|

市场调查报告书

商品编码

1537649

目录管理系统 -市场占有率分析、产业趋势/统计、成长预测 (2024-2029)Catalog Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

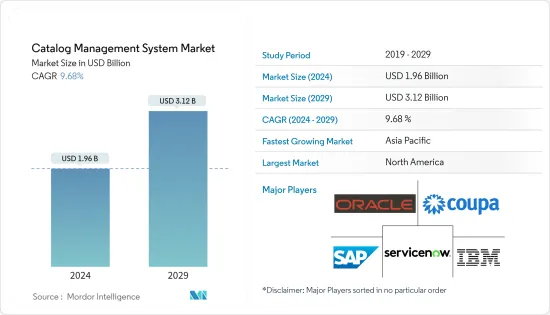

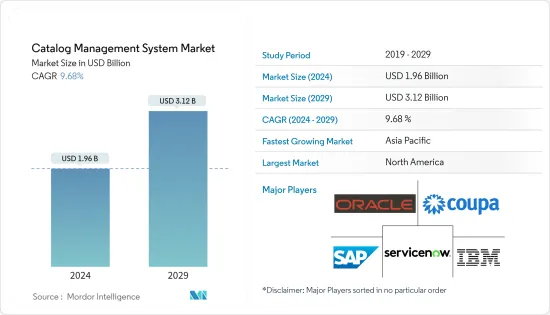

目录管理系统市场规模预计2024年为19.6亿美元,预计2029年将达到31.2亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为9.68%,预计将增长。

对集中管理的产品和服务资料的需求、不断增长的客户需求以及零售和电子商务行业不断增长的数位转型倡议是推动目录管理市场成长的决定因素。

主要亮点

- 目录管理系统允许企业在单一系统中管理其产品资料,从而产生具有最佳布局和设计的庞大目录。目录管理系统简化了工作流程并管理所有管道、地点和平台的目录修订。目录管理可以轻鬆地为许多行业创建目录和季节性目录,从而创造新的商机。

- 云端部署模型可能会见证目录管理系统市场的巨大成长。关键因素包括互动式仪表板、易于灵活性、增强的安全功能以及鼓励企业利用云端部署的高扩充性。此外,中小型企业由于其经济优势而更喜欢云端部署部署的目录管理系统,从而推动了全球市场的发展。

- 全球客户变得更加精通技术,并且更喜欢透过社交媒体、行动应用程式和网站等数位管道与企业互动。因此,该行业现在正在采用数位技术,重点关注客户满意度、要求和回馈。

- 此外,电子商务和零售业的垂直整合正在製定客户参与通路策略,以满足技术先进的消费者的需求。例如,Vue.ai 使用人工智慧来丰富产品资料、控制内容、创建图形并帮助零售商创建有组织的目录。

- 目录管理涉及收集资料并将其从一个通道传输到另一个通道。目录管理系统还包括频道之间的资料同步和发布。许多公司认为,目录管理系统很容易因高度抽象的资料集而遭受资料外洩。这是由于缺乏有关安全框架以及如何实施它们的足够资讯。资料安全问题是限制目录管理解决方案采用的主要障碍。

- 除了捕获和上传资料并将其映射到消费者需求之外,这些系统还提供通路内产品的快速概览。我们还支援即时资料检验、丰富和增强。使用来自多个来源的资料自动建立目录信息,以增强产品分类并跨渠道快速整合产品资料。疫情过后,各产业数位转型活动增多,市场规模不断扩大。

目录管理系统市场趋势

对数位转型的日益关注正在推动市场发展

*零售和电子商务领域不断兴起的数位转型措施正在推动目录管理系统市场的发展。世界各地的客户越来越精通技术,更喜欢透过社群媒体、智慧型手机应用程式和网站等数位管道与企业互动。该行业高度关注客户满意度、要求和反馈,并且越来越多地采用数位技术。此外,零售和电子商务产业正在设计与客户互动的方式,以满足全球对数位化客户的需求。

*在数位时代,随着对智慧型手机和其他资料密集型设备的需求不断增加,在正确的时间为客户提供正确的产品对通讯服务提供者来说是一项挑战。通讯服务提供者很难有效地创建、管理资料并透过资料收益。集中化的产品目录可帮助您抓住商机、缩短上市时间 (TTM)、提供无与伦比的体验品质 (QoE)、维持盈利的用户群、降低解约率以及品牌 - 有助于提高忠诚度。

