|

市场调查报告书

商品编码

1537712

纸吸管:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Paper Straw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

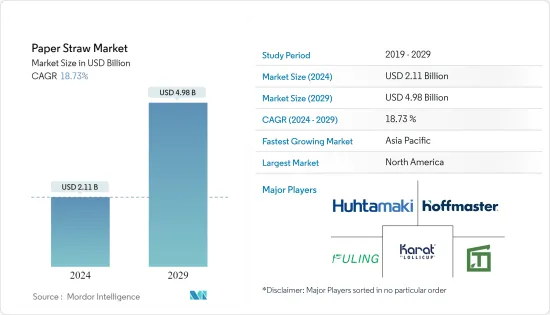

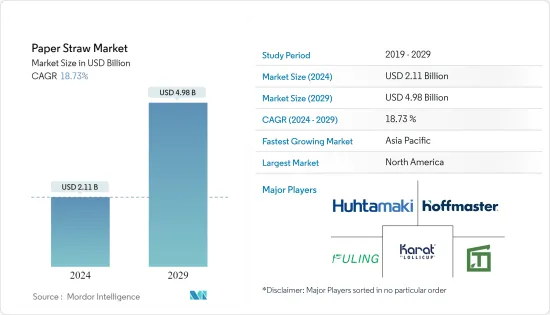

纸吸管市场规模预计到2024年为21.1亿美元,预计到2029年将达到49.8亿美元,预测期内(2024-2029年)复合年增长率为18.73%。

主要亮点

- 由于包装行业从塑胶产品转向永续的非塑胶替代品,预计纸吸管行业在预测期内将出现强劲的需求。特别是,用户的环保意识越来越强。因此,纸吸管在家庭、活动、外出饮酒、餐厅、学校、机构等场所的使用不断增加。

- 随着各国政府实施一次性塑胶特别是塑胶饮用吸管的禁令,对生物分解性纸吸管的需求正在迅速增加。随着政府对一次性塑胶的监管,纸吸管的需求预计也会随之增加。

- 许多跨国公司不断致力于产品创新,为客户提供 100%永续的选择。最近,SIG 印度推出了可回收纸吸管。我们推出了各种尺寸、形状和用途的可回收纸吸管。由于对环境影响较大,SIG 的纸吸管是塑胶吸管的最佳生物分解性非塑胶替代品。

- 餐饮业消耗大量纸吸管,随着餐厅数量的增加,该行业未来有望进一步扩大。世界各地的餐厅和食品服务业已经开始实施新策略,透过开发促进永续性、健康和健康的新产品来应对这种文化转变。

- 企业正在放弃塑胶吸管,食品批发商正在寻找对生态学有益的替代品。然而,低成本替代品的可用性和纸吸管的高成本可能会限制市场扩张。生物分解性食品包装公司 PacknWood执行长Adam Mellan 表示,纸吸管的成本约为 2.5 美分,而塑胶吸管的成本仅为 0.5 美分。

纸吸管市场趋势

符合严格法规的环保吸管的兴起

- 环保吸管由无毒且生物分解性的材料製成。它正在迅速应用于餐厅、酒吧、酒馆、家庭等。由于餐饮领域食品饮料消费量的增加,需要大量的环保吸管来满足需求。此外,环境和政治改革以及世界各地禁止一次性塑胶产品的法律预计将对环保吸管市场的扩张产生重大影响。

- 欧盟(EU)正积极致力于污染防治。自 2021 年 7 月 3 日起,欧盟成员国市场禁止抛弃式塑胶盘、刀叉餐具、吸管、气球拭子和棉花棒。该法规也适用于杯子、发泡聚苯乙烯食品和饮料容器以及所有由Oxo可分解塑胶製成的产品。

- 同样在2022年12月,加拿大政府宣布了一项打击污染的综合计划,到2030年实现零塑胶废弃物的目标,并宣布帮助减少温室气体排放,其中包括一次性塑胶限制规则(SUPPR)。政府对塑胶使用的严格规定正在对世界各地对纸吸管的需求产生积极影响。

