|

市场调查报告书

商品编码

1549582

安全仪器系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Safety Instrumented System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

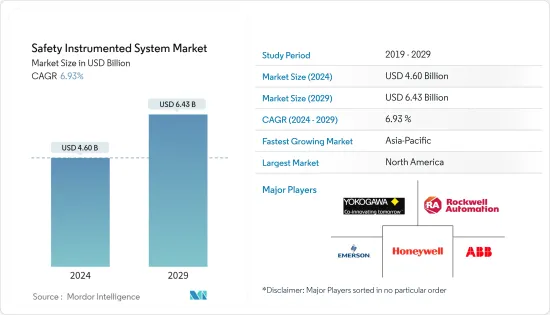

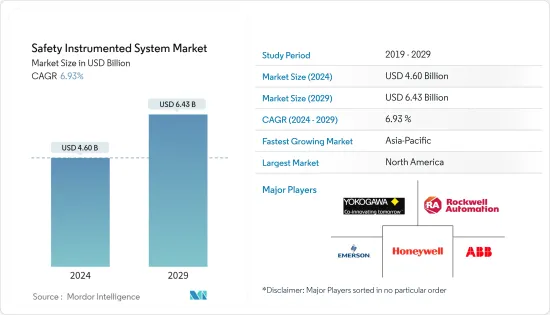

安全仪器系统市场规模预计到 2024 年为 46 亿美元,预计到 2029 年将达到 64.3 亿美元,预计在预测期内(2024-2029 年)复合年增长率为 6.93%。

安全法规和标准的激增,以及个人和组织层面对工业安全管理和能力需求的认识不断提高,导致安全开关的快速引入,以预防事故。

主要亮点

- 2023年8月,中央邦一家食品工厂的五名工人因吸入储槽中疑似有毒气体而死亡。原因是工厂缺乏安全措施。此外,印度古吉拉突邦一家化工厂的 18 名工人因吸入储槽洩漏的有毒气体而住院。这种令人震惊的发展凸显了该国各个最终用户产业采用高可靠性压力保护系统的必要性。

- 化学品和石化、发电、製药、食品和饮料、石油和天然气以及其他最终用户的工业流程受到各个管理机构的严格监管,以防止突然的故障和灾难。法规环境变得越来越严格,以鼓励部署 SIS 作为预防措施。安全法规和标准的广泛采用以及个人和组织层面对工业安全管理和能力需求的认识不断提高,导致製造设备中迅速采用安全开关来防止任何事故,这促使我这样做。

- SIS 在石油和天然气行业的实施受到严格的法律法规的推动,旨在限制灾难性洩漏并避免环境污染。

- 例如,美国《石油污染法》以及《石油洩漏预防和准备条例》旨在防止此类事件发生。一些合规计划,例如 EO 13892 第 7 条中设想的现场民事检查程序规定,确保透过合理的行政检查来检查设施是否符合环境法。各行业日益完善的法规环境正在促进市场成长。

- 自以色列-哈马斯危机爆发以来,油价已上涨约6%,并有望进一步上涨。世界各地的经济学家正在製定应对当前战争造成的通货膨胀影响的策略。分析师正在密切关注中东危机的发展轨迹,将其与该地区过去的衝突进行比较,并评估其潜在的经济影响。

- 世界银行表示,以色列和巴勒斯坦武装组织之间的衝突升级可能导致数十年来首次的重大能源衝击。这种情况源自于最近俄罗斯和乌克兰之间的战争以及中东危机持续存在的后果,引发了人们对重演1970年代石油价格危机的担忧。因此,这场危机预计将对安全仪器系统 (SIS) 产业产生重大影响,因为石油和天然气产业是 SIS 的最大最终用户。

- 战争也可能导致粮食和能源价格上涨,加剧经济影响,并对全球大宗商品市场造成双重衝击。因此,石油和天然气价格上涨将产生连锁反应,增加航运和化肥产业的成本。这可能导致农产品价格上涨,进一步影响安全仪器系统(SIS)的成长。

