|

市场调查报告书

商品编码

1643009

生物分解性地膜:市场占有率分析、产业趋势与成长预测(2025-2030 年)Biodegradable Mulch Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

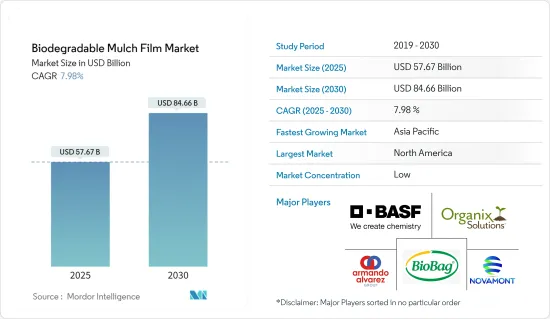

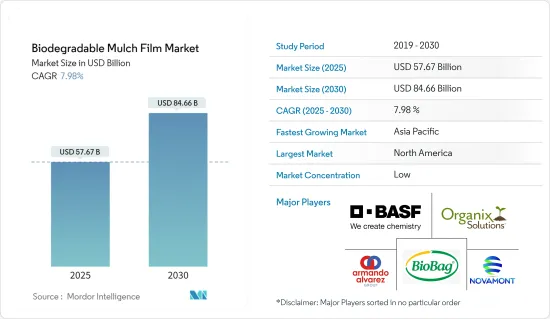

生物分解性地膜市场规模预计在 2025 年为 576.7 亿美元,预计到 2030 年将达到 846.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.98%。

关键亮点

- 土壤中的生物分解性对于农业和园艺产品来说是一个主要优点。生物分解性降解地膜的可用性得到了快速提升,农民可以在田地中使用后将生质塑胶地膜收集起来并犁入土中,而无需进行回收,从而提高了工作效率。然而,使用生物分解性覆盖物对环境的潜在影响尚未得到彻底研究,用于检验其安全性的国际标准(如 ISO 17088、ASTM D6400、ISO 17556 和 ASTM D5988)目前正在研究中。

- 如果处理不当,非生物分解的地膜会导致农业表土流失,估计每年每个作物週期结束时,约有 166 千吨地膜从田地流失。相较之下,经土壤生物分解性认证的地膜由于其生物分解性,不仅可以防止土壤流失,而且在阻止农业土壤中微塑胶的径流和积累方面发挥着至关重要的作用。此外,这些经过认证的地膜有助于减少难以回收的塑胶废弃物的产生。

- 温室业务的扩张将推动市场发展。根据世界温室蔬菜统计数据,全世界有温室种植面积1228,000英亩。生物分解性塑胶覆盖物碎片在完全生物分解之前会以物理方式改良土壤。但PE塑胶碎片会降低土壤的渗透性和吸水性,其累积会影响温室栽培土壤生态系统,最终影响植物的发芽和生长。因此,该领域对生物分解性地膜市场的需求正在增加。

- 政府对有机覆盖物的支持性法规正在推动市场的发展。例如,在欧洲,EN17033是针对农业和园艺使用的生物分解性地膜的新产品标准,规定了必要的要求和测试方法。该标准旨在为农民、经销商和相关人员提供明确的参考。 EN 17033 很可能取代欧洲其他现有的国家标准。

- 製造过程中添加的有害添加剂以及高昂的安装成本对市场成长构成了挑战。由于地膜的初始成本高,无法取得,对成长构成了挑战。此外,随着农民意识的增强,在生物分解性地膜生产中使用塑化剂来提高利润正成为市场挑战。

生物分解性地膜市场趋势

水果和蔬菜占很大份额

- 无论是黑色还是透明的地膜在现代农业中都扮演着重要角色。这些孔使种植或直接播种作物变得更加容易,并增强了对作物生长至关重要的几个因素。此方法不仅提高了各类蔬菜的栽培效率,而且可以提早收穫、增加产量,并改善农产品的品质。

