|

市场调查报告书

商品编码

1642197

瓦楞包装和纸板箱:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Corrugated & Paperboard Boxes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

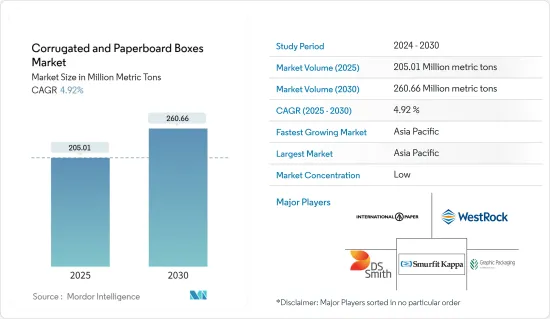

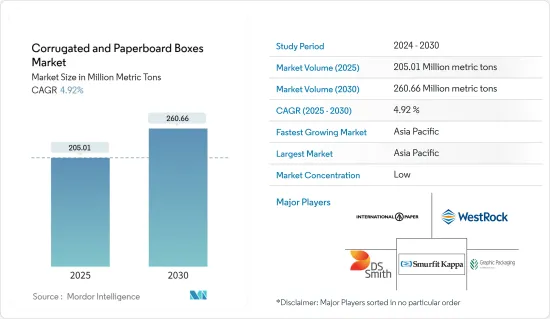

瓦楞包装和纸板箱市场规模预计在 2025 年将达到 2.0501 亿吨,预计在 2030 年将达到 2.6066 亿吨,预测期(2025-2030 年)的复合年增长率为 4.92%。

关键亮点

- 瓦楞纸板和纸板箱市场已经发展起来。儘管如此,仍有获利的机会,尤其是随着盒子功能的兴起,以适应更多直接面向消费者的应用程式并保持永续性。

- 瓦楞纸板和纸板箱用于包装和运输各种各样的产品,近年来由于电子商务行业的加速增长,其重要性显着提升。预计电子商务行业将继续成为全球瓦楞纸板和纸板箱市场的主要推动力,因为它需要瓦楞纸板和纸板箱来运输和储存各种各样的产品。

- 纸板包装也是无灾难性的和安全的,其回收材料覆盖率为 88%,还有来自永续管理森林的新鲜纤维。亚马逊等知名电子商务公司正在推广使用纸板包装作为电子商务包装,因为它有助于控製成本并提供环保选择。

- 虽然食品和饮料行业是瓦楞纸箱最成熟的终端用户应用领域之一,但未来预计其他发展中领域也将成长,例如电子产品和配件包装。亚太地区是全球最全面、成长最快的市场,受经济成长、可支配所得增加和製成品消费加强等因素所推动。自 1992 年以来,瓦楞纸板厂的数量减少了近 200 家,但同一时期的年总产量却增加了 5 亿多平方英尺(Fiberbox Association)。

- 瓦楞包装是一种多功能且经济高效的解决方案,可用于保护、保存和运输各种产品。纸板包装的一些特性包括重量轻、生物分解性和可回收。瓦楞包装是包装食品市场的首选,可用于食品、食品和饮料、汤、调味品和乳製品等各种终端用户行业。与玻璃或金属等不同的包装材料相比,它有助于减轻最终产品的总重量并保护它。

- 消费者越来越意识到包装对环境的危害,并将购买习惯转向更环保的选择。消费者和政府的压力不断增加,迫使企业提高包装和生产流程的环保性。人们愿意为环保包装支付更多钱。这导致对纸板包装的需求增加。

- 禁止使用一次性塑胶的严格立法的实施进一步加剧了对环保包装材料(尤其是纸质包装解决方案)的需求。此外,该地区电子商务平台使用率的不断提高可以归因于日益增长的技术娴熟的人口,他们越来越接受网路购物的便利性和可负担性。

纸板和折迭纸盒市场的趋势

食品和饮料预计将占据较大的市场占有率

- 在终端用户应用中,食品和饮料是瓦楞包装市场的主要终端用户领域,预计在预测期内将快速发展。食品和饮料业主要使用涂布未漂白纸板来包装饮料,使用瓦楞纸箱来包装蔬菜、水果和食品。对冷冻食品的需求不断增长可能会增加对折迭纸盒包装的需求。

