|

市场调查报告书

商品编码

1537636

锶:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Strontium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

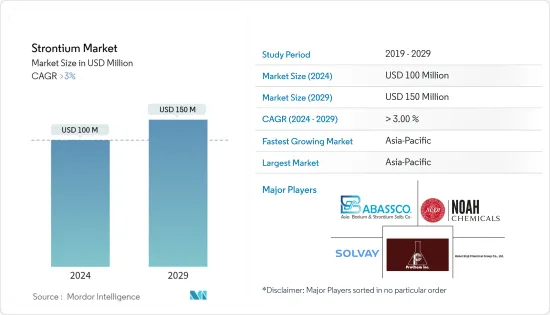

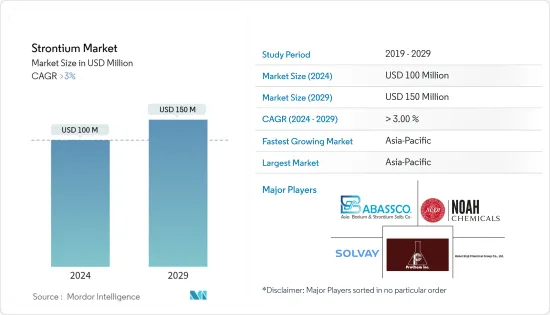

锶市场规模预计到2024年将达到1亿美元,预计到2029年将达到1.5亿美元,在预测期内(2024-2029年)复合年增长率将超过3%。

COVID-19大流行对锶市场产生了负面影响。疫情扰乱了锶的开采、加工和运输活动,影响了锶原料和中间产品的供应。然而,随着封锁的解除,各行业的经济活动逐渐恢復,包括汽车和电子产品,它们是锶基产品的主要消费者。市场復苏是由产品需求增加所推动的,导致含锶产品增加。

主要亮点

- 预计推动锶市场的因素包括油漆和被覆剂对锶的需求增加以及新兴国家建设活动对锶的需求增加。

- 另一方面,与锶相关的爆炸和火灾风险预计将阻碍市场成长。

- 硝酸锶预计将主要用于化学、海洋和国防工业。医疗领域的日益增长的使用预计将为市场相关人员提供有利可图的机会。

- 由于中国、印度和日本等国家的消费增加,预计亚太地区在预测期内将保持其市场主导地位。

锶市场趋势

油漆和被覆剂领域占据市场主导地位

- 硫酸锶作为硫酸锶用于油漆和涂料工业。硫酸锶是一种白色、无味、无害、化学惰性的粉末。它透过充当颜料增量剂(填料)来提高液体和粉末涂料的性能。

- 它还在更高的涂层覆盖率、更好的机械性能、耐盐、防雾、抗紫外线等方面表现出优越的性能。主要用于塑胶、液体涂料、粉末涂料等。

- 根据美国涂料协会2023年8月发布的预计,2022年美国油漆涂料市场规模将达318.5亿美元,2023年将达335.5亿美元。预计到2024年这笔金额将达到357.2亿美元。

- 根据美国涂料协会的年度报告,2023年美国油漆和涂料产量达到约13.1亿加仑。预计到 2024 年将超过 13.4 亿加仑。

- 欧洲有多家大型涂装企业,其中四大经济体分别是德国、法国、义大利和西班牙:德国、法国、义大利和西班牙。德国是欧洲重要的油漆和涂料供应商和市场。德国在油漆、清漆和印表机油墨领域拥有 300 多家製造公司。

- 世界油漆和涂料协会 (WPCIA) 报告中纳入的油漆和涂料行业主要企业包括宣伟 (Sherwin Williams)、PPG Industries Inc.、阿克苏诺贝尔 (Akzo Nobel NV) 和日本涂料控股公司 (Nippon Paint Holdings)。

- 这将使资金注入各个行业,增加世界各地对油漆和被覆剂的需求,并支持锶市场。

亚太地区主导市场

- 由于生产和消费各种锶基最终产品,包括油漆和被覆剂、化妆品以及电气和电子设备,亚太地区是最重要的锶市场。

- 印度商务部工业和内贸促进部发布的报告显示,2022财年印度涂料产业贸易额超过600亿印度卢比。该国涂料及相关产品的出口额约为229.6亿印度卢比,而进口额则超过377亿印度卢比。

- 此外,中国的建设产业预计将在亚太地区成长最快,其次是印度。为了满足日益增长的住宅需求,中国政府正在提供更多资金建造保障性住宅。基础设施领域已成为印度政府重点关注领域之一。

