|

市场调查报告书

商品编码

1537606

防冰涂料:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Anti-icing Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

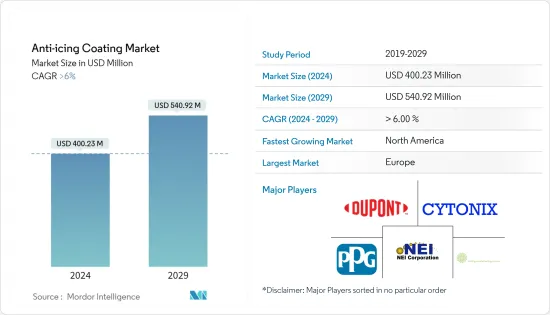

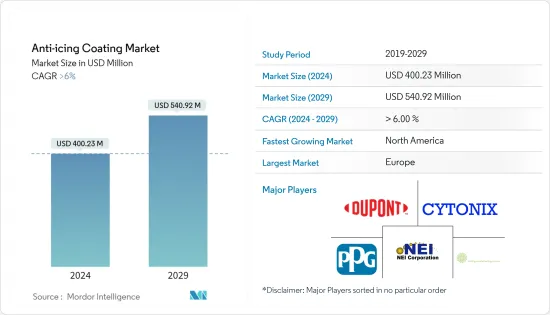

预计2024年全球防冰涂料市场规模将达到4.023亿美元,并在2024-2029年预测期内以超过6%的复合年增长率成长,到2029年将达到5.4092亿美元。

主要亮点

- 由于全球停工、严格的社会隔离措施和供应链中断,COVID-19 大流行对市场产生了负面影响。全国隔离期间原物料价格上涨也对防冰被覆剂市场产生了负面影响。

- 不过,限购解除后,市场稳定復苏。在汽车、交通、建筑、IT/通讯和可再生能源产业防冰被覆剂消费增加的推动下,市场显着反弹。

- 汽车和航太领域不断增长的需求、寒冷地区的高需求以及防冰涂料的优越性能预计将推动防冰涂料市场的发展。

- 具有成本效益的替代品的可用性预计将阻碍市场的成长。

- 在预测期内,自持润滑防冻层的开拓预计将在市场上创造机会。

- 欧洲地区在市场上占据主导地位,因为该地区寒冷的气候条件下防冰涂料的应用不断增加,这增加了防冰涂料的需求。

防冰涂料市场趋势

汽车和交通运输产业主导市场

- 防冰涂料有助于降低能源成本和消费量,提升技术产品的性能,提高产品安全性,提振防冰涂料市场。

- 由于在寒冷气候条件下广泛使用防冰被覆剂,汽车和运输业成为主导产业。清洁能源部长级 (CEM) 下的倡议,例如电动车倡议和电动车的日益普及,可能会在不久的将来推动防冰被覆剂的消费。

- 全球汽车产量的成长预计将推动防冰被覆剂市场的发展。根据国际汽车製造商组织(OICA)预测,2022年全球汽车产量将达8,501万辆,较2021年的8,021万辆成长6%。中国、美国和印度是世界上最重要的汽车市场。

- 中国汽车及零件生产和出口居世界领先地位。中国仍然是全球最大的汽车市场。根据OICA统计,2022年中国汽车产量总合2,702万辆,与前一年同期比较同期成长3%。

- 美国是仅次于中国的全球第二大汽车市场,在全球汽车市场中占有很大份额。根据OICA统计,2022年美国汽车产量达1,006万辆,而2021年产量为915万辆,成长率为9%。这促进了汽车工业的成长,刺激了防冰涂料的市场需求。

- 最近,飞机製造商一直在寻找加速生产的方法,以填补积压订单。例如,波音《2022-2041 年商业展望》预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。因此,飞机产量的增加预计将推动当前的研究市场。

- 因此,由于上述因素,汽车和交通运输终端用户产业预计将带动防冰涂料市场。

欧洲地区主导市场

- 欧洲地区预计将主导防冰被覆剂市场。航太、通讯、电力线路、建筑和海上平台等许多行业的应用不断扩大,预计将推动防冰被覆剂的需求。

- 德国汽车製造业是整个欧洲地区汽车生产的最大股东。该国是大众、梅赛德斯-奔驰、奥迪、宝马和保时捷等主要汽车製造品牌的所在地。 OICA预计,2022年汽车和轻型商用车总产量将达367万辆,而2021年为330万辆,成长率为11%。因此,汽车产业的成长也推动了防冰被覆剂的需求。

