|

市场调查报告书

商品编码

1537609

聚异丁烯(PIB):市场占有率分析、产业趋势/统计、成长预测(2024-2029)Polyisobutylene (PIB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

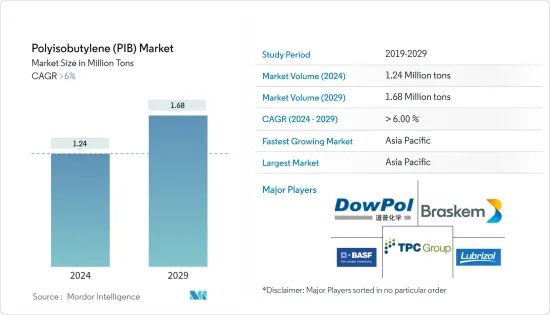

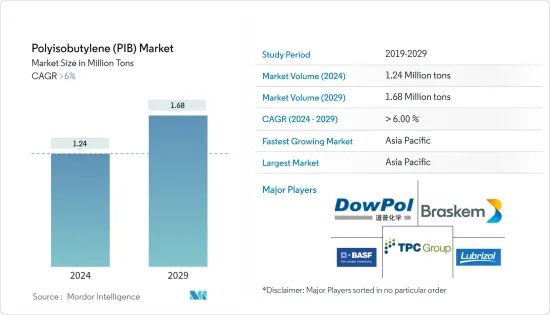

预计2024年全球聚异丁烯(PIB)市场规模将达到124万吨,2029年将达到168万吨,2024-2029年的复合年增长率将超过6%。

主要亮点

- 由于遏制措施和经济中断,黏剂、密封剂和润滑剂等行业被迫推迟生产,导致生产和运输放缓,市场受到了 COVID-19 大流行的负面影响。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

- 推动所研究市场的主要因素是黏剂和密封剂行业需求的不断增长。

- 另一方面,聚异丁烯(PIB)由于缺乏抗紫外线能力而不稳定,阻碍了市场成长。

- 聚异丁烯(PIB)有望作为皮革製造人员编制中羊毛脂的替代,为市场成长提供各种机会。

- 亚太地区主导全球市场,最大的消费来自中国、日本、韩国和印度等国家。

聚异丁烯(PIB)市场趋势

对黏剂和密封剂产业的需求增加

- 预计黏剂和密封剂产业在预测期内将出现巨大需求。聚异丁烯(PIB)在黏剂和密封剂行业的主要用途包括密封接缝、密封和保护电线以及防潮车身腔体。

- 聚异丁烯(PIB)以压敏黏着剂和热熔黏剂的形式用于黏剂系统。由于其黏性、柔韧性和低内聚力,主要用于胶合剂和黏剂。

- 2023年6月,汉高宣布在中国增设一座新的黏剂製造工厂。汉高黏合剂技术公司的新製造工厂位于中国山东省烟台化学工业园区。新工厂「鲯鹏」的建设成本预计约为8.7亿元人民币(1.19亿美元)。新厂增加了汉高在中国高抗衝黏剂产品的产能,并进一步优化其供应链,以满足国内外市场不断增长的需求。

- 2023年5月,黏剂製造商乔瓦特宣布将在中国建立自己的黏剂中心,扩大在亚太地区的业务。位于亚洲的新黏剂中心占地超过11,000平方公尺,预计于2023年完工。

- 亚太地区住宅的成长预计将受到压敏黏着剂和热熔黏剂的推动。聚异丁烯 (PIB) 密封剂用于防潮、橡胶屋顶修復和屋顶薄膜维护。

- 亚太地区是全球最大的办公大楼市场。根据高纬环球 (Cushman & Wakefield) 的报告,预计到 2030 年,亚太地区平均每年将有 1.2 亿平方英尺的办公建筑面积。因此,随着办公活动的增加,办公用品中聚异丁烯(PIB)的需求也预计将大幅增加。

- 各建设公司都认为欧洲办公空间有着长远的未来。此外,多家公司正在投资商业领域的建设计划,推动了对聚异丁烯(PIB)的需求。

- 中国是办公空间建设的领先国家之一。中国武汉復星外滩中心T1等办公空间的建设预计将推动所研究的市场的发展。该计划的建设工作预计将于2021年第三季开始,并于2025年第四季完工。