- 中国的建设产业正在快速扩张。根据中国国家统计局预计,中国建筑业产值年终约为31.2兆元(4.31兆美元),2023年将达31.59兆元人民币(4.37兆美元)。

- 所有这些建设活动和政府措施预计将增加该国的建筑计划数量,从而导致对油漆和清漆的需求增加。

- 随着亚太地区许多产业寻求成长,预计未来五年对锶的需求也将增加。

锶行业概况

锶市场本质上高度分散。市场主要参与者有(排名不分先后)索尔维、Abassco、河北辛集化工集团、诺亚化学、ProChem Inc.等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 涂料产业需求增加

- 亚太新兴经济体建设活动增加

- 抑制因素

- 与锶相关的爆炸和火灾风险

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格趋势

第五章市场区隔

- 副产品

- 碳酸锶

- 硫酸锶

- 硝酸锶

- 其他产品(氢氧化锶)

- 按用途

- 电力/电子

- 医疗/牙科

- 油漆/涂料

- 个人护理

- 焰火

- 其他用途(玻璃、陶瓷)

- 按地区

- 生产分析

- 中国

- 西班牙

- 土耳其

- 墨西哥

- 伊朗

- 阿根廷

- 世界其他地区

- 按消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲

- 生产分析

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Abassco

- Barium & Chemicals Inc.

- Chongqing Yuanhe Fine Chemicals Inc.

- Fertiberia

- Hebei Xinji Chemical Group Co. Ltd

- Joyieng Chemical Limited

- KBM Affilips

- Nanjing Jinyan Strontium Industry Co. Ltd

- Noah Chemicals

- ProChem Inc.

- SAKAI CHEMICAL INDUSTRY CO. LTD

- Shenzhou Jiaxin Chemical Co. Ltd

- Shijiazhuang Zhengding JINSHI Chemical Co. Ltd

- Solvay

第七章 市场机会及未来趋势

- 增加硝酸锶在化学、海洋和国防领域的使用

- 医疗领域的使用增加

The Strontium Market size is estimated at USD 100 million in 2024, and is expected to reach USD 150 million by 2029, growing at a CAGR of greater than 3% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the strontium market. The pandemic disrupted strontium mining, processing, and transportation activities, affecting the availability of strontium raw materials and intermediate products. However, as lockdowns were lifted, economic activities gradually resumed across industries, including automotive and electronics, which are significant consumers of strontium-based products. The market recovery was driven by increased demand for goods, which led to a rise in strontium-content products.

Key Highlights

- The factors that are expected to drive the strontium market are the rising demand for strontium from paints and coatings and the increasing demand for strontium from construction activities in developing countries.

- On the flip side, the risk of explosion and fire hazards that are associated with strontium is expected to hinder the growth of the market.

- It is expected that strontium nitrate will be used majorly in the chemical, marine, and defense industries. The increasing usage in the medical field is expected to provide lucrative opportunities for the market players.

- Due to increasing consumption in countries such as China, India, and Japan, the Asia-Pacific is expected to maintain its dominance of the market during the forecast period.

Strontium Market Trends

Paints and Coatings Segment to Dominate the Market

- Strontium sulfate is used in the paint and coating industry as strontium sulfate. Strontium sulfate is a white, odorless, and unhazardous chemical inert powder. It improves the performance of liquid paint and powder coatings by acting as a pigment extender (filler).

- In addition, it provides higher film coverage, more extraordinary mechanical properties, and excellent performance in the areas of salt, fog, or UV resistance. It's mainly used in plastics, liquid paints, powder coats, and so on.

- According to the estimate released by the American Coatings Association in August 2023, the market value of paints and coatings in the United States was USD 31.85 billion in 2022 and USD 33.55 billion in 2023. This value is expected to reach USD 35.72 billion in 2024.

- The volume of paint and coating production in the United States reached about 1.31 billion gallons in 2023, according to an annual report from the American Coatings Association. It is forecasted that the industry's production will surpass 1.34 billion gallons in 2024.

- Europe is home to a multitude of large painting companies, with its four largest mainland economies: Germany, France, Italy, and Spain. Germany is a significant provider and market of paints and coatings in Europe. It is home to over 300 production companies in the field of paint, varnish, and printer ink.

- Some of the key firms in the paints and coatings sector included in the World's Paints and Coatings Association (WPCIA) report are Sherwin Williams, PPG Industries Inc., Akzo Nobel NV, and Nippon Paint Holdings Co. Ltd.

