|

市场调查报告书

商品编码

1687949

光调变器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Optical Modulators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

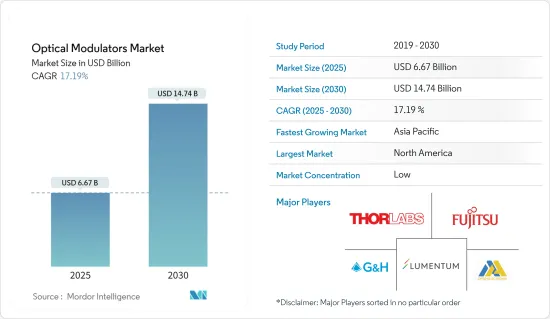

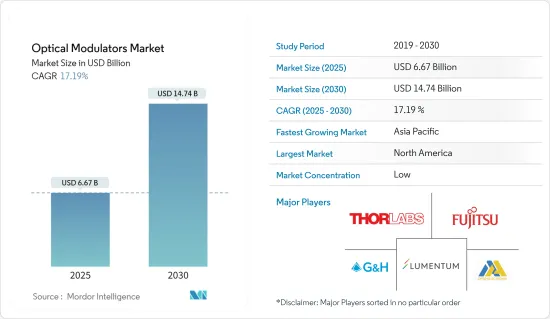

光调变器市场预计到 2025 年将达到 66.7 亿美元,到 2030 年将达到 147.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 17.19%。

主要亮点

- 光调变器在光纤网路中发挥着至关重要的作用。电晶体充当电子讯号的开关。类似地,光调变器充当光讯号的开关。由于光纤通讯主要使用光,光调变器的功能是打开和关闭光以透过光纤发送二进位讯号流。

- 社群媒体平台、电子商务和软体使用量的大幅增长刺激了对资料的巨大需求。 5G为最终用户消费和产生更多资料开闢了新的途径。例如,根据GSMA的数据,到2025年,5G网路将覆盖全球三分之一的人口。该协会还表示,到2025年,5G连线数量将超过20亿,占行动连线的五分之一以上。

- 由于视讯串流、云端运算和物联网 (IoT) 等因素导致的资料传输需求不断增长,通讯网路需要更高的频宽。由于光纤比传统铜缆具有更高的频宽,因此它已成为远距资料传输的首选电缆。因此,对于能够有效地将电讯号转换为宽频光讯号的光调变器的需求日益增长。

- 越来越多的企业正在建立自己的超大规模资料中心来管理各种业务功能和工作负载。资料的快速成长推动了扩大资料中心规模的需求。资料中心分解是一种现代资料中心设计和管理方法,将资料中心的各个元件分离为独立的单元,是一种有效的解决方案。这种方法可以实现灵活性、扩充性、能源效率并节省成本。

- 光连接模组是实现资料中心分解的关键技术,利用光纤电缆实现远距高速传输资料。该技术的高频宽容量和低功耗使其适合资料中心的分散式应用。光调变是此类互连解决方案的关键特性,它推动了光调变器的采用。然而,光调变器是光互连的关键部件之一,其商业化进程缓慢以及性能、成本和效率的平衡是阻碍市场成长的主要挑战之一。

- 在COVID-19疫情期间,随着远距工作、线上学习的转变以及电子商务的使用增加,网路流量增加并推动了光调变器的需求,对更高频宽通讯网路的需求显着增加。疫情也加速了云端基础的服务的采用,需要强大的资料中心基础设施和高速光纤互连。

光调变器市场趋势

光纤通讯可望占据较大市场占有率

- 光纤通讯是一种使用光而不是电流将讯号传送到远处的通讯方法。光纤通讯通讯依靠光纤将讯号传输到目的地。调变/解调器、收发器、光讯号和透明通道是光纤通讯系统的组成部分。

- 过去十年来,对频宽和通讯服务的需求激增,推动了对光纤通讯系统外部调变的需求。特别是,铌酸锂(LiNbO3)外部调变的整合正在成为一种合适的解决方案,它不仅可以提供所需的频宽,而且还可以提供最小化色散效应的手段。

- 与雷射二极体的直接调变相比,LiNbO3 导波调变可以设计用于零啁啾或可调啁啾操作,有助于最大限度地减少与光纤色散相关的系统劣化。在类比系统中,线性化的外部调变可以提供非常低的调变失真。

- 光纤需求对于经济发展至关重要,而增加光纤密度对于支持提高创新和经济成长速度所需的频宽进步是必要的。其中一个例子就是 5G 的进步及其对高速无线电频率和网路密集化的依赖。因此,这些因素正在推动对光纤基础设施的投资需求。

- 2023年7月,印度电子和资讯技术部宣布,计划在现有的83亿美元基础上再投资130亿美元,在印度全国范围内建立光纤网络,以增强连接性并为所有人提供负担得起的互联网。预计光纤通讯相关投资的增加将推动光调变器的需求。

