|

市场调查报告书

商品编码

1693681

设施管理软体-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Facility Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

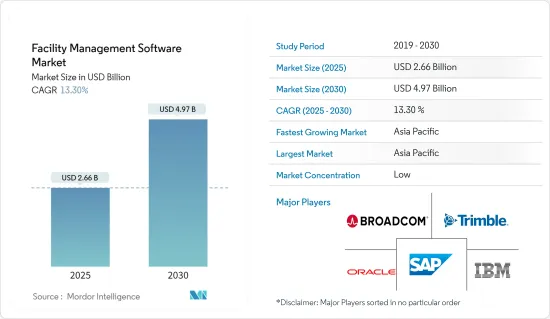

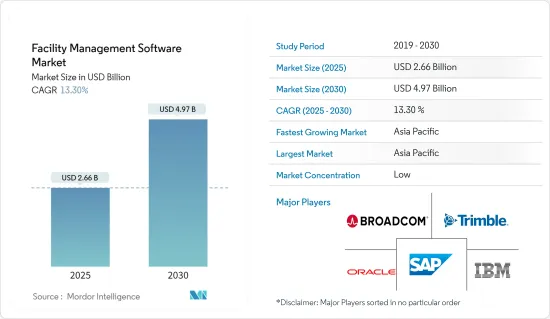

设施管理软体市场规模预计在 2025 年为 26.6 亿美元,预计到 2030 年将达到 49.7 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 13.3%。

设施管理由几个影响组织生产力和效率的部分组成。新的管理系统标准与行业最佳实践保持一致,将成为在全球范围内制定和推广有效的策略、战术性和营运 FM 原则的基准。

关键亮点

- 电脑辅助设施管理 (CAFM) 软体可让设施经理组织、实施和追踪所有维护业务,包括纠正和规划预防性维护、空间和移动管理、资产管理、营运设施服务、房间预订和其他客户服务。 CAFM 占据了设施管理软体市场的很大一部分。

- 由于大型企业定期采用 CAFM 服务和软体来管理其资产、空间、建筑物和财产,预计预测期内对 CAFM 的需求将会成长。基础建设,包括铁路、港口和机场建设,是多国政府的优先事项。这导致对 CAFM 软体的需求增加。这是因为政府与服务供应商的合作更加紧密,以保持基础设施清洁并促进绿化。

- 基础建设,包括铁路、港口和机场建设,是世界各国政府的优先事项。这导致对 CAFM 软体的需求增加。因为政府正在与帮助保持基础设施清洁和绿色的服务供应商更紧密地合作。如今,云端运算技术为最终用户提供了更多选择,将软体和服务的可配置性与运算移动性结合在一起。

- 由于公司内的每个人都可以使用应用程式和服务,这使得公司之间的资料共用更加成功。市场参与企业定期投资开发根据业务需求量身订做的 CAFM 解决方案。因此,软体公司正在大力投资研发,以透过先进技术扩大其提供的服务范围。

- 缺乏与现有工作流程的适当整合可能会导致效率低下、资料孤岛和使用者采用阻力,从而阻碍设施管理软体市场的发展。如果软体无法无缝融入您现有的流程,它可能会扰乱业务并降低整体生产力。对于那些优先考虑相容性和易于部署的潜在买家来说,整合挑战也可能是一种阻碍。

- 在经济扩张期间,对商业产品和服务的需求更大。随着活动的增加,企业经常投资设施管理软体等技术来提高生产力和业务效率。目标是简化业务、降低开支并使您的公司长期成功。

设施管理软体市场趋势

商业领域将强劲成长

- 商业房地产包括企业或营业单位建造或占用的办公大楼,例如製造业办公室、IT、通讯和其他服务供应商。由于全球商业建筑的不断增加,设施管理的重要性日益增加,推动了 FM 软体市场的成长。

- 商业区需要物业会计、租赁、合约管理、采购管理等服务,有效的设施管理软体是必要的。因此,商业类别在市场上正见证着指数级的成长机会,并且预计这一趋势将在整个预测期内持续下去。

