|

市场调查报告书

商品编码

1537608

滑爽添加剂:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Slip Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

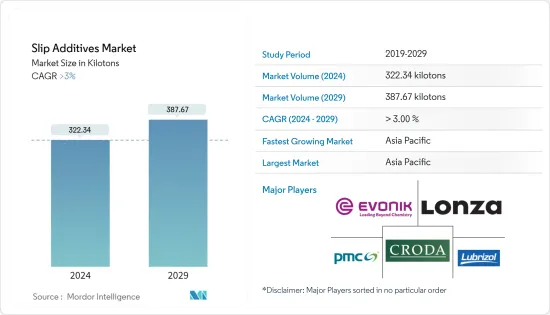

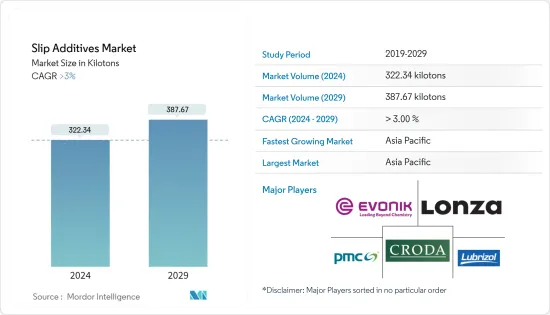

预计2024年全球滑爽添加剂市场规模将达322.34千吨,2029年将达到387.67千吨,2024-2029年预测期间复合年增长率将超过3%。

COVID-19 大流行对滑爽添加剂市场产生了正面影响。封锁期间,消费品、药品、食品和饮料等网路销售增加了对包装产品的需求,而滑爽添加剂的市场前景乐观。 COVID-19大流行后,由于包装和非包装应用的需求增加,市场进一步成长。

食品和饮料包装行业需求的增加以及与替代品相比价格更低的供应预计将推动硅胶涂料市场的发展。

有关塑胶使用的严格环境法规预计将阻碍市场成长。

生物基滑爽添加剂的市场开拓以及医疗应用中塑胶薄膜需求的增加预计将在预测期内为市场创造机会。

预计亚太地区将主导市场。此外,包装和非包装应用中对滑爽添加剂的需求不断增长,预计在预测期内仍将保持最高复合年增长率。

滑爽添加剂市场趋势

包装应用主导市场

- 推动滑爽添加剂需求增加的主要因素是其在食品和饮料行业中的使用量增加。塑胶包装有助于延长包装产品的保质期并减少食品洩漏。

- 包装产业的一个重要趋势是禁止使用一次性塑料,以在不影响产品安全和卫生的情况下减少包装废弃物。这些因素预计将增加对聚烯塑胶包装薄膜的需求。滑爽添加剂用于减少摩擦,似乎有助于赋予包装材料所需的性能。

- 包装行业预计将是滑爽添加剂应用最广泛的领域。聚合物薄膜主要用于包装和标籤。滑爽添加剂在聚乙烯薄膜和铸膜生产中的重要作用是赋予薄膜表面滑爽性能。

- 食品包装市场在未来几年可能会出现显着的成长。根据食品服务包装协会预测,2022年全球食品包装市场销售额预计将达3.638亿美元,2026年将达到4.583亿美元。因此,食品包装市场的成长预计将推动当前的研究市场。

- 在製药业,聚乙烯和聚丙烯包装被广泛用作初级包装材料。这些包装材料用途广泛、性能优异,可用于医疗和製药应用。塑胶薄膜可保护药品免受氧气、异味、湿气、水蒸气传输、污染和细菌的影响。塑胶薄膜用于各种塑胶包装产品,例如滴管和注射器。近年来,全球医药市场显着成长。 2022年,全球医药市场规模达1.48兆美元,与前一年同期比较同期成长4.2%。

