|

市场调查报告书

商品编码

1537635

氯苯:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Chlorobenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

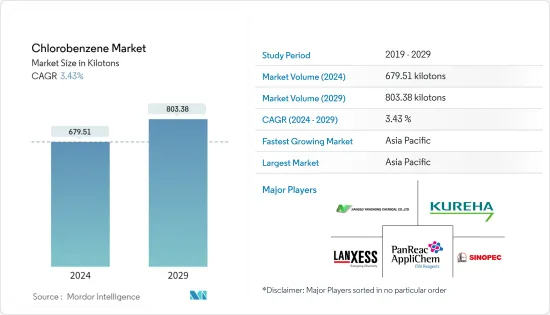

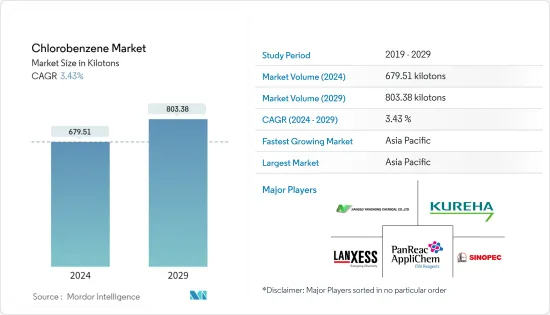

预计2024年全球氯苯市场规模将达679.51千吨,2029年将达到803.38千吨,2024-2029年预测期间复合年增长率为3.43%。

由于供应链中断和生产设施关闭(主要是在中国和印度),COVID-19 对整个氯苯市场产生了重大影响。然而,该行业在大流行后已开始復苏,预计在预测期内将实现稳定成长。

推动市场的主要因素是硝基氯苯需求的增加以及氯苯在化学工业中应用的激增。

此外,接触氯苯导致呼吸和神经相关问题的有害影响可能会阻碍市场成长。

然而,氯苯作为农药製剂溶剂的新应用可能为该产业提供新的成长机会。

由于中国和印度等新兴国家的需求不断增加,预计亚太地区将在预测期内主导市场。

氯苯市场走势

硝基氯苯占据市场主导地位

- 硝基氯苯是生产橡胶、农药、石油添加剂、抗氧化剂、染料和颜料的中间体。

- 我们也生产对硝基苯酚、对硝基苯胺、对胺基、非那西丁、乙酰胺酚、巴拉松和Dapsone(抗疟疾药)。

- 製药业的成长,尤其是美国、中国、日本、印度和其他国家的製药业的成长,预计将推动硝基氯苯的采用。

- 2022年,全球医药市场以出厂价计算约12,229.21亿欧元(12,877.36亿美元)。包括美国和加拿大在内的北美市场以52.3%的大份额继续保持全球第一大市场的地位,遥遥领先欧洲、中国和日本。

- 此外,根据德国联邦统计局(Statistisches Bundesamt)的数据,2022年德国药品产值将达到374亿欧元(405.9亿美元),而2021年为346亿欧元(375.5亿美元),录得增长。

- 此外,印度是全球农业领域的主要企业之一,超过一半的人口从印度采购食品。 2022年,印度粮食产量约为每公顷2,419公斤,其中水稻是当年产量最大的粮食。

- 此外,到2025年,印度农业部门的产值可能会增加到240亿美元。 2022 年,印度政府计划推出 Kisan 无人机,用于作物评估、土地记录数位化以及散布农药和营养物质。

- 因此,各行业的上述趋势很可能会促进硝基氯苯的消费,并促进整个产业的成长。

亚太地区主导市场

- 亚太地区在全球市场占有率中占据主导地位。在化学製造和製药业不断扩张的推动下,亚太地区预计在可预见的未来将保持这一地位。在中国、印度和日本等国家,越来越多地使用氯苯作为橡胶产品、农药和树脂生产过程中的溶剂,促进了该地区氯苯使用量的扩大。

- 氯苯参与合成橡胶的生产,在苯乙烯和丁二烯等单体的聚合过程中充当溶剂和反应介质。然而,人们正在努力寻找更环保的橡胶生产替代品。

- 中国是世界上成长最快的经济体之一,在人口成长、生活水准提高和人均收入增加的推动下,各种终端用户产业正在经历显着成长。

- 国家统计局最新公布资料显示,2022年12月我国合成橡胶产量809千吨,与前一年同期比较下降8.1%,1-12月累计产量比与前一年同期比较下降5.7%总量为823.3万吨。

