|

市场调查报告书

商品编码

1690783

表面黏着技术:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Surface Mount Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

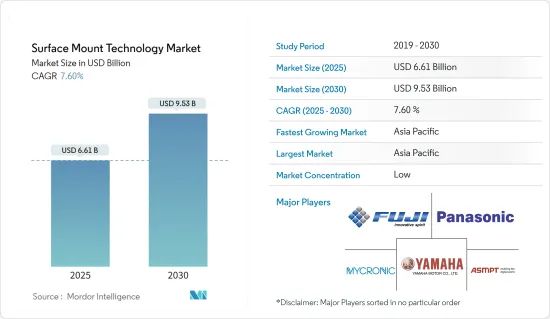

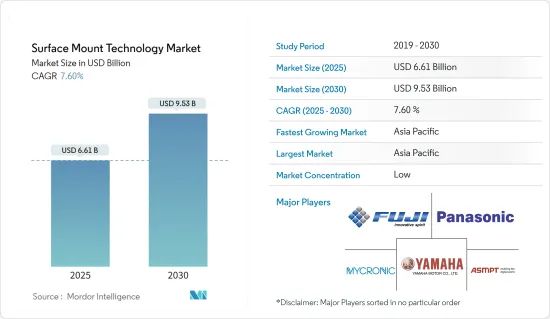

表面黏着技术市场规模预计在 2025 年为 66.1 亿美元,预计到 2030 年将达到 95.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.6%。

表面黏着技术(SMT) 是一种建构电子电路的方法,其中组件直接安装到印刷基板(PCB) 的表面上。这与旧的通孔技术形成对比,旧的通孔技术是将元件插入 PCB 上钻孔中。 SMT 中使用的组件称为 SMD,具有可直接焊接到 PCB 表面的小金属片或端盖。这使得单一 PCB 上可以使用更小、更轻以及更多的组件。

疫情爆发后,笔记型电脑和伺服器市场需求激增。据印度电子和半导体协会 (IESA) 称,随着在家工作和协作工具的采用,越来越多的资料被储存在云端。伺服器、资料中心和运算领域的需求正在激增。美国美光科技公司也报告称,由于远距工作经济、游戏和电子商务的活性化,资料中心的需求增加。此外,根据 Cloudscene 的数据,截至 2024 年 3 月,美国拥有 5,381 个资料中心,比世界上任何其他国家都多。另外有 521 家在德国,514 家在英国。

电子元件的小型化使得生产可以随身携带的小型、便携式、手持式可携式成为可能。因此,现在市场上出现了更小、更轻且处理能力更强大的设备。由于组件可以轻鬆嵌入(例如,放入衣服袋中)并可长时间携带,因此它们变得越来越容易穿戴。元件变得越来越小,对安装它们的印刷电路基板的设计提出了新的要求。 NCAB集团坚定地致力于IPC制定超高密度Ultra HDI印刷电路基板标准的努力,并预计能够在2023年向客户交付。

表面黏着技术(SMT) 已成为现代电子製造的重要组成部分,与传统通孔方法相比具有无数优势。 SMT 的一个明显优势是显着减少所需的 PCB 钻孔量。透过省去钻孔步骤,製造商可以节省时间和金钱,这对于复杂的高密度基板尤其有利。这项转变将简化生产,降低人事费用和材料成本,并提高製造过程的整体成本效益。

表面黏着技术能够生产更小、更有效率、更具成本效益的电子设备,从而彻底改变了电子製造业。然而,儘管 SMT 具有许多优点,但它并不适合所有应用。 SMT不适用于变压器、电源电路等高功率、高压元件。这些组件会产生热量并具有高电负荷,而 SMT 的设计无法有效处理。

根据美国预算办公室预测,到2033年,美国国防支出将逐年增加。到2023年,美国国防支出将达到7,460亿美元。同一项预测也预测,到2033年,国防支出将增加至1.1兆美元。

