|

市场调查报告书

商品编码

1537645

同调雷达:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Coherent Radar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

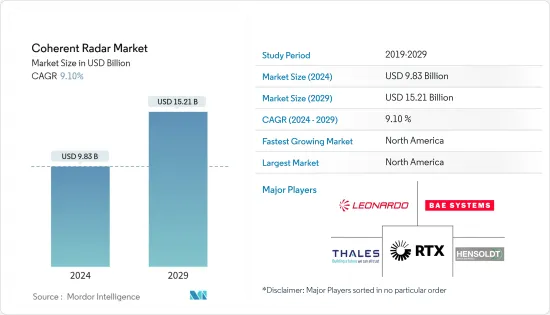

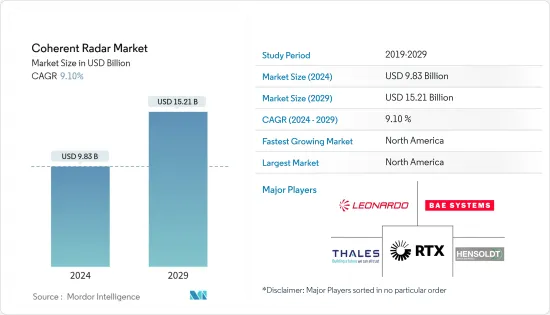

同调雷达市场规模预计到 2024 年为 98.3 亿美元,预计到 2029 年将达到 152.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 9.10%。

同调雷达在军事领域有多种应用。 同调雷达可以侦测和追踪快速移动的隐形目标,并提供地形和物体的高解析度影像。由于中东和亚太地区等某些地区的恐怖主义不断加剧以及地缘政治紧张局势,预计未来几年军事领域对同调雷达的需求将会成长。这一因素增加了用于现代化监视技术(例如用于检测任何潜在威胁的同调雷达)的国防支出。

战场的快速数位化促进了C4ISR系统的采用,以获得针对敌方部队的战术性优势。其中包括同化来自各种资讯来源的资料,包括透过使用同调雷达进行被动感测和监视,从而为在战场上采用这些系统创造机会。

然而,先进的同调雷达系统的采用仅限于技术先进的国家。因此,如果采购和研发资金被转移到其他领域,可能会对市场成长产生负面影响。儘管存在这些因素,由于地缘政治紧张局势加剧和世界各国国防开支增加导致的需求,预计市场在预测期内将出现正增长。

雷达技术的不断进步,例如固体雷达系统的开发和人工智慧的集成,预计将推动该市场的成长,因为它们可以提高雷达系统的性能和效率。

同调雷达市场趋势

空降同调雷达领域呈现最高成长率

机载同调雷达在军事上有多种应用,包括防空、飞弹防御以及情报、监视和侦察 (ISR)。因此,世界各国都在大幅增加军事开支,以开发和采购配备先进光电/红外线系统、预警系统和全天候雷达系统的多用途隐形战斗机。

由于世界主要国家的军事开支增加和各种现代化努力,预计该领域的成长将会增加。例如,2022年全球军费开支达2.24兆美元,较2021年成长6%。随着国防费用的增加,美国、法国、德国、俄罗斯、英国和日本等国家目前都致力于开发隐形战斗机技术。例如,2022年11月,法国、德国和西班牙签署了一项协议,根据未来作战空中系统计画开始下一阶段的新型战斗机开发工作。该国防计划预计耗资超过1,034亿美元。根据该计划,这些国家预计将更换 F-18 和颱风战斗机等较旧的战斗机机队。

同样,2023 年 12 月,英国与日本和义大利签署了一项协议,开发下一代隐形战斗机,作为未来作战空中计画的一部分。该战斗机预计将具有超音速能力,并配备此类军用飞机的最新技术,包括连贯机载雷达。

印度、以色列和土耳其等国也正在投资无人机的开发和采购,以增强其情监侦力量。例如,2023年11月,印度与IAI签署合同,采购六架非武装Hermes 900无人机,以增强该国的监视能力。总体而言,一些国家国防军采用隐形技术同调雷达相干雷达能够穿透敌方防空系统,以静默方式监视目标并在需要时摧毁它们。预计这将在预测期内推动该细分市场的需求。

