|

市场调查报告书

商品编码

1537691

汽车煞车皮:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Brake Pad - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

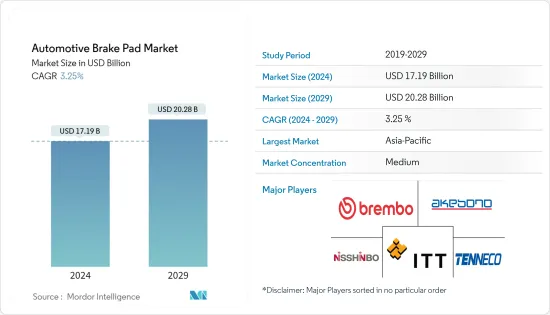

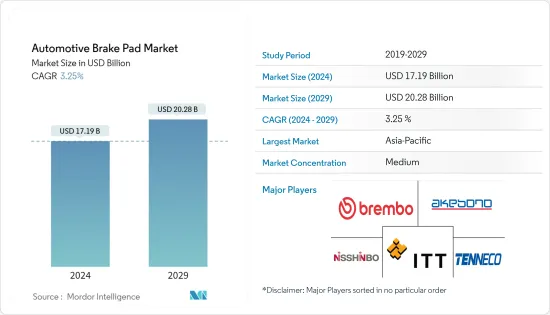

汽车煞车皮市场规模预计到2024年为171.9亿美元,预计到2029年将达到202.8亿美元,在预测期内(2024-2029年)复合年增长率预计为3.25%。

由于消费者偏好的变化、汽车产量的增加以及对车辆安全性的日益重视等多种因素,汽车煞车皮市场正在经历动态成长和转型。市场成长是由对陶瓷和石棉有机复合复合材料等轻质和先进摩擦材料的需求不断增长、产品推出数量的增加、乘客和行人安全意识的提高以及政府加强安全法规所推动的。

此外,快速的都市化、交通拥堵以及对高性能车辆不断增长的需求正在推动乘用车和电动车 (EV) 的需求。电动车的普及为煞车皮製造商提供了开发专用解决方案以满足电动车再生煞车独特要求的机会。汽车需求的激增正在扩大煞车皮市场。

此外,高端和豪华汽车製造商越来越注重製造功能增强的新产品,以及新兴市场乘用车销售需求的不断增长,预计将在预测期内增加汽车煞车皮市场,从而进一步推动成长。产业参与者经常推出针对卡车和 SUV 客製化煞车设计的新产品,预计将在预测期内加速市场成长。然而,原材料价格上涨和有害物质法规等严格法规可能会抑制市场成长。

由于汽车销售的成长和消费者可支配收入的增加,预计亚太地区将主导市场。此外,在整个预测期内,新兴国家廉价劳动力和原材料的供应也推动了该市场的发展。中国和印度正在推动该产品的需求增加,并推动该地区的成长。特别是中国,由于严重事故的迅速增加和机队的扩大,预计将成为该行业的主要企业,并有望进一步促进业务成长。

汽车煞车皮市场趋势

乘用车市场领先的细分市场

乘用车细分市场是汽车煞车皮市场中最大的细分市场,受到乘用车数量增加、消费者对车辆升级偏好的变化以及煞车系统技术进步等因素的推动。

此外,道路上大量的客车直接增加了对煞车皮的需求。 2022年,全球乘用车销量为5,749万辆,相较于2021年的5,644万辆,与前一年同期比较同期成长约1.9%。随着乘用车产量和销量的预计增长以及电动车在全球的普及,未来几年将需要具有更高耐用性和散热性能的先进汽车煞车皮产品,预计需求将快速增长。

此外,严格的安全法规和消费者对车辆安全意识的提高也推动了市场的发展。乘用车是个人和家庭最广泛使用的交通工具,并且由于容易发生事故而受到严格的安全法规的约束。许多地区的政府都推出了有关车辆煞车系统的强制性法规。例如

