|

市场调查报告书

商品编码

1692468

碳酸锂-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Lithium Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

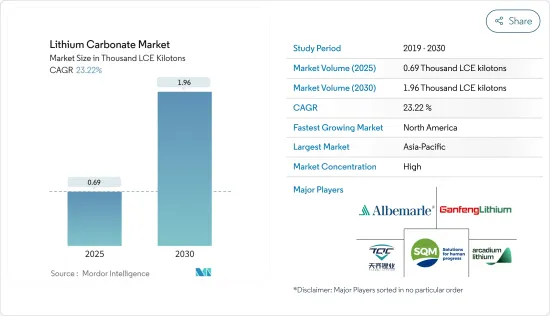

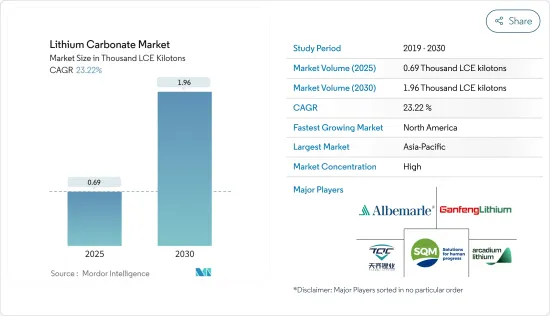

碳酸锂市场规模预计在2025年为690千吨锂,预计2030年达到1960千吨锂,预测期间(2025-2030年)的复合年增长率为23.22%。

预计锂离子电池需求的成长以及玻璃和陶瓷产业投资的增加将推动碳酸锂市场的发展。然而,锂提取的限制和锂矿的地理限制预计会阻碍市场成长。

主要亮点

- 预计冶金业不断扩大的商业机会将在预测期内为市场带来机会。

- 预计亚太地区将主导市场。预计预测期内其成长率还将显着。这是因为锂离子电池、製药、牙科以及玻璃和陶瓷应用对碳酸锂的需求不断增加。

碳酸锂市场趋势

锂离子电池应用可望推动成长

- 根据EV Volumes预测,2023年全球电动车总销量将成长15.8%,达到1,410万辆,而2022年的总销量为1,050万辆。因此,电动车销量的成长预计将增加对磷酸锂铁(LFP)电池的需求。

- 锂离子电池由于重量轻、自放电率低、易于维护和扩充性高,越来越多地被光伏系统(利用光伏效应捕获阳光并将其转化为电能的工程设备)中的太阳能电池组所采用。北美、亚太和欧洲太阳能光电装置的强劲成长正在推动整个市场对锂离子电池的需求。

- 根据国际能源总署 (IEA) 的数据,受电动乘用车销量大幅增长的推动,汽车锂离子电池的需求预计将激增 65%,从 2021 年的 330全球整体时增至 2022 年的 550 吉瓦时,2022 年全球新註册的电动乘用车数量将与前一年同期比较增长 55%。

- 锂空气电池领域的最新趋势显示出满足各个工业领域日益增长的需求的迹象。例如,2023年2月,伊利诺伊理工学院(IIT)和美国能源局(DOE)阿贡国家实验室的研究人员宣布研发出一种锂空气电池,一次充电可为电动车行驶1000多英里。该团队开发的新型电池未来可能用于国内飞机和远距卡车。

- 预计全球电池能源系统的兴起将在未来几年推动碳酸锂的需求。根据 Rystad 2022 年能源报告,预计 2022 年至 2030 年间,年度电池能源储存系统(BESS) 将成长十倍。预计全球新安装的 BESS 数量将在 2022 年达到 43GWh,到 2030 年将达到 421GWh。

- 预计这些因素将在预测期内推动全球碳酸锂市场成长。

预计亚太地区将占据主要市场占有率

- 预计预测期内亚太地区将主导碳酸锂市场。中国、日本和印度等国家对碳酸锂的需求很高,因为它用于锂离子电池、製药和铝生产。

- 中国是碳酸锂净进口国。根据国际贸易中心(Trademap)的数据,该国在2023年第四季进口了价值11.7亿美元的碳酸锂,略低于2022年同期。本季度,该国从智利进口了近88%的碳酸锂。同时,该国在2023年第四季出口了价值2,823万美元的碳酸锂。