*此外,目录管理软体价格的降低预计将推动目录管理系统市场的发展。此外,对集中式系统更好地行销和销售产品和服务的日益渴望也推动了全球需求。小型企业和大型企业使用先进的软体和服务来集中处理报价/折扣、产品资料、付款系统和库存。人工智慧等新兴技术可能会显着改善目录管理解决方案的功能,为目录管理系统市场创造巨大的成长潜力。

*BFSI、零售和医疗保健等行业正在使用人工智慧 (AI) 和机器学习,透过整理来自可信任来源的资料、上下文提案和产品排名来开发和改进业务营运。 。由人工智慧支援的目录管理系统解决方案有可能自动识别资料问题,并协助建立统一的资料观点。

*根据 IHL Group 的数据,使用人工智慧 (AI) 和机器学习 (ML) 技术的零售公司表现优于竞争对手。 2023年和2024年,使用此类技术的零售商与前一年同期比较销售额实现了两位数成长。同样,年利润成长了约 8%,表现优于未使用人工智慧或机器学习解决方案的零售公司。

亚太地区预计将成为成长最快的市场

*在预测期内,亚太地区预计将成为全球目录管理系统市场成长最快的地区。经济的快速开拓、数位化、全球化以及云端基础技术的日益采用预计将推动亚太地区的目录管理系统市场。

*亚太地区许多中小型企业越来越多地采用目录管理解决方案,预计将推动亚太地区目录管理市场的发展。此外,预计该地区电子商务行业的成长也将在预测期内推动目录管理市场。

*根据印度品牌资产基金会的数据,印度电子商务产业预计将与前一年同期比较增21.5%,达到748亿美元。 2030年,印度电子商务业务预计将达到3,500亿美元。网路和智慧型手机使用量的快速成长也刺激了该国电子商务产业的成长。

*GSMA 社群正在迅速扩大,拥有来自 60 多个国家的 2,000 多名成员,预计今年将进一步成长,创始成员包括 AIS、Axiata、depa、DHL、Globe、华为、Kominfo,包括 Maxis、MDEC、Schneider电力、 Telkomsel 和Viettel。该生态系统面向5G产业的所有参与者,包括政府机构、产业协会和行动网路供应商,共同开展Sector 4.0,并建立基于5G网路、边缘云端服务、企业物联网和人工智慧的数位转型。这显示了该地区企业数位转型的成长潜力,推动了亚太市场的发展。

*成本优化以及更好地利用 IT 和通讯基础设施的需求预计将推动对目录管理系统解决方案和相关服务的需求。

目录管理系统产业概述

目录管理系统市场高度分散,主要企业包括 IBM 公司、Oracle 公司、SAP SE、Coupa Software Inc. 和 ServiceNow Inc.。市场参与者正在采取联盟和收购等策略来加强其产品阵容并获得永续的竞争优势。

*2024 年 2 月 - IBM 宣布在 Watsonx 上提供开放原始码Mistral AI 模型。这扩大了模型的选择范围,帮助企业自信、灵活地扩展人工智慧。 IBM 提供了 Mixtral-8x7B 的最佳化版本,可以将延迟减少高达 75%。这增加了不断成长的 IBM、第三方和开放原始码模型目录,为客户提供了选择和灵活性。这种现代开放原始码模型可在 Watsonx 的 AI 和资料平台上使用,其中包括企业级 AI 工作室、资料储存和管治功能。

*2023 年 12 月 - 领先的产品体验管理 (PXM) 平台公司 Salsify 与帮助品牌扩大在全球市场影响力的先驱 Mamenta 合作。 Mamenta 强大的目录管理功能和 Salsify 的 PXM 平台使品牌能够有效地管理和优化其产品目录。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链/供应链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 更加关注数位转型

- 需要一个集中式系统来改善行销和销售

- 市场限制因素

- 隐私和安全问题

第六章 市场细分

- 按类型

- 服务目录

- 产品目录

- 依部署类型

- 云

- 本地

- 按行业分类

- 资讯科技/通讯

- 零售/电子商务

- BFSI

- 媒体娱乐

- 旅游/酒店业

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- SAP SE

- Coupa Software Inc.