- This will make it possible to invest more money in different sectors, which will increase demand for paints and coatings from all over the world and help the strontium market.

Asia-Pacific Region to Dominate the Market

- Due to the production and consumption of a wide range of end products made from strontium, including paints and coatings, cosmetics, electrical and electronic equipment, and others, the Asia Pacific region is the most critical market for strontium.

- According to the report published by the Department of Commerce (India), Department for Promotion of Industry and Internal Trade (India), in fiscal year 2022, the trade value of India's paint sector was over INR 60 billion. The value of exported paint and associated products in the country stood at around INR 22.96 billion, compared to more than INR 37.7 billion for imports.

- In addition, Asia-Pacific is likely to grow fastest in Chinese construction, followed by India. In order to meet the increasing demand for housing, the Chinese government has provided more funds so that affordable houses can be built. The infrastructure sector has become one of the main focus areas of the government in India.

- The Chinese building and construction industry is expanding at a rapid pace. Construction output in China was estimated to be worth about CNY 31.2 trillion (USD 4.31 trillion) at the end of 2022, reaching CNY 31.59 trillion by 2023 (USD 4.37 trillion), according to an estimate released by the Chinese National Statistics Office.

- The number of building projects in this country is expected to increase due to all these construction activities and government measures, which are expected to lead to a higher demand for paints and varnishes.

- The demand for strontium is also expected to increase over the next five years, as many industries in Asia-Pacific are looking for growth.

Strontium Industry Overview

The strontium market is highly fragmented in nature. The major players in the market include (not in any particular order) Solvay, Abassco, Hebei Xinji Chemical Group Co. Ltd, Noah Chemicals, and ProChem Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Demand from the Paints and Coatings Segment

- 4.1.2 Increasing Construction Activities in Emerging Economies of Asia-Pacific

- 4.2 Restraints

- 4.2.1 Risk of Explosion and Fire Hazards Associated with Strontium

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price trends

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product

- 5.1.1 Strontium Carbonate

- 5.1.2 Strontium Sulfate

- 5.1.3 Strontium Nitrate

- 5.1.4 Other Products (Strontium Hydroxide)

- 5.2 By Application

- 5.2.1 Electrical and electronics

- 5.2.2 Medical and Dental

- 5.2.3 Paints and Coatings

- 5.2.4 Personal Care

- 5.2.5 Pyrotechnic

- 5.2.6 Other Applications (Glass and Ceramics)

- 5.3 By Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Spain

- 5.3.1.3 Turkey

- 5.3.1.4 Mexico

- 5.3.1.5 Iran

- 5.3.1.6 Argentina

- 5.3.1.7 Rest of the World

- 5.3.2 By Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Thailand

- 5.3.2.1.6 Malaysia

- 5.3.2.1.7 Indonesia

- 5.3.2.1.8 Vietnam

- 5.3.2.1.9 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Spain

- 5.3.2.3.6 Turkey

- 5.3.2.3.7 Russia

- 5.3.2.3.8 NORDIC

- 5.3.2.3.9 Rest of Europe

- 5.3.2.4 South America

- 5.3.2.4.1 Brazil

- 5.3.2.4.2 Argentina

- 5.3.2.4.3 Colombia

- 5.3.2.4.4 Rest of South America

- 5.3.2.5 Middle East and Africa

- 5.3.2.5.1 Saudi Arabia

- 5.3.2.5.2 South Africa

- 5.3.2.5.3 Nigeria

- 5.3.2.5.4 Egypt

- 5.3.2.5.5 Qatar

- 5.3.2.5.6 United Arab Emirates

- 5.3.2.5.7 Rest of Middle East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Abassco

- 6.4.2 Barium & Chemicals Inc.

- 6.4.3 Chongqing Yuanhe Fine Chemicals Inc.

- 6.4.4 Fertiberia

- 6.4.5 Hebei Xinji Chemical Group Co. Ltd

- 6.4.6 Joyieng Chemical Limited

- 6.4.7 KBM Affilips

- 6.4.8 Nanjing Jinyan Strontium Industry Co. Ltd

- 6.4.9 Noah Chemicals

- 6.4.10 ProChem Inc.

- 6.4.11 SAKAI CHEMICAL INDUSTRY CO. LTD

- 6.4.12 Shenzhou Jiaxin Chemical Co. Ltd

- 6.4.13 Shijiazhuang Zhengding JINSHI Chemical Co. Ltd

- 6.4.14 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Strontium Nitrate in the Chemical, Marine, and Defense Sectors

- 7.2 Increasing Usage in Medical Field