- 据投资印度 (Invest India) 称,印度製药业的规模预计将从 2023 年的 500 亿美元增至 2030 年的 1,300 亿美元。政府的政策和计划正在支持该行业的发展。例如,印度製药部加强製药业(SPI)计画总资金为 6,090 万美元(50 亿印度卢比),正在向全国现有的製药丛集和中小微型企业提供急需的支持,以提高生产力、品质和永续性。

- 印度铝产量的增加预计将增加该国对碳酸锂的需求。例如,根据矿业部的数据,预计2023年该国的铝产量将达到350万吨,比2022年下降13%。预计到 2025 年,国内铝需求将翻倍,这将推动碳酸锂的需求。

- 日本铝合金协会表示,2023年再生裸金属及再生铝合金裸金属的产量及出货量较上年均增加。预计2023年的产量将比2022年增加0.8%至739,580吨,出货量预计将增加0.6%至738,199吨。预计未来几年国内铝及其合金产量的增加将推动碳酸锂的需求。

- 根据水泥协会预测,2023年国内水泥消费量预计为3,537万吨,与前一年同期比较下降5.6%。因此,未来几年水泥消费量的下降可能会影响日本所研究市场的成长。

- 由于这些因素,预计亚太碳酸锂市场在预测期内将稳定成长。

碳酸锂产业概况

全球碳酸锂市场本质上是一体化的,主要企业贡献了大部分市场份额。市场主要企业包括(不分先后顺序)Albemarle Corporation、SQM SA、赣锋锂业集团、天齐锂业和Arcadium Lithium。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 锂离子电池需求不断成长

- 增加对玻璃和陶瓷产业的投资

- 市场限制

- 锂提取限制和锂矿的地理限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按年级

- 技术等级

- 电池级

- 工业级

- 按应用

- 锂离子电池

- 製药和牙科

- 玻璃和陶瓷

- 铝製造

- 水泥工业

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Albemarle Corporation

- Arcadium Lithium

- Jiangxi Ganfeng Lithium Group Co. Ltd

- Levertonhelm Limited

- Lithium Americas Corp.

- Lithium Argentina Corp.

- Shandong Ruifu Lithium Co. Ltd

- SQM SA

- Tianqi Lithium Industry Co. Ltd

第七章 市场机会与未来趋势

- 冶金业的成长机会

The Lithium Carbonate Market size is estimated at 0.69 thousand lce kilotons in 2025, and is expected to reach 1.96 thousand lce kilotons by 2030, at a CAGR of 23.22% during the forecast period (2025-2030).

The growing demand for lithium-ion batteries and the increasing investments in the glass and ceramics industries are expected to drive the market for lithium carbonate. On the flip side, constraints in lithium extraction and geographical restrictions of lithium mines are expected to hinder the growth of the market.

Key Highlights

- The growing opportunity in the metallurgy industry is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register a considerable growth rate during the forecast period. This is due to the rising demand for lithium carbonate from Li-ion batteries, pharmaceuticals and dental, and glass and ceramics applications.

Lithium Carbonate Market Trends

Li-Ion Battery Applications Expected to Drive Growth

- According to EV Volumes, in 2023, the total sales of electric vehicles globally increased by 15.8%, with total sales reaching 14.1 million units compared to 2022, when total sales stood at 10.5 million units. Thus, increasing sales of electric vehicles is expected to increase the demand for lithium iron phosphate (LFP) batteries.

- Li-ion batteries are being increasingly employed for solar energy battery bank applications in solar photovoltaic systems (engineered devices that capture and convert sunlight into electricity using the photovoltaic effect) on account of being lightweight, having low self-discharge, low maintenance, and high scalability. The high growth of solar power installation in North America, Asia-Pacific, and Europe is driving the demand for Li-ion batteries across the market.

- According to the International Energy Agency (IEA), the demand for automotive Li-ion batteries jumped by a whopping 65% in 2022, reaching 550 GWh, up from 330 GWh in 2021, propelled by the tremendous rise in electric passenger car sales as evidenced by the new EV passenger car registrations increasing by 55% in 2022 y-o-y globally.