预计北美将占据最大市场占有率

- 预计该地区市场将受到高频宽和高资料速率应用需求不断增长、电子设备小型化需求不断增长、互联网普及率不断上升以及 5G 基础设施快速发展的重要影响。

- 光纤在该地区通讯行业的广泛使用是由对更高性能和速度的不断增长的需求推动的,预示着光学技术的美好未来。随着广泛的研究活动不断推进并扩大到实际部署,预计将带来新一代光纤通讯。

- 光纤通讯系统在资料中心和高效能运算(HPC)应用中的使用日益增多也推动了市场的发展。由于高频宽和资料速率的要求,资料中心和高效能运算应用预计将推动光调变器的需求。此外,资料中心和 HPC 应用的建设投资不断增加预计将极大地推动该地区光调变器的需求。

- 云端基础的企业应用在北美蓬勃发展。云端基础的解决方案依靠网路连线在託管环境中运作。 5G 将实现更快的网路速度,这意味着您的连线体验将进一步改善。此外,行动宽频的快速成长以及巨量资料分析和云端处理的兴起正在推动北美对新资料中心基础设施的需求。云端基础的资料中心的快速投资预计将为光调变器製造商提供多种应用机会。

光调变器市场概况

光调变器市场较为分散,既有全球性企业,也有中小型企业。市场的主要企业包括 Thorlabs Inc.、Lumentum Holdings Inc.、AA Opto-Electronic、富士通光学元件有限公司和 Gooch &Housego PLC。市场参与者正在采用伙伴关係、协作、併购和产品推出等策略来获得永续的竞争优势和市场占有率。

- 2024 年 5 月,通讯技术公司 Lightwave Logic 与 Advanced Micro Foundry (AMF) 合作,利用 AMF 的硅光电平台开发聚合物槽调变器。此次协议是两家公司去年达成的一项合作,利用 AMF 的 200 毫米晶圆标准製造流程开发电光聚合物槽调变器。

- 2024 年 3 月:整合式电光调变(EOM) 供应商 HyperLight 扩展了其强度调变系列。此公告强调了 HyperLight 对光电积体电路 (PIC) 创新的持续承诺。该公司提供的调变基于其专有的高频宽、低压薄膜铌酸锂 (TFLN) PIC 技术。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 增加对光纤通讯基础设施的投资

- 市场挑战

- 光调变器设计限制影响市场成长

第六章 市场细分

- 按类型

- 振幅调变

- 偏振调变

- 相位调变

- 类比调变

- 其他光调变器

- 按应用

- 光纤通讯

- 光纤感测器

- 太空与国防

- 工业系统

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Thorlabs Inc.

- Lumentum Holdings Inc.

- AA Opto-Electronic

- Fujitsu Optical Components Limited

- Gooch & Housego PLC

- Lightwave Logic

- Hamamatsu Photonics KK

- APE GmbH

- Conoptics Inc.

- L3Harris Technologies Inc.

- AMS Technologies AG

第八章投资分析

第九章:市场的未来

The Optical Modulators Market size is estimated at USD 6.67 billion in 2025, and is expected to reach USD 14.74 billion by 2030, at a CAGR of 17.19% during the forecast period (2025-2030).

Key Highlights

- The optical modulator plays an essential role in fiber-optic networks. A transistor acts as a switch for electronic signals; likewise, an optical modulator acts as a switch for optical signals. Optical communication primarily uses light, so the modulator's function is to turn the light that sends a stream of binary signals over optical fibers on and off.

- The significant rise in the use of social media platforms, e-commerce, and software has accelerated data demand significantly. 5G has opened new avenues for end users to consume and generate more data. For instance, according to the GSMA, by 2025, 5G networks will cover one-third of the world's population. The association also stated that the number of 5G connections would exceed 2 billion by 2025, making up more than a fifth of mobile connections.

- The ever-increasing demand for data transmission, driven by factors like video streaming, cloud computing, and the Internet of Things (IoT), necessitates higher bandwidths in communication networks. As optical fibers provide higher bandwidth compared to traditional copper cables, they become the preferred choice for long-distance data transmission. Thus, the need for optical modulators is growing as they offer an efficient transition of electrical signals into high-bandwidth optical signals.

- An increasing number of businesses and enterprises are acquiring their own hyperscale data centers to manage different business functions and workloads. With the rapid growth in data generated, there is a significant need for data centers to scale up. Datacenter disaggregation, which is a modern approach to data center design and management that separates the different components of a data center into distinct units, can be an effective solution. The approach allows greater flexibility, scalability, and improved energy efficiency and cost savings.

- Optical interconnects are the key technology that enables data center disaggregation and uses fiber optic cables to transmit data at high speeds over long distances. This technology is well-suited for disaggregated data center applications due to its high bandwidth capacity and low power consumption. As optical modulation is the key functionality in such interconnect solutions, it drives the adoption of optical modulators. However, optical modulators are one of the primary components used in optical interconnection, and their slow commercialization and balancing performance, cost, and efficiency are some of the major challenges hampering the market's growth.

- During the COVID-19 pandemic, the demand for increased bandwidth communication networks increased significantly owing to the shift toward remote work, online learning, and increased use of e-commerce that propelled internet traffic, driving the demand for optical modulators. Also, the pandemic accelerated the adoption of cloud-based services, requiring robust data center infrastructure and high-speed optical interconnects, potentially benefiting the market for data center-specific modulators.

