|

市场调查报告书

商品编码

1548905

全球安全印刷市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Security Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

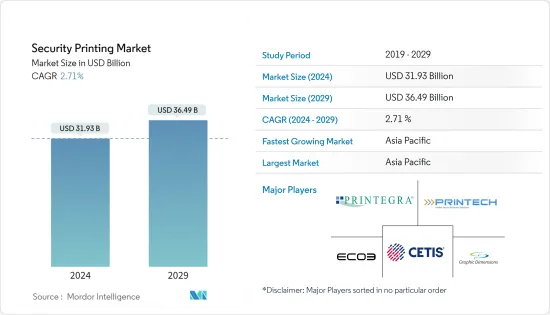

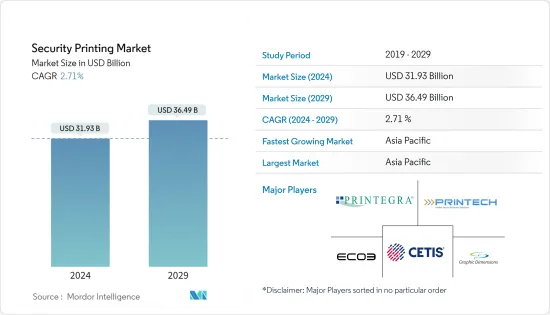

根据预测,2024年全球安全印刷市场规模预估为319.3亿美元,2029年达364.9亿美元,预测期间(2024-2029年)复合年增长率为2.71%。

主要亮点

- 假冒可能会给组织带来经济损失和声誉损害,因此组织实施安全措施以确保用户产品在出厂后未被篡改并且是正品变得非常重要。针对钞票、支票、ID卡和其他服务的伪造攻击的增加可能会显着推动安全列印市场的成长。

- 此外,政府和企业部门的技术进步也推动了对安全列印服务的需求。这些进步透过结合生物辨识、智慧卡、数位浮水印和安全墨水等先进功能,提高了文件和产品的安全性、效率和可靠性。这些特性使得印刷材料具有很强的防伪和诈欺,增加了对安全印刷服务的需求。

- 例如,泰雷兹生产用于安全金融交易的智慧卡,例如信用卡和签帐金融卡,其晶片与传统磁条卡相比可提供更高的安全性。该公司也是 EMV(Europay、Mastercard、Visa)智慧卡的重要供应商,这些卡广泛用于安全付款交易。此外,泰雷兹将于 2023 年 10 月为企业提供无密码指纹身份验证。最新的 SafeNet IDPrime FIDO Bio 智慧卡提供了一种简单、安全、快速的方式,只需您的指纹即可存取应用程式。组织智慧卡的此类发明可能会在所研究的市场中创造更多机会。

- 然而,引进先进的安全印刷技术成本高昂,对市场成长构成了挑战。整合全像图、特殊墨水和安全线等先进功能会显着增加生产成本。对于预算有限的小型企业来说,这项挑战尤其严峻。

- 此外,为了智取造假者和解决新的安全风险而进行的持续研发需求进一步增加了财务负担。这些成本挑战可能会阻碍安全列印解决方案的广泛采用并抑制市场成长。

- 国际衝突、贸易政策、经济制裁、监管变化和政治不稳定是影响安全印刷市场的地缘政治因素。国际衝突和战争对安全印刷市场有重大影响。对护照、签证和军人身分证等安全文件的需求不断增加,供应链受到干扰,法规也改变了。例如,俄罗斯和乌克兰之间的衝突增加了流离失所者和难民对护照、签证和ID卡等安全文件的需求。

- 然而,由于与俄罗斯的製裁和贸易限製而导致供应链和製造流程中断,将影响原材料和技术的取得。此外,斯德哥尔摩国际和平研究所的数据显示,俄罗斯预计2024年军费开支占GDP的比例将增加至7.1%,占政府总开支的35%。此类军事安全支出可能会在预测期内为所研究的市场创造更多机会。

