|

市场调查报告书

商品编码

1548566

资料中心服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Data Center Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

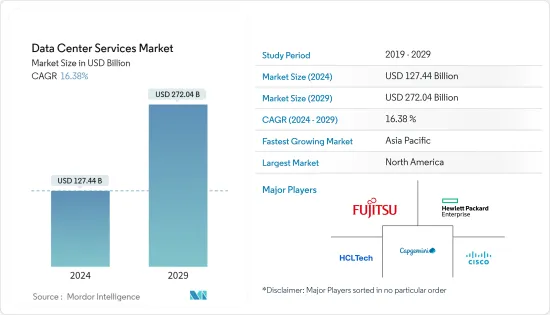

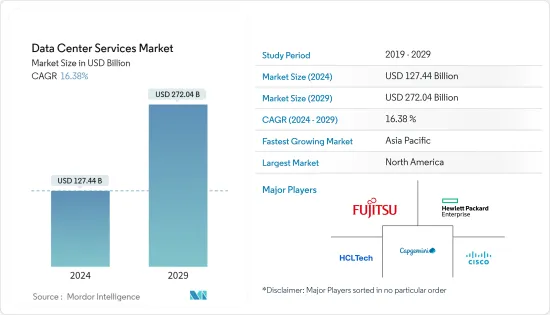

资料中心服务市场规模预计到2024年为1,274.4亿美元,预计到2029年将达到2,720.4亿美元,在预测期间(2024-2029年)复合年增长率预计为16.38%。

资料中心服务需求激增的主要因素是云端处理的普及。企业和企业正在转向云端服务来满足其储存、运算和应用程式需求,而快速增长的资料量需要增加资料中心容量。

各行业对数位转型倡议的需求不断增长,推动了对强大资料中心基础设施的需求。企业越来越多地利用数位技术来简化业务、改善客户体验并促进创新。组织越来越依赖巨量资料和分析来收集和分析大量资料集以进行决策。这一趋势凸显了对强大的资料储存和资料处理基础设施日益增长的需求。

2024 年 1 月,全球云端和营运商中立资料中心服务供应商 Digital Realty 在印度推出了第一个资料中心。占地 10 英亩的园区位于清奈的工业中心,能够支援高达 100 MW 的关键 IT 负载。这是对公司全球资料中心平台的重要扩展,满足了全球主要市场对数位转型日益增长的需求。

此外,物联网 (IoT) 的兴起正在创造新的需求,无数连网装置产生大量必须储存、处理和分析的资料。人工智慧和机器学习的日益复杂化需要大量的运算能力和存储,从而推动了对资料中心服务的需求。

COVID-19 大流行引发的远距工作和数位服务激增凸显了资料中心的重要性。资料中心现在是安全可靠地存取资讯和应用程式的关键枢纽。此外,严格的资料保护条例正在促使企业增加对资料中心服务的投资,以满足合规标准。节能设计和增强型冷却解决方案等技术进步使资料中心更具吸引力和成本效益,从而推动市场成长。

2024 年 4 月,美国铁塔子公司、混合IT 解决方案供应商 Coresight 宣布取得 NVIDIA DGX-Ready资料中心计画认证。透过此认证,Coresight 可以提供可扩展的高效能基础设施,专为希望利用人工智慧 (AI)、机器学习 (ML) 和其他高密度应用程式不断增长的需求的组织而构建。选择在其核心站点託管 NVIDIA DGX 基础设施的客户可以访问洛杉矶、硅谷、芝加哥和北维吉尼亚州等关键地点为 NVIDIA AI 和高效能运算量身定制的高密度资料中心和园区网路。

然而,市场成长受到高营运成本、能源消耗问题和熟练专业人员有限的限制。此外,资料安全和隐私挑战以及监管合规要求是市场扩张的主要障碍。

资料中心服务市场趋势

云端和託管预计将占据资料中心服务市场的主要份额

- 对云端和託管服务的需求不断增长正在推动资料中心服务市场的发展。这种快速成长是由对高度扩充性的基础设施的需求所推动的。随着企业因其灵活性、扩充性和成本效益而转向云,对支援这些服务的可靠资料中心设施的需求正在迅速增加。

- 不断增长的需求正在推动资料中心建设和扩建的投资。这种扩散不仅刺激了技术进步,而且增加了对高效能运算、储存和网路解决方案的需求。此外,向云端基础的服务的转变正在推动资料中心领域的创新和竞争。竞争的加剧带来了更强大的服务组合併提高了营运效率。

- 根据 Cloudscene 的数据,截至 2024 年 3 月,美国拥有全球最多的资料中心,据报告数量为 5,381 个。德国以 521 名紧随其后,英国以 514 名紧随其后。