- 此外,该薄膜还能显着减少土壤水分流失,保持地面湿润,减少额外浇水的需要,从而节省成本。实地试验表明,与传统方法相比,使用农膜可使蔬菜产量提高近一倍。

- 黑白地膜具有双重用途。它不仅可以防止杂草生长,还可以阻断相关植物的生长。此外,这些薄膜还可以作为防雨屏障,防止有价值的农药和肥料被冲走。它还有助于保持土壤湿度,防止土壤压实,保持土壤疏鬆,适合植物生长。

- 由于用于水果和蔬菜的地膜比例很高,而且其处理会产生许多环境问题,因此生物分解性地膜被认为是替代传统聚乙烯地膜的最佳解决方案。

- 此外,传统地膜废弃物受到土壤和蔬菜残留物的严重污染,回收过程成本高、耗时且不经济,造成了环境问题。这种生物分解性的地膜具有以下优点:在其使用寿命结束后,可以简单地将其处理到土壤中或堆肥系统中,由土壤微生物进行生物分解。这可以节省您的时间和金钱。

- BASF的聚合物 Ecovio M 由聚乳酸 (PLA) 製成,是一种生物基材料,可完全生物分解。这样做的好处是,农民收成后不用费力去除地膜,可以直接耕地,节省时间和金钱。

- 此外,义大利每年也向其他国家出口大量新鲜水果和蔬菜,Novamon 等公司提供用于蔬菜加工的 Mater-Bi 地膜。义大利是欧洲领先的番茄生产国。据义大利国家食品蔬菜工业保护协会称,2023 年义大利番茄产品出口额与前一年同期比较增长了 25.2%。

亚太地区将经历显着的市场成长

- 预计亚太地区生物分解性地膜的成长率最高。这是由于人口不断增长,特别是中国和印度的人口,导致粮食需求增加,从而导致作物生产中生物分解性地膜的使用增加。

- 政府也正在采取必要措施提高农业生产力。在中国,国家发展和改革委员会表示希望在农业领域推广包括生物分解性地膜在内的非塑胶产品。

- 此外,印度政府预计未来几年将增加豆类产量,预计将大幅增加对生物分解性地膜的需求。根据 PIB 预测,2021-2022 年豆类种植面积将达到 2,730.2 万吨,预计 2022-2023 年将增加 2,750.4 万吨。

- 此外,2023 年 5 月,新加坡 RWDC Industries 与生物技术新兴企业和工艺技术提供商 Lummus Technology 签署了一份谅解备忘录,该公司开创了生物聚合物解决方案来取代石油基塑胶。此次合作旨在引领全球措施,推广使用生物分解性的聚合物 PHA。

生物分解性地膜产业概况

生物分解性地膜市场细分化,主要参与者采用新产品推出和协议等各种策略来扩大其在该市场的份额。主要参与企业包括BASF SE 和 BioBag International AS。

- 2023 年 10 月,包装和纸张製造商 Mondi 与领先的农业绳、网和绳索製造商 Cotesi 合作,发起了一项联合计划,以加强农业部门的永续性。两家公司合作的核心是推出一种新的纸基解决方案「Advantage Kraft Mulch」。这种创新产品旨在取代长期以来一直是农民主要食物的传统塑胶地膜。地膜在农业中发挥着至关重要的作用,可以保护农作物免受鸟类、杂草、土壤侵蚀、过度阳光和暴雨等各种威胁。传统上,这些薄膜由塑胶製成,在种植时铺设,在收穫时丢弃。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 扩大温室业务

- 世界各地政府对有机覆盖物的支持与监管

- 市场限制

- 安装成本高,生产过程中添加有害添加剂

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按聚合物

- 淀粉

- 聚羟基烷酯(PHA)

- 聚乳酸(PLA)

- 其他聚合物(脂肪族-芳香族共聚物 (AAC))

