|

市场调查报告书

商品编码

1537632

选矿设备:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Mineral Processing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

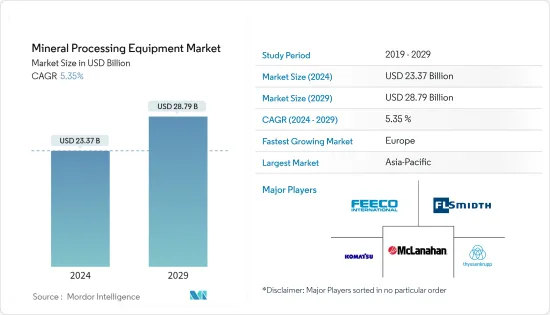

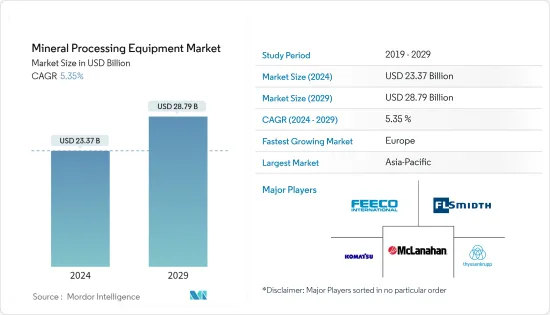

选矿设备市场规模预计到 2024 年为 233.7 亿美元,预计到 2029 年将达到 287.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.35%。

从中期来看,全球采矿机械和设备的进步正在增加铁、铜和其他矿石等矿物的产量。这种增长体现在重大的扩张和计划。随着基础设施和製造业的增加,对采矿设备的需求也增加,导致各地区的采矿活动增加。

基础设施领域对钢、铁和铝等金属的需求增加可能会增加预测期内对选矿设备的需求。此外,采矿业严格的安全法规正在刺激自主采矿机械的创新。此外,减少通风有限和矿工呼吸风险的封闭矿井的排放气体势在必行,这正在推动电动式和混合采矿机械的进步。

采矿设备製造商优先考虑使用者体验,致力于创建直觉且使用者友好的介面,以优化远端监控和控制大型采矿设备的便利性和满意度。这些因素的结合确保采矿设备符合不断变化的操作要求,其中安全性和用户满意度至关重要。然而,开发和扩大采矿活动的困难、环境问题等严格的政府法规、采矿成本的增加和安全标准等挑战可能会限制市场的成长。

选矿设备市场趋势

钢铁预计将成为预测期内成长最快的领域

钢铁对于建设业和其他製造业至关重要。在建设产业,90%的提炼金属是钢材。然而,矿石品位下降和生产成本上升正在阻碍世界某些地区的生产。

- 2023年,全球可用铁矿石总产量预计将达25亿吨。当年最大的铁矿石生产国是澳大利亚,生产了9.6亿吨可用铁矿石。

巴西和澳洲的铁产量大幅成长,企业投资新矿取代旧矿。例如,必和必拓已核准40亿美元用于西澳大利亚铁矿石相关计划,显示铁矿石加工设备的成长。

- 2023年,英美资源集团在南非的昆巴矿场生产了约3,600万吨(湿基)铁矿石。英美资源集团是一家跨国矿业公司,总部位于约翰尼斯堡和伦敦。

由于世界各地对铁矿石的需求不断增加,多家选矿设备公司正在争取各种铁加工设备计划,以保持在竞争的前沿。例如

- 2024年1月,采矿业最尖端科技解决方案的知名供应商TAKRAF为毛里塔尼亚F'Derick计划安装了综合铁矿石加工设施,包括破碎、筛分、物料输送设备和火车装载站- 成功赢得了与法国国家工业与矿业公司(SNIM) 的一份重要合同,提供搬运系统。

对这些金属的需求增加将导致采矿活动增加,这可能有助于推动预测期内对新选矿设备的需求。

亚太地区预计将占据主要市场占有率

亚太地区是选矿设备的主要市场,以中国、澳洲、印度和日本等国家为首,其中仅中国就占2023年市场需求的50%以上。这一优势是由于该地区拥有丰富的活跃矿山,以及将未使用的采矿土地重新用于出口的趋势不断增长。此外,在工业和基础设施发展措施的推动下,该地区对金属和矿物的需求正在增加。例如