防伪印刷市场趋势

纸币细分市场占据主要市场占有率

- 中央银行越来越多地选择先进材料,例如纯聚合物基材、纸聚合物混合物和增强涂层。儘管这些选择成本高昂,但改用聚合物可以为发证机构节省大量成本。这是因为聚合物的使用寿命更长,并且更能抵抗弯曲、染色和微生物威胁。

- 国内和全球聚合物伪造品的氾滥已成为推动银行实现纸币现代化的关键因素。传统上,纸币的基材是由纸製成的,为了耐用,通常由棉纤维衍生。有些采用亚麻、特殊颜色或法医学纤维,使其独一无二并防止复製。

- 此外,钞票印刷中越来越多地使用防伪纸是对日益严重的假钞问题的直接反应。线程、全息图和浮水印等安全功能现在很常见。水印,尤其是纸币上的水印,通常很容易识别并防止扫描、化学品、机械篡改和影印。与水印相辅相成的安全纤维可进一步防止彩色影印。

- 例如,印度储备银行引入了水印和线等明确的安全元素,以将其与假币区分开来。由于假币的增加以及保持货币流通以支持经济的需要,证券纸市场正在蓬勃发展。随着预测期的推移,市场准备在纸币製造中利用尖端的安全技术和印刷方法。

- 欧元纸币由纯棉纸製成,随着时间的推移自然劣化。欧元体系采用「分散集中」的方式进行印刷,每个设施都集中在特定的面额上。重点是防伪、维持纸币品质、永续生产和环境保护。

- 印度储备银行的年度报告强调,2022-23 财政年度发现了约 91,110 张 500 印度卢比假钞。值得注意的是,最新资料显示,新设计的20印度卢比假钞数量与前一年同期比较增加8.4%,而500印度卢比假钞数量较去年同期增加14.4%。

- 针对钞票、支票、ID卡和其他服务的伪造攻击的增加可能会显着推动安全列印市场的成长。据韩国央行称,2023年上半年韩国发现的假钞最多的是5,000韩元纸币,共73张。接下来是26张1万韩元的纸币。

亚太地区占主要市场占有率

- 由于印度、中国和日本等国家采用先进的安全印刷技术,预计亚太地区在预测期内将显着成长。由于技术进步和对文件安全的兴趣日益浓厚,预计未来几年市场将持续扩张。此外,政府重点关注在新兴经济体中增加个人识别技术的采用,预计也将进一步推动该地区对安全列印解决方案的需求。

- 例如,由 Reconnaissance 主办的亚洲高安全印刷展是每年针对特定地区举办的三场区域活动的一部分。活动将重点放在政府规定的文件,例如货币、信託文件、商品印花、ID卡、电子护照、签证、车辆文件和执照,特别重点是钞票以及我将推出的身份证件和旅行证件新技术。与此活动同时举行的展览会将有来自货币、电子护照、智慧卡、认证及相关行业的约 30 家参展参加。

- 由于安全印刷技术的日益普及,预计印度市场在未来几年将显着成长。正如国际全像图製造商协会(IHMA)所强调的那样,印度全像安全印刷市场的需求正在不断增长。

- 这一增长是由州和国家政府以及执法机构透过公开和隐蔽的保护策略加强安全努力所推动的。在政府打击假冒的努力以及各行业越来越多地使用安全列印解决方案的推动下,该地区的安全列印行业正在显着增长。

- 随着全部区域假冒行为的增加,对安全列印服务的需求预计将会增加。印度储备银行最新报告显示,2022-23财年银行业发现的假印度纸币(FICN)总量中,4.6%可追溯到储备银行,其余95.4%是在其他银行发现的我做到了。与前一年相比,2022 年 20 种印度卢比面值的假钞发现量增加了 8.4%,500 种印度卢比面值(新设计)的假钞发现量增加了 14.4%。

- 此外,央行同一年还发现了 78,699 张假 100 卢比纸钞和 27,258 张假 200 卢比纸钞。这些影响该地区假冒活动的关键因素可能有助于扩大安全印刷的机会。