表面黏着技术(SMT) 市场趋势

消费性电子终端用户产业预计将占据相当大的市场占有率

- 在汽车产业,SMT 用于电控系统(ECU)、仪表板显示器、雷达和相机模组、电池管理系统(BMS)、安全辅助系统等。 SMT 已成为汽车应用中的关键製造流程。 SMT 以其高效、精确和可靠而闻名,对于驱动各种车载电子产品至关重要,包括 ADAS(高级驾驶辅助系统)、资讯娱乐系统和车辆控制系统。

- 在现代汽车中,车载控制系统充当汽车的“大脑”,监督和协调所有电子元件的功能。车载控制系统对于导航、音讯、空调等一切设备的无缝运作至关重要。这些控制系统可靠性的核心是 SMT 技术。此技术可将微小的电子元件精确地放置在电路基板,确保系统有效率且可靠的运作。

- 引擎控制单元 (ECU) 是汽车电子系统的核心,监督引擎性能、传动和煞车等重要操作。表面黏着技术(SMT) 对于将微晶片、电阻器、电容器和其他表面黏着技术组件组装到 ECU 中至关重要。

- 此外,人工智慧技术预计将在汽车领域得到更广泛的应用。电子组装中表面黏着技术(SMT)的精度和效率为人工智慧晶片和处理器的生产提供了动力。因此,汽车电子产品将具有增强的自主决策能力,促进智慧驾驶和车辆自动化。

- 正如国际能源总署所强调的,全球汽车产业正在经历深刻的变革时期,这可能对能源产业产生重大影响。预测表明,到 2030 年,电气化将减少每天 500 万桶石油的需求。

- IEA报告也显示,电动车销量将大幅成长,2023年销量将与2022年相比成长35%至350万辆。最值得注意的是,全年每週都有超过 250,000 个新註册。 2023 年,电动车将占总销量的 18% 左右,高于五年前的 2% 和 2022 年的 14%。这些趋势表明,随着电动车市场的成熟,强劲成长预计将持续下去。此外,预计到2023年,70%的电动车保有量将由电池电动车组成。

亚太地区预计将经历最快成长

- 亚太地区,尤其是日本、中国、韩国、台湾和东南亚等国家,是全球电子製造中心。该地区强大的製造业基础设施、熟练的劳动力和支持性的政府政策正在吸引跨国公司,刺激当地电子产业的成长。平板电脑、智慧型手机和其他电子设备的需求持续成长,需要透过表面黏着技术实现高效、大量的生产能力。该公司预计,透过在本地引进SMT(表面黏着技术),附加价值将从目前的15%提升至25%。

- 例如,2023年8月,印度政府正积极与全球电子公司合作,提昇在印度组装的产品的本地附加价值,目标在未来5-10年内大幅成长60-80%。为实现此目标,政府鼓励印度工业采用表面黏着技术(SMT)生产线等先进的生产方法。

- 碳化硅(SiC)因具有耐高温、优异的电导性、优异的能源效率等特点,受到越来越多的关注。随着工业 4.0 推动对电动车 (EV)、太阳能板和先进电源管理的需求,SiC 製造变得越来越重要。鑑于需要尽量减少这些区域的电力消耗,宽能带隙导体是自然的选择。

- 2024 年 2 月,大陆设备印度有限公司 (CDIL) 迈出了重要一步,运作了一条专用于 SiC表面黏着技术(SMT) 组件的新组装。这确立了 CDIL 作为印度 SiC 元件製造先驱的地位。透过这项改进,CDIL 现在能够生产各种汽车级设备,如 SiC 肖特基二极体、SiC MOSFET、齐纳二极体、整流器和 TVS 二极管,以满足全球和国内市场的需求。

- 2024 年 4 月,TDK 公司宣布推出 B40910 系列,这是一系列混合聚合物电容器,最大电流可达 4.6 A(100 kHz、+125 度C时)。这些表面黏着技术元件在室温下具有惊人的低 ESR 值 17mΩ 和 22mΩ。

