|

市场调查报告书

商品编码

1685752

智慧高速公路:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Smart Highway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

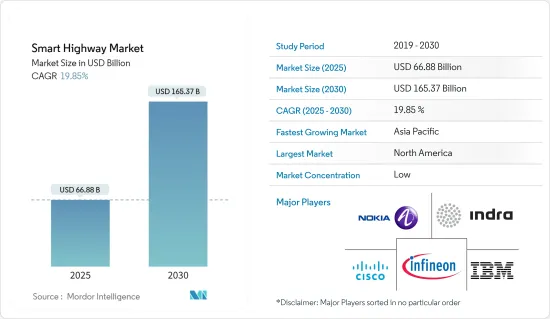

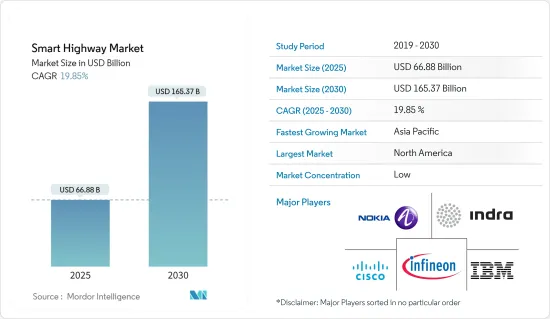

2025年智慧高速公路市场规模预估为668.8亿美元,预估至2030年将达1,653.7亿美元,预测期间(2025-2030年)复合年增长率为19.85%。

智慧技术的好处,例如由于资料驱动的交通控製而提高道路安全性和减少基础设施损坏,以及对智慧城市的投资不断增加,正在推动智慧高速公路市场的成长。

主要亮点

- 随着都市化的快速发展,温室气体(GHG)排放的增加导致了碳足迹的扩大,迫使智慧交通采用清洁和永续的技术。例如,根据美国环保署的数据,交通运输产生的温室气体 (GHG)排放约占美国温室气体排放总量的 28%。

- 智慧交通管理系统使用数位感测器,可以在发生山崩、恶劣天气或交通堵塞时捕获并记录资料。它还可以在州和国家高速公路的 LED 萤幕上显示预报和警告。

- 许多因素正在推动市场的发展,例如减少高速公路上发生的事故、提供安全和高效的运输系统、减少连接全国主要城市的高速公路上的运输时间。所有这一切都可以透过实施智慧技术来实现,智慧技术可以有效监控交通状况并保持高速公路正常运转,同时向当局提供即时资讯。

- 新兴国家缺乏基础设施发展可能会严重抑制智慧高速公路市场的发展。智慧高速公路的实施需要在技术、感测器、通讯网路和熟练劳动力方面进行大量投资。新兴国家通常面临预算限制,政府可能会优先考虑其他重要领域,而不是先进的交通基础设施。

智慧高速公路市场趋势

智慧交通管理系统产品技术可望占领较大市场占有率

- 智慧交通管理系统 (STMS) 在智慧高速公路市场中发挥关键作用,因为它是实现先进交通解决方案整合的关键技术,可提高效率、安全性和永续性。 SMTS 包括一系列产品和技术,有助于对运输系统内的各个元素进行即时监控、控制和管理。

- ITMS 包括感测器、摄影机和交通控制系统网络,可监控即时交通状况。这些系统收集交通流量、交通密度和拥塞资料,使交通操作员能够优化交通号誌时序、管理车道控制并有效应对事故。

- ETC系统是智慧高速公路的重要组成部分。使用 RFID、ANPR、DSRC 和 GNSS 等各种技术,收费将实现自动化,从而减少收费站的拥塞并改善交通流量。例如,2024 年 4 月,德里运输部计划在首都各个路口安装 5,000 台CCTV摄影机,作为 ITSMS 整合计划的一部分。在新的竞标文件中,选定的机构将被要求在三年内为 16 项道路交通违规安装带有 ANPR 系统的CCTV摄影机以及 ICCC 基础设施。选定的机构还必须安排储存容量,以保存所有CCTV影像和资料五年。

- 交通资讯和导航系统 (TINS) 透过可变讯息标誌、行动应用程式和导航设备为驾驶员提供即时交通资讯。这使得驾驶员能够做出更明智的决定,避开拥挤的路线并改善交通分配。

- 环境监测系统将监测高速公路沿线的空气品质和其他环境参数,以评估污染水平并采取资料主导的决策,以减少排放并改善空气品质。

预计北美将占据较大的市场占有率

- 北美智慧高速公路市场经历了智慧交通系统(ITS)和智慧基础设施的稳定成长和进步。北美政府机构正积极推动采用智慧交通解决方案,以解决交通拥堵、减少事故并提高整体交通效率。

