|

市场调查报告书

商品编码

1537602

二甲醚:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Dimethyl Ether - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

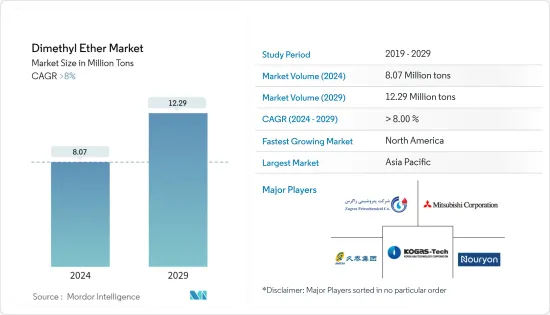

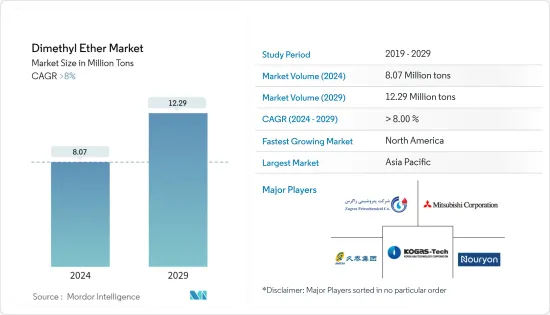

预计2024年全球二甲醚市场规模将达到807万吨,2029年将达到1,229万吨,2024-2029年预测期间复合年增长率超过8%。

COVID-19 对市场产生了负面影响,考虑到大流行的情况,随着人们出行频率的减少,汽车行业对基于 DME 的液化石油气燃料的需求减少。然而,在封锁放鬆后,该行业出现反弹,全球燃料需求不断增加。

主要亮点

- 短期内,对液化石油气混合用途应用的需求不断增长以及对非电动和电动车日益增长的兴趣正在推动市场成长。

- 改造现有基础设施以使用 DME 的高昂成本以及电动车使用量的增加可能会成为市场的限制因素。

- 未来几年可能是市场的机会,因为越来越多的研究使用二甲醚作为替代燃料,但市场尚未建立。

- 由于对燃料、液化石油气等的强劲需求,亚太地区可能在预测期内主导调查市场。

二甲醚市场趋势

液化石油气混合领域占市场主导地位

- 液化石油气 (LPG) 是二甲醚 (DME) 的重要应用之一,在许多应用中,二甲醚可以预先指定的比例与常规 LPG 混合。

- 二甲醚作为替代燃料添加剂混入液化石油气中,可增强燃烧、减少有害排放,并减少对液化石油气的依赖。目前,DME-LPG 混合物中使用的 DME 大约为 15-25%,但更高的混合物正在研究中,因为更好的混合物可能需要改变所使用的设备。

- DME 用于车辆用丙烷汽车燃气的液化石油气混合物中。据丙烷教育和研究委员会称,美国道路上有近 26 万辆液化石油气车辆配备经过认证的燃料系统。许多用于车队应用,例如校车、接驳车和警车。

- 同样,根据欧洲替代燃料观测站(EAFO)的数据,2022年匈牙利液化石油气(LPG)汽车的数量将为23,194辆。不过,与 2021 年的 24,141 套相比,这是最低的。

- 中国、印度、印尼等国正积极推广使用二甲醚作为替代燃料。

- 根据中国国家统计局的数据,2023年12月中国液化石油气(LPG)产量为443万吨,较2023年11月的415万吨增加。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区主导市场

- 二甲醚 (DME) 来自各种最终用途,例如液化石油气混合、推进剂和燃料,其中亚太地区消耗量最大。在亚太地区,中国占了最大的需求份额,其次是日本、韩国和印度。

- 中国是第一个开始商业规模使用二甲醚混合液化石油气的国家。中国的二甲醚需求大部分用于家庭使用(液化石油气混合烹饪燃气供应)。在中国,20%的二甲醚混合液化石油气产品用于此目的。

- 根据石油规划和分析小组的数据,截至 2023 年 10 月,PSU OMC(IOCL、BPCL、HPCL)的国内液化石油气客户群总计达 31.54 亿,有 25,425 家液化石油气经销商为其提供服务。

- 据经济产业省预计,2022年日本液化石油气(LPG)产量将为307万吨。

- 印尼是另一个积极推广二甲醚混合液化石油气以满足其能源需求的亚洲国家。 Air Products and Chemicals 和 PT Bukit Asam 等公司正在进行以煤炭生产二甲醚用于液化石油气混合的计划。

- 因此,由于上述因素,预计该地区的 DME 需求在预测期内将会增加。

二甲醚行业概况

二甲醚市场部分整合,前五家公司占据主要份额。市场主要企业包括(排名不分先后)韩国天然气公司、ZPCIR、九台能源集团、三菱商事株式会社和诺力昂。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章 研究方法

第三章执行摘要

第四章市场动态

- 促进因素

- 液化石油气混合用途需求增加

- 人们对非电动和电动车的兴趣日益浓厚

- 其他的

- 抑制因素

- 修改现有基础设施以使用 DME 的成本很高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商议价能力

- 消费者议价能力

- 新进入的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 目的

- 推进剂

- 液化石油气混合物

- 燃料

- 其他用途

- 起源

- 天然气

- 煤炭

- 生物基产品

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 合併、收购、合资、合作伙伴关係和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- DME-AEROSOL

- Grillo-Werke AG

- Jiutai Energy Group

- KOREA GAS CORPORATION

- Mitsubishi Corporation

- Nouryon

- Oberon Fuels, Inc.

