|

市场调查报告书

商品编码

1687099

MLaaS(机器学习即服务):市场占有率分析、产业趋势与统计、成长预测(2025-2030)Machine Learning As A Service (MLaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

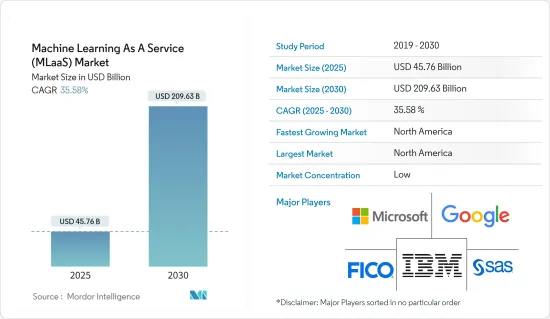

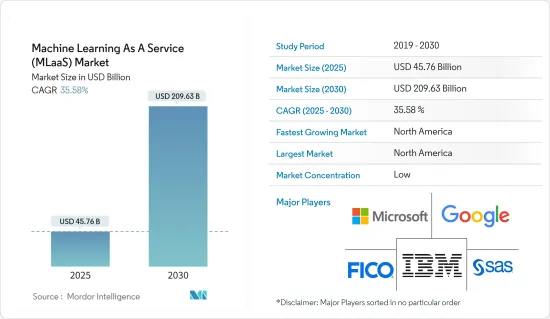

MLaaS(机器学习即服务)市场规模预计在 2025 年为 457.6 亿美元,预计到 2030 年将达到 2096.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 35.58%。

机器学习即服务 (MLaaS) 市场正在迅速发展,原因是企业越来越多地采用云端基础的服务、物联网和自动化,企业越来越需要缩短智慧应用程式的上市时间,并且越来越需要了解消费行为,同时还需要增强决策能力、实现流程自动化和推动创新。

主要亮点

- MLaaS 模型有望主导市场,因为使用者可以从各种专注于不同业务需求的工具中进行选择,包括资料视觉化、API、脸部辨识、自然语言处理、预测分析、深度学习等。资料科学和人工智慧的进步正在加速机器学习的性能。随着企业越来越意识到这项技术的潜力,预计预测期内 MLaaS 的采用率将会上升。

- 此外,MLaaS 让企业无需内部专业知识即可利用机器学习的潜力,使其成为推动创新和竞争优势的宝贵工具。此外,随着全球各地的企业都希望在即时场景中利用机器学习的预测能力,寻求改善决策、自动化流程和增强使用者体验的企业对 MLaaS 平台的需求将迅速增长。

- MLaaS(机器学习即服务)是云端处理的重要特性。从资料视觉化和 API 到脸部辨识、NLP、预测分析和深度学习,MLaaS 提供了一系列工具,使其成为企业寻求增强业务的综合解决方案。云端服务的快速扩张和业务向云端平台的转移证明 MLaaS 正处于良好的发展轨道。

- 机器学习(ML)技术作为一种新的攻击方法正在受到关注。随着机器学习越来越融入医疗保健、金融、行动装置、汽车系统和家庭安全等日常业务中,它将不可避免地成为网路攻击者的诱人目标。

- 疫情过后,企业在云端服务的支出呈现显着成长,有助于终端用户领域采用 MLaaS 平台。例如,Flexera Software 的《2024 年云端运算状况报告》发现,到 2024 年下半年,17% 的受访企业报告称,每年的公共云端支出在 600 万美元以上至 1,200 万美元之间。此外,到 2024 年底,10% 的受访企业表示其每年的公共云端支出将超过 6,000 万美元。此外,14%的受访企业表示其每年在公共云端的支出在 1,200 万美元至 2,400 万美元之间。