- 2023 年 7 月,NHTSA提案了新的联邦机动车辆安全标准,要求轻型车辆配备自动紧急煞车系统,包括行人 AEB。 NHTSA 估计,这项提议的规则每年将挽救至少 360 人的生命并减少至少 24,000 人受伤。

此外,随着已开发国家对乘用车的需求不断增加,市场主要参与者正在增加对煞车皮耐用性的投资,因为高端和豪华汽车製造商被迫增加投资来开发具有先进功能的新产品。研发,引进尖端材料与设计,提升性能、安全性和性能。例如

- 2023 年 8 月,日本 Totachi Industrial 开始生产煞车皮,扩大其综合解决方案产品范围。煞车皮是该公司产品线的新成员,专为各种品牌的乘用车而设计。这些煞车皮作为OEM(目的地设备製造商)产品精心製造,确保卓越的品质。

因此,预计乘用车领域在预测期内将显着成长。

亚太地区是最有前景的市场

全球整体,亚太地区占据市场主导地位,其次是欧洲和北美。预计亚太地区的成长率最高,由于安全标准和政府法规的收紧,中国、印度、日本和韩国等国家对全球防锁死煞车系统收益成长做出了重大贡献。

作为全球最大的汽车市场,中国预计将成为关键地区之一。到2022年,中国将成为全球最大的区域汽车市场,光是汽车销售就将超过2,360万辆。这种成长直接影响了对煞车皮的需求,因为每辆车都需要这个重要零件。此外,中国的汽车工业正在不断发展,煞车皮技术也不断发展。

降低噪音、延长垫片寿命和提高煞车性能是极为重要的功能。在噪音污染令人担忧的城市环境中,低噪音煞车皮的需求量很大。中国煞车皮市场竞争激烈,国内外厂商争夺市场占有率。几个主要市场参与者正在大力投资在该国建立新的生产设施。例如

- 2023年6月,美国供应商天纳克宣布,其目标是透过专注于本土电动车製造商来提高其在中国煞车零件业务的收益,而这也是中国煞车皮市场的驱动力。

此外,印度汽车产业的生产和销售正在成长,使其成为煞车皮的潜在市场。售后市场领域在印度煞车皮市场中扮演重要角色。定期更换煞车皮对于道路安全和车辆维护至关重要,从而推动售后市场销售。在这个市场上,许多公司正在大力投资在国内建立新的生产设施,以满足不断增长的国内外需求并提高盈利和市场占有率。例如

- 2023 年 3 月,印度和全球OEM的一级供应商 Brakes India 推出了 ZAP煞车皮,该煞车片采用专为电动车量身定制的先进摩擦技术。这款专用煞车皮旨在满足电动车客户的独特需求,提供更好的防腐蚀保护和更安静的运行。

在此类全部区域发展的支持下,汽车煞车皮的需求预计在预测期内将以合理的速度成长。

汽车煞车皮产业概况

汽车煞车皮市场主要分为ITT Inc.、Brembo SpA、ADVICS、北京德尔福万源引擎管理系统、博格华纳上海汽车燃油系统、罗伯特·博世有限公司、德尔福科技、天纳克公司、Akebono Brake Company、 主要企业 Brakes等。由于少数製造公司的存在,该市场正在经历适度的整合。

这些市场领导在研发方面投入大量资金,将尖端技术融入其产品中,并不断推出升级产品以保持竞争力。

- 例如,2023 年 3 月,Brakes India 推出了 ZAP煞车皮,该煞车片采用专用电动车设计的卓越摩擦技术。除了高度耐腐蚀之外,该垫片还提供安静的製动,直接满足电池供电车辆的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 煞车皮材料和技术的进步

- 市场限制因素

- 煞车皮市场受原物料成本影响

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依材料类型

- 半金属

- 无石棉有机

- 低金属

- 陶瓷製品

- 按职位类型

- 正面

- 后部

- 按销售管道

- 目的地设备製造商(OEM)

- 售后市场

- 按车型

- 客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 韩国

- 日本

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Brembo SpA

- Nisshinbo Brake Inc

- ITT Inc.

- Robert Bosch GmBH

- Tenneco Inc.