- 按应用

- 水果和蔬菜

- 花朵

- 谷物和油籽

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第六章 竞争格局

- 公司简介

- BASF SE

- BioBag International AS

- Organix AG

- Armando Alvarez Group

- Novamont SpA

- Agriplast Tech India Pvt. Ltd

- Pooja Plastic Industries

- Barbier Group

- Dubois Agrinovation

- Hopewell Industries

- Investment Analysis

第七章 市场机会与未来趋势

简介目录

Product Code: 69049

The Biodegradable Mulch Film Market size is estimated at USD 57.67 billion in 2025, and is expected to reach USD 84.66 billion by 2030, at a CAGR of 7.98% during the forecast period (2025-2030).

Key Highlights

- Biodegradability in the soil provides huge benefits for agricultural and horticultural products. Biodegradable mulching films have made rapid improvements in terms of usability, allowing cultivators to plow in bioplastic mulch after use instead of collecting them from the field for recycling, which improves operational efficiency. However, the potential environmental consequences of using biodegradable mulches have not been thoroughly studied, and international standards, such as ISO 17088, ASTM D6400, ISO 17556, and ASTM D5988, for validating their safeness are in the ongoing research phase.

- Non-biodegradable mulch films, when not properly disposed of, can lead to the loss of agricultural topsoil, with an estimated 166 kiloton/year dragged away from fields at the end of each crop cycle. In contrast, certified soil-biodegradable mulch films, with their biodegradability, not only prevent this soil loss but also play a crucial role in halting the leakage and accumulation of microplastics in agricultural soils. Additionally, these certified mulch films help curb the production of plastic waste that is notoriously challenging to recycle.

- The expansion of the greenhouse project drives the market. According to the World Greenhouse Vegetable Statistics, there are 1,228,000 acres of greenhouse growing space for production worldwide. Biodegradable plastic mulch fragments physically modify soil before they are fully biodegraded. However, PE plastic fragments reduce soil infiltration and water absorption, by which the accumulation may affect soil ecosystems in greenhouse plantations and, ultimately, result in plant germination and growth. Thus, the demand for biodegradable mulch film market increases in this segment.

- Supportive regulation from the governments for organic mulching across the world is driving the market. For instance, in Europe, EN 17033 is the new product standard made for biodegradable mulch films used in agriculture and horticulture and specifies the necessary requirements and test methods. The standard is designed for a clear reference to farmers, distributors, and stakeholders. EN 17033 is more likely to replace other pre-existing national standards in Europe.

- High installation cost, along with the addition of harmful additives during the manufacturing process, challenges the growth of the market. The deficit in the availability of such mulch films with high initial costs is challenging the growth. Moreover, the involvement of plasticizers in the manufacturing of biodegradable mulch film to make profits may challenge the market with growing awareness among the farmers.

Biodegradable Mulch Film Market Trends

Fruits and Vegetables to Account for a Significant Share

- Mulch films, whether black or transparent, play a crucial role in modern agriculture. They facilitate the planting or direct sowing of crops through punched holes, enhancing several factors pivotal for crop growth. This method not only boosts the effectiveness of growing various vegetables but also leads to earlier harvests, increased yields, and improved produce quality.

- Moreover, these films significantly reduce moisture loss from the soil, keeping the ground moist and subsequently cutting down on the need for additional watering, thus reducing costs. Field trials have demonstrated that using agricultural films can nearly double vegetable harvests compared to traditional methods.

- Black and black/white mulch films serve a dual purpose. They not only prevent weed growth but also shield against accompanying flora. Additionally, these films act as a protective barrier against rain, safeguarding valuable agrochemicals and fertilizers from being washed away. By maintaining soil moisture, they also prevent soil compaction, ensuring it stays loose and conducive for plant growth.

- Due to the large proportion of mulch films used in fruits and vegetables and all the environmental problems related to their disposal, biodegradable mulch films seem to be the best solution for replacing conventional polyethylene mulches.