MLaaS(机器学习即服务)市场趋势

医疗保健是成长最快的终端用户

- 近年来,机器学习技术的应用迅速扩展。世界各地的医疗保健机构都需要机器学习技术来分析大量患者资料,以识别模式并对疾病诊断、药物发现和个人化治疗计划做出更准确的预测。这些因素,加上以经济高效的方式获取机器学习工具和资源的需求,正在推动医疗保健领域对 MLaaS 平台的需求。

- 为了有效管理员工日程安排,医疗保健组织对 MLaaS 的需求日益增长。机器学习即服务 (MLaaS) 为医疗保健组织提供了先进的调度演算法。这些演算法旨在分析大量历史资料,从而准确预测未来的人员需求。此外,医疗保健机构采用 MLaaS 无需内部开发这些复杂的演算法,从而节省了时间和资源。

- 2023 年 7 月,亚马逊网路服务公司 (AWS) 宣布推出合格HIPAA 要求的服务 AWS HealthScribe。该服务使医疗保健软体提供者能够创建由语音辨识和生成性人工智慧驱动的临床应用程式。其目标是透过自动化临床文件来简化临床医生的工作流程。由 Amazon Bedrock 支援的 AWS HealthScribe 简化了医疗保健软体供应商的生成式 AI 功能的整合。

- 具体来说,我们为两大医学专业(普通医学和整形外科)提供了这种能力,从而无需服务提供者处理复杂的机器学习基础设施或开发自己的大规模语言模型(LLM)。这些发展将进一步促进市场发展。

- 根据应用,其他应用如 NLP、电脑视觉和情感分析预计将在医疗保健领域获得显着发展。例如,MLaaS 平台可以提供电脑视觉功能,发现 X 光、 电脑断层扫描、MRI 和乳房 X 光检查中的异常,帮助医疗保健提供者诊断疾病。此外,MLaaS平台还可以提供情绪分析服务,有效衡量患者的情绪、心情和满意度。

- 因此,分析认为,医疗保健领域采用 MLaaS 平台将彻底改变医疗保健领域,使医疗保健提供者能够有效地诊断疾病、监测患者健康状况、协助药物发现并提供个人化治疗以加强对患者的护理。

- 此外,预测期内,物联网(尤其是医疗物联网设备)的使用日益增多,以及全球医疗保健组织对云端基础的服务的采用日益增多,将进一步推动医疗保健领域 MLaaS 市场的成长。

- 企业对物联网的日益采用,推动了从物联网设备产生的大量资料中有效提取有意义的见解的需求日益增长。这种需求推动了机器学习即服务 (MLaaS) 的快速成长,它正在日益影响资料探勘并推动创新业务解决方案的创建。例如,根据GSMA的资料,到2030年,全球企业物联网(IoT)连线数量预计将达到240亿。

北美占有最大市场占有率

- 北美预计将推动 MLaaS 的发展并占据大部分市场份额,这得益于其强大的创新生态系统,该生态系统由联邦政府对先进技术的战略投资推动,并辅以来自世界知名研究机构的远见卓识的科学家和企业家。

- 例如,2023年5月,美国国家科学基金会(NSF)宣布将投资1.4亿美元与高等教育机构、其他联邦机构和其他相关人员合作建立七个新的国家人工智慧(AI)研究所。透过这项投资,政府旨在推动人工智慧系统和技术的发展,在美国培养多元化的人工智慧劳动力,并形成应对人工智慧相关机会和风险的统一方法。预计地方政府的此类投资将为研究市场带来新的成长机会。

- 此外,2024年3月,英特尔宣布大规模投资1,000亿美元用于扩张和升级计画。该计划包括在美国四个州建立新的製造工厂,并在联邦政府的财政支持下升级现有设施。美国政府将提供195亿美元的联邦补助和250亿美元的税收优惠,帮助英特尔拓展业务。此外,英特尔计划未来五年内在俄亥俄州哥伦布附近建造「全球最大的AI晶片製造地」。此类人工智慧措施可能会进一步刺激该地区研究市场的需求。