- 该地区强大的技术基础设施和较高的智慧型手机普及率正在促进电子收费系统、交通管理系统和即时交通资讯等 ITS 技术的采用。

- 人们一直强调引入智慧高速公路技术,透过事故侦测、管理系统和车辆间通讯来提高道路安全。

- 该地区对自动驾驶和车联网技术的兴趣日益浓厚。这些技术有可能改变交通运输,并需要智慧高速公路基础设施来支援其部署。

- 北美是全球技术领导者。预计建筑和道路基础设施支出的增加将为该地区的扩张创造更多的机会。此外,美国在高速公路和道路计划上的公共建设支出非常高。例如,2024年3月,领先的AI行动平台公司NoTraffic宣布,此前其係统在科利尔县、帕斯科县和奥兰多等地部署取得巨大成功,该公司已获得佛罗里达州运输部(FDOT)的批准,可以在该州运营。这一重要里程碑彰显了 NoTraffic 对最高安全和未来标准的坚定承诺。

智慧高速公路产业概况

智慧高速公路市场高度分散,主要参与者包括阿尔卡特朗讯企业公司(诺基亚)、思科Cisco公司、IBM 公司、Indra Systemas SA 和英飞凌科技股份公司。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024 年 5 月,Applied Information Inc. 和 Curruix Vision LLC 宣布建立策略合作伙伴关係,为日益复杂的交通管理环境提供新的先进交通洞察和主动安全解决方案。此次策略合作将把Curruix Vision的智慧城市ITS路口AI技术与Applied Information的智慧城市监控平台Applied Information Glance结合,结合两家公司的技术优势。

- 2024 年 2 月 Actelis Networks 是一家为物联网 (IoT) 应用提供网路安全、快速部署网路解决方案的供应商,该公司已在纳帕一些最繁忙的路口部署了混合光纤到户 (H2P) 连接解决方案。 Acteris 的当地合作伙伴 Econolite 订购并安装了此解决方案。 Econolite 和 Actelis 已在该市最繁忙的十字路口之一完成了 ATMS 升级计划。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业相关人员分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 更多高速公路和基础设施计划

- 安全高效交通的需求日益增加

- 市场挑战

- 资本密集型计划

- 新兴国家缺乏基础设施

- 市场机会

- 近期重要案例

- 智慧高速公路技术的演变

第六章 市场细分

- 依产品技术

- 智慧交通管理系统

- 智慧交通管理系统

- 监控系统

- 服务

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Alcatel-Lucent Enterprise(Nokia Corporation)

- Cisco Systems Inc.

- IBM Corporation

- Indra Sistemas SA

- Infineon Technologies AG

- Huawei Technlogies Co. Ltd

- Kapsch AG

- LG CNS Co. Ltd(LG Electronics Inc.)

- Schneider Electric SE

- Siemens AG

- Xerox Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Smart Highway Market size is estimated at USD 66.88 billion in 2025, and is expected to reach USD 165.37 billion by 2030, at a CAGR of 19.85% during the forecast period (2025-2030).

The growing investment in smart cities, along with the benefits associated with smart technologies, such as improved traffic safety and data-driven traffic control to reduce infrastructure damage, drives the growth of the smart highway market.

Key Highlights

- With rapid urbanization, an increase in greenhouse gas (GHG) emissions contributes to an expanding carbon footprint and forcing the adoption of clean and sustainable technology for intelligent transportation. For instance, according to the United States Environmental Protection Agency, greenhouse gas (GHG) emissions from transportation account for about 28% of the total greenhouse gas emissions in the United States.

- Smart transport management systems use digital sensors that can acquire and record data during landslides, poor weather conditions, and traffic congestion. They can also display forecasts and alerts on LED screens on state and national highways.

- The market is driven by many factors, such as reducing the number of accidents occurring on highways, providing safe and efficient transportation systems, and reducing the transportation time on highways connecting the major cities of a country. All of these can be done by implementing smart technologies, which efficiently monitor traffic and help properly functioning highways while providing real-time information to the authorities.

- The lack of infrastructural support in developing countries can significantly restrain the smart highway market. Implementing smart highways necessitates substantial investment in technology, sensors, communication networks, and a skilled workforce. Developing countries often face budget constraints, and governments may prioritize other essential sectors over advanced transportation infrastructure.

Smart Highway Market Trends

Smart Transport Management Systems Product Technology is Expected to Hold Significant Market Share

- Smart transport management systems (STMS) play a vital role in the smart highway market, as they are a key technology that enables the integration of advanced transportation solutions to improve efficiency, safety, and sustainability. SMTS encompasses a range of products and technologies that facilitate real-time monitoring, control, and management of various elements within the transportation system.