安全仪器系统市场趋势

化学和石化行业预计将占据主要市场占有率

- 安全仪器系统包括感测器、逻辑控制器和最终控制元件,以在违反指定条件时确保製程安全。安全仪器系统相对于传统系统的优势越来越大,正在刺激市场需求。化学和石化行业被认为是一个不断发展的行业,老化的安全问题以及扩展和升级基础设施的需求至关重要。

- 例如,根据Brand Finance预测,2023年全球工业产业的品牌价值将达到约620亿美元。与全球工业的品牌价值相比,这意味着 2015 年增加了超过 360 亿美元。传统的安全系统是透过电气控制系统部署的,并且采用硬连线,因此有可能发生影响人员、财产和环境的事故。

- 因此,石化产业享有多项优势,包括延长现场寿命、减少非计画性停机时间、降低年度维护成本、消除计画外维修成本以及遵守现行法规和标准,预计安全仪器系统的需求将会增加。因此,安全仪器系统相对于传统安全系统的优势不断增加,预计将推动该产业的成长。

- 化学工业的环境充满气体、油和灰尘,在机器上和周围形成爆炸性环境。此外,与监管、地缘政治风险、自然资源使用的法律限制、股东激进主义和日益严格的社会监督相关的行业问题也带来了进一步的挑战。因此,火灾和气体监测和侦测、SCADA 和 HIPPS 等安全设备的安装至关重要。

- 此外,许多公司还提供商务用的控制器,以处理石化厂复杂的设备维护。例如,智慧安全公司 HIMA 提供的控制器可以执行经典的紧急关闭业务并处理复杂的设备功能。 SafeEthernet通讯协定可确保安全完整性等级 3 (SIL 3) 控制器之间的安全通讯。它还在安全停车期间具有快速响应时间,并且在安全关键生产过程中具有高操作安全性 (SIL 3),有助于乙炔工厂的高运转率和生产率。

亚太地区预计将出现高成长率

- 在许多工业製程和自动化系统中,安全仪器系统在提供保护层方面发挥重要作用。安全系统工程一词是指在工厂整个生命週期内进行危险识别、安全要求规范以及系统维护和操作的规范、系统的方法。石化和能源产业的崛起对于安全仪器系统产业的发展至关重要。

- 此外,随着製程产业逐渐采用更高的安全标准,需要能够管理蒸气涡轮、压缩机、变速驱动器等变化的控制系统,以在满足敏捷需求的同时保持盈利。

- 工业国家的工业成长停滞已经减缓了对阀门和致动器的需求。政府加大对新兴产业的支持力度,政治条件有利于产业扩张。因此,外国公司正在考虑投资该行业。此外,正在努力并计划在该地区建立水和污水处理厂。

- 例如,柬埔寨政府与日本国际协力机构已同意在Dangkor地区兴建污水处理厂。该计划将投资2500万美元,旨在改善该地区的排水基础设施,使废水直接流向工厂而不是河流。此类计划预计将推动亚太地区安全仪器系统市场的发展。

- 食品和饮料行业有保护其员工的道德和法律责任。重型机械、危险化学物质和湿滑的道路是眼前的问题,而吸入灰尘、听力损失和重复性压力损伤是更渐进的威胁。全球最大的饮料公司可口可乐注意到东南亚对无糖和低糖饮料的需求激增。在 COVID-19 大流行之后,这一点变得更加明显。

- 由于工业活动的快速成长、成本压力和生产力的上升以及中国和印度等开发中国家的有利政府政策,预计亚太地区将呈现最快的成长速度。製造商正在透过针对特定应用开发新产品来满足根据应用程式不断变化的需求。

- 此外,安全仪器系统的激增正在创建更复杂的系统。此外,石油和天然气、化学和电力行业越来越多地使用这些系统,因为它们有助于监控使用时间、锅炉管理的各个方面、烟囱温度、锅炉、燃料效率等,这些对于该行业都很重要。