- 该地区还广泛采用了 5G、物联网和连网型设备。因此,通讯服务供应商(CSP)需要透过虚拟、网路切片、新用例和服务要求来有效管理日益增加的复杂性。这将使得管理网路和服务的传统方法不再可持续,并将推动 MLaaS 解决方案的发展。根据 GSMA 预测,到 2025 年,北美消费者和工业物联网连接总数将成长到 54 亿。

机器学习即服务 (MLaaS) 产业概览

MLaaS 市场高度分散,主要企业包括微软公司、IBM 公司、Google有限责任公司 (Alphabet Inc.)、SAS 研究所公司和 Fair Isaac 公司 (FICO)。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024 年 5 月-着名技术服务和顾问公司 Wipro 与微软合作推出了三款针对金融业量身订製的认知助理。其中包括 Wipro GenAI Investor Intelligence、Wipro GenAI Investor Onboarding 和 Wipro GenAI Loan Origination。在 Azure OpenAI 的支援下,此认知助理旨在与目前的数位和行动平台无缝整合。这种集成为金融专业人士及其客户提供了统一、易于使用的资讯中心。

- 2024 年 3 月-惠普企业宣布扩展 AIOps 网路管理功能。此增强功能包括将多个生成式 AI (GenAI) 大型语言模型 (LLM) 整合到 HPE Aruba Networking Central。此云端原生网路管理解决方案是 HPE 在 HPE GreenLake 云端平台上提供的产品的一部分。这些增强功能主要是为了提高使用者体验和营运效率,特别注重搜寻回应时间、准确性和资料隐私。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 物联网和自动化的采用日益广泛

- 越来越多地采用云端基础的服务

- 市场限制

- 隐私和资料安全问题

- 需要熟练的专业人员

第六章 市场细分

- 按应用

- 行销和广告

- 预测性维护

- 自动网路管理

- 诈欺侦测和风险分析

- 其他应用

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户

- 资讯科技和电讯

- 车

- 卫生保健

- 航太和国防

- 零售

- 政府

- BFSI

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- IBM Corporation

- Google LLC(Alphabet Inc.)

- SAS Institute Inc.

- Fair Isaac Corporation(FICO)

- Hewlett Packard Enterprise Company

- Yottamine Analytics LLC

- Amazon Web Services Inc.(Amazon.Com, Inc.)

- BigML Inc.

- Iflowsoft Solutions Inc.

- Monkeylearn Inc.

- Sift Science Inc.

- H2O.ai Inc.

第八章投资分析

第九章:市场的未来

The Machine Learning As A Service Market size is estimated at USD 45.76 billion in 2025, and is expected to reach USD 209.63 billion by 2030, at a CAGR of 35.58% during the forecast period (2025-2030).

The Machine Learning as a Service market is evolving rapidly owing to the growing adoption of cloud-based services, IoT, and automation in businesses, the growing need among businesses for accelerated time to market for intelligent applications, the rising need to understand consumer behavior coupled with the growing need to enhance decision-making, automate processes, and drive innovation.

Key Highlights

- MLaaS model is poised to dominate the market, with users having the option to choose from a wide variety of tools such as data visualization, APIs, face recognition, natural language processing, predictive analytics, and deep learning focused on different business needs. Advancements in data science and artificial intelligence have propelled the pace of machine learning's performance. Companies are increasingly recognizing the technology's potential, indicating a projected uptick in adoption rates of MLaaS over the forecast period.

- Moreover, MLaaS empowers businesses to leverage the potential of machine learning without the need for extensive in-house expertise, thus making it a valuable tool in fostering innovation and competitive advantage. Further, as businesses worldwide seek to leverage the predictive capabilities of machine learning in real-time scenarios, the demand for MLaaS platforms is analyzed to grow at a rapid pace among businesses to improve decision-making, automate processes, and enhance user experiences.