- 生活方式的改变和人口的年轻化导致对品牌和包装物质的需求不断增长。根据软包装协会统计,美国饮料产业占了包装市场的近50%。超过 30% 的美国人每週订两次外卖,预计未来几年这数字将成长到 3%。

- 食品和饮料领域是市场中成长迅速的一个领域。由于人们的生活方式忙碌,对简便食品的需求很高。因此,无需花费很长时间准备的加工食品吸引了越来越多的消费者。人口不断增长,推动了人们对方便、健康的加工食品的需求。

- 随着消费者偏好转向更方便、更环保的产品,食品业正在成长,对永续包装解决方案的需求也日益增加。瓦楞包装由于其强度高、适应性强、可回收性而成为食品领域的热门选择。

- 顾客和企业越来越意识到包装对环境的影响。由于纸板可回收且生物分解性,越来越多的人选择它,而不是塑胶等永续的材料。越来越多的公司采用瓦楞包装来为客户提供更好的效果,特别是在二次和三级包装中,因为瓦楞包装可以使产品远离潮湿并且可以承受长时间的运输。麵包、肉品和其他生鲜产品等加工食品需要这些一次性使用的包装材料,这就是它们需求量很大的原因。

- 此外,外出消费也进一步推动了中国、日本、印度和澳洲等国家的需求。澳洲法规支持永续性并在 2025 年减少塑胶废弃物,鼓励使用环保包装解决方案。例如,根据国家包装目标,所有包装必须可回收、可重复使用或可堆肥。

- 根据澳洲农业和资源经济与科学局的数据,澳洲、加拿大、德国和法国是世界上粮食最安全的国家。食品业约占全国製造业和服务业收益的20%。澳洲农民生产并供该国大部分食品市场。

- 在印度和中国等国家,对食品和饮料的需求达到了前所未有的高度。因此,它是纸板包装市场的一股驱动力。预计食品和饮料行业的强劲成长将在整个预测期内推动对纸板包装的需求。

亚太地区:预计将出现显着成长

- 预计亚太地区将出现显着成长。亚太地区製造工厂数量的不断增加,加上消费者意识的不断增强以及运输包装行业的不断发展,推动了瓦楞包装和纸板箱市场的成长。由于中国和印度等新兴国家对纸浆和纸张的需求不断增长,预计该地区将成为成长最快的地区。中国运输包装产业的发展,加上消费主义的兴起,导致纸质包装的需求量迅速扩大。

- 自2008年以来,该地区瓦楞纸市场的需求以6.5%的速度成长,远超过世界其他任何地方。随着对纸质包装的需求不断增长,对再生纸的需求也不断增长。

- 零售商及其电子商务履约合作伙伴为改善客户体验而做出的共同努力,正在透过一流的客户服务推动电子商务的成长,并最终满足履行线上订单所需的瓦楞包装要求。商务的成长— 人与人之间的贸易。

- 例如,2024年1月,澳洲邮政公司与线上珠宝饰品零售商Myer结成策略合作伙伴关係,以涵盖Myer的大部分线上订单并改善Myer的线上客户体验。此次全面伙伴关係还包括澳洲邮政的城市服务,为墨尔本、雪梨、布里斯班和黄金海岸大都会圈的迈尔电子商务客户提供隔天送达服务。在过去的 12 个月中,澳洲邮政为迈尔百货运送了超过 500 万件小包裹。

- 根据美国农业部(USDA)对外农业服务局(2023年7月报告),泰国是东南亚第二大经济体。泰国仍然是一个强大的农业竞争对手,并且是大米、糖、金枪鱼罐头、菠萝罐头、天然橡胶、冷冻虾、已烹调和木薯的主要出口国。泰国也是美国第20大农产品出口国。

- 此外,不断发展的技术环境、智慧型手机和社交媒体的使用日益增加以及电子商务颠覆该地区传统的网路购物,正在推动显着的成长。越来越多的企业主和企业家正在建立社交媒体商店,透过社群媒体平台进行交易和销售。

