|

市场调查报告书

商品编码

1548920

全球超宽频 (UWB) 市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Ultra-Wideband - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

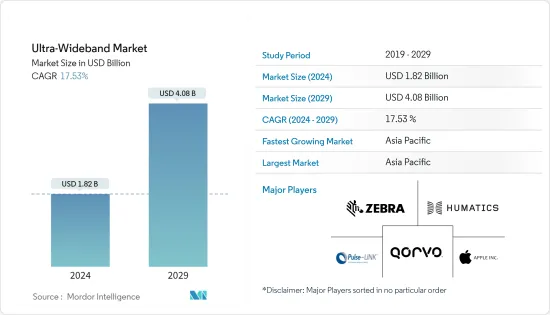

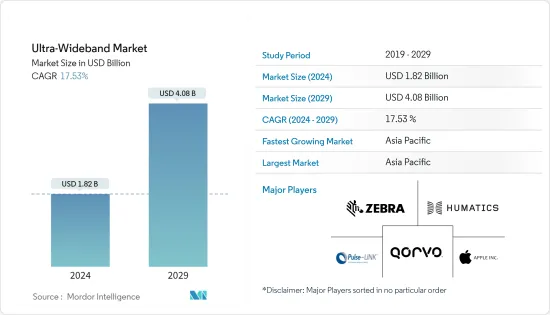

全球超宽频(UWB)市场规模预计2024年为18.2亿美元,2029年达到40.8亿美元,在预测期内(2024-2029年)复合年增长率为17.53%。

主要亮点

- 由于工业基础设施和智慧家庭的增加而增加的都市化和数数位化策略的采用、提高半导体工具可操作性的技术进步以及全球医疗保健和零售行业的数位化的提高也是推动市场成长的因素。

- 随着智慧城市和智慧家庭的发展,UWB技术在数位安全领域的应用不断增加,预计将推动市场成长,其中包括增强门禁系统安全性的超宽频技术。透过利用其精确的测距功能,存取控制系统可以限制对安全区域的访问,并只允许授权的个人进入。由于全球对智慧安全解决方案的需求不断增长,这预示着市场未来的成长机会。

- 然而,Wi-Fi 和蓝牙是传统上在连接设备中实施的标准无线通讯协定。 UWB 技术的需求成长有限,因为 Wi-Fi 和蓝牙是传统上在连网型设备中实施的标准无线通讯协定,并且在各种应用中仍然很受欢迎。与其他无线通讯协定相比,蓝牙技术由于成本低廉,目前仍广泛应用于消费性电子产品。

- OEM在电子设备中使用基于超宽频 (UWB) 的晶片和组件预计将支援未来的市场成长。例如,2023 年 10 月,三星电子发表了 Galaxy SmartTag2。该产品可以追踪贵重物品,并可以与支援 UWB 的智慧型手机整合以管理其位置。

- 支援UWB的Galaxy产品包括Galaxy Note20 Ultra、Galaxy S21+、Galaxy S21 Ultra、Galaxy S22+、Galaxy S22 Ultra、Galaxy S23+、Galaxy S23 Ultra、Galaxy Z Fold2、Z Fold3、Z Fold4、Z Fold5 等连网型。市场对UWB 技术的需求预计将支持市场成长。

超宽频 (UWB) 市场趋势

最大的最终用户产业是家用电器。

- 超宽频 (UWB) 技术可实现高资料速率无线通讯,过去几年在消费性电子产品中已广泛应用。超宽频技术主要在各种高阶智慧型手机(苹果、三星、GooglePixel)、部分高阶笔记型电脑(联想)、扬声器(HomePod Mini)穿戴式装置中引入,并在各种智慧家庭应用中快速应用。扩大。

- 过去几年,UWB 技术在智慧型手机中得到了广泛采用,苹果智慧型手机为iPhone 11 配备了用于空间识别的UWB 晶片(U1),并且在2019 年9 月,iPhone 11 Pro 用UWB 晶片取代了其他配备U1 的苹果智慧型手机。此后,该公司在 iPhone 12、iPhone 13、iPhone 14 和 iPhone 15 等旗舰产品中引进了 UWB 技术。我们也在 Apple Watch Series 6、Series 7、Series 8 和 Series 9 等穿戴式装置中使用 UWB 技术。

- 另一个新的 UWB 应用是让智慧家庭变得更加方便和直觉。透过将 UWB 技术融入智慧家庭设备,它们可以自动对特定的使用者动作做出反应,例如打开风扇或灯、播放喜爱的播放清单或调节温度。因此,未来几年消费电子产品对超宽频(UWB)的需求可能会增加。

- 根据分析,由于中国、印度和美国等国家的智慧型手机普及率较高,智慧型手机在出货量上占比最高。根据 GSMA 预测,2023 年全球智慧型手机普及率将达到 69%,高于前一年的 2022 年。这些资讯来自全球约 67 亿智慧型手机用户和约 74 亿总人口。

亚太地区将显着成长

- 亚太地区的超宽频 (UWB) 市场受到智慧型手机中 UWB 技术可用性的推动,许多汽车OEM在下一代车辆中采用该技术来为驾驶员提供安全的汽车访问,从而刺激了增长。