- 因此,对食品和饮料包装以及药品包装应用的需求不断增加将推动对滑爽添加剂的需求。

亚太地区主导市场

- 亚太地区是全球最大的滑爽添加剂市场。中国、印度和日本是该地区最大的滑爽添加剂市场。

- 在亚太地区,不断增长的中阶人口、快速工业化以及包装产品使用量的增加等因素预计将推动包装行业的发展,导致滑爽添加剂市场的成长前景各不相同。

- 中国和印度是该地区最大的食品和饮料市场。根据中国国家轻工业委员会统计,年销售额超过280万美元的主要食品生产企业2022年收益超过1.53兆美元。与2021年相比,总收入年与前一年同期比较5.6%,显示食品业成长强劲。因此,食品和饮料行业的成长预计将增加食品和饮料包装应用中使用的滑爽添加剂的需求。

- 同样,药品包装应用中对滑爽添加剂的需求也在增加。印度是世界製药中心,向 200 多个国家出口药品。 2023年上半年,流入医药产业的外商直接投资成长25%。根据IBEF预测,到2024年,製药业的收益预计将达到650亿美元。因此,医药市场的扩大将带动目前的研究市场。

- 日本目前是世界第三大电子商务市场。预计2023年,日本电子商务市场收益将达到2,322亿美元,到2027年将进一步达到3,554亿美元。消费者在日本化妆品市场购买产品时也变得更加挑剔和注重价值。因此,电商市场的扩大将促进日本的包装应用,带动滑爽添加剂市场。

- 由于上述因素,亚太滑爽添加剂市场预计在预测期内将显着成长。

滑爽添加剂产业概况

滑爽添加剂市场因其性质而部分分散。该市场的主要企业包括(排名不分先后)Croda International Plc、Evonik Industries AG、Lonza、PMC Group, Inc. 和 The Lubrizol Corporation。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料包装产业需求增加

- 与替代品相比,价格较低

- 其他司机

- 抑制因素

- 关于塑胶使用的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 载体树脂

- 聚乙烯

- 聚丙烯

- 其他载体树脂

- 类型

- 脂肪酰胺

- 蜡聚硅氧烷

- 其他类型

- 目的

- 包装

- 食品/饮料

- 消费品

- 卫生保健

- 展开的

- 包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Afron

- ALTANA

- BASF SE

- Croda International Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Fine Organics

- Honeywell International

- Lonza

- The Lubrizol Corporation

- PMC Group, Inc.

第七章市场机会与未来趋势

- 生物基滑爽添加剂的开发

- 医疗应用对塑胶薄膜的需求增加

The Slip Additives Market size is estimated at 322.34 kilotons in 2024, and is expected to reach 387.67 kilotons by 2029, growing at a CAGR of greater than 3% during the forecast period (2024-2029).

The COVID-19 pandemic had a positive impact on the slip additives market. During the lockdown, the online sales of consumer goods, pharmaceuticals, food, and beverage products increased the demand for packaged products, thus creating a positive market outlook for slip additives. Post-COVID-19 pandemic, the market further registered a growth rate due to rising demand from packaging and non-packaging applications.

Increasing demand from the food and beverage packaging industry and the availability at low prices compared to substitutes are expected to drive the market for silicone coatings.

The stringent environmental regulations on the use of plastics are expected to hinder the market's growth.

The development of bio-based slip additives and the increasing demand for plastic films in medical applications are expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for slip additives in packaging and non-packaging applications.

Slip Additives Market Trends

Packaging Application to Dominate the Market

- The increasing demand for slip additives is majorly attributed to the growing usage in the food & beverage industry. Plastic packaging helps increase the shelf life of the products packed and reduces leakages of food products.

- One of the significant trends in the packaging industry is the ban on the usage of single-use plastic to reduce packaging waste without compromising the safety and hygiene of the products. These factors will increase the demand for polyolefin plastic packaging films. The slip additives are used to decrease friction and will likely help to get the desired properties in the packaging material.

- The packaging segment is anticipated to be the most extensive application of slip additives. Polymer films are mainly preferred in the packaging industry for packing and labeling. The critical function of slip additives in the production of polyethylene and cast film is to deliver slip properties to the film surface.