- 亚太地区其他地区(例如中国、香港和日本)的假币活动也在增加,预计这将推动安全印刷市场的发展。 2024 年 1 月,根据四川省相关部门报告,一对居住在重庆市的夫妇因在住所製造假钞并在五年内使用价值超过 50 万元(7 万美元)的假钞而被捕。调查显示,2018年至2023年,这对夫妻在全部区域成功散发价值超过50万元的假钞,对当地居民造成重大经济损失。这些决定假钞可用性的重要活动改善了市场机会。

- 同样,2024年6月,香港警务处就2024年1月至4月香港假币增加向公众发出警告。在此期间,当局总合查获 3,396 张假钞,价值 255 万港币(326,130 美元),而 2022 年同期查获的假钞为 553 张,价值 166,220港币(21,291 美元)。值得注意的是,三起与加密货币交易相关的诈骗案件对今年的造假案件起到了重要作用。假币事件的增加预计将推动市场需求。

防伪印刷业概况

安全列印市场正在变得半固体,主要公司包括 ECO3、Graphic Dimensions Inc.、Cetis DD、Printegra (Ennis Inc) 和 Printech Global Secure Payment Solutions。市场上的竞争对手正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024 年 6 月 - ECO3 和 eProductivity Software (ePS) 宣布建立策略合作伙伴关係,旨在提高印刷生产的自动化程度。透过提供无缝整合和客製化的工作流程解决方案,这种合作伙伴关係将在效率方面树立新的标准,并为成长铺平道路。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 地缘政治和经济因素对产业的影响

第五章市场动态

- 市场驱动因素

- 仿冒案件增加

- 基于 RFID 的解决方案的出现

- 市场挑战

- 向无现金数位化过渡

第六章 市场细分

- 按使用类型

- 钞票

- 付款卡

- 查看

- 个人身分证

- 票务

- 邮票

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- ECO3

- Graphic Dimensions Inc.

- Cetis DD

- Printegra(Ennis Inc)

- Printech Global Secure Payment Solutions

- Graphic Security Systems Corporation

- Baldwin Technology Company Inc.

第八章投资分析

第九章 市场机会及未来趋势

第10章技术对安全印刷市场生态系的影响

The Security Printing Market size is estimated at USD 31.93 billion in 2024, and is expected to reach USD 36.49 billion by 2029, growing at a CAGR of 2.71% during the forecast period (2024-2029).

Key Highlights

- As counterfeiting can cause both monetary and reputation loss to the organizations, to assure the user that the product is not tampered with after leaving the factory and is authentic, implementing security measures becomes highly important for the organizations. The increasing number of counterfeit attacks on banknotes, cheques, ID cards, and other services will significantly drive the growth of the security printing market.

- In addition, technological advancements in the government and corporate sectors fuel the need for security printing services. These advancements strengthen documents and products' security, efficiency, and reliability by incorporating advanced features like biometrics, smart cards, digital watermarks, and secure inks. These features ensure that printed materials become significantly resistant to counterfeiting and fraud, amplifying the demand for security printing services.

- For instance, Thales manufactures smart cards for secure financial transactions, including credit and debit cards with embedded chips that enhance security compared to traditional magnetic stripe cards. The company is also a significant player in providing EMV (Europay, MasterCard, and Visa) smart cards that are widely used for secure payment transactions. Further, in October 2023, Thales Brings Passwordless Fingerprint Authentication to the Enterprise. The latest SafeNet IDPrime FIDO Bio Smart Card offers an easy, secure, and quick way to access applications with just their fingerprint. Such inventions in the smart cards for organizational use may further create opportunities in the studied market.

- However, the substantial cost of deploying advanced security printing technologies poses a challenge to the market's growth. Integrating advanced features like holograms, specialized inks, and security threads can significantly increase production expenses. This challenge is especially pronounced for small and medium-sized enterprises operating on constrained budgets.

