number of travelers has increased in recent years, the demand for iodine as a disinfectant has also been increasing.

- In January 2024, according to the University of Maryland School of Medicine, a large multicenter clinical trial co-led by the University of Maryland School of Medicine researchers found that an antiseptic containing iodine (iodine povacrylex in alcohol) resulted in about one-quarter fewer post-surgical infections in patients with limb fractures compared to another frequently used skin antiseptic.

- In January 2024, China National Nuclear Corporation (CNNC) started the construction of a powerful solution-type medical isotope test reactor. This initiative will produce Iodine-131 and iodine-125, among other medical isotopes. Medical isotopes are typical radioactive isotopes that are used for medical purposes. For example, iodine-131 is used for radiotherapy or imaging. It can also be used to destroy dysfunctional thyroid tissues and many other medical applications. According to CNNC, after completing the medical isotope reactor, which is estimated to be completed by 2027, it will attain an annual production capacity of 20,000 curies of iodine-131, surpassing the current domestic demand.

- According to AstraZeneca, the projected pharmaceutical sales in 2024 are expected to be USD 633 billion for North America, holding the major share, followed by the European Union (excluding the United Kingdom) with USD 287 billion at the second position, followed by Southeast and East Asia and expected to register USD 232 billion. Also, the total spending on medicines in 2020 was USD 1,265.2 billion, which is expected to generate a revenue of USD 1,595 billion in 2025.

- Hence, owing to the above-mentioned factors, the medical end-user industry is expected to dominate the market for iodine from 2024 to 2029.

Europe is Expected to Dominate the Market

- Europe is expected to dominate the iodine market between 2024 and 2029. Countries like Germany, the United Kingdom, and Italy are seeing rising demand for iodine in animal feed, medical, and biocide applications.

- According to the German Animal Feed Association (DVT), at 21.7 million metric tons (mmt), feed production in Germany in the 2023 calendar year was around 360,000 metric tons (mt), or 1.6% less than in the previous 12 months. The DVT President announced that the year-on-year contraction represents a partial easing in the long-term contraction in the German feed sector. The decline in total national feed output is attributed mainly to reduced sales of pig feeds. This segment's production was down approximately 500,000 mt or 5.8% to 8 mmt for 2023.

- Moreover, Germany has the highest wastewater reprocessing and recycling rate in Europe. More than 96% of the wastewater from private households or public facilities is discharged into nearby sewage treatment plants for processing. With the country's increasing sewage water volume, these plants are expected to exploit a larger volume of iodine-based biocides between 2024 and 2029.

- The medical industry is the largest consumer of iodine. According to data from the Association of the British Pharmaceutical Industry released in December 2023, businesses in the UK life sciences industry generated EUR 108.1 billion (USD 115.4 billion) in turnover in 2022, a 13% increase from the EUR 95.9 billion (USD 102.37 billion) turnover in 2022. Turnover has seen an upward trend since 2013 but increased sharply between 2021 and 2022. The sector that generated the highest turnover was the biopharmaceutical core sector, accounting for 43% of the total turnover generated across the life sciences industry. This was followed by the biopharmaceutical service and supply and medical technology core sectors, each accounting for 25% of turnover in 2022. Such trends affect the consumption of iodine.

- The Italian pharmaceutical industry represents a vast and reliable manufacturing base with a dedicated workforce of around 67,000 people. It is technologically advanced and has a strong leadership position in Europe and beyond.

- According to the data from the Farmindustria-Prometeia 2023 survey, the Italian pharmaceutical industry is the driving force of the country's economy. In 2023, the industry value reached EUR 50 billion (USD 55.3 billion). The Italian pharmaceutical production plays a vital role in Europe's pharmaceutical industry. The sector's output increased by 7.3% in 2023 compared to 2022, according to the Farmindustria-Prometeia 2023 survey.

- Owing to the factors mentioned above, the market for iodine in Europe is projected to grow significantly between 2024 and 2029.

Iodine Industry Overview

The iodine market is highly consolidated in nature. Some of the major players in the market (not in any particular order) are SQM SA, ISE CHEMICALS CORPORATION, Cosayach, GODO SHIGEN Co. Ltd, and Algorta Norte.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand in X-ray Contrast Media

- 4.1.2 Growing Iodine Deficiency Among People

- 4.2 Restraints

- 4.2.1 Toxicity of Iodine and Health-related Issues

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Source

- 5.1.1 Underground Brine

- 5.1.2 Caliche Ore

- 5.1.3 Recycling

- 5.1.4 Seaweeds

- 5.2 Form

- 5.2.1 Inorganic Salts and Complexes

- 5.2.2 Organic Compounds

- 5.2.3 Elementals and Isotopes

- 5.3 End-user Industry

- 5.3.1 Animal Feed

- 5.3.2 Medical

- 5.3.3 Biocides

- 5.3.4 Optical Polarizing Films

- 5.3.5 Fluorochemicals

- 5.3.6 Nylon

- 5.3.7 Other End-user Industry

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers And Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Algorta Norte

- 6.4.2 Calibre Chemicals Pvt. Ltd

- 6.4.3 Cosayach

- 6.4.4 Deep Water Chemicals

- 6.4.5 Eskay Iodine

- 6.4.6 Glide Chem Private Limited

- 6.4.7 Godo Shigen Co. Ltd

- 6.4.8 Iochem Corporation

- 6.4.9 Iofina

- 6.4.10 ISE Chemicals Corporation

- 6.4.11 Itochu Chemical Frontier Corporation

- 6.4.12 K&O Energy Group Inc.

- 6.4.13 Nippoh Chemicals Co. Ltd

- 6.4.14 Parad Corporation Pvt. Ltd

- 6.4.15 Proto Chemical Industries

- 6.4.16 Salvi Chemical Industries Ltd

- 6.4.17 Samrat Pharmachem Limited

- 6.4.18 SQM SA

- 6.4.19 TOHO Earthtech Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Recycling Iodine

- 7.2 Rise in the Usage of Biocides