- Akebono Brake Company

- Beijing Delphi Wanyuan Engine Management Systems Co., Ltd.

- ADVICS

- EBC Brakes

- BorgWarner Shanghai Automotive Fuel Systems Co., Ltd.

第七章 市场机会及未来趋势

- 对环保煞车皮的需求不断增长

The Automotive Brake Pad Market size is estimated at USD 17.19 billion in 2024, and is expected to reach USD 20.28 billion by 2029, growing at a CAGR of 3.25% during the forecast period (2024-2029).

The automotive brake pad market is experiencing dynamic growth and transformation, driven by a combination of factors, including changing consumer preferences, increasing vehicle production, and the growing focus on vehicle safety. The growth of the market depends on several factors, such as the rise in demand for lightweight and advanced friction materials, such as ceramic and asbestos organic composites, the rising number of product launches, increasing awareness regarding passenger and pedestrian safety and increasing safety regulations by the government.

Furthermore, rapid urbanization, traffic congestion, and the growing demand for high-performance vehicles are propelling the demand for passenger and electric vehicles (EVs). The proliferation of electric vehicles is presenting opportunities for brake pad manufacturers to develop specialized solutions tailored to the unique requirements of regenerative braking in EVs. This surge in demand for automobiles, in turn, augments the brake pad market.

Moreover, the growing focus by the premium and luxury car manufacturers to manufacture new products with enhanced features and growing demand for passenger car sales in developed nations is further expected to drive the automotive brake pads market growth during the forecast period. Industry players are frequently launching new products with customized braking designs for trucks and SUVs is expected to accelerate the market growth during the forecast period. However, increases in the prices of raw materials and stringent regulations such as toxic substances control are likely to restrain the market's growth.

The Asia-Pacific region is projected to dominate the market due to the increasing sales of vehicles, as well as an uptick in disposable income among consumers. This is further bolstered by the availability of inexpensive labor and raw materials in emerging economies throughout the forecast period. China and India serve as catalysts for growth within the region, as they contribute to the rising demand for the product. China, in particular, is anticipated to emerge as a major player in the industry due to a surge in serious accidents and an expanding fleet, which is expected to further contribute to the growth of the business.

Automotive Brake Pad Market Trends

Passenger Car is the Leading Segment in the Market

The passenger car segment is the largest segment in the automotive brake pad market, driven by factors like increasing volume of passenger cars, changing consumer preferences towards vehicle upgradation, technological advancement in braking systems, etc. among others.

Further, the huge volume of passenger cars on the roads contributes directly to the demand for brake pads. In 2022, 57.49 million units of passenger cars were sold globally, as compared to 56.44 million units in 2021, registering an year-on-year growth of about 1.9 percent. With the increase in passenger car production and sales and the anticipation of greater adoption of electric vehicles across the globe, there will be surge in demand for advanced automotive brake pad products with higher durability and greater heat dissipation capability in the coming years.

Additionally, stringent safety regulations and increasing consumer awareness regarding vehicle safety also drives the market. Being the most widely used personal mode of transport for individuals as well as for families, passenger cars are prone to accidents, and thus are subject to strict safety norms. Government in many regions gave introduced mandatory regulations regarding braking system in cars. For instance,

- In July 2023, the NHTSA proposed a new Federal Motor Vehicle Safety Standard to require automatic emergency braking systems including pedestrian AEB on light vehicles. The NHTSA projects that this proposed rule would save at least 360 lives a year and reduce injuries by at least 24,000 annually.

Additionally, the rising investments from premium and luxury car manufacturers to develop new products with advanced features, coupled with the increasing demand for passenger cars in developed nations, are compelling the key market players to invest in research and development to introduce advanced materials and designs that enhance the durability, performance, and safety of brake pads. For instance,

- In August 2023, Totachi Industrial Co. Ltd., based in Japan, expanded its comprehensive solution by initiating the manufacturing of brake pads. The latest addition to their product lineup encompasses brake pads designed for passenger cars across diverse brands. These brake pads are meticulously crafted to serve as original equipment manufacturer (OEM) products, guaranteeing exceptional quality.