- 目前运作十亿台设备连接到互联网正在运行,而且这个数字还在不断增加。这些设备通常会产生大量必须进行记录、处理、储存、评估和搜寻的资料。随着物联网和工业 4.0 的进步,製造商越来越多地利用巨量资料和分析来提高生产力、降低成本、增强安全性并简化营运。

- 随着资料生成的加速,及时获得洞察变得越来越困难。智慧城市、智慧建筑等新的数位领域提供了大量易于存取的资料。此外,公有云正在迅速普及,因为它们具有成本效益且需要较少的维护。此外,云端服务可存取性的提高使中小型企业能够根据其需求调整基础设施成本,从而有效地扩展规模。

- 2024 年 5 月,专门从事比特币挖矿和集中计算绿色资料中心的 Soluna Holdings 宣布建立新的合作伙伴关係。我们宣布计划与世界各地的企业 GPU 伺服器OEM和 AI 基础设施即服务供应商合作。 Soluna Cloud 计划利用策略合作伙伴提供的可再生能源运作的高效能资料中心推出其服务。此外,透过此次合作,Soluna Cloud的服务可望从基础基础设施扩展到一整套策略合作伙伴AI管道软体解决方案。

北美占有很大的市场份额

- 北美是众多科技创新者的聚集地,对云端运算、物联网等尖端技术的需求不断增长。鑑于这些技术的复杂性,对弹性资料中心设施的需求日益增长。因此,该地区对资料中心服务的需求预计将激增。

- 美国作为全球经济的中心,有能力引领公有云资料中心的扩张。 IT 产业是该国主要的私人雇主,资料中心的激增进一步推动了市场成长。此外,随着超大规模平台的激增,该国越来越多地满足超大规模平台资料中心的需求。

- 该地区的公司越来越喜欢主机代管资料中心,而不是建立自己的资料中心。这种转变是由于实现了主机代管设施租赁带来的许多好处而推动的。由于网路和连接设备等技术的快速集成,基础设施变得越来越复杂。

- 市场正在见证老牌和新兴企业竞争对手之间的激烈竞争。这些市场参与企业正在部署有机和无机策略相结合的策略,以增强竞争力并推动市场成长。例如,2024 年 6 月, Oracle和 Google Cloud 宣布建立策略合作伙伴关係,为客户提供整合Oracle Cloud Infrastructure (OCI) 和 Google Cloud 技术的弹性。此次合作旨在加速用户的应用程式迁移和升级。 Oracle Interconnect for Google Cloud 最初预计将在全球 11 个地区推出,让客户能够无缝部署通用工作负载,而无需在云端之间产生资料传输费用。

- 2023 年 10 月,安全、可扩展的资料中心解决方案供应商 Flexential 宣布,专注于大规模 GPU 加速工作负载的专业云端供应商 CoreWeave 将扩大其资料中心业务。 CoreWeave 的扩张意味着迁至位于奥勒冈州州希尔斯伯勒和乔治亚道格拉斯维尔的两个策略性主机代管设施。这两个设施均由 Flexential 拥有和营运。 CoreWeave 的基础设施专为满足机器学习、人工智慧、视觉特效、渲染和像素串流等计划不断变化的需求而量身定制,并展示了先进的运算框架。

资料中心服务产业概述

资料中心服务市场高度分散,竞争公司之间的竞争非常激烈。主要市场参与者包括富士通有限公司、思科系统公司、凯捷公司、HCL 技术有限公司和惠普企业公司。市场参与企业正在加强其产品组合,并透过策略合作伙伴关係和产品创新寻求持久的竞争优势。

- 2024 年 5 月 北美网路中立互连和超大规模边缘资料中心供应商 Corogix 宣布成功推出在该地区的第四个也是最大的资料中心。此次扩张标誌着 Cologix 在满足俄亥俄州哥伦布市日益增长的主机代管和互连服务需求方面迈出了重要一步。

- 2024 年 2 月 全球基础设施平台即服务公司 MOD Mission Critical (MOD) 宣布扩大与以网路为中心的主机代管、云端和託管服务供应商 365 Data Centers (365) 的合作伙伴关係。此次合作将使 MOD 能够提供部分主机代管和连接解决方案,使客户能够存取 20 个市场的 365 个以网路为中心的资料中心提供的服务和资源。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

- 市场驱动因素

- 增加资料中心技术支出

- 由于扩充性,资料中心的复杂性增加

- 市场限制因素

- 资料隐私问题

第五章市场区隔

- 按服务类型

- 託管服务

- 主机代管服务

- 依资料中心类型

- 第一层级和第二层级

- 层级

- IV层级

- 按最终用户产业

- BFSI

- 卫生保健

- 零售

- 製造业

- 资讯科技/通讯

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Fujitsu Limited

- IBM Corporation

- Singapore Telecommunications Limited(Singtel)

- Digital Realty Trust Inc.