- The development in the lithium-air battery segment in recent years has shown signs of meeting the growing demand from various industry sectors. For instance, in February 2023, researchers at the Illinois Institute of Technology (IIT) and the US Department of Energy's (DOE) Argonne National Laboratory announced the development of a lithium-air battery that could power electric vehicles for more than a thousand miles on a single charge. The team's new battery design could also power domestic airplanes and long-haul trucks in the future.

- The rising battery energy system globally is expected to boost the demand for lithium carbonate in the coming years. As per the Rystad Energy report 2022, the annual battery energy storage system (BESS) is expected to grow ten times from 2022 to 2030. The new global BESS installations are expected to reach 421 GWh by 2030 from 43 GWh in 2022.

- Owing to all these factors, the market for lithium carbonate is likely to grow globally during the forecast period.

Asia-Pacific Projected to Hold Major Market Share

- Asia-Pacific is expected to dominate the lithium carbonate market during the forecast period. There is a rising demand for lithium carbonate from the Li-ion battery, pharmaceutical, and aluminum production applications in countries like China, Japan, and India.

- China is a net importer of lithium carbonate. According to the International Trade Centre (Trademap), in the fourth quarter of 2023, the country imported USD 1,170 million worth of lithium carbonate, which is slightly lower than the same period in 2022. The country imported nearly 88% of lithium carbonate from Chile in the same quarter. On the other hand, the country exported USD 28.23 million worth of lithium carbonate in Q4 2023.

- The pharmaceutical industry in India is expected to reach USD 130 billion by 2030 from USD 50 billion in 2023, according to Invest India. The government policies and schemes are supporting the growth of the industry. For instance, The Ministry's scheme "Strengthening of Pharmaceutical Industry (SPI)," with a total financial outlay of USD 60.9 million (INR 500 crores), extends support required to existing pharma clusters and MSMEs across the country to improve their productivity, quality, and sustainability.

- The rising aluminum production in India is expected to increase the demand for lithium carbonate in the country. For instance, aluminum production in the country reached 3.50 million tons in 2023, which decreased by 13% compared to 2022, according to the Ministry of Mines. The demand for aluminum in the country is expected to double by 2025, which is projected to propel the demand for lithium carbonate.

- According to the Japan Aluminum Alloy Association, the production and shipment volumes of secondary aluminum ingots and secondary aluminum alloy ingots in 2023 have both increased compared to the previous year. Production volume increased by 0.8% to 730,958 tons in 2023, and shipment volume increased by 0.6% to 738,199 tons in 2023 compared to 2022. The rising aluminum and its alloy production in the country is likely to foster the demand for lithium carbonate in the coming years.

- According to the Cement Association of Japan, domestic cement consumption reached 35.37 million tons in 2023, which declined by 5.6% compared to the previous year. Thus, declining cement consumption will likely impact the growth of the market studied in Japan in the coming years.

- Due to these factors, the lithium carbonate market in Asia-Pacific is expected to experience steady growth during the forecast period.

Lithium Carbonate Industry Overview

The global lithium carbonate market is consolidated in nature, with top players contributing to the major share of the market. Some of the major players in the market include (not in any particular order) Albemarle Corporation, SQM SA, Ganfeng Lithium Group Co. Ltd, Tianqi Lithium Industry Co. Ltd, and Arcadium Lithium.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand From Lithium-ion Batteries

- 4.1.2 Increasing Investments in the Glass and Ceramics Industry

- 4.2 Market Restraints

- 4.2.1 Constraints in Lithium Extraction and Geographical Restriction of Lithium Mines

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Grade

- 5.1.1 Technical Grade

- 5.1.2 Battery Grade

- 5.1.3 Industrial Grade

- 5.2 By Application

- 5.2.1 Li-ion Battery

- 5.2.2 Pharmaceuticals and Dental

- 5.2.3 Glass and Ceramics

- 5.2.4 Aluminum Production

- 5.2.5 Cement Industry

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Arcadium Lithium

- 6.4.3 Jiangxi Ganfeng Lithium Group Co. Ltd

- 6.4.4 Levertonhelm Limited

- 6.4.5 Lithium Americas Corp.

- 6.4.6 Lithium Argentina Corp.

- 6.4.7 Shandong Ruifu Lithium Co. Ltd

- 6.4.8 SQM SA

- 6.4.9 Tianqi Lithium Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunity in the Metallurgy Industry