- 与使用液体电解质的标准电解电容器不同,TDK 电容器的 ESR 随温度的变化很小。这些紧凑型元件的尺寸为 10 x 10.2 毫米或 10 x 12.5 毫米(深 x 高),额定电压为 63 V,电容范围为 82 μF 至 120 μF。因此,SMT 製造商正在透过技术整合和创新来推动对该技术的需求。这些努力促进了表面黏着技术(SMT) 在各行业的广泛应用和发展。

表面黏着技术(SMT) 产业概览

表面黏着技术市场高度分散,既有全球参与者,也有中小型企业。市场的主要企业包括FUJIFILM、Yamaha Motor Co, Ltd.、Mycronic AB、ASMPT 和Panasonic。市场参与者正在采用合作和收购的方式,以加强其产品供应并获得竞争优势。

2024 年 3 月 - 诺信公司在墨西哥克雷塔罗设立了新的拉丁美洲技术中心,以帮助该地区的製造商及时获得反馈,了解哪种流体分配设备最适合他们的装配流体、零件、基板和生产要求。实验室配备了 3D 列印机、秤和其他测量设备,使我们能够根据每个客户的特定应用要求确定合适的流体分配设备。

2024年1月-Yamaha Motor Co, Ltd.株式会社宣布推出YRM10表面黏着技术,该贴片机在贴片性能方面被誉为同类产品中最快的。其速度高达 52,000 CPH,在 1 光束 1 头类别中远远超过其他竞争对手。该机器结构紧凑,节省空间,提供广泛的组件相容性和多功能性,使其成为高速模组组装的下一代解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对表面黏着技术市场的影响

第五章 市场动态

- 对技术小型化的需求日益增加

- 与其他技术相比, 基板上需要的孔更少

- 市场挑战

- SMT 不适用于大型、高功率、高压元件或经常受到机械应力的元件。

- 初始成本高且返工问题

第六章 市场细分

- 按组件

- 被动元件

- 电阻器

- 冷凝器

- 主动元件

- 电晶体

- 积体电路

- 被动元件

- 按最终用户产业

- 消费性电子产品

- 车

- 工业电子

- 航太和国防

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Fuji Corporation

- Yamaha Motor Co. Ltd

- Mycronic AB

- ASMPT

- Panasonic Corporation

- Nordson Corporation

- Juki Corporation

- Hanwa Precision Machinery Co. Ltd

- Zhejiang Neoden Technology Co. Ltd

- Europlacer Limited

- Viscom SE

第八章投资分析

第九章 市场机会与未来趋势

The Surface Mount Technology Market size is estimated at USD 6.61 billion in 2025, and is expected to reach USD 9.53 billion by 2030, at a CAGR of 7.6% during the forecast period (2025-2030).

Surface mount technology (SMT) is a method for constructing electronic circuits in which the components are mounted directly onto the surface of printed circuit boards (PCBs). This contrasts with older through-hole technology, where components are inserted into holes drilled into the PCB. Components used in SMT, known as SMDs, have small metal tabs or end caps that can be soldered directly onto the PCB surface. This allows for using smaller, lighter, and more components on a single PCB.

After the effect of the pandemic, the market for laptops and servers is witnessing a surge in demand. According to the India Electronics and Semiconductor Association (IESA), more data is stored on the cloud as work-from-home increases and more collaboration tools are deployed. A surge in demand is witnessed in the server, data centers, and computing segments. US-based Micron Technology also reported a more robust demand from data centers due to the remote-work economy, increased gaming, and e-commerce activity. Additionally, as per Cloudscene, as of March 2024, there are 5,381 data centers in the United States, the most of any country worldwide. A further 521 are in Germany, while 514 are in the United Kingdom.

Miniaturization of electronic components has made it possible to build small portable and handheld computer devices that can be carried anywhere. As a result, smaller, lighter devices with high processing capacity are available on the market. They are becoming more wearable since components can be easily embedded (for example, in clothing bags) and carried for long periods. Components are shrinking, putting new demands on the design of the PCBs they are mounted on. NCAB Group is firmly committed to IPC's efforts in defining standards for ultra-dense Ultra HDI PCBs and anticipates being able to provide them to clients in 2023.