- 从类型来看,CAFM(电脑辅助设施管理)预计将显着成长。电脑辅助设施管理 (CAFM) 软体使设施管理人员能够规划、执行和监控预防性维护、空间管理、资产管理、营运设施服务和其他客户服务。对空间规划和管理、租赁和物业管理、资本计划管理、资产管理、能源性能分析、维护管理、实体建筑管理和空间预订的需求不断增长,可能会增加商业领域对 CAFM 软体的采用。

- 2024 年 3 月,关键基础设施服务服务供应商与物业营运软体公司 Facilio 合作,部署该公司云端基础的Connected CaFM 解决方案,以优化和简化资料中心业务。 Facilio 的 Connected CaFM 解决方案提高了效率、回应能力和整体效能,提供了可扩展的架构以满足 CFS 日益增长的需求。该公司的人工智慧主导平台使商业终端用户能够集中汇总数据、优化效能并管理其投资组合。

- 中东和非洲正在见证 FM 软体的广泛采用。沙乌地阿拉伯的 CIT 集团和杜拜的优质设施管理 (QFM) 等综合 FM服务供应商已采用 Connected CaFM 作为其 FM 平台,以集中管理业务内部和外包业务,提供完整的可视性、控制力和增值。

- 全球IT和电讯产业的兴起正在推动商业物业管理软体的扩张。例如,通讯业者正专注于部署5G,为该地区的设施管理产业创造了巨大的机会。此外,爱立信预计,到2029年,5G将覆盖全球85%的人口。例如,加强伙伴关係和协作将实现建筑物检查以及通风、空调、电气、暖气和卫生系统、仪器和控制技术的维护和维修。这将使市场参与企业能够在市场上建立强大的影响力并扩大基本客群。

亚太地区预计将经历强劲成长

- 亚太地区的设施管理软体市场可能会受到多种趋势的推动。例如,物联网 (IoT) 是指使用互联网连接到 FM 团队的实体设备和感测器。这些会产生性能数据,提醒设施管理人员潜在问题。 FM 软体可让您从任何地方监控和控制您的流程。物联网可以为您的营运提供即时洞察。

- 物联网将与 FM 软体(例如电脑化维护管理系统 (CMMS))相结合,以识别问题(例如,办公室温度不适合)、建立和调度工作订单并追踪其执行情况——所有这些都无需人工干预。

- 智慧城市和智慧建筑在市场上的出现刺激了对设施管理软体的整体需求,这促使该地区的市场参与企业推出新产品和服务。

- 例如,在印度拥有大量业务的全球物联网推动者公司 Telit Cinterion 也提供物联网模组、边缘到云端服务、物联网内建软体和设施管理软体分析。此外,该公司的服务还包括能源使用管理和卫生管理等功能,这些功能以前在传统的建筑管理中都是手动完成的。智慧设施解决方案透过将感测器输入和机器学习与连接性和分析相结合来自动化这些流程。透过基于物联网的设施管理,可以提前安排和协调这些功能以实现最高效率。

- 建设活动的增加和住宅的扩张可能会促进印度设施管理软体市场的成长。

设施管理软体产业概况

设施管理软体市场分散,包括拥有数十年行业经验的国内和国际参与企业。场地供应商利用他们的专业知识,采取了强有力的竞争策略。设施软体公司正在将技术融入其服务中,以增强其服务组合。主要参与企业包括 IBM Corporation、Broadcom、Oracle Corporation、SAP SE 和 Trimble Inc.。

- 2024 年 3 月,关键基础设施服务服务供应商与物业营运软体公司 Facilio 合作,部署该公司云端基础的Connected CaFM 解决方案,以优化和简化资料中心营运。 Facilio 的 Connected CaFM 解决方案提高了效率、回应能力和整体效能,提供了可扩展的架构以满足 CFS 日益增长的需求。该公司的人工智慧主导平台使商业终端用户能够集中汇总数据、优化效能并管理其投资组合。

- 2023年11月,德勤宣布将与IBM合作,协助客户加速其排放策略,并将永续性计画融入其组织的核心营运。它还可以帮助监控资产监控、管理、预测性维护和可靠性规划的绩效目标和脱碳计划,并与 IBM 永续性软体解决方案套件 IBM Maximo Application Suite 中的其他产品整合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- CAFM解决方案需求旺盛

- 人工智慧和物联网在设施管理软体中的应用日益广泛

- 市场限制

- 缺乏与工作流程的适当集成

第六章市场区隔

- 按类型

- 电脑辅助设施管理(CAFM)

- 整合工作场所管理系统 (IWMS)

- 电脑化维护管理系统(CMMS)

- 按最终用户

- 商业设施

- 设施

- 公共基础设施

- 工业的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- IBM Corporation

- Broadcom

- Oracle Corporation

- SAP SE

- Trimble Inc.