- Machine learning-as-a-service (MLaaS) is a pivotal feature within cloud computing offerings. With its array of tools, from data visualization and APIs to facial recognition, NLP, predictive analysis, and deep learning, MLaaS stands out as a comprehensive solution for businesses seeking to enhance their operations. The rapid expansion of cloud services and businesses increasingly transitioning to cloud platforms underscores a promising trajectory for MLaaS.

- Machine learning (ML) technology introduces a novel attack surface, garnering significant research attention. As ML integrates further into daily operations, spanning healthcare, finance, mobile devices, automotive systems, and home security, it inevitably becomes a prime target for cyber attackers.

- Post-pandemic, the spending on cloud services across enterprises is witnessing significant growth, which is analyzed to bolster the adoption of MLaaS platforms in the end-user sectors. For instance, according to Flexera Software's State of the Cloud Report 2024, by late 2024, 17% of enterprise respondents reported annual public cloud expenditures ranging from over USD 6 million to USD 12 million. Furthermore, by late 2024, 10% of enterprise respondents reported annual public cloud expenditures of more than USD 60 million. Moreover, 14% of enterprise respondents reported annual public cloud expenditures between USD 12 million and USD 24 million.

Machine Learning As A Service (MLaaS) Market Trends

Healthcare to be the Fastest Growing End User

- The application of machine learning technology has been expanding at a significant pace in the past few years. Healthcare organizations worldwide are demanding machine learning technology to analyze vast amounts of patient data to identify patterns and make more accurate predictions about disease diagnosis, drug discovery, and personalized treatment plans. Due to these factors, the need to access machine learning tools and resources cost-effectively has driven the demand for MLaaS platforms in the healthcare sector.

- The demand for MLaaS is gaining significant traction in healthcare organizations to manage staff schedules effectively. Machine Learning as a Service (MLaaS) equips healthcare organizations with advanced scheduling algorithms. These algorithms are designed to analyze extensive historical data, enabling precise predictions of future staffing requirements. Further, the adoption of MLaaS in healthcare organizations eliminates the need to develop these complex algorithms in-house, saving them time and resources.

- In July 2023, Amazon Web Services Inc. (AWS) unveiled AWS HealthScribe, a HIPAA-eligible service. This service equips healthcare software providers to create clinical applications that leverage speech recognition and generative AI. The goal is to streamline clinicians' workflows by automating the generation of clinical documentation. AWS HealthScribe, backed by Amazon Bedrock, simplifies the integration of generative AI features for healthcare software providers.

- Notably, it offers this functionality for two key medical specialties-general medicine and orthopedics-eliminating the need for providers to handle the complex machine-learning infrastructure or develop their own large language models (LLMs). Such developments further support the market growth.

- By application other applications such as NLP, computer vision, and sentiment analysis are analyzed to gain significant traction in the healthcare sector. For instance, MLaaS platforms offer computer vision capabilities, spotting irregularities in X-rays, CT scans, MRIs, and mammograms, thus helping healthcare providers in diagnosing diseases. Furthermore, MLaaS platforms can also offer sentiment analysis services that can effectively measure patients' emotions, moods, or satisfaction levels.

- Therefore, the adoption of MLaaS platforms in the healthcare sector is analyzed to revolutionize the healthcare sector by helping healthcare providers to effectively diagnose diseases, monitor patients' health, drug discovery, and offer personalized treatment to enhance patient care.

- Additionally, the expanding use of IoT, notably medical IoT devices, and the growing adoption of cloud-based services in healthcare organizations worldwide will further bolster the growth of the MLaaS market in the healthcare sector over the forecast period.

- The increasing adoption of IoT in businesses fuels a heightened need to effectively extract meaningful insights from the vast data generated by IoT devices. This demand is propelling the rapid growth of Machine Learning as a Service (MLaaS), which is increasingly shaping data mining and enabling the creation of innovative business solutions. For instance, according to the data from GSMA, the number of enterprise Internet of Things (IoT) connections worldwide is forecasted to reach 24 billion by 2030.