- PCC Group

- Shell plc

- The Chemours Company

- ZPCIR

第七章 市场机会及未来趋势

- 加强二甲醚作为替代燃料的研究

- 未成熟市场为 DME 成长提供巨大潜力

The Dimethyl Ether Market size is estimated at 8.07 Million tons in 2024, and is expected to reach 12.29 Million tons by 2029, growing at a CAGR of greater than 8% during the forecast period (2024-2029).

COVID-19 negatively impacted the market, and considering the pandemic scenario, the demand for DME-based LPG fuel from the automotive segment decreased as people were not traveling frequently. However, after the easing of lockdowns, the industry picked up, and the fuel demand has increased worldwide.

Key Highlights

- Over the short term, the growing demand for LPG blending applications and increasing interest in non-electric and electric vehicles are driving the market growth.

- High costs for altering current infrastructure to use DME and increasing EV use can act as a restraint for the market.

- Growing research for using DME as an alternative fuel and an under-established market will likely create opportunities for the market in the coming years.

- Asia-Pacific is likely to dominate the market studied during the forecast period with robust demand for fuel, LPG, and others.

Dimethyl Ether Market Trends

LPG Blending Segment to Dominate the Market

- Liquefied petroleum gas (LPG) is one of the significant applications of dimethyl ether (DME), which can be blended with traditional LPG at a pre-specified ratio for many applications.

- DME is blended with LPG as an alternative fuel additive for enhancing combustion, reducing hazardous emissions, and reducing dependency on LPG. Currently, around 15-25% of DME is utilized in DME-LPG blends, with higher ratio blends being researched, as a better blend may require equipment changes for usage.

- DME is used for LPG blending that is in Propane autogas in vehicles. According to the Propane Education and Research Council, there are nearly 260,000 on-road LPG vehicles with certified fuel systems in the United States. Many are used in fleet applications, such as school buses, shuttles, and police vehicles.

- Similarly, according to the European Alternative Fuels Observatory (EAFO), the number of liquefied petroleum gas (LPG) vehicles in Hungary will be 23,194 in 2022. However, the number is lowest when compared to 24,141 in 2021.

- Countries like China, India, and Indonesia are aggressively pushing for the use of DME as an alternate fuel, as these countries are highly dependent on imports to meet their local LPG demand.

- According to the National Bureau of Statistics of China, the liquefied petroleum gas (LPG) production output in China was 4.43 million metric tons in December 2023 and registered growth when compared to 4.15 million metric tons in November 2023.

- Therefore, the factors above are expected to impact the market significantly in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the largest consumption share of dimethyl ether (DME) from various end-use applications such as LPG blending, propellants, fuels, and others. In Asia-Pacific, China has a significant share of demand, followed by Japan, South Korea, and India, among others.

- China is the first country to start using DME-blended LPG on a commercial scale. The majority of China's DME demand is from households (for LPG blended cooking gas supply). In China, 20% of DME blended LPG products are used for this purpose.

- According to the Petroleum Planning and Analysis Cell, as of October 2023, PSU OMCs (IOCL, BPCL, and HPCL) together have 31.54 crore active LPG customers in the domestic category whom 25,425 LPG distributors are serving.

- According to the METI (Japan), the production volume of liquified petroleum gas (LPG) in Japan accounted for 3.07 million metric tons in 2022.

- Indonesia is another Asian country aggressively pushing for DME blended LPG for its energy needs. Companies, such as Air Products and Chemicals and PT Bukit Asam, are moving forward with significant projects in the country to produce DME from coal for LPG blending applications.

- Thus, the demand for DME in the region is expected to increase during the forecast period due to the factors mentioned above.

Dimethyl Ether Industry Overview

The dimethyl ether market is partially consolidated, with the top five players accounting for a significant share. Some of the key players in the market include (not in any particular order) KOREA GAS CORPORATION, ZPCIR, Jiutai Energy Group, Mitsubishi Corporation, and Nouryon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from LPG Blending Applications

- 4.1.2 Increasing Interest in Non-Electric and Electric Vehicles

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 High Costs for the Alteration of Current Infrastructure to Use DME

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Propellants

- 5.1.2 LPG Blending

- 5.1.3 Fuel

- 5.1.4 Other Applications

- 5.2 Source

- 5.2.1 Natural Gas

- 5.2.2 Coal

- 5.2.3 Bio-based Products

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 DME-AEROSOL

- 6.4.2 Grillo-Werke AG

- 6.4.3 Jiutai Energy Group

- 6.4.4 KOREA GAS CORPORATION

- 6.4.5 Mitsubishi Corporation

- 6.4.6 Nouryon

- 6.4.7 Oberon Fuels, Inc.

- 6.4.8 PCC Group

- 6.4.9 Shell plc

- 6.4.10 The Chemours Company

- 6.4.11 ZPCIR

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research for Use of DME as an Alternative Fuel

- 7.2 Under Established Market Offers Huge Potential for DME Growth