- 印度2024年2月矿产生产指数升至139.6,较2023年2月的水准上涨8%。该指数4月至2月11个月累积年增率为8.2%。

- 铁矿石产量从2023年4月的2.3亿吨增加至2024年2月的2.52亿吨,成长9.6%。

- 2023年,中国估计开采了280 MMT的铁矿石。中国是世界第三大铁矿石生产国。锂蕴藏量对于电动车中使用的锂离子电池至关重要,这刺激了采矿作业的增加,并需要引进先进的选矿机械来进行高效、安全的加工。此外,对煤、铜、矾土、金、铀和镍等各种矿物和贵金属的需求不断增长,正在推动采用先进加工设备来提高采矿能力。

全部区域矿山产量的增加可能会增加预测期内对选矿设备的需求。

选矿设备产业概况

选矿设备市场由以下全球公司组成: FLSmidth & Co. A/S、Komatsu Ltd、Metso Oyj、FEECO International, Inc. 和Multotec Pty Ltd. 多家设备製造商正在建立合资企业和合作伙伴关係,并推出采用先进技术的新产品,以比竞争对手较具优势。

- 2023 年 6 月,Epiroc AB 完成了对领先的反循环 (RC) 钻井产品製造商 Schramm Australia 的主要资产的收购。这些资产包括智慧财产权、珀斯附近的两个生产设施以及昆士兰州和南澳大利亚州的两个服务中心。安百拓僱用 Schramm Australia 员工。

- 2023年4月,FLSmidth赢得中东某金矿价值5,085万美元的选矿设备订单。 FLSmidth交付的设备是世界上最高效的设备之一。这项技术使矿山能够在对环境影响较小的情况下提取黄金。

- 2022 年 5 月,山特维克 AB 收购了 Schenck Process Group (SP Mining) 的采矿业务。透过此次收购,SP Mining 被纳入山特维克岩石加工解决方案 (SRP) 旗下定置型破碎和筛检部门。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 对金属和矿物的需求增加振兴了市场

- 市场限制因素

- 严格的环境法规和社区担忧可能会阻碍市场

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按采矿业划分

- 矾土

- 铁

- 锂

- 其他的

- 按设备分类

- 破碎机

- 餵食器

- 输送带

- 钻头和破碎机

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- FLSmidth A/S

- Komatsu Ltd

- Metso Outotec

- FEECO International Inc.

- Multotec Pty Ltd

- McLanahan Corporation

- Sandvik AB

- ThyssenKrupp AG

- TAKRAF GmbH

- McCloskey International

- Sotecma

- Wirtgen Group

- Nordberg Manufacturing Company

- Terex Corporation

第七章 市场机会及未来趋势

The Mineral Processing Equipment Market size is estimated at USD 23.37 billion in 2024, and is expected to reach USD 28.79 billion by 2029, growing at a CAGR of 5.35% during the forecast period (2024-2029).

Over the medium term, globally, advancements in mining machinery and equipment have increased the production of minerals such as iron, copper, and other ores. This growth has seen large-scale expansions and projects. With the increase in infrastructure and manufacturing sectors, the demand for mining equipment has increased, resulting in an augmented level of mining activity in various regions.

Rising demand for metals such as steel, iron, and aluminum across infrastructure sectors is likely to increase the demand for mineral processing equipment during the forecast period. Moreover, stringent safety regulations in mining sectors have spurred the innovation of autonomous mining machinery. Furthermore, the imperative to mitigate emissions in enclosed mines, where ventilation is limited and poses respiratory risks to miners, has propelled the advancement of electric and hybrid mineral equipment.

Prioritizing user experience, manufacturers of mineral processing machinery are dedicated to crafting intuitive and user-friendly interfaces that optimize convenience and satisfaction for remotely overseeing and controlling large-scale mining equipment. These combined factors ensure that mineral machinery aligns with evolving operational requirements while placing the utmost emphasis on safety and user satisfaction. However, challenges like the difficulty involved in developing and expanding mining activity, strict government regulations such as environmental concerns, an increase in the cost of mining, and safety standards can restrain the market's growth.

Mineral Processing Equipment Market Trends

Iron is Poised to be the Fastest-growing Segment Over the Forecast Period

Iron is critically essential for the construction and other manufacturing industries. In the construction industry, 90% of all refined metal is accounted for by steel. However, falling ore grades and high production costs are hindering production in some parts of the world.

- In 2023, the total volume of usable iron ore produced worldwide amounted to an estimated 2.5 billion metric tons. The leading iron ore-producing country that year was Australia, which produced 960 million metric tons of usable iron ore.

Iron production in Brazil and Australia witnessed a massive increase, with companies investing in new mines to replace older ones. For instance, BHP approved USD 4 billion for iron ore-related projects in Western Australia, indicating growth for iron ore processing equipment.