Surface mount technology (SMT) has emerged as a pivotal element in modern electronics manufacturing, eclipsing traditional through-hole methods with its myriad benefits. A standout advantage of SMT lies in its drastic reduction of necessary PCB drilling. Manufacturers slash both time and costs by sidestepping the drilling process, a notable boon for intricate, high-density boards. This shift streamlines production and trims labor and material expenses, bolstering the overall cost-effectiveness of the manufacturing process.

Surface mount technology has revolutionized the electronics manufacturing industry by enabling the production of smaller, more efficient, and cost-effective electronic devices. However, despite its numerous advantages, SMT is unsuitable for all applications. SMT is unsuitable for high-power and high-voltage components, such as transformers and power circuitry. These components generate heat and carry high electric loads, which SMT is not designed to handle effectively.

According to the US Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States amounted to USD 746 billion in 2023. The forecast predicts an increase in defense outlays up to USD 1.1 trillion in 2033.

Surface Mount Technology (SMT) Market Trends

Consumer Electronics End-user Industry Segment is Expected to Hold Significant Market Share

- In the automotive industry, SMT is used in Electronic Control Units (ECU), dashboard displays, radar and camera modules, Battery Management Systems (BMS), safety assistance systems, and more. SMT has emerged as a pivotal manufacturing process in the automotive application. Renowned for its efficiency, precision, and reliability, SMT is crucial in bolstering various automotive electronic products, including advanced driver-assistance systems (ADAS), infotainment systems, and vehicle control systems.

- In modern cars, the on-board control system acts as the vehicle's 'brain,' overseeing and harmonizing the functions of its electronic components. The on-board control system is crucial in their seamless operation, from navigation to audio and air conditioning. Central to the reliability of these control systems is SMT technology. This technology enables the precise mounting of minuscule electronic components on circuit boards, ensuring the systems operate efficiently and reliably.

- The Engine Control Unit (ECU) is the automotive electronic system's nucleus, overseeing critical operations like engine performance, transmission, and braking. Surface-mount technology (SMT) is essential in assembling microchips, resistors, capacitors, and other surface-mounted components onto the ECU.

- Furthermore, Artificial Intelligence technology is poised to see increased adoption in the automotive sector. The precision and efficiency of Surface Mount Technology (SMT) in electronic assembly are set to bolster the production of AI chips and processors. Consequently, automotive electronic products will have enhanced autonomous decision-making abilities, advancing intelligent driving and vehicle automation.

- As highlighted by the IEA, the global automotive industry is undergoing a significant transformation, with potentially far-reaching implications for the energy sector. According to projections, the rise of electrification is anticipated to result in a daily elimination of the need for 5 million barrels of oil by 2030.

- The IEA's report also revealed a substantial increase in electric vehicle sales, with 3.5 million units sold in 2023 compared to 2022, marking a 35% growth. Notably, over 250,000 new registrations were recorded weekly, and over 250,000 new registrations were recorded weekly throughout the year. In 2023, electric vehicles accounted for approximately 18% of all vehicles sold, a significant increase from 2% five years ago and 14% in 2022. These trends indicate that solid growth is expected to persist as the electric vehicle market matures. Additionally, it was projected that 70% of the electric vehicle stock in 2023 would consist of battery electric vehicles.

Asia Pacific is Expected to Witness Fastest Growth

- Asia-Pacific, particularly countries like Japan, China, South Korea, Taiwan, and Southeast Asia, has become a global hub for electronics manufacturing. The region's robust manufacturing infrastructure, skilled labor force, and supportive government policies attract multinational corporations and promote the growth of local electronics industries. Demand for tablets, smartphones, and other electronic devices continues to grow, necessitating efficient and high-volume production capabilities by surface mount technology. The company projects that by implementing SMT (Surface Mount Technology) locally, the value addition will increase to 25% from the current 15%.

- For instance, in August 2023, the Indian government is actively engaging with global electronics firms to ramp up local value addition in products assembled in India, targeting a significant increase of 60-80% over the next five to ten years. To achieve this, the government is urging industries in India to adopt advanced production methods, like surface-mount technology (SMT) lines.