- Furthermore, the ongoing demand for R&D to outpace counterfeiters and tackle emerging security risks further amplifies the financial burden. These cost challenges have the potential to impede the uptake of security printing solutions, thereby restraining market growth.

- International conflicts, trade policies, economic sanctions, regulatory changes, and political instability are geopolitical factors affecting the security printing market. International conflicts and wars have significantly influenced the security printing market. They have heightened the need for secure documents like passports, visas, and military IDs, disrupted supply chains, and altered regulatory mandates. For instance, Due to the Russia-Ukraine Conflict, there is Increased demand for secure documents such as passports, visas, and ID cards for displaced individuals and refugees.

- However, disruption of supply chains and manufacturing processes due to sanctions and restricted trade with Russia affects the availability of raw materials and technology. In addition, according to the Stockholm International Peace Research Institute, Russia is projected to increase its military spending to 7.1% of its GDP in 2024, constituting 35% of its total government expenditure. Such expenditures on military security may further create opportunities for the studied market in the forecasted period.

Security Printing Market Trends

Banknotes Segment Holds Major Market Share

- Central banks are increasingly opting for advanced materials like pure polymer substrates, paper/polymer blends, and enhanced coatings. While these choices come at a higher cost, the switch to polymer can yield substantial savings for issuing authorities. This is due to the polymer's extended lifespan and heightened resilience to folding, soiling, and microbial threats.

- The surge in both local and global polymer counterfeiting has been a pivotal factor driving banks to modernize their banknotes. Traditionally, banknote substrates have been crafted from paper, often derived from cotton fibers for robustness. Some variants incorporate linen, specialized colors, or even forensic fibers to bolster their distinctiveness and deter replication.

- Furthermore, the uptick in security paper usage in currency printing is a direct response to the escalating counterfeit banknote challenge. Security features like threads, holograms, and watermarks are now commonplace. Watermarks, especially prevalent in banknotes, offer easy public recognition and shield against scanning, chemicals, mechanical tampering, and reproduction. Complementing watermarks, security fibers further fortify defenses against color photocopying.

- For instance, the Reserve Bank of India has introduced distinct security elements like watermarks and threads to set its currency apart from counterfeits. With incidents of counterfeit currency on the rise and the need for continuous currency circulation to support economies, the security paper market is witnessing a surge. As the forecast period progresses, the market is poised to leverage cutting-edge security technologies and printing methods in banknote production.

- Euro banknotes, crafted from pure cotton paper, possess a natural degradation process over time. The Euro system employs a "decentralized pooling" approach for printing, where each of its facilities focuses on specific denominations. Emphasis is placed on countering counterfeiting, maintaining note quality, sustainable production, and environmental protection.

- The Reserve Bank of India's annual report highlighted the detection of around 91,110 counterfeit INR 500 notes in the fiscal year 2022-23. Notably, the latest data reveals an 8.4% rise in counterfeit notes for the newly designed INR 20 and a 14.4% increase for the INR 500 compared to the previous year.

- The increasing number of counterfeit attacks on banknotes, cheques, ID cards, and other services will significantly drive the growth of the security printing market. According to the Bank of Korea, during the first half of 2023, the most detected counterfeit banknote in South Korea was the KRW 5,000 bill, with 73 such banknotes. It was followed by 26 KRW 10,000 banknotes.

Asia-Pacific to Account for Significant Market Share

- Asia-Pacific is forecasted to observe impressive growth during the forecast period as a result of the adoption of advanced security printing technology in countries like India, China, and Japan. The market is anticipated to witness consistent expansion in the forthcoming years, driven by technological advancements and a growing focus on document security. Moreover, the government's focus on increasing the adoption of personal identification technologies across emerging economies is further expected to drive the demand for security printing solutions in the region.

- For instance, High-Security Printing Asia, organized by Reconnaissance, is part of a trio of regional events that take place every year to cater to specific regions. This event focuses on government-specified documents, including currency, fiduciary documents, excise stamps, ID cards, e-passports, visas, vehicle documents, and licenses, with a special emphasis on banknotes and emerging technologies for ID and travel documents. Running alongside the event is a trade exhibition featuring approximately 30 exhibitors from the currency, e-passport, smart card, authentication, and related industries.