- 亚太地区联网汽车和电动车的成长预计将推动市场成长。例如,根据国际能源总署(IEA)的预测,2023年中国将成为亚太地区电动车销量最多的国家,销量将超过800万辆。同时,2023 年印度将售出约 82,000 辆电动车。

- 2024年2月,中国无线系统晶片系统(SoC)供应商深圳巨人微电子有限公司在MWC2024上发布了业界领先的GT1500 UWB SoC,用于测距、定位和无线连接应用。 GT1500 非常适合空间受限的穿戴式和物联网产品应用。

- 由于物联网设备对 UWB 技术的需求不断增加,物联网在製造和汽车领域的采用正在创造市场机会。由于在预测期内强大的製造基础、汽车和现有基础设施的快速成长,製造业和汽车产业可能成为主要驱动力。

超宽频 (UWB) 产业概览

由于国际和国内市场上存在各种主要供应商,超宽频 (UWB) 市场竞争激烈且复杂。市场集中度中等,各大公司纷纷采取併购、收购、产品创新等策略来扩大产品系列、拓宽地域覆盖范围。市场上一些重要的参与者包括 Qorvo Inc.、Humatics Corporation、Pulse~Link Inc.、Apple Inc. 和 Zebra Technologies Corporation。

- 2024 年 2 月 - 特斯拉宣布版本 2024.2.3,这是其作业系统的重大更新,融入了苹果的超宽频 (UWB) 技术。此更新显着增强了电话钥匙的功能,使特斯拉车主能够绕过以前用于访问车辆的不太安全和不太准确的蓝牙连接。

- 2023 年 11 月 - 恩智浦半导体推出 Trimension NCJ29D6。该汽车单晶片 UWB(超宽频)系列整合了先进、安全、准确的即时定位和短程雷达。它旨在在一个系统中支援多种应用,包括安全汽车存取、儿童存在检测、入侵警告和手势姿态辨识。汽车製造商已经配备了这些设备,预计将在 2025 年车型中引入。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 对 RTLS 应用的需求不断增长

- 工业物联网 (IIoT) 的采用率不断提高

- 市场限制因素

- 替代产品的竞争

第六章 市场细分

- 按用途

- RTLS

- 影像处理

- 通讯

- 按最终用户产业

- 卫生保健

- 汽车/交通

- 製造业

- 家电

- UWB 相容设备的全球出货量:按主要应用划分

- 支援 UWB 的智慧型手机设备的指示性份额:按地区

- UWB 智慧型手机指标份额:亚太国家

- 洞察智慧型手机、物联网和穿戴式装置的关键应用

- 监管变化对家用电器采用 UWB 的影响

- 智慧型手机公司的主要UWB供应商

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Qorvo Inc.

- Humatics Corporation

- Pulse~Link Inc.

- Apple Inc.

- Zebra Technologies Corporation

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Johanson Technology Inc.

- Alereon Inc.

- Fractus SA

第八章投资分析

第9章市场的未来

The Ultra-Wideband Market size is estimated at USD 1.82 billion in 2024, and is expected to reach USD 4.08 billion by 2029, growing at a CAGR of 17.53% during the forecast period (2024-2029).

Key Highlights

- Increasing urbanization and digitalization strategy adoptions in line with the growing industrial infrastructure and smart homes, technological advancements to improve the operation of semiconductor tools, and increasing digitization in healthcare and retail sectors worldwide are other factors driving the market's growth.

- With the growth of smart cities and homes, the increasing applications of UWB technology in the digital security segments are expected to boost the market's growth, including Ultra-wideband technology enhancing security in access control systems. Access control systems can restrict access to secure areas by utilizing their precise ranging capabilities, allowing only authorized individuals entry. This shows the market's future growth opportunity with the increasing demand for intelligent security solutions worldwide.

- However, Wi-Fi and Bluetooth are the standard wireless communications protocols traditionally implemented in connected devices. They are still gaining significant traction in various applications, thus limiting the growth in demand for UWB technology. Bluetooth technology is still widely used in consumer electronic products, owing to its low price among other wireless communication protocols.

- OEMs' increasing usage of Ultra-wideband-based chips and components in electronic devices will support market growth in the future. For instance, in October 2023, Samsung Electronics announced the Galaxy SmartTag2, enabling users to track valuables better and can be integrated with UWB-enabled smartphones for managing the locations.

- Galaxy products that support UWB include Galaxy Note20 Ultra, Galaxy S21+, Galaxy S21 Ultra, Galaxy S22+, Galaxy S22 Ultra, Galaxy S23+, Galaxy S23 Ultra, Galaxy Z Fold2, Z Fold3, Z Fold4, and Z Fold5, which shows the increasing demand for the UWB technology in the smartphones and connected devices in the market, which would fuel the market's growth.