- Upkeep Maintenance Management

- Accruent LLC(Fortive Corporation)

- Planon Software Services Private Limited

- FTMaintenance(FasTrak SoftWorks Inc.)

- Eptura

第八章投资分析

第九章 市场机会与未来趋势

The Facility Management Software Market size is estimated at USD 2.66 billion in 2025, and is expected to reach USD 4.97 billion by 2030, at a CAGR of 13.3% during the forecast period (2025-2030).

Facility management consists of multiple factors that influence the productivity and efficiency of organizations. The new management system standard, conforming with the best industry practices, constitutes a benchmark for developing and driving effective strategic, tactical, and operational FM principles globally.

Key Highlights

- Facility managers can use computer-aided facility management (CAFM) software to organize, carry out, and keep track of all maintenance tasks, such as reactive and planned preventative maintenance, space and move management, asset management, operational facility services, room reservations, and other client services. CAFM holds a significant portion of the facility management software market.

- The demand for CAFM is expected to grow during the forecast period as large enterprises regularly implement CAFM services and software to manage assets, spaces, buildings, and properties. Infrastructure development, including building railways, ports, and airports, is a priority for governments in several nations. With this, the need for CAFM software has grown because the government works more closely with service providers that help keep infrastructure clean and green.

- Infrastructure development, including building railways, ports, and airports, is a priority for governments in several different nations. With this, the need for CAFM software has grown because the government works more closely with service providers that help keep infrastructure clean and green. At present, end users are getting various options due to cloud computing technology, which combines software and service configurability and computing mobility.

- Due to this, sharing data between businesses is now more successful because it ensures that everyone in the company can use applications and services. The key players in the market regularly invest in developing customized CAFM solutions according to business demand. As a result, software companies are investing heavily in research and development to broaden their offerings through advanced technology.

- The lack of proper integration with existing workflows can hinder the facility management software market by causing inefficiencies, data silos, and resistance to adoption among users. When software does not seamlessly fit into existing processes, it can disrupt operations and decrease overall productivity. Integration challenges may also deter potential buyers who prioritize compatibility and ease of implementation.

- There is a greater need for business goods and services during economic expansion. Due to this increase in activity, businesses frequently invest in technology like facility management software that can increase productivity and operational efficiency. The goal is to streamline operations, cut expenses, and put the company in a position for long-term success.

Facility Management Software Market Trends

Commercial Sector to Witness Significant Growth

- The commercial entities include office buildings constructed or occupied by businesses or enterprises, such as manufacturers' offices, IT and telecommunication, and other service providers. Owing to the increasing establishment of commercial buildings across the globe, facility management has gained significant importance, driving the growth of the FM software market.

- Commercial spaces require property accounting, renting, contract management, procurement management, and other services, so effective facility management software becomes necessary. Therefore, the commercial category is witnessing exponential growth opportunities in the market, and the trend is likely to continue throughout the forecast period.

- By type, Computer-Aided Facility Management (CAFM) is anticipated to grow significantly. Computer-Aided Facility Management (CAFM) software enables facility managers to plan, execute, and monitor preventative maintenance, space management, asset management, operational facility services, and other customer services. Growing demands for space planning and management, leasing and real estate management, capital project management, asset management, energy performance analysis, maintenance management, physical building administration, and space reservations will likely increase the adoption of CAFM software in the commercial segment.

- In March 2024, MDS Critical Facilities Services, a service provider for critical infrastructure, partnered with property operations software firm Facilio to implement their cloud-based Connected CaFM solution to optimize and streamline its data center operations. Facilio's Connected CaFM solution enhances efficiency, responsiveness, and overall performance, offering a scalable architecture that aligns with CFS's growing needs. The company's AI-driven platform allows commercial sector end users to aggregate data, optimize performance, and control portfolio operations from a single place.