- 此外,根据中国国家统计局的数据,2022年中国建筑业产值达到高峰约4.11兆美元。结果,这些因素往往会增加市场需求。

- 预计黏剂和密封剂产业将在预测期内主导全球聚异丁烯(PIB)市场。

亚太地区主导市场

- 在预测期内,聚异丁烯(PIB)市场预计将由亚太地区主导。这是因为该地区主导着黏剂、密封剂、润滑剂和燃料添加剂等应用市场。

- 2023年3月,Pidilite宣布在印度生产Jowat黏剂。黏剂将在 Pidilite 位于古吉拉突邦皮的製造工厂生产。该公司进一步宣布,黏剂将以 Pidilite 品牌生产。

- 聚异丁烯(PIB)广泛用于润滑油中,调节和提高润滑油的黏度至所需的最终黏度。由于更好和改进的性能,例如降低可燃性、减少齿轮磨损和延长使用寿命,润滑油市场目前对高性能润滑油的需求不断增加。

- 聚异丁烯(PIB)被添加到燃料中以改善其黏弹性。聚异丁烯 (PIB) 衍生物用作无灰分散剂(例如 PIBSA),以最大限度地减少沉积物并防止油稠化和油泥形成。

- 因此,汽车行业的成长预计将拉动市场需求。中国是世界上最大的汽车製造国。由于对环境问题的日益关注,该国的汽车行业正在专注于製造在确保燃油效率的同时最大限度地减少排放气体的产品,并正在努力改进其产品。

- 根据OICA(国际汽车构造组织)统计,2022年汽车产量达2,702.1万辆,汽车销售量达2,686.4万辆,与前一年同期比较同期成长3.4%及2.1%。

- 因此,上述聚异丁烯(PIB)应用需求的成长预计将推动亚太地区的市场成长。

聚异丁烯(PIB)产业概况

聚异丁烯(PIB)市场较为分散。研究市场的主要企业包括(排名不分先后)BASF股份公司、Braskem、Dowpol Corporation、TPC Group 和 The Lubrizol Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对黏剂和密封剂的需求增加

- 交通运输领域对 PIB 的需求不断增加

- 其他司机

- 抑制因素

- 聚异丁烯 (PIB) 不稳定,不具备抗紫外线能力

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 目的

- 轮胎内胎

- 黏剂/密封剂

- 润滑剂

- 塑化剂

- 燃料添加剂

- 电绝缘

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Braskem

- Dowpol Corporation

- TPC Group

- The Lubrizol Corporation

- Exxon Mobil Corporation

- JX Nippon Oil & Gas Exploration Corporation

- Kemipex

- SABIC

- Zhejiang Shunda New Material Co., Ltd.

第七章 市场机会及未来趋势

- 聚异丁烯作为皮革生产人员编制中羊毛脂的替代

- 其他机会

简介目录

Product Code: 69511

The Polyisobutylene Market size is estimated at 1.24 Million tons in 2024, and is expected to reach 1.68 Million tons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

Key Highlights

- The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries, such as adhesives and sealants, lubricants, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The major factor driving the market studied is increasing demand from the adhesives and sealants industry.

- On the flip side, the instability of polyisobutylene, being non-UV resistant, is hindering the growth of the market.

- Polyisobutylene, as a substitute for wool fat in stuffing agents for the production of leather, is expected to offer various opportunities for the growth of the market.

- Asia-Pacific region dominates the market globally, with the most substantial consumption from countries like China, Japan, South Korea, and India.

Polyisobutylene (PIB) Market Trends

Increasing Demand from Adhesives and Sealants Industry

- The adhesive and sealant industry is anticipated to witness significant demand during the forecast period. Major applications of polyisobutylene in the adhesive and sealant industry are to seal joints, to seal and protect electrical wirings, and to protect body cavities from moisture.

- Polyisobutylene is used in adhesive systems in the form of pressure-sensitive and hot-melt adhesives. It is used due to its tackiness, flexibility, and low cohesive strength, mainly in PSAs and hot-melt adhesives.