- 此外,中国共产党在 2020 年全国人民代表大会 (NPC) 上宣布,除了加倍实施「中国製造 2025」和「中国标准 2035」倡议外,中国共产党还将拨款约 1.4 兆美元用于数位公共支出计划宣布有消费的可能性。中国的新基础设施倡议为全球企业提供了令人兴奋的机会。因此,SIS设备在新能源汽车、石油天然气、5G设备、物流、能源电力等各个领域的采用预计将增加,从而推动该地区的市场成长。

安全仪器系统产业概述

安全仪器系统市场已半固体,有几家重要公司,例如西门子公司、ABB 有限公司和Schneider Electric公司。这些拥有大量市场份额的大公司正致力于扩大海外基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。市场竞争、快速的技术进步和消费者偏好的频繁变化预计将威胁预测期内的市场成长。

- 2023 年 10 月,Honeywell推出了一款锂离子 (Li-ion) 电池安全感测器,旨在在识别电动车 (EV) 潜在电池火灾方面发挥至关重要的作用。为了补充这一点,Honeywell提供各种个人防护设备(PPE) 和气体检测解决方案,以提高电动车工厂工人的安全。将Honeywell电池安全感测器整合到电动车和Scooter电池组中,可以及早发现热失控风险,及时向乘客发出警告,并有助于满足全球电池消防安全标准。

- 2023年8月,横河马达宣布计画推出协作资讯伺服器(CI伺服器)的升级版本,这是OpreX控制和安全系统套件的关键元件。此版本升级加强了警报管理,提高了维护资讯的可存取性,并支援扩展对全球通讯标准的支援。该解决方案旨在集中来自不同工厂设备和系统的大量资料,以促进整个企业生产活动的简化管理。这为远端监控、从任何位置控制操作和快速决策创建了一个环境。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 宏观趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 产业法规环境的成长

- 存在强大的 SIS 服务生态系统

- 市场限制因素

- 操作复杂、维护成本高

第六章 市场细分

- 按用途

- 紧急关闭系统(ESD)

- 火灾与气体监测与控制系统(F&GC)

- 高可靠性压力保护系统(HIPPS)

- 燃烧器管理系统 (BMS)

- 涡轮机械控制

- 其他的

- 按最终用户

- 化学/石化

- 发电

- 製药

- 饮食

- 石油和天然气

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东

- 非洲

第七章 竞争格局

- 公司简介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- HIMA Paul Hildebrandt GmbH

- SIS-TECH Solutions LP

- Schlumberger Limited

第八章投资分析

第9章市场的未来

The Safety Instrumented System Market size is estimated at USD 4.60 billion in 2024, and is expected to reach USD 6.43 billion by 2029, growing at a CAGR of 6.93% during the forecast period (2024-2029).

The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent accidents.

Key Highlights

- In August 2023, five laborers died after inhaling a suspected poisonous gas that emanated from a tank at a food product factory in Madhya Pradesh. It was due to a lack of negligence in taking safety measures at the factory. Also, 18 workers were hospitalized after inhaling a toxic gas that leaked from a tank in a chemical factory in Gujarat, India. Such an alarming situation has emphasized the need for various end-user industries in the country to adopt high-integrity pressure protection systems.

- The industrial processes across chemicals and petrochemicals, power generation, pharmaceuticals, food and beverage, oil and gas, and other end users are closely regulated by various governing bodies to prevent sudden breakdowns and mishaps. The regulatory environment has tightened to encourage the deployment of SIS as a precautionary measure. The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at both individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent any accidents.

- The deployment of the SIS in the oil and gas industry is driven by the strict laws and acts that are formulated to restrict catastrophic spillage and avoid environmental pollution.

- For instance, the US Oil Pollution Act, alongside Oil Spills Prevention and Preparedness Regulations, is placed to prevent such accidents. Several compliance programs, such as the On-Site Civil Inspection Procedures Rule, as contemplated by section 7 of EO 13892, ensure that reasonable administrative inspections check whether the facilities comply with environmental laws. The growing regulatory environment in various industries contributes to market growth.