- The Middle East and African region is witnessing a significant adoption of FM software. Integrated FM service providers such as CIT Group in Saudi Arabia, Quality Facility Management (QFM) in Dubai, and others have adopted Connected CaFM as their FM platform for centralized management of in-house and contracted operations, providing complete visibility, control, and increased value.

- The rise in the global IT and telecom industry will enable commercial facility management software expansion. For instance, the telecom players focus on 5G deployments, creating significant opportunities for the region's facilities management sector. Moreover, according to Ericsson, the global 5G population is expected to be 85% by 2029. For example, increased partnerships and collaborations enable building inspection, maintenance, and repair of ventilation, air conditioning, electrical, heating, sanitary systems, instrumentation, and control technology. This will allow the market players to establish a strong position in the market and expand the customer base.

Asia-Pacific Expected to Register Significant Growth

- Numerous trends may propel the facility management software market in Asia-Pacific. For example, the Internet of Things (IoT) refers to physical equipment and sensors that use the Internet to connect with FM teams. They produce performance data that alerts facility managers to potential problems. FM software can monitor and control the processes from any location. It uses IoT to deliver real-time insights into its operations.

- IoT paired with FM software, such as a computerized maintenance management system (CMMS), identifies problems (e.g., uncomfortable office temperatures), inevitably prepares and dispenses work orders without human intervention, and tracks their execution.

- The advent of smart cities and smart buildings in the developing countries in the region is fueling the overall demand for facility management software, which has encouraged the market players in the region to launch new products and services.

- For instance, Telit Cinterion, a global IoT enabler company with critical operations in India, also provides IoT modules, edge-to-cloud services, IoT embedded software, and analytics for facility management software applications. Moreover, the company's services deliver functions like energy usage management and sanitation, which are manual operations in traditional building management. Smart facility solutions automate these processes by combining sensor input and machine learning with connectivity and analytics. With IoT-based facilities management, these functions can be prescheduled and adjusted for maximum efficiency.

- The increase in construction activities and the expansion of residential buildings would contribute to the growth of the Indian facility management software market.

Facility Management Software Industry Overview

The facility management software market is fragmented, with local and international players having decades of industry experience. The facility vendors are incorporating a powerful competitive strategy by leveraging their expertise. Facility software companies are incorporating technologies into their services, strengthening their service portfolio. The major players are IBM Corporation, Broadcom, Oracle Corporation, SAP SE, and Trimble Inc.

- In March 2024, MDS Critical Facilities Services, a service provider for critical infrastructure, partnered with property operations software firm Facilio to implement their cloud-based Connected CaFM solution to optimize and streamline its data center operations. Facilio's Connected CaFM solution enhances efficiency, responsiveness, and overall performance, offering a scalable architecture that aligns with CFS's growing needs. The company's AI-driven platform allows commercial sector end users to aggregate data, optimize performance, and control portfolio operations from a single place.

- In November 2023, Deloitte announced that the company collaborated with IBM to help clients accelerate emissions reduction strategies and make sustainability programs an embedded part of their organization's core business. It will also help monitor performance targets and decarbonization programs, which are integrated with other products from IBM's suite of Sustainability Software solutions, IBM Maximo Application Suite, for asset monitoring, management, predictive maintenance, and reliability planning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Demand for CAFM Solutions

- 5.1.2 Rising Use of AI and IoT in Facility Management Software

- 5.2 Market Restraints

- 5.2.1 Lack of Proper Integration with the Workflow

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Computer Aided Facility Management (CAFM)

- 6.1.2 Integrated Workplace Management Systems (IWMS)

- 6.1.3 Computerized Maintenance Management Systems (CMMS)

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Institutional

- 6.2.3 Public Infrastructure

- 6.2.4 Industrial

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Broadcom

- 7.1.3 Oracle Corporation

- 7.1.4 SAP SE

- 7.1.5 Trimble Inc.

- 7.1.6 Upkeep Maintenance Management

- 7.1.7 Accruent LLC (Fortive Corporation)

- 7.1.8 Planon Software Services Private Limited

- 7.1.9 FTMaintenance (FasTrak SoftWorks Inc.)

- 7.1.10 Eptura