- 全部区域网路购物的迅猛增长推动了对瓦楞包装(如瓦楞纸箱,瓦楞包装因其耐用性和成本效益而成为首选的包装材料。网路购物的便利性和全天候购物的能力导致订单更频繁、订单更小,需要独特的包装,进一步推动了对瓦楞包装的需求。

- 随着新兴国家物流领域的出口成长,瓦楞纸箱预计将占据该地区的市场主导地位。在快速消费品和化妆品等行业健康成长的推动下,快速成长的中阶人口预计将推动该地区瓦楞纸箱市场的需求。

瓦楞纸板和纸板箱产业概况

瓦楞包装和纸板箱市场细分化,由几家领先的公司组成。从市场占有率来看,目前主要几家参与企业占据着市场主导地位。由于区域和本地参与企业的产品差异化有限和低价策略,未来几年供应商之间的参与程度可能会加剧。该市场的多个参与企业正在推行各种无机成长策略,包括收购、伙伴关係和协作。这些发展为市场参与企业扩大业务和基本客群铺平了道路。

- 2023年11月,澳美私人公司公司Visy Industries在澳洲Hemmant开设了一家新的先进包装瓦楞纸厂。该公司将向新厂投资 1.75 亿澳元(1.11 亿美元),新厂每天将生产多达 100 万个瓦楞纸箱。该工厂将向昆士兰食品和饮料公司、农民和生产商供应瓦楞纸箱。

- 2023 年 11 月,纸包装供应商 Opal Packaging 在沃东加开设了一家新的高科技瓦楞包装厂,投资 1.4 亿美元。新厂每天的生产能力为 400 吨印刷和成品瓦楞纸箱。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 电子商务销售额成长

- 提高消费者对纸包装的认知

- 市场限制

- 高性能替代品的可用性

- 营运成本上升

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按产品

- 纸板和固态纤维箱

- 折迭式纸箱

- 瓦楞纸箱

- 其他的

- 按最终用户产业

- 饮食

- 耐久性消费品

- 造纸与出版

- 化学

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- International Paper Company Inc.

- WestRock Company

- Smurfit Kappa Inc.

- DS Smith PLC

- Graphic Packaging International Inc.

- Mondi Group

- Georgia-Pacific LLC

- Cascades Inc.

- Klabin SA

- Oji Holding Corporation

- Nine Dragons Paper(Holding)Limited

- Packaging Corporation Of America

- Nippon Paper Industries Co. Ltd

- Orora Packaging Australia Pty Ltd

- Rengo Co. Ltd

第七章投资分析

第八章 市场机会与未来趋势

The Corrugated & Paperboard Boxes Market size is estimated at 205.01 million metric tons in 2025, and is expected to reach 260.66 million metric tons by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

Key Highlights

- The corrugated and paperboard box market has been developed. Still, there are opportunities for gains, especially in the rise of box features, to account for more direct-to-consumer applications and maintain sustainability.

- Corrugated and paperboard boxes are utilized in the packaging and transportation of a wide variety of products and have become immensely significant in recent years due to the accelerated growth of the e-commerce industry, which is anticipated to remain a principal driving factor for the global corrugated and paperboard boxes market, as it requires corrugated and paperboard boxes for carrying and storing the wide variety of products it handles.

- Also, corrugated packaging covers 88% of recycled content with added fresh fibers originating from sustainably managed forests, so it is safe rather than catastrophic. Notable e-commerce businesses like Amazon are pushing towards corrugated board packaging for e-commerce packaging as it aids in controlling costs and gives an environment-friendly option.

- While the food and beverage industry ranks as one of the biggest established end-user application sectors for corrugated and paperboard boxes, future growth is anticipated from other developing fields, such as electronic products and accessory packaging. Asia-Pacific serves the most comprehensive and fastest-growing market globally, led by factors such as rising economies, increasing disposable incomes, and enhanced consumption of manufactured goods. Although the number of corrugator plants has declined by nearly 200 since 1992, the total production levels have increased by over 500 million square feet in the whole yearly production at a similar time (Fibre Box Association).