- Since the onset of the Israeli-Hamas crisis, oil prices have surged by approximately 6%, with expectations of further increases. Global economists are formulating strategies to address the inflationary impact resulting from the ongoing war, which has already left a lasting mark on the global economy, causing continuous disruptions. Analysts are closely scrutinizing the trajectory of the Middle East crisis, drawing comparisons with past conflicts in the region to assess potential economic repercussions.

- According to the World Bank, an escalation in the conflict between Israel and the Palestinian militant group could trigger a significant energy shock, marking the first such occurrence in decades. These consequences stem from the aftermath of Russia's recent war with Ukraine and the persisting Middle East crisis, raising concerns of a recurrence of the oil price crisis seen in the 1970s. Consequently, the crisis is anticipated to significantly impact the Safety Instrumented Systems (SIS) sector, given that the oil and gas industry ranks among the largest end-users of SIS.

- The war is also poised to lead to higher food and energy prices, potentially intensifying economic consequences and causing a dual shock in global commodity markets. The resulting surge in oil and gas prices would have a cascading effect, elevating costs in the shipping and fertilizer sectors. This, in turn, could translate into increased prices for agricultural commodities, further influencing the growth of Safety Instrumented Systems (SIS).

Safety Instrumented System Market Trends

Chemical and Petrochemical Industry is Expected to Hold a Major Market Share

- A safety instrumented system encompasses sensors, logic solvers, and final control elements to keep the process safe when predetermined conditions are violated. The growing benefits of safety instrumented systems over traditional ones fuel the market demand. The chemicals and petrochemicals industries are identified as continuously developing industries where the need to expand and upgrade aging safety problems and infrastructures is essential.

- For instance, according to Brand Finance, in 2023, the world's chemical industry had a brand value of nearly USD 62 billion. This represents an increase of over USD 36 billion in 2015 when comparing the global chemical industry's brand value. Traditional safety systems are deployed through an electrical control system and are hardwired, leading to potential accidents affecting people, assets, and the environment.

- This is expected to increase the demand for safety-instrumented systems in petrochemical industries that deliver several advantages, such as prolonged field life, reduction in unplanned downtime, reduction in annual maintenance cost, elimination of unexpected repair expenses, and adherence to current codes and standards. Thus, the increasing advantages of safety instrumented systems over traditional safety systems are expected to drive industry growth.

- Chemical industries have hazardous environments due to gas, oil, or dust, creating an explosive atmosphere in and around the machines. Moreover, the industry issues related to regulation, geopolitical risk, legal limits on using natural resources, shareholder activism, and increasing public scrutiny have created additional challenges. Thus, safety equipment such as fire and gas monitoring and detection, SCADA, and HIPPS installation is paramount.

- Further, many companies offer controllers for emergency and safety shutdown duties and handle complex equipment maintenance in the petrochemical plant. For instance, HIMA, an intelligent safety company, offers controllers that perform classic emergency shutdown duties and handle complex equipment functions. The SafeEthernet protocol ensures safe cross-communication between controllers at safety integrity level 3 (SIL 3). It also offers fast response times in a safety shutdown, and the high operational safety (SIL 3) within safety-critical production processes contributes to the acetylene plant's high availability and productivity.

Asia-Pacific is Expected to Witness High Growth Rate

- In many industrial processes and automation systems, safety instrumented systems play an important role in delivering protective layer functions. The term "safety system engineering" refers to a disciplined and methodical approach to hazard identification, safety requirement specifications, and system maintenance and operation throughout the life of a plant. The rise of the petrochemical and energy sectors is critical to the growth of the safety instrumented system industry.

- Furthermore, as the process sector advances toward embracing greater safety standards, control systems that can manage changes, such as steam turbines, compressors, and variable speed drives, may become necessary to maintain profitability while meeting agile needs.

- Because of stagnating industrial growth in industrialized countries, demand for valves and actuators has slowed. The government's increasing support for new industries, as well as political conditions, make the country conducive to industrial expansion. As a result, foreign corporations are looking to invest in this industry. In addition, there are ongoing and planned initiatives for establishing water and wastewater treatment plants in the region.