- ServiceNow Inc.

- Proactis Holdings Plc

- Fujitsu Limited

- Broadcom Corporation

- Comarch SA

- Zycus Inc

- GEP Worldwide

- Telefonaktiebolaget LM Ericsson

- Salsify Inc.

- Insite Software Solutions, Inc.

- Amdocs

- Vroozi, Inc.

- Sellercloud Inc.

- Plytix.com ApS

第八章投资分析

第9章市场的未来

The Catalog Management System Market size is estimated at USD 1.96 billion in 2024, and is expected to reach USD 3.12 billion by 2029, growing at a CAGR of 9.68% during the forecast period (2024-2029).

The requirement to have centrally managed product and service data, increasing customer requirements, and expanding the number of digital transformation initiatives in the retail and e-commerce industry verticals are determinants driving the growth of the catalog management market.

Key Highlights

- Catalog management systems enable companies to manage their product data in a single system, resulting in vast catalogs with optimum layout and design. Catalog management systems streamline workflow and manage catalog modifications across all channels, locations, and platforms. Catalog management makes creating tailored and seasonal catalogs for many industries easier, resulting in new business Opportunities.

- The cloud deployment model would grow tremendously in the catalog management systems market. Significant factors include interactive dashboards, ease of flexibility, enhanced security features, and better scalability that could promote businesses to utilize cloud deployment. In addition, SMEs prefer the cloud-deployed catalog management system because of its economic benefits and drive the global market.

- Customers globally are becoming tech-savvy and prefer to engage with businesses via digital channels, such as social media, mobile apps, and websites. Hence, nowadays, this industry vertical is wholly focused on customer satisfaction, requirements, and feedback and is adopting digital technologies.

- Moreover, the e-commerce and retail industry verticals strategize customer engagement channels to fulfill the needs of technologically advanced consumers. For example, Vue.ai uses AI to enhance product data, control content, create graphics, and assist retailers in creating organized Catalogs.

- Data collection and transmission from one channel to another are involved in catalog management. Catal catalog management systems also include data synchronization and publication across channels. Many businesses believe that catalog management systems could result in data breaches in their highly abstracted data sets because they lack sufficient information about security frameworks and how to implement them. Concerns regarding data security are the main barriers limiting the adoption of catalog management solutions.

- In addition to capturing and uploading data and mapping it to consumer demands, these systems offer a fast overview of the products in a channel. They also assist in real-time data validation, enrichment, and augmentation. They automate the production of catalog information utilizing data from many sources to enhance product assortment and accomplish quicker product data syndication across channels. After the pandemic, the market has been proliferating with increased digital transformation activities in various sectors.

Catalog Management System Market Trends

Growing Digital Transformation Initiatives Drives the Market

* Growing digital transformation initiatives in the retail and e-commerce sectors are driving the catalog management system market. Customers throughout the globe are growing more tech-savvy, preferring to interact with businesses through digital channels such as social media, smartphone applications, and websites. This industrial vertical is very concerned with customer satisfaction, requirements, and feedback, and it is progressively embracing digital technology. Furthermore, the retail and e-commerce sector vertical is designing customer interaction methods to meet the global need for digitally sophisticated customers.

* With the increasing need for smartphones and other data-hungry devices in the digital era, giving customers the right products at the right time continues to challenge CSPs. It can be challenging for CSPs to efficiently create, manage, and monetize data offers. A centralized product catalog assists in seizing revenue-generating opportunities, reducing time-to-market (TTM), delivering unparalleled Quality of Experience (QoE), retaining a profitable subscriber base, reducing churn, and improving brand loyalty.

* Furthermore, the increasing affordability of catalog management software is likely to propel the catalog management system market forward. Furthermore, the growing desire for centralized systems for better marketing and selling products and services is driving global demand. Small and medium-sized businesses and huge corporations use advanced software and services to centrally handle offers/discounts, product data, payment systems, and inventories. The newest technologies, such as artificial intelligence, are likely to improve the capabilities of catalog management solutions substantially, providing great growth potential to the catalog management systems market.

* To develop and improve their company operations, industries such as BFSI, retail, and healthcare have invested in and adopted new technologies such as Artificial Intelligence (AI) and Machine Learning (ML) by picking data from reliable sources, contextual suggestions, and product rankings, AI-enabled catalog management delivers enrichment procedures, anomaly detection, and automatic classification of items. AI-powered catalog management system solutions may generate automatic perceptions of data problems and aid in the creation of a unified perspective of the data.