- India is expected to contribute significant market growth over the coming years due to the growing adoption of security printing technologies. The market for holographic security printing in India is experiencing a boost in demand, as highlighted by the International Hologram Manufacturers Association (IHMA).

- This growth is being driven by efforts from state authorities, the national government, and law enforcement agencies to enhance security measures through both overt and covert protection strategies. The region is seeing a notable rise in the security printing sector, attributed to the government's initiatives to combat counterfeiting and the growing utilization of security printing solutions across various industries.

- The increasing number of counterfeit activities across the region is expected to drive the demand for security printing services. According to the Reserve Bank of India's latest report, during the 2022-23 fiscal year, 4.6% of the total Fake Indian Currency Notes (FICNs) detected in the banking sector were traced back to the Reserve Bank, while the remaining 95.4% were detected at other banks. There was an 8.4% surge in spotting counterfeit notes in the INR 20 denomination and a 14.4% increase in the INR 500 (new design) denomination compared to the previous year, 2022.

- Additionally, the central bank identified 78,699 fake Rs 100 notes and 27,258 fake Rs 200 notes in the same year. These significant factors influencing counterfeit activities in the region will contribute to the enhancement of security printing opportunities.

- Growing fake currency activities across other regions of APAC, such as China, Hong Kong, Japan, and others, are expected to drive the security printing market. In January 2024, as reported by Sichuan City authorities, a couple residing in Chongqing was arrested for producing counterfeit currency in their residence and using more than half a million yuan (USD 70,000) in fake notes over a period of five years. The investigation uncovered that from 2018 to 2023, the couple successfully circulated over 500,000 yuan in counterfeit money throughout Wanzhou and nearby regions, resulting in significant financial harm to the local populace. Such significant activities in determining the availability of counterfeit currency will improve the market opportunities.

- Similarly, in June 2024, The Hong Kong police issued a warning to the general public regarding the increasing prevalence of counterfeit banknotes in the city between January and April 2024. During this period, authorities confiscated a total of 3,396 fake notes amounting to HKD 2.55 million (USD 326,130), a significant surge from the 553 bills worth HKD 166,220 (USD 21,291) seized in the same timeframe in 2022. Notably, three cases of fraud related to cryptocurrency transactions contributed substantially to this year's counterfeit incidents. The rise in counterfeit currency instances is expected to fuel demand in the market.

Security Printing Industry Overview

The Security Printing Market is semi-consolidated, with the presence of major players like ECO3, Graphic Dimensions Inc., Cetis D.D., Printegra (Ennis Inc), and Printech Global Secure Payment Solutions. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2024 - ECO3 and eProductivity Software (ePS) have unveiled a strategic partnership aimed at elevating automation in print production. By offering seamlessly integrated and customized workflow solutions, this collaboration is poised to establish a new standard in efficiency, paving the way for enhanced growth prospects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geo-political and Economic Factor on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidences of Forgery

- 5.1.2 Emergence of RFID-based Solutions

- 5.2 Market Challenges

- 5.2.1 Transition Towards Cashless Economy and Digitization

6 MARKET SEGMENTATION

- 6.1 By Application Type

- 6.1.1 Banknotes

- 6.1.2 Payment Cards

- 6.1.3 Cheques

- 6.1.4 Personal ID

- 6.1.5 Ticketing

- 6.1.6 Stamps

- 6.1.7 Other Application Type

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Middle East and Africa

- 6.2.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ECO3

- 7.1.2 Graphic Dimensions Inc.

- 7.1.3 Cetis D.D.

- 7.1.4 Printegra (Ennis Inc)

- 7.1.5 Printech Global Secure Payment Solutions

- 7.1.6 Graphic Security Systems Corporation

- 7.1.7 Baldwin Technology Company Inc.