Optical Modulators Market Trends

Optical Communication is Expected to Hold a Significant Market Share

- Optical communication is any type of communication in which light is used to carry the signal to the remote end instead of an electrical current. Optical communication relies on optical fibers to carry signals to their destinations. A modulator/demodulator, a transmitter/receiver, a light signal, and a transparent channel are the building blocks of the optical communications system.

- The demand for bandwidth and telecommunication services has surged over the past decade, which has boosted the requirement for external modulation in fiber-optic communication systems. Notably, integrating lithium niobate (LiNbO3) external modulators is evolving as a suitable solution that offers not just the desired bandwidth but also the means for minimizing dispersion effects.

- Compared to direct modulation of a laser diode, LiNbO3-guided wave modulators can be designed for zero-chirp or adjustable-chirp operation that aids in minimizing the system degradation associated with fiber dispersion. In analog systems, linearized external modulators can provide very low modulation distortion.

- The demand for optical fiber is imperative for economic development, and there is a need for increased fiber density to support the advancements in bandwidth that are necessary to improve the pace of innovation and economic growth. One such example is the advancements in 5G and its dependency on high-speed radio frequency and greater network densification. Thus, such factors are driving the demand for investments in optical fiber infrastructure.

- In July 2023, the Ministry of Electronics and Information Technology India announced its plan to invest an additional USD 13 billion to the prior investment of USD 8.3 billion in the establishment of a fiber grid across India to enhance connectivity and provide affordable internet to all. Such an increase in the investments related to optical communication is expected to drive the need for optical modulators.

North America is Expected to Hold the Largest Market Share

- The region's market is anticipated to be significantly impacted by the rising demand for high bandwidth and high data rate applications, the requirement for electronic device miniaturization, rising internet penetration, and the quick development of 5G infrastructure.

- The widespread use of optical fibers in the region's communications industry is boosted by the growing demand for higher performance and speed, portending a promising future for optical technology. This is anticipated to lead to a new generation of fiber optic communications as extensive research activities continue and are extended to practical deployment.

- The growing use of optical communication systems in data centers and high-performance computing (HPC) applications is another factor driving the market. Due to their high bandwidth and data rate requirements, data centers and high-performance computing applications are predicted to drive the demand for optical modulators. Additionally, the demand for optical modulators is anticipated to increase significantly in the area due to rising investments in constructing data centers and HPC applications.

- Cloud-based enterprise applications are thriving in the North American region. Cloud-based solutions depend on internet connectivity to function in the hosted environment. With 5G enabling much faster internet speed, it will further enhance the connectivity experience. Furthermore, the rapid growth of mobile broadband with an increase in big data analytics and cloud computing drives the demand for new data center infrastructures in North America. The rapid investments in cloud-based data centers are expected to provide several application opportunities for optical modulator makers.

Optical Modulators Market Overview

The optical modulators market is fragmented due to the presence of both global players and small and medium-sized enterprises. The major players in the market are Thorlabs Inc., Lumentum Holdings Inc., AA Opto-Electronic, Fujitsu Optical Components Limited, and Gooch & Housego PLC. Players in the market are adopting strategies such as partnerships, collaboration, mergers & acquisitions, and product launches to gain sustainable competitive advantage and market share.

- May 2024: Optical communications technology company Lightwave Logic collaborated with Advanced Micro Foundry (AMF) to develop polymer slot modulators utilizing AMF's silicon photonics platform. The agreement between the two companies came amid a collaboration in the previous year in which they teamed to develop electro-optic polymer slot modulators using AMF's standard manufacturing process flow on 200-mm wafers.

- March 2024: HyperLight, the provider of integrated electro-optical modulators (EOMs), expanded its intensity modulator series. This announcement underscored HyperLight's continued commitment to the innovation of photonics integrated circuits (PICs). The modulators offered by the company are based on proprietary high-bandwidth and low-voltage thin film lithium niobate (TFLN) PIC technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Optical Fiber Communication Infrastructure

- 5.2 Market Challenges

- 5.2.1 Design Constraints in Optical Modulators Affect Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Amplitude Modulators

- 6.1.2 Polarization Modulators

- 6.1.3 Phase Modulators

- 6.1.4 Analog Modulators

- 6.1.5 Other Types of Optical Modulators

- 6.2 By Application

- 6.2.1 Optical Communication

- 6.2.2 Fiber Optic Sensors

- 6.2.3 Space and Defense

- 6.2.4 Industrial Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thorlabs Inc.

- 7.1.2 Lumentum Holdings Inc.

- 7.1.3 AA Opto-Electronic

- 7.1.4 Fujitsu Optical Components Limited

- 7.1.5 Gooch & Housego PLC

- 7.1.6 Lightwave Logic

- 7.1.7 Hamamatsu Photonics KK

- 7.1.8 APE GmbH

- 7.1.9 Conoptics Inc.

- 7.1.10 L3Harris Technologies Inc.

- 7.1.11 AMS Technologies AG