* According to IHL Group, Retailers using artificial intelligence (AI) and machine learning (ML) technologies performed better than their competitors. In 2023 and 2024, retail companies using this kind of technology saw a two-digit growth in their sales compared to previous years. Similarly, their annual profit grew by roughly eight percent, outperforming retailers who did not use AI or ML solutions.

Asia Pacific is Expected to be the Fastest Growing Market

* APAC is foreseen to be the fastest-growing region in the global catalog management systems market during the forecast period. Rapid economic developments, digitalization, globalization, and the increased adoption of cloud-based technologies are expected to drive the APAC region's catalog management systems market.

* The catalog management market in Asia-Pacific is expected to be fueled by an increase in the adoption of catalog management solutions by many SMEs in the region. The growth of the e-commerce sector in the region is also estimated to drive the catalog management market during the forecast period.

* According to the India Brand Equity Foundation, the Indian e-commerce sector is expected to grow by 21.5% and reach USD 74.8 billion in the previous year. By 2030, it is anticipated that India's e-commerce business will be worth USD 350 billion. In addition, the surge in internet and smartphone usage has spurred the country's industry's growth.

* The GSMA community has swiftly expanded to over 2,000 members from over 60 countries, with more growth expected in the current year, with inaugural members including AIS, Axiata, depa, DHL, Globe, Huawei, Kominfo, Maxis, MDEC, Schneider Electric, Telkomsel, and Viettel. The ecosystem was created to facilitate collaboration on Sector 4.0 and digital transformation built on 5G networks, edge-cloud services, enterprise IoT, and AI for all players in the 5G industry, including government agencies, industry groups, and mobile network providers. This shows the growth potential of digital transformation of businesses in the region and driving the market in APAC.

* The need for cost optimization and effective utilization of IT and telecom infrastructures is expected to propel the demand for catalog management systems solutions and associated services.

Catalog Management System Industry Overview

The Catalog Management System Market is highly fragmented, with major players like IBM Corporation, Oracle Corporation, SAP SE, Coupa Software Inc., and ServiceNow Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

* February 2024 - IBM Announced the availability of the Open-Source Mistral AI Model on Watsonx, expanding model choice to assist enterprises in scaling AI with trust and flexibility. IBM offers an optimized version of Mixtral-8x7B that offers the potential to cut latency by up to 75% - It adds to a growing catalog of IBM, third-party, and open-source models to give clients choice and flexibility - The latest open-source model available on watsonx AI and data platform with enterprise-ready AI studio, data store, and governance capabilities.

* December 2023 - Salsify, one of the leading Product Experience Management (PXM) platforms, partnered with Mamenta, a pioneer in empowering brands to expand their global marketplace presence. Mamenta's robust catalog management capabilities and Salsify's PXM platform would enable brands to manage and optimize product catalogs efficiently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Digital Transformation Initiatives

- 5.1.2 Necessity of Centralized Systems for Improved Marketing and Selling

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Service Catalogs

- 6.1.2 Product Catalogs

- 6.2 By Deployment Type

- 6.2.1 Cloud

- 6.2.2 On-Premises

- 6.3 By Industry Vertical

- 6.3.1 IT and Telecom

- 6.3.2 Retail and E-commerce

- 6.3.3 BFSI

- 6.3.4 Media and Entertainment

- 6.3.5 Travel and Hospitality

- 6.3.6 Other Industry Verticals

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 SAP SE

- 7.1.4 Coupa Software Inc.

- 7.1.5 ServiceNow Inc.

- 7.1.6 Proactis Holdings Plc

- 7.1.7 Fujitsu Limited

- 7.1.8 Broadcom Corporation

- 7.1.9 Comarch SA

- 7.1.10 Zycus Inc

- 7.1.11 GEP Worldwide

- 7.1.12 Telefonaktiebolaget LM Ericsson

- 7.1.13 Salsify Inc.

- 7.1.14 Insite Software Solutions, Inc.

- 7.1.15 Amdocs

- 7.1.16 Vroozi, Inc.

- 7.1.17 Sellercloud Inc.

- 7.1.18 Plytix.com ApS