Hence, the passenger car segment is expected to witness significant growth during the forecast period.

Asia Pacific to be the most Potential Market

Globally, Asia-Pacific is the most dominant region in the market, followed by Europe and North America. Asia-Pacific is likely to possess the highest growth rate, with countries like China, India, Japan, and South Korea expected to contribute significantly to the growth in terms of revenue in the global anti-lock braking system due to safety norms and firm government regulations.

China is expected to emerge as one of the major regions, owing to its largest automotive market in the world. China was the world's largest regional market for automobiles in 2022, accounting for over 23.6 million units sales alone. This growth directly influences the demand for brake pads, as each vehicle requires this essential component. Also, the automotive industry in China is evolving, and so is the brake pad technology.

Noise reduction, extended pad life, and enhanced braking performance are crucial features. In urban environments where noise pollution is a concern, low-noise brake pads are highly sought after. The brake pad market in China is highly competitive, with both local and international players vying for market share. Multiple key market players are making substantial investments to establish new production facilities within the country. For instance,

- In June 2023, Tenneco, a U.S. supplier, set its sights on boosting revenue from its brake parts business in China by focusing on local manufacturers of electrified vehicles, which also drive the brake pad market in the country.

Moreover, the growing vehicle production and sales in the automotive sector in India makes it a potential market for brake pads. The aftermarket segment plays a substantial role in the Indian brake pad market. Regular brake pad replacement is essential for road safety and vehicle maintenance, which fuels aftermarket sales. Numerous players in the market are investing heavily in setting up new production units in the country to meet the rising demands for local and international markets and enhance their profitability and market share. For instance,

- In March 2023, Brakes India, a Tier-1 supplier to both Indian and global OEMs, introduced ZAP brake pads featuring advanced friction technology tailored for electric vehicles. These specialized brake pads are designed to meet the unique needs of electric vehicle customers, providing improved corrosion protection and ensuring quieter braking.

On the back of such development across the region, the demand for automotive brake pads is likely to grow at a decent rate during the forecast period.

Automotive Brake Pad Industry Overview

The automotive brake pad market is primarily dominated by key players such as ITT Inc., Brembo S.p.A., ADVICS, Beijing Delphi Wanyuan Engine Management Systems Co., Ltd., BorgWarner Shanghai Automotive Fuel Systems Co., Ltd., Robert Bosch GmBH, Delphi Technologies, Tenneco Inc., Akebono Brake Company, and EBC Brakes, among others. This market exhibits moderate consolidation due to the presence of a select few manufacturing companies.

These market leaders are heavily investing in research and development to integrate state-of-the-art technology into their products, consistently introducing upgraded offerings to maintain their competitive edge.

- For instance, in March 2023, Brakes India introduced ZAP brake pads, leveraging superior friction technology specifically designed for electric vehicles. These pads not only offer better corrosion protection but also ensure silent braking, catering directly to the needs of battery-powered

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Advancements in Brake Pad Materials and Technologies

- 4.2 Market Restraints

- 4.2.1 The Brake Pad Market is Influenced by the Cost of Raw Materials

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Semi-Metallic

- 5.1.2 Non-Asbestos Organic

- 5.1.3 Low-Metallic

- 5.1.4 Ceramic

- 5.2 By Position Type

- 5.2.1 Front

- 5.2.2 Rear

- 5.3 By Sales Channel Type

- 5.3.1 Original Equipment Manufacturers (OEMs)

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 South Korea

- 5.5.3.4 Japan

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the world

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Brembo S.p.A.

- 6.2.2 Nisshinbo Brake Inc

- 6.2.3 ITT Inc.

- 6.2.4 Robert Bosch GmBH

- 6.2.5 Tenneco Inc.

- 6.2.6 Akebono Brake Company

- 6.2.7 Beijing Delphi Wanyuan Engine Management Systems Co., Ltd.

- 6.2.8 ADVICS

- 6.2.9 EBC Brakes

- 6.2.10 BorgWarner Shanghai Automotive Fuel Systems Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Environmentally Friendly Brake Pads