- Silicon Carbide (SiC) is increasingly in the spotlight for its high-temperature resilience, superior electrical conductivity, and remarkable energy efficiency. As the demand for electric vehicles (EVs), solar panels, and advanced power management rises with Industry 4.0, SiC manufacturing's significance has heightened. Wide Band Gap conductors are a natural fit given the imperative for minimal power consumption in these sectors.

- In February 2024, Continental Device India Limited (CDIL) took a significant step by inaugurating a new assembly line specifically for SiC Surface Mount Technology (SMT) components. This move positions CDIL as India's pioneer in SiC component manufacturing. With this enhancement, CDIL can now produce a range of auto-grade devices, such as SiC Schottky Diodes, SiC MOSFETs, Zeners, Rectifiers, and TVS Diodes, catering to both global and domestic markets.

- In April 2024, TDK Corporation introduced the B40910 series, a line of hybrid polymer capacitors designed to handle up to 4.6 A (at 100 kHz and +125 °C). These surface mount components boast impressively low ESR values of 17 mΩ and 22 mΩ at room temperature.

- Notably, unlike standard electrolytic capacitors with liquid electrolytes, the ESR of TDK's capacitors shows minimal variation with temperature. These compact components, measuring 10 x 10.2 mm or 10 x 12.5 mm (D x H), feature a rated voltage of 63 V and offer capacitances ranging from 82 µF to 120 µF. Thus, SMT manufacturers drive the need for the technology by integrating and innovating technologies. These efforts contribute to the widespread adoption and growth of surface mount technology (SMT) in various industries.

Surface Mount Technology (SMT) Industry Overview

Surface Mount Technology market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Fuji Corporation, Yamaha Motor Co. Ltd, Mycronic AB, ASMPT, and Panasonic Corporation. Players in the market are adopting partnerships and acquisitions to enhance their product offerings and gain competitive advantage.

March 2024 - Nordson Corporation introduced a new Latin America Tech Center based in Queretaro, Mexico, to allow manufacturers in the region to get timely feedback on the best fluid dispensing equipment for their assembly fluid, parts, substrates, and production requirements. The lab has a 3D printer, scales, and other measurement equipment to determine the correct fluid dispensing equipment for each customer's unique application requirements.

January 2024 - Yamaha Motor Co. Ltd announced the launch of YRM10, a surface mounter with the title of being the fastest in its class regarding mounting performance. With an impressive speed of 52,000 CPH, it outshines its competitors in the 1-Beam/1-Head category. This device is compact and space-saving and offers a range of component compatibility and versatility, making it a next-generation solution for high-speed modular assembly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Surface Mount Technology Market

5 MARKET DYNAMICS

- 5.1 Rising Demand For Miniaturization of Technology

- 5.1.1 Fewer Holes Required to Drill on PCBs Compared to Other Technologies

- 5.2 Market Challenges

- 5.2.1 SMT is Unsuitable for Any Large, High-Power and High-Voltage Parts and Parts Undergoing Frequent Mechanical Stress

- 5.2.2 High Initial Cost and Rework Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Passive Components

- 6.1.1.1 Resistors

- 6.1.1.2 Capacitors

- 6.1.2 Active Components

- 6.1.2.1 Transistors

- 6.1.2.2 Integrated Circuits

- 6.1.1 Passive Components

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Industrial Electronics

- 6.2.4 Aerospace and Defense

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fuji Corporation

- 7.1.2 Yamaha Motor Co. Ltd

- 7.1.3 Mycronic AB

- 7.1.4 ASMPT

- 7.1.5 Panasonic Corporation

- 7.1.6 Nordson Corporation

- 7.1.7 Juki Corporation

- 7.1.8 Hanwa Precision Machinery Co. Ltd

- 7.1.9 Zhejiang Neoden Technology Co. Ltd

- 7.1.10 Europlacer Limited

- 7.1.11 Viscom SE