- 同样,在法国,汽车工业也录得强劲成长。根据OICA统计,2022年全国汽车产量138万辆,与前一年同期比较同期成长2%。由于车辆成本上涨,2022 年乘用车、轻型商用车、大型商用车、巴士和客车的销售量下降。

- 德国是欧洲建筑业规模最大的国家。在新住宅建设活动增加的推动下,该国的建筑业继续温和增长。例如,根据欧盟统计局的数据,2022年建筑施工收入为1,140亿美元,预计2024年将达到1,254亿美元。因此,建筑业的成长可能会推动当前的研究市场。

- 在欧洲,随着空中交通量的增加,对飞机的需求也增加。根据波音《2022-2041年商业展望》,预计到2041年新飞机交付总量将达到8,550架,市场服务价值将达到8,500亿美元,从而增加该地区对防冰被覆剂的需求。

- 防冰涂层广泛应用于风力发电机叶轮,以防止结冰对机械强度的影响,降低维护成本并确保平稳运作。欧洲的风力发电能力正在增加。 2022年,欧洲新增风电装置容量19吉瓦。此外,欧洲的目标是在 2023 年至 2027 年间安装 129GW(吉瓦)的新风力发电厂。因此,风力发电产业的成长预计将推动该地区防冰涂料市场的发展。

- 因此,所有这些市场趋势预计将在预测期内推动该地区防冰涂料市场的需求。

防冰涂料产业概况

防冰涂料市场得到部分完整。该市场的主要企业包括(排名不分先后)NEI Corporation、Cytonix、PPG Industries, Inc.、DuPont 和 NanoSonic, Inc.。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车和航太领域的需求不断增长

- 寒冷地区需求量大

- 防冰涂层的优异性能

- 抑制因素

- 具有成本效益的替代方案的可用性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:以金额为准)

- 基板

- 金属

- 玻璃

- 陶瓷

- 混凝土的

- 最终用户产业

- 汽车/交通

- 建造

- 通讯

- 可再生能源

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 其他领域

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aerospace & Advanced Composites GmbH

- Battelle Memorial Institute

- CG2 Nanocoatings

- Cytonix

- DuPont

- Fraunhofer

- Helicity Technologies, Inc.

- HygraTek

- NanoSonic, Inc.

- NEI Corporation

- Opus Materials Technologies

- PPG Industries, Inc.

第七章 市场机会及未来趋势

- 永续自润滑防冰层的开发

- 其他机会

简介目录

Product Code: 69435

The Anti-icing Coating Market size is estimated at USD 400.23 million in 2024, and is expected to reach USD 540.92 million by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the market due to worldwide lockdowns, strict social distancing measures, and disruptions in supply chains, which had adverse effects on the market for anti-icing coatings. The prices of raw materials increased during the lockdown, further contributing to the negative impact on the anti-icing coatings market.

- However, the market recovered well after the restrictions were lifted. It rebounded significantly, driven by increased consumption of anti-icing coatings in the automotive, transportation, construction, telecommunication, and renewable energy industries.

- The growing demand from the automotive and aerospace sectors, high demand in cold climatic conditions, and the superior properties of anti-icing coatings are expected to drive the market for anti-icing coatings.

- The availability of cost-effective alternate substitutes for anti-icing coatings is expected to hinder market growth.

- The development of a self-sustainable lubricating anti-icing layer is expected to create opportunities for the market during the forecast period.

- The European region dominates the market, owing to the growing application of anti-icing coatings in cold climatic conditions in the region, which augments the demand for anti-icing coatings.

Anti-Icing Coating Market Trends

Automotive and Transportation Industries to Dominate The Market

- Anti-icing coatings help reduce the cost and consumption of energy, enhance the performance of technical goods, and contribute to product safety, which will provide a boost to the anti-icing coating market.

- The automotive and transportation industry stands to be the dominant segment owing to the extensive consumption of anti-icing coatings in vehicles under cold climatic conditions. The initiatives under the Clean Energy Ministerial (CEM), like the electric vehicle initiative and the growing popularity of electric vehicles, are likely to drive the consumption of anti-icing coatings in the near future.