- 此外,氯苯在製药工业中发挥重要作用,在各种药物化合物和活性成分的合成中充当化学中间体,促进製造过程中的某些反应。由于它有毒,因此遵守严格的安全法规至关重要。

- 据厚生劳动省称,2022年日本伦理药品产值将达到9.98兆日圆(660亿美元),较2021年的9.17兆日圆(610亿美元)成长。处方药是医疗药品市场的主要产品,几乎占年产值的92%。

- 印度在医药工业製剂领域占有重要地位,是世界第三大医药产品生产国。印度也是美国以外拥有最多 FDA核准工厂数量的国家。

- 印度的製药业在全球整体价值420亿美元。 2022年印度药品出口额为246亿美元,2021年为244.4亿美元。印度是全球领先的学名药供应国,以其高性价比的疫苗和学名药而闻名。

- 由于上述因素,预计预测期内各种应用的氯苯消耗量将会增加。

氯苯产业概况

氯苯市场部分整合。该市场的主要企业包括(排名不分先后)ITW试剂事业部(PanReac Applichem)、中国石化集团公司、江苏扬农化工集团公司、吴羽公司和朗盛公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对硝基氯苯的需求不断增长

- 化工产业应用快速成长

- 其他司机

- 抑制因素

- 接触氯苯的不利影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

- 价格趋势

- 技术简介

- 贸易分析

- 监理政策分析

第五章市场区隔(市场规模:数量)

- 类型

- 一氯苯

- 邻二氯苯

- 对二氯苯

- 间二氯苯

- 其他类型

- 目的

- 飞蛾防治

- 硝基氯苯

- 聚亚苯硫醚

- 聚砜聚合物

- 溶剂

- 室内/卫生除臭机

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Anhui Bayi Chemical Industry

- Chemada Fine Chemicals

- China Petrochemical Corporation

- ITW Reagents Division(PanReac Applichem)

- J&K Scientific Ltd

- Jiangsu Yangnong Chemicals Group Co., Ltd.

- Kureha Corporation

- Lanxess

- Meryer(Shanghai)Chemical Technology Co. Ltd.

- Tianjin Bohai Chemical Industry Co., Ltd.

第七章市场机会与未来趋势

- 氯苯作为农药製剂溶剂的新用途

The Chlorobenzene Market size is estimated at 679.51 kilotons in 2024, and is expected to reach 803.38 kilotons by 2029, growing at a CAGR of 3.43% during the forecast period (2024-2029).

COVID-19 highly impacted the overall chlorobenzene market due to the disruption in the supply chain and halt in production facilities, mainly in China and India. However, the industry started recovering after the pandemic and was expected to grow steadily during the forecast period.

The major factors driving the market are the increasing demand for nitrochlorobenzene and the surging application of chlorobenzene in the chemical industry.

Moreover, the detrimental effects of chlorobenzene exposure causing respiratory and neurological-associated issues are likely to hinder the market's growth.

Nevertheless, the emerging applications of chlorobenzene as a solvent for pesticide formulations will likely offer the industry new growth opportunities.

Asia-Pacific will likely dominate the market through the forecast period due to increased demand in developing countries such as China and India.

Chlorobenzene Market Trends

Nitrochlorobenzenes to Dominate the Market

- Nitrochlorobenzenes are intermediates in manufacturing rubber, agricultural chemicals, oil additives, antioxidants, dyes, and pigments.

- It also manufactures p-nitrophenol, p-nitroaniline, p-aminophenol, phenacetin, acetaminophen, parathion, and dapsone (an antimalarial drug).

- The growing pharmaceutical industry, especially in the United States, China, Japan, India, and various other countries, is expected to boost the adoption of nitrochlorobenzenes.

- In 2022, the global prescription pharmaceutical market was valued at approximately EUR 1,222,921 million (USD 1,287,736 million) at ex-factory prices. The North American market, encompassing the United States and Canada, retained its position as the world's largest market, holding a significant 52.3% share, surpassing Europe, China, and Japan by a considerable margin.

- Furthermore, according to Statistisches Bundesamt ( a federal authority of Germany), the value of pharmaceutical production in Germany reached EUR 37.4 billion (USD 40.59 billion) in 2022 and registered growth compared with EUR 34.6 billion (USD 37.55 billion) in 2021.