- In June 2023, Henkel announced the addition of a new adhesive manufacturing facility in China. The new manufacturing facility of Henkel Adhesive Technologies in the Yantai chemical industry park in Shandong province, China. The new plant, 'Kunpeng,' will cost approximately CNY 870 million (USD 119 Million). The new plant will increase Henkel's production capacity of high-impact adhesive products in China and further optimize the supply chain to meet the increasing demand from domestic and foreign markets.

- In May 2023, Jowat, the adhesive manufacturer, announced to expand its presence in Asia-Pacific with the establishment of its own adhesive center in China. The new adhesive center in Asia will have a surface area of more than 11,000 sq meters and is planned to be finished by 2023.

- Growth in residential construction in the Asia-Pacific region is expected to act as a driver for pressure-sensitive and hot melt adhesives. Polyisobutylene sealant is used for damp proofing, rubber roof repair, and maintenance of roof membranes.

- The Asia-Pacific accounted for the largest market for office construction across the globe. The reports by Cushman & Wakefield state the Asia-Pacific region is likely to incorporate office construction at an average of 120 million square feet annually till 2030. Thus, with the increasing number of office activities, the demand for polyisobutylene in office supplies will also significantly increase.

- Various construction firms consider Europe's long future for office spaces. Also, several companies have invested in construction projects in the commercial sector, driving the demand for polyisobutylene.

- China is one of the leading countries in office space construction. The construction of office spaces such as Wuhan Fosun Bund Center T1 in China is expected to boost the market studied. Construction work for the project started in Q3 2021 and is forecasted to complete in Q4 2025.

- Also, according to the National Bureau of Statistics of China, China's construction output peaked in 2022 at a value of about USD 4.11 trillion. As a result, these factors tend to increase the market demand.

- The adhesives and sealants industry is expected to dominate the global polyisobutylene market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the dominant market for polyisobutylene during the forecast period. This is because the region dominates the market for applications such as adhesives and sealants, lubricants, fuel additives, and among others.

- In March 2023, Pidilite announced the manufacture of Jowat's hot melt adhesive in India. The adhesives will be produced at Pidilite's manufacturing plant in Vapi, Gujarat. The company further announced that the adhesive will be manufactured under the Pidilite brand.

- Polyisobutylene is widely used in lubricants for modifying or improving the viscosity of the lubricant formulations to the desired final viscosity. The lubricants market is currently witnessing an increasing demand for high-performance lubricants owing to their better and improved properties, such as reduced flammability, reduced gear wear, and increased service life.

- Polyisobutylene is added to fuel to improve the viscoelastic property. Derivatives of polyisobutylene are used as ash-less dispersants (such as PIBSA) to minimize deposits and prevent oil thickening and formation of sludge.

- Thus, the growing automotive industry is expected to boost the market demand. China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products to ensure fuel economy while minimizing emissions, owing to the growing environmental concerns.

- According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), automobile production and sales reached 27.021 million and 26.864 million, respectively, in 2022, up 3.4% and 2.1% from the previous year.

- Thus, rising demands from the polyisobutylene applications mentioned above are expected to drive the growth of the market in the Asia-Pacific region.

Polyisobutylene (PIB) Industry Overview

The polyisobutylene market is fragmented in nature. The major players in the studied market (not in any particular order) include BASF SE, Braskem, Dowpol Corporation, TPC Group, and The Lubrizol Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Adhesives and Sealants

- 4.1.2 Rising Demand for PIB from Transportation Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Instability of Polyisobutylene being Non-UV Resistant

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Tire Tubes

- 5.1.2 Adhesive and Sealants

- 5.1.3 Lubricants

- 5.1.4 Plasticizers

- 5.1.5 Fuel Additives

- 5.1.6 Electrical Insulation

- 5.1.7 Other Applications (Lube Additives, Etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Braskem

- 6.4.3 Dowpol Corporation

- 6.4.4 TPC Group

- 6.4.5 The Lubrizol Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 JX Nippon Oil & Gas Exploration Corporation

- 6.4.8 Kemipex

- 6.4.9 SABIC

- 6.4.10 Zhejiang Shunda New Material Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Polyisobutylene as Substitute for Wool Fat in Stuffing Agents for the Production of Leather

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219