- ITMS includes a network of sensors, cameras, and a traffic control system that monitors real-time traffic conditions. These systems collect traffic flow, density, and congestion data, enabling traffic operators to optimize traffic signal timing, manage lane control, and respond to incidents efficiently.

- ETC systems are an essential part of smart highways. They use various technologies like RFID, ANPR, DSRC, or GNSS to automate toll collection, reducing congestion and improving traffic flow at toll plazas. For instance, in April 2024, the Delhi transport department planned to set up 5,000 CCTV cameras at various junctions in the national capital as part of the ITSMS integration project. Under the new tender document, the chosen agency will be required to set up CCTV cameras with an ANPR system for 16 road traffic violations, along with the ICCC infrastructure, within three years. The selected agency will also be required to arrange for a storage capacity to store all the CCTV footage and data for five years.

- Traffic information and navigation systems (TINS) provide real-time traffic information to drive through variable message signs, mobile apps, or navigation devices. This helps drivers make informed decisions, avoid congested routes, and improve traffic distribution.

- Environmental monitoring systems monitor air quality and other environmental parameters along highways to assess pollution levels and make data-driven decisions to reduce emissions and improve air quality.

North America is Expected to Hold Significant Market Share

- The North American smart highway market experienced steady growth and advancements in intelligent transportation systems (ITS) and smart infrastructure. Government agencies in North America have been actively promoting the adoption of smart transportation solutions to address traffic congestion, reduce accidents, and enhance overall transportation efficiency.

- The region's strong technological infrastructure and high smartphone penetration have facilitated the implementation of ITS technologies, such as electronic toll collection systems, traffic management systems, and real-time traffic information.

- There has been a significant emphasis on deploying smart highway technologies to enhance road safety through incident detection, management systems, and vehicle-to-infrastructure communication.

- The region has seen increasing interest in autonomous and connected vehicle technologies. These technologies have the potential to revolutionize the transportation landscape and require smart highway infrastructure to support their deployment.

- North America is a global technological leader. The increased spending on construction and road infrastructure is expected to offer more opportunities for the region to expand. Moreover, the public construction spending on highway and street projects in the United States is very high. For instance, in March 2024, NoTraffic, the developer of the leading AI Mobility Platform, announced that it received approval from the Florida Department of Transportation (FDOT) to operate in the state, accompanied by substantial successful implementations of NoTraffic's systems in various locations including Collier County, Pasco County, Orlando, and more. This significant milestone underscores NoTraffic's unwavering commitment to the highest safety and future-ready standards.

Smart Highway Industry Overview

The smart highway market is highly fragmented, with the presence of major players like Alcatel-Lucent Enterprise (Nokia Corporation), Cisco Systems Inc., IBM Corporation, Indra Sistemas SA, and Infineon Technologies AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Applied Information Inc. and Curruix Vision LLC announced a strategic partnership to provide new, enhanced traffic insights and proactive safety solutions to increasingly complex traffic management environments. The strategic partnership will combine their technical strengths by integrating Curruix Vision's smart city ITS intersection AI technology into Applied Information's intelligent city supervisory platform, Applied Information Glance.

- February 2024: Actelis Networks Inc., a cyber-secure, fast-deployment networking solution for Internet of Things (IoT) applications, deployed a hybrid fiber-to-the-premises (H2P) connectivity solution at several of Napa's busiest traffic junctions. Actelis' local partner, Econolite, ordered and installed the solution. Econolite and Actelis completed an ATMS upgrade project at the city's busiest intersections.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Highway and Infrastructure Projects

- 5.1.2 Rising Need for Safe and Efficient Transportation

- 5.2 Market Challenges

- 5.2.1 Capital-intensive Projects

- 5.2.2 Lack of Infrastructural Support in Developing Countries

- 5.3 Market Opportunities

- 5.4 Key Recent Case Studies

- 5.5 Evolution of Smart Highway Technology

6 MARKET SEGMENTATION

- 6.1 By Product Technology

- 6.1.1 Smart Traffic Management Systems

- 6.1.2 Smart Transport Management Systems

- 6.1.3 Monitoring Systems

- 6.1.4 Services

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alcatel-Lucent Enterprise (Nokia Corporation)

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Indra Sistemas SA

- 7.1.5 Infineon Technologies AG

- 7.1.6 Huawei Technlogies Co. Ltd

- 7.1.7 Kapsch AG

- 7.1.8 LG CNS Co. Ltd (LG Electronics Inc.)

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Xerox Corporation