北美地区成长率最高

美国是北美同调雷达等先进雷达技术的热衷开发者与使用者。军事领域这一市场的需求是由美国庞大的军事开支所推动的,这支持了包括同调雷达技术在内的各种雷达技术的开发和采购。例如,2022年美国军事国防费用达8,770亿美元,比2021年成长9%。对技术先进武器的投资增加是由于中国和俄罗斯在战场上的能力增强所构成的威胁越来越大,这一因素极大地推动了该国对同调雷达系统的需求。

随着国防支出的增加,美国正在积极订购大型军机以增强其防御能力,这正在提振美国市场的需求。例如,截至2022年12月,美国已订购约2,000架F-35A/B/C飞机。诺斯罗普·格鲁曼公司为这些 F-35 提供主动电子扫描阵列 (AESA) 雷达,这些 AESA 雷达系统包括许多单独的辐射元件,每个辐射元件都有一个发射器和接收器模组。这些模组协同工作,形成同调雷达波束,以侦测潜在的空中威胁。

北美也是主要国防技术公司的所在地,这些公司不断投资开发先进的情境察觉增强系统。例如,Raven Industries Inc. 是透过其 HiPointer 100同调雷达系统解决方案向同调雷达市场提供解决方案的OEM之一。该公司的 HiPointer 100 提高了持续监视能力,并增强了各种有人和无人平台的全面情境察觉,为陆地、海上和空中的最终用户和决策者提供极低的误报,使您能够在动态情报、监视、和侦察(ISR)任务。

同调雷达行业概览

同调雷达系统市场由 HENSOLDT AG、RTX Corporation、BAE Systems PLC、Leonardo SpA 和 Thales 等主要参与者主导,占据了大部分市场占有率。

国防部门严格的安全和监管政策预计将限制新进入者。随着敌方航空平台和武器越来越多地采用隐形技术,市场开发商正在专注于开发先进的雷达系统,以有效探测小型雷达截面的目标。为了确保与最终用户国家的长期合作伙伴关係并促进与各种军事资产的整合,这些公司正在投入资源来开发尖端雷达技术。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按平台

- 海军

- 地上

- 海军

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- HENSOLDT AG

- BAE Systems PLC

- IAI

- Leonardo SpA

- RTX Corporation

- Lockheed Martin Corporation

- Thales

- Saab AB

- L3 Harris Technologies Inc.

- Indra Sistemas SA

第七章 市场机会及未来趋势

The Coherent Radar Market size is estimated at USD 9.83 billion in 2024, and is expected to reach USD 15.21 billion by 2029, growing at a CAGR of 9.10% during the forecast period (2024-2029).

Coherent radar has various applications in the military. It can detect and track fast-moving and stealthy targets and provide high-resolution images of the terrain and objects of interest. The demand for coherent radar in the military is expected to grow in the coming years due to the rise in terrorism and geopolitical tensions in certain regions like the Middle East and Asia-Pacific. This factor has led to a rise in defense expenditure on modernizing surveillance technology, such as coherent radar, to detect any potential threat.

The rapid digitization of the battlefield has fostered the adoption of C4ISR systems to gain a tactical edge over hostile forces. These include the assimilation of data from various sources, including passive detection and monitoring through the use of coherent radars, thereby creating an opportunity for adopting these systems on the battlefield.

However, adopting advanced coherent radar systems is limited to technologically advanced countries. Hence, the diversion of procurement and R&D funds toward other sectors can deleteriously affect market growth. Despite this factor, the market is expected to grow positively during the forecast period due to the demand driven by rising geopolitical tensions and increasing defense expenditures in various economies worldwide.

Continuous advancements in radar technologies, such as the development of solid-state radar systems and the integration of artificial intelligence, are expected to drive the growth of this market as these technological advancements enable improved performance and increased efficiency of radar systems.

Coherent Radar Market Trends

Airborne Coherent Radar Segment to Exhibit the Highest Growth Rate

Airborne coherent radar has various applications in the military, such as air and missile defense, intelligence, surveillance, and reconnaissance (ISR). Hence, various countries worldwide are significantly increasing their military spending in developing and procuring multirole and stealth fighter aircraft equipped with advanced EO/IR systems, early warning systems, and all-weather radar systems.