North America Holds Largest Market Share

- North America is expected to hold a significant share of the market owing to its robust innovation ecosystem, fueled by strategic federal investments into advanced technology and complemented by the presence of visionary scientists and entrepreneurs coming together from globally renowned research institutions, which has propelled the development of MLaaS.

- For instance, in May 2023, The US National Science Foundation (NSF), in collaboration with higher education institutions, other federal agencies, and other stakeholders, announced an investment of USD 140 million to establish seven new National Artificial Intelligence Research Institutes (AI) institutes. Through this investment, the government aims to promote AI systems and technologies and develop a diverse AI workforce in the United States to advance a cohesive approach to AI-related opportunities and risks. Such investments by the regional government are expected to create new growth opportunities for the market studied.

- In addition, in March 2024, Intel announced a significant USD 100 billion investment in an expansion and upgrade initiative. This initiative includes establishing new manufacturing plants in four US states and enhancing current facilities, bolstered by the federal government's financial backing. The US government committed USD 19.5 billion in federal grants and an additional USD 25 billion in tax incentives to bolster Intel's expansion. Furthermore, Intel plans to construct "the world's largest AI chip manufacturing site" near Columbus, Ohio, within the next five years. Such initiatives in AI may further propel the studied market demand in the region.

- The region also witnessed a significant proliferation of 5G, IoT, and connected devices. As a result, communications service providers (CSPs) need to manage an ever-growing complexity efficiently through virtualization, network slicing, new use cases, and service requirements. This is expected to drive MLaaS solutions as traditional network and service management approaches are no longer sustainable. According to GSMA, North America's total number of consumer and industrial IoT connections is forecast to grow to 5.4 billion by 2025.

Machine Learning As A Service (MLaaS) Industry Overview

The MLaaS market is highly fragmented, with the presence of major players like Microsoft Corporation, IBM Corporation, Google LLC (Alphabet Inc.), SAS Institute Inc., and Fair Isaac Corporation (FICO). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024 - Wipro, a prominent technology services and consulting firm, partnered with Microsoft to launch a trio of cognitive assistants tailored for the financial sector. It includes Wipro GenAI Investor Intelligence, Wipro GenAI Investor Onboarding, and Wipro GenAI Loan Origination. The cognitive assistants leveraging Azure OpenAI are designed to merge with current digital and mobile platforms seamlessly. This integration offers a unified and user-friendly information hub for financial professionals and their clientele.

- March 2024 - Hewlett Packard Enterprise unveiled an expansion of its AIOps network management capabilities. This enhancement involves the integration of multiple Generative AI (GenAI) Large Language Models (LLMs) into HPE Aruba Networking Central. This cloud-native network management solution is part of HPE's offerings on the HPE GreenLake Cloud Platform. These enhancements primarily aim to elevate user experience and operational efficiency, with a specific emphasis on search response times, accuracy, and data privacy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of IoT and Automation

- 5.1.2 Increasing Adoption of Cloud-based Services

- 5.2 Market Restraints

- 5.2.1 Privacy and Data Security Concerns

- 5.2.2 Need for Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Marketing and Advertisement

- 6.1.2 Predictive Maintenance

- 6.1.3 Automated Network Management

- 6.1.4 Fraud Detection and Risk Analytics

- 6.1.5 Other Applications

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 IT and Telecom

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Aerospace and Defense

- 6.3.5 Retail

- 6.3.6 Government

- 6.3.7 BFSI

- 6.3.8 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 SAS Institute Inc.

- 7.1.5 Fair Isaac Corporation (FICO)

- 7.1.6 Hewlett Packard Enterprise Company

- 7.1.7 Yottamine Analytics LLC

- 7.1.8 Amazon Web Services Inc. (Amazon.Com, Inc.)

- 7.1.9 BigML Inc.

- 7.1.10 Iflowsoft Solutions Inc.

- 7.1.11 Monkeylearn Inc.

- 7.1.12 Sift Science Inc.

- 7.1.13 H2O.ai Inc.