- For example, the Cambodian government and the Japanese International Cooperation Agency struck an agreement to construct a wastewater treatment plant in the Dangkor area. With a USD 25 million investment, the project aims to improve the drainage infrastructure in the district so that wastewater can flow directly to the plant rather than into the river. Such projects are expected to fuel the safety instrumentation systems market in Asia-Pacific.

- The food and beverage sector has a moral and legal responsibility to protect its employees. Heavy machinery, hazardous chemicals, and slick surfaces are among the immediate concerns, while dust inhalation, hearing loss, and repetitive strain injuries are among the more gradual threats. Coca-Cola, the world's largest beverage company, has noticed a surge in demand for sugar-free and low-sugar beverages in Southeast Asia. After the COVID-19 pandemic, this became more prominent.

- Due to rapidly increasing industrial activities, rising cost pressures and production rates, and favorable government policies in developing countries like China and India, Asia-Pacific is predicted to witness the fastest growth rate. Manufacturers have responded by developing new goods for specific uses in response to changing demands based on usage.

- Furthermore, an increase in the number of safety instrumented systems has resulted in the creation of more complex systems. Furthermore, the use of these systems has increased in the oil and gas, chemicals, and power industries because they help monitor usage hours, different aspects of boiler management, stack temperature, boiler, and fuel efficiency, all of which are important in this business.

- Moreover, at the 2020 National People's Congress, the CCP announced that in addition to doubling down on its Made in China 2025 and China Standards 2035 initiatives, it might spend approximately USD 1.4 trillion on a digital infrastructure public spending program. China's New Infrastructure initiative presents exciting opportunities for global companies. Owing to the same, the number of SIS equipment adopters in different sectors, such as new energy vehicles, oil and gas, 5G equipment, logistics, and energy and power, is expected to grow, boosting the growth of the market in the region.

Safety Instrumented System Industry Overview

The safety instrumented systems market is semi-consolidated with several significant players like Siemens AG, ABB Ltd, and Schneider Electric SE. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the market's growth during the forecast period.

- October 2023: Honeywell launched lithium-ion (Li-ion) battery safety sensors designed to play a pivotal role in identifying potential battery fires in electric vehicles (EVs). Complementing this, Honeywell offers a range of personal protective equipment (PPE) and gas detection solutions to enhance worker safety in EV plants. The integration of Honeywell battery safety sensors into EV and scooter battery packs enables the early detection of thermal runaway risks, providing timely warnings to passengers and assisting manufacturers in meeting global battery fire safety standards.

- August 2023: Yokogawa Electric Corporation unveiled plans to launch an upgraded version of the Collaborative Information Server (CI Server), a key component within the OpreX Control and Safety System suite. This upgrade boasts enhanced alarm management, improved accessibility to maintenance information, and extended support for global communication standards. The solution aims to aggregate substantial data from diverse plant equipment and systems, facilitating the streamlined management of production activities throughout the enterprise. It establishes an environment conducive to remote monitoring, control operations from any location, and prompt decision-making.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Threat of New Entrants

- 4.1.2 Bargaining Power of Buyers

- 4.1.3 Bargaining Power of Suppliers

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regulatory Environment in the Industry

- 5.1.2 Presence of Robust SIS Service Ecosystem

- 5.2 Market Restraints

- 5.2.1 Operational Complexity Coupled with High Maintenance Costs

6 Market SEGMENTATION

- 6.1 By Application

- 6.1.1 Emergency Shutdown Systems (ESD)

- 6.1.2 Fire and Gas Monitoring and Control (F&GC)

- 6.1.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.1.4 Burner Management Systems (BMS)

- 6.1.5 Turbo Machinery Control

- 6.1.6 Other Applications

- 6.2 By End User

- 6.2.1 Chemicals and Petrochemicals

- 6.2.2 Power Generation

- 6.2.3 Pharmaceutical

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East

- 6.3.7 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 HIMA Paul Hildebrandt GmbH

- 7.1.9 SIS-TECH Solutions LP

- 7.1.10 Schlumberger Limited