The growth of this segment is expected to increase due to rising military expenditure and various modernization efforts by major global powers. For instance, in 2022, the global military expenditure reached USD 2,240 billion, a growth of 6% from 2021. With this increased defense expenditure, various countries, such as the United States, France, Germany, Russia, the United Kingdom, and Japan, are currently working on the development of stealth fighter jet technology. For instance, in November 2022, France, Germany, and Spain signed an agreement to start the next phase of development of a new fighter jet under the Future Combat Air System program. The defense project is estimated to cost more than USD 103.4 billion. Under the program, these countries are expected to replace older fighter aircraft fleets such as the F-18 and Typhoon.

Similarly, in December 2023, the United Kingdom entered an agreement with Japan and Italy to create a next-generation stealth fighter as part of the future combat air program. The fighter is expected to have supersonic capabilities and be equipped with the latest technology in these military aircraft, such as coherent airborne radars.

Countries such as India, Israel, and Turkey are also investing in developing and procuring unmanned air vehicles to boost their ISR strength. For instance, in November 2023, India awarded a contract to IAI to procure six Hermes 900 unarmed drones to augment the country's surveillance capabilities. Overall, the adoption of stealth technology by the defense forces of several countries necessitates the integration of coherent radar systems on board the aircraft to silently monitor the target and penetrate enemy air defenses to neutralize them if the need arises. This is expected to drive the demand for this segment during the forecast period.

North America to Exhibit the Highest Growth Rate

The United States is an avid developer and user of sophisticated radar technologies such as coherent radar in North America. The demand for this market in the military is driven by the large military spending of the United States, which, in turn, supports the development and procurement of various radar technologies, including coherent radar technologies. For instance, in 2022, the US military defense expenditure rose to USD 877 billion, a growth of 9% compared to 2021. The increased investments toward technologically advanced weaponry are due to the growing threat to the country from the enhanced capabilities of China and Russia on the battlefield, and this factor is heavily driving the demand for coherent radar systems in the country.

With this increased defense spending, the United States is actively ordering huge military aircraft to enhance its defense capabilities, which is driving the demand for this market in the United States. For instance, as of December 2022, the US military had placed orders for around 2,000 F-35A/B/C aircraft variants. For these F-35s, Northrop Grumman provides its active electronically scanned array (AESA) radar, and these AESA radar systems involve numerous individual radiating elements, each with its own transmit and receive module. These modules work harmoniously to form a coherent radar beam to detect potential airborne threats.

North America is also home to leading defense technology firms that are constantly investing in developing advanced situational awareness enhancement systems. For instance, Raven Industries Inc. is one of the OEMs that provides its solutions in the coherent radar market with its HiPointer 100 coherent radar system solution. The company's HiPointer 100 increases persistent surveillance capabilities, enhances total situational awareness from a diverse set of manned and unmanned platforms with extremely low false alarms, and enables end users and decision-makers to achieve success in dynamic intelligence, surveillance, and reconnaissance (ISR) missions spanning land, sea, and air.

Coherent Radar Industry Overview

The coherent radar systems market is consolidated with leading players, such as HENSOLDT AG, RTX Corporation, BAE Systems PLC, Leonardo SpA, and Thales, accounting for a majority of the market share.

The stringent safety and regulatory policies in the defense segment are expected to restrict the entry of new players. With the growing implementation of stealth technologies in adversary aerial platforms and weapons, market players are focusing on the development of sophisticated radar systems that can effectively detect targets with lower radar cross-sections. To ensure long-term partnerships with end-user countries and easy integration with a broad spectrum of military assets, these companies are dedicating their resources to the development of cutting-edge radar technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Airborne

- 5.1.2 Terrestrial

- 5.1.3 Naval

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Latin America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 HENSOLDT AG

- 6.2.2 BAE Systems PLC

- 6.2.3 IAI

- 6.2.4 Leonardo SpA

- 6.2.5 RTX Corporation

- 6.2.6 Lockheed Martin Corporation

- 6.2.7 Thales

- 6.2.8 Saab AB

- 6.2.9 L3 Harris Technologies Inc.

- 6.2.10 Indra Sistemas SA