- 世界各地的几家公司正在重新引入最常见的一次性塑料,这些塑料构成了最大量的海洋废弃物,包括吸管、塑胶杯、盖子、刀叉餐具、搅拌器和食品容器。阿布达比计划从 2022年终开始禁止所有一次性塑胶製品。阿拉伯联合大公国的豪华酒店和商店已开始使用永续的豪华吸管,作为逐步淘汰传统塑胶使用的全球运动的一部分,符合该国的永续发展目标。这种对一次性塑胶的重大观点是迈向更永续、更干净的环境的真正一步。

- 餐饮业市场扩张的另一个驱动力是消费行为的改变。餐饮服务业是纸吸管的主要终端消费者,餐饮服务网点数量的增加使得纸吸管的需求量显着增加。

- 根据某些速食连锁店发布的报告,麦当劳门市数量将从2022年的40,275家增加到2023年的41,822家,达美乐披萨的数量将从2022年的19,880家增加到2023年的41,822家。年的27,760家增加到2023年的29,900家。食物链的持续成长预计将推动市场成长。

亚太地区旅馆业的扩张影响市场成长

- 由于亚太地区酒店业的扩张,预计该市场将在预测期内成长。随着食品店和旅馆业的发展,对纸吸管的需求急剧增加,食品和旅馆业占最终用户的很大一部分。由于都市化的快速发展、西方生活方式意识的增强、职业妇女数量的迅速增加以及可支配收入的增加等因素,餐饮业得以扩张。

- 印度国家餐厅协会 (NRAI) 预测印度的摊位和美食广场将迅速扩张。据 NRAI 称,这种快速成长是由与餐厅空间相比较低的租金、较高的投资收益、品牌渗透和新的位置机会所推动的。

- 在对抗塑胶废弃物的斗争中,亚洲是受塑胶污染有害影响最严重的地区。包括印度、中国、孟加拉、新加坡和其他几个国家立法在内的几个亚洲国家已经推出了有关一次性塑胶的法规。由于这些禁令,亚洲国家对纸吸管的需求预计未来将会增加。

- 国际计划管理协会(IPMA)的一份报告称,造纸业也认为印度拥有生产纸吸管用纸的技术力和能力。

- 该地区的许多製造商不断对其产品进行投资,以满足不断增长的需求。近年来,UFlex Limited 宣布了倡议,透过在印度古吉拉突邦建立印度第一条 U 形纸吸管生产线来实现永续转变。这条秸秆生产线采用了荷兰技术,年产能约24亿根秸秆。

- 全部区域消费者对永续产品的需求不断增长,加上政府对塑胶使用的监管政策,预计将推动纸吸管未来的成长。此外,亚太地区酒店业的崛起和可支配收入的增加可能会支持未来几年的市场成长。

纸吸管行业概况

纸吸管市场较为分散。市场主要企业包括Hoffmaster Group Inc.、Huhtamaki Oyj、Fuling Global Inc.、Transcend Packaging Ltd.、Tembo Paper BV、Karat Packaging Inc. (Lollicup USA Inc.)等。在这个市场上运营的公司专注于提供创新产品以保持竞争力。

2023年8月,Transcend Packaging Ltd.宣布与克鲁勃润滑剂公司合作,使用植物来源润滑剂生产纸吸管,减少矿物油芳香烃(MOAH)的使用。此次合作将使该公司能够改进其製造工艺,以消除矿物油残留物,并提供符合预计在欧洲实施的未来立法的产品。

2023年5月,IPI SRL宣布收购王子控股。透过此次收购,王子控股将利用 IPI 的技术和知识进一步开发纸张市场。

额外好处

- Excel 格式的市场评估 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估地缘政治对市场的影响

第五章市场动态

- 市场驱动因素

- 消费者对环保吸管的需求不断增加

- 一次性塑胶产品禁令推动市场成长

- 市场限制因素

- 纸吸管的高成本和替代品的可用性

第六章 市场细分

- 依材料类型

- 原生纸

- 再生纸

- 按用途

- 食品服务

- 一般家庭

- 教育机构

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Uflex Limited

- Hoffmaster Group Inc.