- Additionally, traditional mulch film waste causes an environmental problem because it is very contaminated with soil and vegetable residues, making the recycling process expensive, time-consuming, and an uneconomic activity. These biodegradable mulch films have the advantage of being disposed directly into the soil or into a composting system at the end of their lifetime and undergo biodegradation by soil microorganisms. This saves time and money.

- BASF offers the polymer Ecovio M, which is made up of polymer PLA (polylactic acid), which has biobased content and is completely biodegradable. Its advantage is that the farmer does not have to laboriously collect the mulch films after harvest but can plow them directly, which helps save time and money.

- Furthermore, Italy exports tons of fresh fruits and vegetables to other countries annually, and players such as Novamont offer Mater-Bi mulch film for processing vegetables. Italy is the main European producer of tomatoes. According to the Associazione Nazionale Industriali Conserve Alimentari Vegetali, the export value of tomato products in Italy rose by 25.2% in 2023 compared to the previous year.

Asia-Pacific to Witness Significant Market Growth

- Asia-Pacific is projected to register the highest rate in biodegradable mulch film, as the increasing population, especially in China and India, is increasing the demand for food, increasing the usage of biodegradable mulch films in crop production.

- The government is also taking necessary steps to improve the productivity of crops. In China, the government's National Development and Reform Commission stated that China wants to promote non-plastic products, including biodegradable mulch film, in the agriculture sector.

- Additionally, in India, the government estimates an increase in pulse production for the coming years, which is expected to significantly raise the demand for biodegradable mulch films. According to PIB, 273.02 lakh tonnes of pulses were expected to be farmed during 2021-2022, with an increment of 275.04 lakh tonnes compared to 2022-2023.

- Furthermore, in May 2023, Singapore's RWDC Industries, a biotech start-up pioneering biopolymer solutions as alternatives to petroleum-based plastics, and Lummus Technology, a provider in process technology, inked a memorandum of understanding (MOU). This collaboration aims to spearhead worldwide initiatives for deploying PHA, a biodegradable polymer.

Biodegradable Mulch Film Industry Overview

The biodegradable mulch film market is fragmented, and the major players are using various strategies, such as new product launches and agreements, to increase their footprints in this market. Key players in the market are BASF SE, BioBag International AS, etc.

- October 2023: Packaging and paper provider Mondi teamed up with Cotesi, a prominent producer of twine, nets, and ropes for agriculture, in a joint effort to bolster sustainability in the agricultural sector. Their collaboration centers around the launch of a new paper-based solution, Advantage Kraft Mulch. This innovative product is designed to supplant the conventional plastic mulch films that have long been a staple for farmers. Mulch films play a crucial role in agriculture, shielding crops from a gamut of threats, including birds, weeds, soil erosion, excessive sunlight, and heavy rain. Traditionally, these films were crafted from plastic, laid out during planting, and subsequently discarded at harvest, exacerbating the prevalent plastic waste dilemma.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Greenhouse Projects

- 4.2.2 Supportive Regulation from the Governments for Organic Mulching Across the World

- 4.3 Market Restraints

- 4.3.1 High Installation Cost and Addition of Harmful Additives in Manufacturing

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Starch

- 5.1.2 Polyhydroxyalkanoates (PHA)

- 5.1.3 Polylactic Acid (PLA)

- 5.1.4 Other Polymers (Aliphatic-Aromatic Copolymers (AAC))

- 5.2 By Application

- 5.2.1 Fruits and Vegetables

- 5.2.2 Flowers and Plants

- 5.2.3 Grains and Oilseeds

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BASF SE

- 6.1.2 BioBag International AS

- 6.1.3 Organix AG

- 6.1.4 Armando Alvarez Group

- 6.1.5 Novamont SpA

- 6.1.6 Agriplast Tech India Pvt. Ltd

- 6.1.7 Pooja Plastic Industries

- 6.1.8 Barbier Group

- 6.1.9 Dubois Agrinovation

- 6.1.10 Hopewell Industries

- 6.2 Investment Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219