- Corrugated board packaging is an adaptable and cost-efficient solution to protect, preserve, and transport a range of products. The corrugated packaging features include light weight, biodegradability, and recyclability. It is the preferred option in the packaged food market and can be found in various end-user industries, such as food, beverage, soups, seasonings, and dairy products. Compared to different packaging materials such as glass and metal, it helps reduce and protect the final product's total weight and protect it.

- Consumers are becoming more aware of the environmental hazards of packaging and are moving their purchasing practices to more eco-friendly options. With the growing consumer and government pressure, it becomes necessary for companies to make their packaging and processes more environmentally friendly. Individuals are ready to pay more for environmentally friendly packaging. Thus, the demand for corrugated packaging is growing.

- The need for green packaging materials, particularly paper packaging solutions, is further fueled by the enforcement of strict legislation regarding the ban on single-use plastic. In addition, the increasing use of e-commerce platforms in the region is owing to the growth of a tech-savvy population that is increasingly embracing the convenience and affordability of online shopping.

Corrugated & Paperboard Boxes Market Trends

Food and Beverage Expected to Hold Significant Market Share

- Amongst end-user applications, food and beverage is the principal end-user segment of the corrugated and paperboard boxes market and are anticipated to advance at a fast speed in the forecast period. The food and beverage industry majorly utilizes coated, unbleached boards for packaging beverages and corrugated container boards for packaging vegetables, fruits, and food products. The accelerated demand for frozen foods is possible to push the demand for folding carton packaging.

- Alterations in lifestyle and a budding young population lead to a greater demand for branded and packaged substances. According to the Flexible Packaging Association, the beverage sector in the United States is valued at nearly 50% of the packaging market. Over 30% of Americans order meals twice a week, which is anticipated to grow to 3% in the coming years.

- Within the market, the food and beverage segment is quickly expanding segment. Because of people's hectic lifestyles, convenience foods are in high demand. As a result, processed food, which takes less time to prepare, attracts a growing number of consumers. The ever-increasing population drives the desire for processed food, which is both convenient and healthy.

- Consumer preferences are shifting toward more convenient and ecologically friendly products, the food industry is growing, and there is a growing need for sustainable packaging solutions. A popular option for the food sector is corrugated board packaging because of its strength, adaptability, and recyclable nature.

- Customers and companies are becoming more conscious of how packaging affects the environment. More people choose corrugated boards over plastic and other nonsustainable materials because they are recyclable and biodegradable. As corrugated paperboard packaging keeps moisture from products and can withstand long shipping times, companies are increasingly adopting this packaging to offer better customer outcomes, especially for secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used just once, thus driving the demand.

- Furthermore, on-the-go consumption in countries like China, Japan, India, and Australia further feeds the demand. The use of environmentally friendly packaging solutions is encouraged by Australian regulations that support sustainability and reduction in plastic waste by 2025. For instance, all packaging is to be recyclable, reused, or compostable, according to the National Packaging Targets.

- According to the Australian Bureau of Agricultural and Resource Economics and Sciences, Australia, Canada, Germany, and France are among the world's most food-secure countries. About 20% of domestic manufacturing and service revenue comes from the food industry. Australian farmers grow and supply the great bulk of the food market in this country.

- In countries such as India and China, the demand for food and beverages is always high. This consequently drives the paperboard packaging market. Such assertive growth in the food and beverage industry is supposed to boost the need for paperboard packaging throughout the forecast period.

Asia-Pacific Expected to Have Significant Growth

- Asia-Pacific is supposed to have significant growth. The growing number of manufacturing plants all over the region, combined with the increasing consumerism and transit packaging sector in the APAC region, is adding to the growth of the corrugated and paperboard boxes market. Due to the growing demand for paper pulp in developing countries such as China and India, the region is anticipated to be the fastest-growing region. There is an addition to the transit packaging sector in China, combined with increasing consumerism, leading to a quickly expanding demand for paper packaging.

- Corrugated and paperboard boxes market demand in the region has been expanding at a rate of 6.5% since 2008, far greater than anywhere else in the world. Along with this requirement for paper packaging, the need for recycled paper is also growing.