- Cisco Systems Inc.

- Equinix Inc.

- Hewlett Packard Enterprise Company

- Vertiv Co.

- Dell Inc.

- NTT Communications

- Capgemini SE

第七章 投资分析

第八章市场的未来

The Data Center Services Market size is estimated at USD 127.44 billion in 2024, and is expected to reach USD 272.04 billion by 2029, growing at a CAGR of 16.38% during the forecast period (2024-2029).

The primary driver behind the surge in demand for data center services is the widespread adoption of cloud computing. Businesses and firms are turning to cloud services for their storage, computing, and application requirements, leading to a surge in data volumes that necessitates expanded data center capacity.

The rising demand for digital transformation initiatives in multiple industries is driving the need for robust data center infrastructure. Firms are increasingly turning to digital technologies to boost operations, elevate customer experiences, and foster innovation. Organizations are progressively relying on big data and analytics, collecting and analyzing extensive data sets for decision-making. This trend underscores the growing need for robust data storage and processing infrastructure.

In January 2024, Digital Realty, a global provider of cloud- and carrier-neutral data center services, unveiled its inaugural data center in India. Situated in Chennai's industrial hub, the 10-acre campus boasts the capacity to support up to 100 megawatts of critical IT load. This marks a pivotal expansion for the company's global data center platform, addressing the escalating digital transformation demands in significant global markets.

Moreover, the increase of the Internet of Things (IoT) adds another layer of demand, with countless connected devices generating massive amounts of data that need to be stored, processed, and analyzed. The expanding sophistication of artificial intelligence and machine learning necessitates substantial computational power and storage, thereby driving up the demand for data center services.

The surge in remote work and digital services, catalyzed by the COVID-19 pandemic, underscored the importance of data centers. They now serve as crucial hubs for secure and reliable access to information and applications. Additionally, stringent data protection regulations are nudging businesses to bolster their investments in data center services to meet compliance standards. Technological advancements, including energy-efficient designs and enhanced cooling solutions, are enhancing the appeal and cost-effectiveness of data centers, thereby fuelling market growth.

In April 2024, CoreSite, a subsidiary of American Tower Corporation and a provider of hybrid IT solutions, revealed its certification under the NVIDIA DGX-Ready Data Center program. This certification equips CoreSite to offer scalable, high-performance infrastructure, catering specifically to organizations seeking to leverage the growing appetite for artificial intelligence (AI), machine learning (ML), and other high-density applications. Customers opting to host their NVIDIA DGX infrastructure with CoreSite can gain access to a network of high-density data center campuses in key locations, such as Los Angeles, Silicon Valley, Chicago, and Northern Virginia, tailored for NVIDIA AI and high-performance computing.

However, the growth of the market is restricted by high operational costs, energy consumption concerns, and limited availability of skilled professionals. Additionally, data security and privacy challenges, along with regulatory compliance requirements, pose significant barriers to expansion.

Data Center Services Market Trends

Cloud and Hosting is Expected to Capture a Major Share in the Data Center Services Market

- The growing demand for cloud and hosting services is propelling the data center services market. This surge is fuelled by the necessity for enhanced, scalable infrastructure. With businesses increasingly shifting to the cloud for its flexibility, scalability, and cost-effectiveness, the demand for reliable data center facilities has surged to support these services.

- The rising demand is driving investments in data center construction and expansion. This surge is not only spurring technological advancements but also amplifying the necessity for high-performance computing, storage, and networking solutions. Furthermore, the transition to cloud-based services is fuelling innovation and competition in the data center sphere. This heightened competition is resulting in more robust service portfolios and greater operational efficiencies.

- According to Cloudscene, as of March 2024, the United States boasted the highest number of data centers globally, with a reported count of 5,381. Germany followed with 521, and the United Kingdom closely behind with 514.

- Billions of internet-connected devices are in operation today, a number that continues to climb. These devices often produce substantial data volumes, necessitating recording, processing, storage, assessment, and retrieval. As IoT and Industry 4.0 advance, manufacturers increasingly turn to big data and analytics to enhance productivity, cut costs, bolster security, and streamline operations.

- As data generation accelerates, capturing timely insights becomes increasingly challenging. Emerging digital arenas, like smart cities and intelligent buildings, provide a wealth of readily accessible data. Furthermore, the public cloud's popularity is surging due to its cost-effectiveness and minimal maintenance requirements. Moreover, the accessibility of cloud services is empowering small and medium enterprises to scale efficiently, as they can tailor their infrastructure expenses to match their requirements.