- Furthermore, India is one of the major players in the agriculture sector worldwide, and it is the primary source of food for over half of its population. In 2022, the food grain yield in India was around 2,419 kilograms per hectare, and rice was the largest food grain produced in that year.

- Moreover, the Indian agricultural sector will likely increase to USD 24 billion by 2025. In 2022, the Government of India planned to launch Kisan Drones for crop assessment, digitization of land records, and spraying insecticides and nutrients.

- Therefore, the trends above across various industries will likely enhance the consumption of nitrochlorobenzenes, propelling overall industry growth.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region has asserted its dominance in the global market share. It is expected to maintain this position in the foreseeable future, driven by the expanding chemical manufacturing and pharmaceutical sectors. The rising utilization of chlorobenzene as a solvent in the production processes of rubber items, pesticides, and resins in countries like China, India, and Japan has contributed to the growing usage of chlorobenzene in the region.

- Chlorobenzene is involved in the production of synthetic rubber, serving as a solvent or reaction medium in the polymerization process of monomers like styrene and butadiene. However, efforts are underway to explore more environmentally friendly alternatives in rubber production.

- China, among the world's fastest-growing economies, is experiencing notable growth across various end-user industries, attributed to increasing population, elevated living standards, and rising per-capita income.

- According to the most recent data published by the National Bureau of Statistics, China witnessed a year-on-year decrease of 8.1%, with a total output of 809 kilotons of synthetic rubber in December 2022 and a cumulative production of 8.233 million tons from January to December, reflecting a 5.7% decline compared to the previous year.

- Furthermore, chlorobenzene plays a crucial role in the pharmaceutical industry by serving as a chemical intermediate in the synthesis of various pharmaceutical compounds and active ingredients, facilitating specific reactions in the manufacturing process. Due to its toxic nature, adherence to stringent safety regulations is paramount.

- According to the Ministry of Health, Labour and Welfare of Japan, the production value of medical drugs in Japan amounted to JPY 9.98 trillion (USD 0.066 trillion) in 2022 and registered growth when compared with JPY 9.17 trillion (USD 0.061 trillion) in 2021. Prescription drugs represent the staple products of the medical drug market, accounting for almost 92 percent of the annual production value.

- India holds a significant position in the formulation segment of the pharmaceutical industry, ranking as the third-largest global producer of pharmaceuticals by volume. India has the most significant number of FDA-approved plants outside the United States.

- The Indian pharmaceutical sector is worth USD 42 billion globally. Indian drug and pharmaceutical exports stood at USD 24.60 billion in 2022 and USD 24.44 billion in 2021. India is the primary global provider of generic drugs and is renowned for its cost-effective vaccines and generic pharmaceuticals.

- The factors mentioned above are expected to increase the consumption of chlorobenzene in various applications during the forecast period.

Chlorobenzene Industry Overview

The Chlorobenzene Market is partially consolidated in nature. Some of the key players in the market include (not in any particular order) ITW Reagents Division (PanReac Applichem), China Petrochemical Corporation, Jiangsu Yangnong Chemicals Group Co., Ltd., Kureha Corporation, and LANXESS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising demand for Nitrochlorobenzene

- 4.1.2 Surging Application in the Chemical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Chlorobenzene Exposure

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Price trends

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Monochlorobenzene

- 5.1.2 o-dichlorobenzene

- 5.1.3 p-dichlorobenzene

- 5.1.4 m-Dichlorobenzene

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Moth Control

- 5.2.2 Nitrochlorobenzenes

- 5.2.3 Polyphenylene Sulfide

- 5.2.4 Polysulfone Polymers

- 5.2.5 Solvents

- 5.2.6 Room and Sanitary Deodorants

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anhui Bayi Chemical Industry

- 6.4.2 Chemada Fine Chemicals

- 6.4.3 China Petrochemical Corporation

- 6.4.4 ITW Reagents Division (PanReac Applichem)

- 6.4.5 J&K Scientific Ltd

- 6.4.6 Jiangsu Yangnong Chemicals Group Co., Ltd.

- 6.4.7 Kureha Corporation

- 6.4.8 Lanxess

- 6.4.9 Meryer (Shanghai) Chemical Technology Co. Ltd.

- 6.4.10 Tianjin Bohai Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Chlorobenzene as a Solvent for Pesticide Formulations