- The increase in the global production of automotive vehicles is expected to drive the market for anti-icing coatings. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global automotive vehicle production reached 85.01 million in 2022, compared to 80.21 million manufactured in 2021, at a growth rate of 6%. China, the United States, and India are the most prominent automotive vehicle markets globally.

- China is the world's leading producer and exporter of automobiles and their parts. China continues to be the world's largest vehicle market. According to OICA, automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- The United States is the second-largest automotive market in the world after China, which occupies a significant share of the global automotive vehicles market. According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%. This enhanced the growth of the automobile industry, which has stimulated the market demand for anti-icing coatings.

- Furthermore, recently, aircraft manufacturers have been looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. Thus, the increased aircraft production is expected to drive the current studied market.

- Hence, owing to the above-mentioned factors, the automotive and transportation end-user industry is expected to drive the market for anti-icing coatings.

Europe Region to Dominate the Market

- The European region is expected to dominate the market for anti-icing coatings. The increasing application in many industries, including aerospace, telecommunications, power lines, construction, and offshore platforms, is expected to propel the demand for anti-icing coatings.

- The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc. According to OICA, the total production volume of cars and light commercial vehicles reached 3.67 million units in 2022, compared to 3.30 million units manufactured in 2021, at a growth rate of 11%. Therefore, such growth in the automotive industry has also been driving the demand for anti-icing coatings.

- Similarly, in France, the automotive industry registered a significant growth rate. According to OICA, the total production of vehicles in the country amounted to 1.38 million units in 2022, registering a growth of 2% from the previous year. Passenger cars, light commercial vehicles, heavy commercial vehicles, buses, and coaches witnessed a decline in 2022 sales in the country owing to the growing cost of vehicles.

- Germany has the most significant construction industry in Europe. The country's construction industry has been growing slowly, driven by increasing new residential construction activities. For instance, according to Eurostat, the building construction revenue is registered at USD 114 billion in 2022 and is expected to reach USD 125.4 billion by 2024. Thus, growth in the construction industry is likely to drive the current studied market.

- In Europe, with the increase in air traffic, the demand for aeroplanes is increasing in the country. According to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion, thereby increasing the demand for anti-icing coatings in the region.

- Anti-icing coatings are widely used on rotor blades of wind turbines to protect against the effect of icing on mechanical strength, reduce maintenance costs, and ensure smooth operations. Europe is increasing its wind energy generation capacity. In 2022, Europe installed 19 gigawatts of new wind energy capacity. Furthermore, Europe aims to install 129 GW (gigawatts) of new wind farms over the period 2023-2027. Thus, the growth in the wind energy sector is expected to drive the anti-icing coating market in the region.

- Hence, all such market trends are expected to drive the demand for the anti-icing coating market in the region during the forecast period.

Anti-Icing Coating Industry Overview

The anti-icing coating market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) NEI Corporation, Cytonix, PPG Industries, Inc., DuPont, and NanoSonic, Inc., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing demand from Automotive and Aerospace Sector

- 4.1.2 High Demand in Cold Climatic Conditions

- 4.1.3 Superior Properties of Anti-icing Coatings

- 4.2 Restraints

- 4.2.1 Availability of Cost-Effective Alternate Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Substrate

- 5.1.1 Metal

- 5.1.2 Glass

- 5.1.3 Ceramics

- 5.1.4 Concrete

- 5.2 End User Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Construction

- 5.2.3 Telecommunication

- 5.2.4 Renewable Energy

- 5.2.5 Other End-User Industries (Marine, Industrial, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aerospace & Advanced Composites GmbH

- 6.4.2 Battelle Memorial Institute

- 6.4.3 CG2 Nanocoatings

- 6.4.4 Cytonix

- 6.4.5 DuPont

- 6.4.6 Fraunhofer

- 6.4.7 Helicity Technologies, Inc.

- 6.4.8 HygraTek

- 6.4.9 NanoSonic, Inc.

- 6.4.10 NEI Corporation

- 6.4.11 Opus Materials Technologies

- 6.4.12 PPG Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Self Sustainable Lubricating Anti-Icing Layer

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219