- In May 2024, Soluna Holdings Inc., a company specializing in green data centers for Bitcoin mining and intensive computing, revealed a new partnership. It announced its plan to collaborate with a global enterprise GPU-server OEM and an AI Infrastructure-as-a-Service provider. Soluna Cloud is set to launch its services, tapping into the renewable-powered, high-performance data centers of its strategic partner. Moreover, this partnership is expected to broaden Soluna Cloud's services from basic infrastructure to encompass its strategic partner's full suite of AI pipeline software solutions.

North America Holds a Substantial Share in the Market

- North America boasts a surplus of technological innovators, driving demand for advanced technologies such as cloud computing and IoT. Given the intricate nature of these technologies, there is a growing need for resilient data center facilities. Consequently, the region is poised to witness a surge in demand for data center services.

- The United States, a significant global economy, is poised to drive the expansion of public cloud-based data centers. With the IT industry governing as the nation's primary private employer, the widespread adoption of data centers further fuels market growth. Furthermore, with the surge in hyper-scale platforms, the country finds itself increasingly catering to the data center needs of its hyper-scale platforms.

- Businesses in the region are increasingly favoring colocation data centers over building their own. This shift is driven by the realization of the myriad benefits that come with leasing from a colocation facility. Infrastructure facilities are becoming increasingly complex due to the rapid integration of technologies such as networks and connectivity devices.

- The market is witnessing intense competitive rivalry driven by both established and emerging players. These industry participants are deploying a mix of organic and inorganic strategies to enhance their competitive edge and fuel market growth. For instance, in June 2024, Oracle and Google Cloud unveiled a strategic partnership, offering customers the flexibility to integrate Oracle Cloud Infrastructure (OCI) with Google Cloud technologies. This collaboration aims to expedite application migrations and upgrades for users. Oracle Interconnect for Google Cloud is projected to be initially available in 11 global regions for customer onboarding, enabling seamless deployment of general-purpose workloads without incurring cross-cloud data transfer fees.

- In October 2023, Flexential, a provider of secure and scalable data center solutions, announced that CoreWeave, a specialized cloud provider focusing on large-scale GPU-accelerated workloads, is set to broaden its data center presence. CoreWeave's expansion would see the company moving into two additional colocation facilities, strategically located in Hillsboro, Oregon, and Douglasville, GA. Notably, both these facilities are under the ownership and operation of Flexential. CoreWeave's infrastructure is tailored to cater to the evolving needs of projects spanning machine learning, AI, VFX, rendering, and pixel streaming, showcasing an advanced computing framework.

Data Center Services Industry Overview

The data center service market is highly fragmented, with high competitive rivalry. The major market players are Fujitsu Ltd, Cisco Systems Inc., Capgemini, HCL Technologies Limited, and Hewlett Packard Enterprise Company. Market players are bolstering their portfolios and pursuing enduring competitive edges through strategic partnerships and product innovations.

- May 2024: Cologix, the network-neutral interconnection and hyperscale edge data center provider in North America, announced the successful launch of its fourth and most extensive data center in the region. This expansion signifies a pivotal step in Cologix's dedication to addressing the escalating need for colocation and interconnection services in Columbus, Ohio.

- February 2024: Global infrastructure Platform-as-a-Service company MOD Mission Critical (MOD) announced an expansion of its partnership with 365 Data Centers (365), a provider of network-centric colocation, cloud, and managed services. Through this partnership, MOD can provide fractional colocation and connectivity solutions, allowing its clients to access the services and resources offered by 365's network-centric data centers across 20 markets, complemented by an additional 125 nationwide points of presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Increase in the Expenditure on Data Center Technology

- 4.5.2 Rising Data Center Complexities Due to Scalability

- 4.6 Market Restraint

- 4.6.1 Concerns Relating to Data Privacy

5 MARKET SEGMENTATION

- 5.1 By Type of Service

- 5.1.1 Managed Hosting Service

- 5.1.2 Colocation Service

- 5.2 By Data Center Type

- 5.2.1 Tier-I and -II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Manufacturing

- 5.3.5 IT and Telecom

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujitsu Limited

- 6.1.2 IBM Corporation

- 6.1.3 Singapore Telecommunications Limited (Singtel)

- 6.1.4 Digital Realty Trust Inc.

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Equinix Inc.

- 6.1.7 Hewlett Packard Enterprise Company

- 6.1.8 Vertiv Co.

- 6.1.9 Dell Inc.

- 6.1.10 NTT Communications

- 6.1.11 Capgemini SE