- Transcend Packaging Ltd

- Huhtamaki Oyj

- Fuling Global Inc.

- Tembo Paper BV

- Tetra Pak International SA

- Canada Brown Eco Products Ltd

- Karat Packaging Inc.(Lollicup USA Inc.)

- IPI SRL

第八章投资分析

第九章市场机会与未来展望

The Paper Straw Market size is estimated at USD 2.11 billion in 2024, and is expected to reach USD 4.98 billion by 2029, growing at a CAGR of 18.73% during the forecast period (2024-2029).

Key Highlights

- The paper straw industry is expected to witness robust demand during the forecast period due to the packaging industry's transition from plastic products to sustainable, non-plastic alternatives. Notably, users have become environmentally conscious. Consequently, the use of paper straws at home, at events, for on-the-go beverages, foodservice outlets, in schools, institutions, and elsewhere has increased.

- The demand for biodegradable paper straws is increasing quickly due to the many governments across several nations implementing bans on single-use plastics, especially plastic drinking straws. With government regulations on single-use plastic, the demand for paper straws is expected to increase proportionately.

- Many global firms are constantly moving toward innovating products to provide their customers with 100% sustainable options. Recently, SIG India launched recyclable paper straws. It launched various recyclable paper straws with multiple dimensions, shapes, and applications. SIG's paper straws provide the best biodegradable, non-plastic alternative to plastic straws due to the huge environmental impact caused by plastic straws.

- The foodservice industry consumes a lot of paper straws, and due to increased food outlets, this industry is anticipated to proliferate. Global restaurants and food outlets have already started implementing new strategies to keep up with this cultural transition by developing new products that promote sustainability, wellness, and health.

- Businesses are abandoning plastic straws, and food wholesalers are seeking ecologically sound alternatives. However, the availability of a low-cost alternative and the high cost of paper straws may limit the market's expansion. According to Adam Merran, the CEO of PacknWood, a biodegradable food packaging company, paper straws cost roughly 2.5 cents, and plastic straws cost only 0.5 cents.

Paper Straw Market Trends

The Rise of Environmentally Friendly Straws in Response to Stringent Regulations

- Environment-friendly straws are made of non-toxic and biodegradable materials. They are rapidly used in restaurants, bars, pubs, and homes. Increasing food and beverage consumption in catering areas necessitates a large number of eco-friendly straws to meet the demand. Additionally, the expansion of the eco-friendly straw market is anticipated to be fueled by the significant influence of environmental and political reforms and legislation to ban single-use plastic products worldwide.

- The European Union is taking active action to combat plastic pollution. Starting on July 3, 2021, single-use plastic plates, cutlery, straws, balloon sticks, and cotton buds were banned from the markets of EU member states. The same regulation also applies to cups, expanded polystyrene food and drink containers, and all products made of oxo-degradable plastic.

- Also, in December 2022, the Government of Canada announced its comprehensive plan to address pollution, achieve its goal of zero plastic waste by 2030, and assist in lowering greenhouse gas emissions, including the Single-use Plastics Restriction Rules (SUPPR). These strong regulations made by the government against the use of plastic have positively impacted the demand for paper straws across the world.

- Several businesses worldwide are reintroducing the most common single-use plastics, such as straws, plastic cups, lids, cutlery, stirrers, and food containers, which account for the largest amount of marine waste. Abu Dhabi planned to outlaw all single-use plastics from the end of 2022. To align with the country's sustainable ambition, luxury hotels and high-end stores in the United Arab Emirates started using premium sustainable straws as part of a global movement to eliminate conventional plastic use. This marked change in perspective toward single-use plastic is a practical step toward a more sustainable and cleaner environment.

- A further factor driving market expansion in the foodservice industry is changing consumer behavior. The foodservice industry is a primary end-use consumer of paper straws, and the increasing number of food outlets significantly boosts the need for paper straws.