- In 2023, Anglo American produced around 36 million metric tons (wet basis) of iron ore in the Kumba mine, South Africa. Anglo-American is a multinational mining company headquartered in Johannesburg and London.

Owing to the growing demand for iron ore across the world, several mineral processing equipment companies are securing various iron processing equipment projects to remain at the forefront of the competitive race. For instance,

- In January 2024, TAKRAF, a renowned provider of cutting-edge technological solutions for the mining sector, successfully secured a significant contract with Societe Nationale Industrielle et Miniere (SNIM) for the provision of a comprehensive iron ore processing and handling system, including crushing, screening, and material handling facilities, as well as a train loading station for the F'Derick project in Mauritania.

The increasing demand for these metals will lead to rising mining activity, which may help drive the demand for new mineral processing equipment over the forecast period.

Asia-Pacific is Expected to Hold a Significant Market Share

Asia-Pacific stands as the primary market for mineral processing equipment, led by countries such as China, Australia, India, and Japan, with China alone accounting for over 50% of the market demand in 2023. This dominance is attributed to the region's abundance of active mines and the growing trend of repurposing unused mine sites for exportation. In addition, the region is experiencing heightened demand for metals and minerals driven by industrial and infrastructure development initiatives. For instance,

- In February 2024, India's index of mineral production rose to 139.6, 8% higher than the level recorded in February 2023. The cumulative growth of this index for the 11 months from April to February of FY24 over the corresponding period of the previous year was 8.2%.

- Iron ore production in the country increased from 230 MMT during the 11-month period from April to February of FY23 to 252 MMT during the corresponding period of FY24, at a 9.6% growth rate.

- In 2023, an estimated 280 MMT of iron ore was extracted in China. China is the third-largest producer of iron ore in the world. China's significant reserves of lithium, essential for lithium-ion batteries used in electric vehicles, have spurred increased extraction efforts, necessitating the adoption of advanced mineral processing machinery for efficient and safe processing. Moreover, the escalating demand for various minerals and precious metals like coal, copper, bauxite, gold, uranium, and nickel has prompted the adoption of sophisticated processing equipment to enhance extraction capabilities.

The rise in production of minerls across the region is likely to increase the demand for mineral processing equipment during the forecast period.

Mineral Processing Equipment Industry Overview

The mineral processing equipment market comprises global players such as FLSmidth & Co. A/S, Komatsu Ltd, Metso Oyj, FEECO International, Inc., and Multotec Pty Ltd. Several equipment manufacturers are making joint ventures and partnerships and launching new products with advanced technology to have an edge over their competitors. For instance,

- In June 2023, Epiroc AB completed the purchase of the key assets of Schramm Australia, a major manufacturer of products for reverse circulation (RC) mining drilling. The assets include intellectual property, two production facilities near Perth, and two service centers located in Queensland and South Australia. Epiroc will employ Schramm Australia's employees.

- In April 2023, FLSmidth secured an order worth USD 50.85 million for mineral processing equipment for a gold mine in the Middle East. The equipment delivered by FLSmidth is among the most efficient in the world. When installed, the technology allows the mine to extract gold with reduced impact on the environment.

- In May 2022, Sandvik AB acquired the mining-related business of Schenck Process Group (SP Mining). Through this acquisition, SP Mining reported in Stationary Crushing and Screening, a division of Sandvik Rock Processing Solutions (SRP).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Metals and Minerals to Fuel the Market

- 4.2 Market Restraints

- 4.2.1 Stringent Environmental Regulations and Community Concerns may Hinder the Market

- 4.3 Porters Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Mineral Mining Sector

- 5.1.1 Bauxite

- 5.1.2 Iron

- 5.1.3 Lithium

- 5.1.4 Others

- 5.2 By Equipment

- 5.2.1 Crushers

- 5.2.2 Feeders

- 5.2.3 Conveyors

- 5.2.4 Drills and Breakers

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 FLSmidth A/S

- 6.2.2 Komatsu Ltd

- 6.2.3 Metso Outotec

- 6.2.4 FEECO International Inc.

- 6.2.5 Multotec Pty Ltd

- 6.2.6 McLanahan Corporation

- 6.2.7 Sandvik AB

- 6.2.8 ThyssenKrupp AG

- 6.2.9 TAKRAF GmbH

- 6.2.10 McCloskey International

- 6.2.11 Sotecma

- 6.2.12 Wirtgen Group

- 6.2.13 Nordberg Manufacturing Company

- 6.2.14 Terex Corporation