- The food packaging market is likely to register a significant growth rate in the coming years. According to the Foodservice Packaging Association, the global food packaging market revenue is recorded at USD 363.8 million in 2022, and it is projected to reach USD 458.3 million by 2026. Thus, the growth in the food packaging market will drive the current studied market.

- In the pharmaceutical industry, polyethylene and polypropylene packaging are widely used as primary packaging materials. These packaging materials are versatile, high-performance, and used in medical and pharmaceutical applications. The plastic films protect the pharmaceutical product against oxygen and odor, moisture, water vapor transmission, contamination, and bacteria. They are used in various plastic packaging products, including eyedroppers, syringes, and others. The global pharmaceutical market has grown significantly in recent years. In 2022, the global pharmaceutical market registered at USD 1.48 trillion, at a growth rate of 4.2% compared to the previous year.

- Thus, the growing demand for food and beverage packaging and pharmaceutical packaging applications will drive the demand for slip additives.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific is the largest market for slip additives in the world. China, India, and Japan are the largest markets for slip additives in the region.

- In the Asia-Pacific region, factors such as the growing middle-class population, rapid industrialization, and the increasing usage of packed products are expected to drive the packaging industry, providing various growth prospects to the slip additives market.

- China and India are the largest food and beverage markets in the region. According to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6%, indicating strong growth in the food industry. Thus, the growth of the food and beverage industries is expected to increase the demand for slip additives used in food and beverage packaging applications.

- Similarly, the demand for slip additives is increasing in pharmaceutical packaging applications. India is a global pharmaceutical hub, exporting pharmaceuticals to over 200 countries. In the first half of FY 2023, foreign direct investment inflows into the pharmaceutical industry increased by 25%. According to IBEF, the pharmaceutical industry revenue is expected to reach USD 65 billion by 2024. Thus, the increasing market for pharmaceuticals will drive the current studied market.

- Japan is currently the world's third most prominent e-commerce market in the world. Revenue in the e-commerce market in Japan was expected to generate USD 232.20 billion by 2023 and is further expected to reach USD 355.40 billion by 2027. Also, consumers purchasing goods within the cosmetics market in Japan are becoming more selective and value-conscious. Thus, the increasing e-commerce market will drive the packaging application in the country, thereby driving the market for slip additives.

- Owing to the factors mentioned above, the slip additives market in the Asia-Pacific is projected to grow significantly during the forecast period.

Slip Additives Industry Overview

The slip additives market is partially fragmented in nature. Some of the major players in the market include (not in any particular order) Croda International Plc, Evonik Industries AG, Lonza, PMC Group, Inc., and The Lubrizol Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Food & Beverage Packaging Industry

- 4.1.2 Availability at Low Price Compared to Substitutes

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations on The Use of Plastics

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Carrier Resin

- 5.1.1 Polyethylene

- 5.1.2 Polypropylene

- 5.1.3 Other Carrier Resins (Polyvinyl Chloride, Polyamide,etc.)

- 5.2 Type

- 5.2.1 Fatty Amides

- 5.2.2 Waxes and Polysiloxanes

- 5.2.3 Other Types (Esters, Salts, etc.)

- 5.3 Application

- 5.3.1 Packaging

- 5.3.1.1 Food and Beverage

- 5.3.1.2 Consumer Goods

- 5.3.1.3 Healthcare

- 5.3.2 Non-Packaging

- 5.3.1 Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Afron

- 6.4.2 ALTANA

- 6.4.3 BASF SE

- 6.4.4 Croda International Inc.

- 6.4.5 Emery Oleochemicals

- 6.4.6 Evonik Industries AG

- 6.4.7 Fine Organics

- 6.4.8 Honeywell International

- 6.4.9 Lonza

- 6.4.10 The Lubrizol Corporation

- 6.4.11 PMC Group, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Slip Additives

- 7.2 The Increasing Demand for Plastic Films in Medical Applications