Ultra Wideband (UWB) Market Trends

Consumer Electronics to be the Largest End-user Industry

- With its capability of providing high data rate wireless communications, ultra-wideband (UWB) technology has found significant applications in consumer electronic products in the past few years. The ultra-wideband technology is largely being deployed in various high-end smartphones (Apple, Samsung, and Google Pixel), some premium laptops (Lenovo), speakers (Homepod Mini) wearable devices, and its uses are rapidly increasing in various smart home applications, thus providing vast potential for the growth of the UWB market in the consumer electronics segment in coming years.

- UWB technology has gained significant smartphone adoption over the past few years, with Apple smartphone launching UWB chips (U1) in its iPhone 11 for spatial awareness, allowing iPhone 11 Pro to locate other U1-equipped Apple devices in September 2019 precisely. Since then, the company has deployed UWB technology in its flagship products, such as iPhone 12, iPhone 13, iPhone 14 and iPhone 15. The company also uses UWB technology in wearables such as the Apple Watch Series 6, Series 7, Series 8, and Series 9.

- Making smart homes more accessible and intuitive is another emerging UWB application. Embedding UWB technology within smart home devices allows them to automatically respond to specific user movements, such as turning on a fan or a light, playing a preferred playlist, or adjusting the temperature. Thus, this drives the demand for ultra-wideband in consumer electronics in the coming years.

- Smartphones are analyzed to hold the highest share shipment-wise owing to the high smartphone penetration in countries such as China, India, the United States, etc. According to GSMA, in 2023, the worldwide smartphone adoption rate reached 69%, increasing from the previous year in 2022. This information is derived from approximately 6.7 billion smartphone subscriptions globally and a total population of roughly 7.4 billion.

Asia-Pacific to Register Major Growth

- The increasing availability of UWB technology in smartphones and the growing adoption by many car OEMs in their next generation of vehicles to provide drivers with secure car access are fueling ultra-wideband market growth in Asia-Pacific.

- The growth of connected cars and EVs in the Asia-Pacific is expected to drive the market's growth. For instance, according to the International Energy Agency, in 2023, China experienced the most electric car sales throughout Asia-Pacific, with over 8 million electric cars sold. Comparatively, approximately 82 thousand electric cars were sold in India in 2023.

- In February 2024, China's Shenzhen Giant Microelectronics Company Limited, which supplies wireless system-on-chip (SoC), introduced an industry-leading GT1500 UWB SoC for ranging, positioning, and wireless connectivity applications at MWC 2024. GT1500 is ideally suited for space-constrained wearable and IoT product applications.

- The adoption of IoT in the manufacturing and automobile sectors is creating an opportunity for the market due to the increasing requirement for UWB technologies in IoT devices. The manufacturing and automotive sectors are likely to be primary drivers due to a strong manufacturing base, rapid automotive growth, and existing infrastructure over the forecast period.

Ultra Wideband (UWB) Industry Overview

The market for Ultra-Wideband is fragemented and exceptionally competitive, mainly due to the presence of various critical vendors in the market operating in both international and domestic markets. The market is moderately concentrated, with the significant players adopting strategies such as mergers, acquisitions, and product innovation to widen their product portfolio and extend their geographic reach. Some vital players in the market are Qorvo Inc., Humatics Corporation, Pulse~Link Inc., Apple Inc., and Zebra Technologies Corporation, among others.

- February 2024 - Tesla introduced a significant update to its operating system, version 2024.2.3, incorporating Apple's Ultra Wideband (UWB) technology. This update substantially enhances the functionality of the phone key, allowing Tesla owners to bypass the less secure and less accurate Bluetooth connections previously used for vehicle access.

- November 2023 - NXP Semiconductors introduced the Trimension NCJ29D6. This automotive single-chip Ultra-Wideband (UWB) family integrates advanced, secure, and precise real-time localization with short-range radar. It is engineered to support a variety of applications within a single system, including secure car access, child presence detection, intrusion alerts, and gesture recognition. Automotive OEMs are already incorporating these devices, with deployment expected in vehicles for the 2025 model year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for RTLS applications

- 5.1.2 Increased Adoption of the Industrial Internet of Things (IIoT)

- 5.2 Market Restraints

- 5.2.1 Competition from the Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 RTLS

- 6.1.2 Imaging

- 6.1.3 Communication

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Automotive and Transportation

- 6.2.3 Manufacturing

- 6.2.4 Consumer Electronics

- 6.2.4.1 Global UWB-enabled Device Shipments by Major Application

- 6.2.4.2 Indicative Share of UWB-enabled Smartphone Devices by Region

- 6.2.4.3 Indicative Share of UWB Smartphones - Asia-Pacific Country Level

- 6.2.4.4 Key Applications Insights in Smartphone, IoT, and Wearables

- 6.2.4.5 Impact of Regulatory Changes on the Adoption of UWB in Consumer Devices

- 6.2.4.6 Major UWB Suppliers for Smartphone Companies

- 6.2.5 Retail

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qorvo Inc.

- 7.1.2 Humatics Corporation

- 7.1.3 Pulse~Link Inc.

- 7.1.4 Apple Inc.

- 7.1.5 Zebra Technologies Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 Johanson Technology Inc.

- 7.1.9 Alereon Inc.

- 7.1.10 Fractus SA