- The collaborative initiative of retail businesses and e-commerce fulfillment partners in the country to improve customer experience further augments e-commerce growth among the larger population due to the best customer services driving e-commerce growth and, ultimately, the requirement for corrugated board packaging required for shipping online orders.

- For instance, in January 2024, Australia Post Corporation and Myer, an online Jewellery retailer, strategically partnered to improve Myer's online customer experience, covering most of Myer's online orders. The comprehensive partnership also includes Australia Post's Metro Service, which offers next-day delivery for Myer e-commerce customers in metropolitan Melbourne, Sydney, Brisbane, and the Gold Coast. During the past 12 months, Australia Postal Corporation delivered more than five million parcels for Myer.

- According to the United States Department of Agriculture (USDA), Foreign Agricultural Service, July 2023 Report, Thailand is Southeast Asia's second-largest economy. It remains a strong agricultural competitor and is a major exporter of rice, sugar, canned tuna, canned pineapples, natural rubber, frozen shrimp, cooked poultry, and cassava. Thailand is also the 20th largest export of US agricultural products.

- Moreover, the evolving technology environment, increasing use of smartphones and social media, and changes in the region's traditional online shopping through e-commerce are driving significant growth. More and more business owners and entrepreneurs are setting up social media stores to trade and sell through social media platforms.

- This exponential growth in online shopping across the region is driving demand for corrugated board packaging like corrugated boxes, which are the preferred packaging material owing to their durability and cost-effectiveness. The convenience of online shopping and the ability to shop 24/7 has led to more frequent and smaller orders requiring their own packaging, further driving demand for corrugated packaging.

- There is an escalating rate of exports in the developing logistics sector as corrugated boxes are supposed to dominate the market in this region. Due to sound growth in sectors like (FMCG) and cosmetics, the fast-growing middle-class population is anticipated to boost the demand for the corrugated and paperboard boxes market in the region.

Corrugated & Paperboard Boxes Industry Overview

The market for corrugated and paperboard boxes is fragmented and consists of several major players. In terms of market share, few of these major players currently dominate the market. The level of engagement among the vendors will strengthen in the years to come due to limited product differentiation and the underpricing strategy of the regional and local players. Various inorganic growth strategies are witnessed in the market by several players, including acquisitions, partnerships, and collaborations. These exercises have paved the way for augmentation of the business and customer base of market players.

- November 2023: Visy Industries, a privately owned Australian-American paper, packaging, and recycling company, opened a new advanced corrugated box factory in Hemmant, Australia. The company invested AUD 175 million (USD 111 million) in the new factory to manufacture up to one million boxes per day. The factory supplies cardboard boxes to food and beverage companies, farmers, and growers in Queensland.

- November 2023: Opal Packaging, a paper packaging provider, has opened its new high-tech corrugated cardboard packaging facility in Wodonga with an investment of USD 140 million. The new facility has the capacity to produce 400 tons of printed and finished corrugated boxes every day.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growth in E - commerce Sales

- 4.3.2 Growing Consumer Awareness on Paper Packaging

- 4.4 Market Restraints

- 4.4.1 Availability of High-performance Substitutes

- 4.4.2 Rising Operational Costs

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Corrugated and Solid Fiber Boxes

- 5.1.2 Folding Paperboard Boxes

- 5.1.3 Set-up Paperboard Boxes

- 5.1.4 Other Products

- 5.2 By End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Durable Goods

- 5.2.3 Paper & Publishing

- 5.2.4 Chemicals

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 International Paper Company Inc.

- 6.1.2 WestRock Company

- 6.1.3 Smurfit Kappa Inc.

- 6.1.4 DS Smith PLC

- 6.1.5 Graphic Packaging International Inc.

- 6.1.6 Mondi Group

- 6.1.7 Georgia-Pacific LLC

- 6.1.8 Cascades Inc.

- 6.1.9 Klabin SA

- 6.1.10 Oji Holding Corporation

- 6.1.11 Nine Dragons Paper (Holding) Limited

- 6.1.12 Packaging Corporation Of America

- 6.1.13 Nippon Paper Industries Co. Ltd

- 6.1.14 Orora Packaging Australia Pty Ltd

- 6.1.15 Rengo Co. Ltd