- According to reports published by selected fast-food restaurant chains, the number of McDonald's restaurants increased from 40,275 in 2022 to 41,822 in 2023, Domino's Pizza stores reached 20,591 in 2023 from 19,880 in 2022, and Kentucky Fried Chicken restaurants rose from 27,760 in 2022 to 29,900 in 2023. The consistent growth of food chains is expected to boost the market growth.

Expanding Hospitality Sector in Asia-Pacific to Impact the Market Growth

- The market is predicted to grow during the projected period due to the expansion of the hospitality sector in Asia-Pacific. The need for paper straws has been dramatically improved by the development of food shops and the hospitality sector, which account for a sizable portion of their end users. The restaurant industry has expanded due to rapid urbanization, increased awareness of Western lifestyles, a surge in working women, and rising disposable income.

- The National Restaurant Association of India (NRAI) anticipates an exponential expansion in kiosks and food courts in India. According to the NRAI, decreased rental rates compared to restaurant space, higher return on investment, brand penetration, and new location opportunities are among the factors contributing to this rapid rise.

- In the struggle against plastic waste, Asia is the most affected by the harmful repercussions of plastic pollution. Several Asian nations, including India, China, Bangladesh, Singapore, and several other national legislations, introduced restrictions on single-use plastics. These bans are expected to propel the demand for paper straws in Asian countries in the upcoming period.

- Additionally, according to a report by the International Project Management Association (IPMA), the paper industry believes that India has the technological capability and capacity to produce paper for paper straws.

- Many manufacturers across the region are consistently investing in products to meet the rising demand. In the past couple of years, UFlex Limited announced its initiative to bring a sustainable shift to its fold by establishing India's first U-shaped paper straw manufacturing line in Gujarat, India. The paper straw production line is equipped with Dutch technology and has a production capacity of about 2.4 billion straws per year.

- The rise in consumer demand for sustainable products across the region, coupled with the government's regulatory policies against the use of plastic, is expected to propel the growth of paper straws in the future. Also, the upswing in the Asia-Pacific hospitality sector and the rise in disposable income would boost the market growth in the future.

Paper Straw Industry Overview

The paper straw market is fragmented in nature. The key players in the market include Hoffmaster Group Inc., Huhtamaki Oyj, Fuling Global Inc., Transcend Packaging Ltd, Tembo Paper BV, and Karat Packaging Inc. (Lollicup USA Inc.). The players operating in the market are focusing on offering innovative products to stay competitive.

In August 2023, Transcend Packaging Ltd announced its partnership with Kluber Lubrications to make paper straws using vegetable-origin lubricants and reduce the use of mineral oil aromatic hydrocarbons (MOAH). The partnership will help the company evolve its production process, eliminate traces of mineral oil residue, and offer products that are compliant with future legislation that is expected to come into effect across Europe.

In May 2023, IPI SRL announced the acquisition of Oji Holdings Corporation. The acquisition will help Oji Holdings Corporation leverage IPI's technology and knowledge, leading to further development in the paper market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Geopolitical Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Demand for Eco-Friendly Straws

- 5.1.2 Ban on Single-use Plastic Products Aids the Market Growth

- 5.2 Market Restraint

- 5.2.1 High Cost of Paper Straws and Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Virgin Paper

- 6.1.2 Recycled Paper

- 6.2 By Application

- 6.2.1 Foodservice

- 6.2.2 Households

- 6.2.3 Institutions

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Uflex Limited

- 7.1.2 Hoffmaster Group Inc.

- 7.1.3 Transcend Packaging Ltd

- 7.1.4 Huhtamaki Oyj

- 7.1.5 Fuling Global Inc.

- 7.1.6 Tembo Paper BV

- 7.1.7 Tetra Pak International SA

- 7.1.8 Canada Brown Eco Products Ltd

- 7.1.9 Karat Packaging Inc. (Lollicup USA Inc.)

- 7.1.10 IPI SRL